by Calculated Risk on 3/12/2014 11:33:00 AM

Wednesday, March 12, 2014

Weekly Update: Housing Tracker Existing Home Inventory up 5.8% year-over-year on March 10th

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.8% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Las Vegas Real Estate in February: Year-over-year Non-contingent Inventory Doubles

by Calculated Risk on 3/12/2014 09:24:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports increasing home prices, slower sales

GLVAR said the total number of existing local homes, condominiums and townhomes sold in February was 2,518, down from 2,565 in January and down from 3,232 one year ago.There are several key trends that we've been following:

...

GLVAR continued to chart the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. For instance, in February, 14 percent of all existing local home sales were short sales, down from 17 percent in January. Another 12 percent of all February sales were bank-owned properties, up from 11 percent in January.

GLVAR said 46.8 percent of all existing local homes sold in February were purchased with cash. That’s unchanged from January, but down from a peak of 59.5 percent set in February 2013.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service in February was 13,624. That’s up 0.6 percent from 13,537 single-family homes listed for sale at the end of January, but down 3.5 percent from 14,120 homes one year ago. ...

By the end of February, GLVAR reported 6,316 single-family homes listed without any sort of offer. That’s down 3.4 percent from 6,541 such homes listed in January, but still a 107.3 percent jump from one year ago.

emphasis added

1) Overall sales were down about 22% year-over-year.

2) Conventional sales are up 11% year-over-year. In February 2013, only 51.9% of all sales were conventional. This year, in February 2014, 74% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 107.3% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014).

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/12/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 7, 2014. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.52 percent from 4.47 percent, with points increasing to 0.29 from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 4.41 percent from 4.37 percent, with points unchanged at 0.20 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 70% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 18% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Note: Jumbo rates are still below conforming rates.

Tuesday, March 11, 2014

Phoenix ARMLS: Total Sales down 17.4% year-over-year in February, Distressed Sales down 61%, Inventory up 37%

by Calculated Risk on 3/11/2014 07:11:00 PM

Another "bubble" area that has seen rapid price appreciation over the last two years. Now sales are declining and inventory is increasing.

The Arizona Regional Multiple Listing Service reported Statistics for February

• Total Sales are down 17.4% year-over-year.

• Distressed sales are down 60.7% year-over-year.

• Active inventory is up 36.6% year-over-year.

Inventory has clearly bottomed in Phoenix (A major theme for housing last year). And fewer distressed sales - probably less investor buying - and more inventory means price increases will slow.

There is commentary in the release from Tom Ruff. Excerpt:

In MLS, 5,474 total homes were sold in February, 14.1% higher than 4,797 in January 2014. As the monthly sales volume comparison is clearly seasonal, one must look at the year-over-year comparisons to get a clear view of sales activity. The February 2014 sales total was 17.4% lower than the total in February 2013 of 6,630. The last time we saw a lower sales volume in February was 2008 where only 3,448 sales were reported. Last year at this tie total inventory numbers were dropping, this year they continue to climb, up 4.2% to 29,661.

...

The imbalance we are seeing between supply and demand will exert downward pressure on pricing which will likely appear later this year.

CBO: Federal Deficit through February $148 billion less this year than it was in fiscal year 2013 (adjusted for timing)

by Calculated Risk on 3/11/2014 02:30:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for February 2014

The federal government ran a budget deficit of $379 billion for the first five months of fiscal year 2014, CBO estimates, $115 billion less than the shortfall recorded in the same span last year. Revenues are higher and outlays are lower than they were at this time a year ago. Without shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the five-month period would have been $148 billion less this year than it was in fiscal year 2013.And for February 2014:

The federal government incurred a deficit of $195 billion in February 2014, CBO estimates—$9 billion less than the $204 billion deficit incurred in February 2013. Because March 1 and February 1 both fell on a weekend in 2014, certain payments that ordinarily would have been made in March this year were made in February, and certain payments that would have been made in February were made in January. Without those shifts in the timing of payments, the deficit in February 2014 would have been $1 billion larger than it was.The consensus was the deficit for February would be around $218 billion, and it appears the deficit for fiscal 2014 will be smaller than the CBO currently expects (less than 3.0% of GDP).

CBO estimates that receipts in February totaled $144 billion—$21 billion (or 17 percent) more than those in the same month last year ... Total spending in February 2014 was $338 billion, CBO estimates, $12 billion more than outlays in the same month in 2013.

emphasis added

BLS: 4 Million Jobs Openings in January

by Calculated Risk on 3/11/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

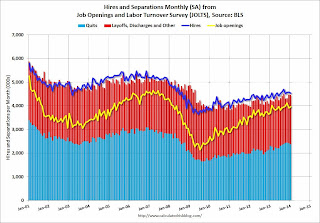

There were 4.0 million job openings on the last business day of January, little changed from December, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in January for total nonfarm, total private, and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased slightly in January to 3.974 million from 3.914 million in December.

The number of job openings (yellow) is up 7.6% year-over-year compared to January 2013.

Quits decreased in January and are up about 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are close to 4.0 million and are at 2005 levels.

NFIB: Small Business Optimism Index declines in February

by Calculated Risk on 3/11/2014 09:10:00 AM

From the National Federation of Independent Business (NFIB): February optimism takes a tumble

Small business optimism continues its winter hibernation with the latest Index dropping 2.7 points to 91.4 ... NFIB owners increased employment by an average of 0.11 workers per firm in February (seasonally adjusted), virtually unchanged from January.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 92.7 in February from 94.1 in January.

Monday, March 10, 2014

Tuesday: Job Openings, Small Business Optimism Index

by Calculated Risk on 3/10/2014 08:09:00 PM

Congratulations to Tom Lawler for winning another "Crystal Ball" award (most accurate 2- and 3-year forecasts ending in 2013 for panel of forecasters).

Also I've another great site to the right sidebar: House of Debt by Atif Mian and Amir Sufi (I've linked to several over their papers of the years and I'm happy to see them blogging).

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for February.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for January from the BLS. The number of job openings were up 10.5% year-over-year in December compared to December 2012, and Quits increased in December and were up about 12% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.4% increase in inventories.

Update on California Budget: Revenue Almost $1 Billion above Forecast in February

by Calculated Risk on 3/10/2014 02:37:00 PM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved since then. Here is the most recent update from California State Controller John Chiang: Controller Releases February Cash Update

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in February 2014. Revenues for the month totaled $5.6 billion, surpassing estimates in the 2014-15 Governor's Budget by $968.9 million, or 20.9 percent.This is just one state, but I expect local and state governments (in the aggregate) to add to both GDP and employment in 2014.

"Driven by strong retail sales and personal income tax withholdings, February receipts poured in at nearly $1 billion above projections," said Chiang. "How we conserve and invest during the upswings of California's notorious boom-or-bust revenue cycles will determine how critical programs – such as public safety and education – will weather the next economic dip. With fiscal discipline and a focus on slashing debt, we can make California more recession-resistant and prosperity a more enduring hallmark of our state."

Income tax receipts exceeded the Governor’s expectations by $721.7 million, or 45.7 percent. Corporate tax receipts came in ahead of estimates by $87.4 million, or 236.2 percent. Sales and use taxes were $113.7 million above, or 3.9 percent, expectations in the Governor's 2014-15 proposed budget.

The State ended the month with a General Fund cash deficit of $14.1 billion, which was covered with both internal and external borrowing. That figure was down from last year, when the State faced a cash deficit of $16.2 billion at the end of February 2013.

emphasis added

Update: Framing Lumber Prices

by Calculated Risk on 3/10/2014 01:15:00 PM

Here is another graph on framing lumber prices. Early last year lumber prices came close to the housing bubble highs. Then prices started to decline sharply, with prices declined over 25% from the highs by June.

The price increases early last year were due to stronger demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices are down about 10% from a year ago, probably due to more supply coming on the market. Here is another mill coming back from the Oregonian: Cave Junction sawmill will reopen

If all goes as planned, the small-log mill will be retooled and running by July. Its owners say they are confident that they can maintain a single shift, and put 67 people to work running the mill.

...

Rough & Ready was the last sawmill operating in Josephine County, putting a psychological and economic capstone on the decades-long decline of Oregon’s timber industry. The industry employed 25,400 people statewide in 2012, half as many as in 1992.

...

“Demand is good right now,” Link Phillippi said. “Our markets are good. our customers are begging for wood.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Prices are probably close to the peak for this year (demand usually peaks seasonally in March and April).