by Calculated Risk on 3/11/2014 07:11:00 PM

Tuesday, March 11, 2014

Phoenix ARMLS: Total Sales down 17.4% year-over-year in February, Distressed Sales down 61%, Inventory up 37%

Another "bubble" area that has seen rapid price appreciation over the last two years. Now sales are declining and inventory is increasing.

The Arizona Regional Multiple Listing Service reported Statistics for February

• Total Sales are down 17.4% year-over-year.

• Distressed sales are down 60.7% year-over-year.

• Active inventory is up 36.6% year-over-year.

Inventory has clearly bottomed in Phoenix (A major theme for housing last year). And fewer distressed sales - probably less investor buying - and more inventory means price increases will slow.

There is commentary in the release from Tom Ruff. Excerpt:

In MLS, 5,474 total homes were sold in February, 14.1% higher than 4,797 in January 2014. As the monthly sales volume comparison is clearly seasonal, one must look at the year-over-year comparisons to get a clear view of sales activity. The February 2014 sales total was 17.4% lower than the total in February 2013 of 6,630. The last time we saw a lower sales volume in February was 2008 where only 3,448 sales were reported. Last year at this tie total inventory numbers were dropping, this year they continue to climb, up 4.2% to 29,661.

...

The imbalance we are seeing between supply and demand will exert downward pressure on pricing which will likely appear later this year.

CBO: Federal Deficit through February $148 billion less this year than it was in fiscal year 2013 (adjusted for timing)

by Calculated Risk on 3/11/2014 02:30:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for February 2014

The federal government ran a budget deficit of $379 billion for the first five months of fiscal year 2014, CBO estimates, $115 billion less than the shortfall recorded in the same span last year. Revenues are higher and outlays are lower than they were at this time a year ago. Without shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the five-month period would have been $148 billion less this year than it was in fiscal year 2013.And for February 2014:

The federal government incurred a deficit of $195 billion in February 2014, CBO estimates—$9 billion less than the $204 billion deficit incurred in February 2013. Because March 1 and February 1 both fell on a weekend in 2014, certain payments that ordinarily would have been made in March this year were made in February, and certain payments that would have been made in February were made in January. Without those shifts in the timing of payments, the deficit in February 2014 would have been $1 billion larger than it was.The consensus was the deficit for February would be around $218 billion, and it appears the deficit for fiscal 2014 will be smaller than the CBO currently expects (less than 3.0% of GDP).

CBO estimates that receipts in February totaled $144 billion—$21 billion (or 17 percent) more than those in the same month last year ... Total spending in February 2014 was $338 billion, CBO estimates, $12 billion more than outlays in the same month in 2013.

emphasis added

BLS: 4 Million Jobs Openings in January

by Calculated Risk on 3/11/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

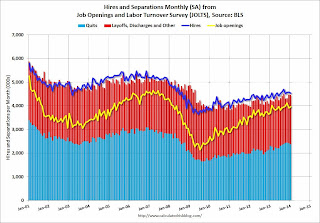

There were 4.0 million job openings on the last business day of January, little changed from December, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in January for total nonfarm, total private, and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased slightly in January to 3.974 million from 3.914 million in December.

The number of job openings (yellow) is up 7.6% year-over-year compared to January 2013.

Quits decreased in January and are up about 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are close to 4.0 million and are at 2005 levels.

NFIB: Small Business Optimism Index declines in February

by Calculated Risk on 3/11/2014 09:10:00 AM

From the National Federation of Independent Business (NFIB): February optimism takes a tumble

Small business optimism continues its winter hibernation with the latest Index dropping 2.7 points to 91.4 ... NFIB owners increased employment by an average of 0.11 workers per firm in February (seasonally adjusted), virtually unchanged from January.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 92.7 in February from 94.1 in January.

Monday, March 10, 2014

Tuesday: Job Openings, Small Business Optimism Index

by Calculated Risk on 3/10/2014 08:09:00 PM

Congratulations to Tom Lawler for winning another "Crystal Ball" award (most accurate 2- and 3-year forecasts ending in 2013 for panel of forecasters).

Also I've another great site to the right sidebar: House of Debt by Atif Mian and Amir Sufi (I've linked to several over their papers of the years and I'm happy to see them blogging).

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for February.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for January from the BLS. The number of job openings were up 10.5% year-over-year in December compared to December 2012, and Quits increased in December and were up about 12% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.4% increase in inventories.

Update on California Budget: Revenue Almost $1 Billion above Forecast in February

by Calculated Risk on 3/10/2014 02:37:00 PM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved since then. Here is the most recent update from California State Controller John Chiang: Controller Releases February Cash Update

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in February 2014. Revenues for the month totaled $5.6 billion, surpassing estimates in the 2014-15 Governor's Budget by $968.9 million, or 20.9 percent.This is just one state, but I expect local and state governments (in the aggregate) to add to both GDP and employment in 2014.

"Driven by strong retail sales and personal income tax withholdings, February receipts poured in at nearly $1 billion above projections," said Chiang. "How we conserve and invest during the upswings of California's notorious boom-or-bust revenue cycles will determine how critical programs – such as public safety and education – will weather the next economic dip. With fiscal discipline and a focus on slashing debt, we can make California more recession-resistant and prosperity a more enduring hallmark of our state."

Income tax receipts exceeded the Governor’s expectations by $721.7 million, or 45.7 percent. Corporate tax receipts came in ahead of estimates by $87.4 million, or 236.2 percent. Sales and use taxes were $113.7 million above, or 3.9 percent, expectations in the Governor's 2014-15 proposed budget.

The State ended the month with a General Fund cash deficit of $14.1 billion, which was covered with both internal and external borrowing. That figure was down from last year, when the State faced a cash deficit of $16.2 billion at the end of February 2013.

emphasis added

Update: Framing Lumber Prices

by Calculated Risk on 3/10/2014 01:15:00 PM

Here is another graph on framing lumber prices. Early last year lumber prices came close to the housing bubble highs. Then prices started to decline sharply, with prices declined over 25% from the highs by June.

The price increases early last year were due to stronger demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices are down about 10% from a year ago, probably due to more supply coming on the market. Here is another mill coming back from the Oregonian: Cave Junction sawmill will reopen

If all goes as planned, the small-log mill will be retooled and running by July. Its owners say they are confident that they can maintain a single shift, and put 67 people to work running the mill.

...

Rough & Ready was the last sawmill operating in Josephine County, putting a psychological and economic capstone on the decades-long decline of Oregon’s timber industry. The industry employed 25,400 people statewide in 2012, half as many as in 1992.

...

“Demand is good right now,” Link Phillippi said. “Our markets are good. our customers are begging for wood.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Prices are probably close to the peak for this year (demand usually peaks seasonally in March and April).

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 3/10/2014 09:09:00 AM

Friday on the employment report:

• February Employment Report: 175,000 Jobs, 6.7% Unemployment Rate

• Comments on Employment Report

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is at 2.5% of the labor force - the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 509 thousand.

Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in 2014.

The BLS diffusion index for total private employment was at 59.3 in February, down from 60.6 in January.

The BLS diffusion index for total private employment was at 59.3 in February, down from 60.6 in January.For manufacturing, the diffusion index decreased to 51.2, down from 52.5 in January.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was fairly widespread in February.

Sunday, March 09, 2014

Sunday Night Futures

by Calculated Risk on 3/09/2014 08:52:00 PM

A couple of interesting housing articles in the WSJ ...

First, from Nick Timiraos: Surging Home Prices Are a Double-Edged Sword

The U.S. housing market faces a challenge at the start of the spring sales season: higher prices.And from Conor Dougherty at the WSJ: New-Home Building Is Shifting to Apartments

It is hard to overstate the benefits of rising prices to the economy broadly and to homeowners, banks and home builders specifically after years of declines. Price gains have pulled more Americans from the brink of foreclosure and given home buyers more confidence that they won't get stuck with an asset whose value will decline.

But those gains have a painful edge, too, especially because prices have bounced back so strongly. The increases have rekindled concerns about affordability, particularly for first-time buyers, and could damp the gains of a housing rebound still in its early stages.

"Prices ran up so fast in 2013, it hurt first-timers' ability to become homeowners," said John Burns, chief executive of a home-building consulting firm in Irvine, Calif. "It's going to be a slower recovery than people had hoped because a number of people have been priced out of the market."

The share of new homes being built as rental apartments is at the highest level in at least four decades, as an improving jobs picture spurs younger Americans to form their own households but tighter lending standards make it more difficult to buy.Weekend:

• Schedule for Week of March 9th

• Mortgage Equity Withdrawal Still Negative in Q4

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 25 (fair value).

Oil prices are down slightly with WTI futures at $102.45 per barrel and Brent at $108.71 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.47 per gallon (up sharply over the last month, but down significantly from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Mortgage Equity Withdrawal Still Negative in Q4

by Calculated Risk on 3/09/2014 11:24:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q4 2013, the Net Equity Extraction was minus $46 billion, or a negative 1.5% of Disposable Personal Income (DPI).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding decreased by $10.8 billion in Q4. Compared to recent years, this was a small decrease in mortgage debt and following Q3 when mortgage debt increased for the first time since Q1 2008

The Flow of Funds report also showed that Mortgage debt has declined by over $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again soon.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.