by Calculated Risk on 3/10/2014 09:09:00 AM

Monday, March 10, 2014

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Friday on the employment report:

• February Employment Report: 175,000 Jobs, 6.7% Unemployment Rate

• Comments on Employment Report

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is at 2.5% of the labor force - the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 509 thousand.

Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in 2014.

The BLS diffusion index for total private employment was at 59.3 in February, down from 60.6 in January.

The BLS diffusion index for total private employment was at 59.3 in February, down from 60.6 in January.For manufacturing, the diffusion index decreased to 51.2, down from 52.5 in January.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was fairly widespread in February.

Sunday, March 09, 2014

Sunday Night Futures

by Calculated Risk on 3/09/2014 08:52:00 PM

A couple of interesting housing articles in the WSJ ...

First, from Nick Timiraos: Surging Home Prices Are a Double-Edged Sword

The U.S. housing market faces a challenge at the start of the spring sales season: higher prices.And from Conor Dougherty at the WSJ: New-Home Building Is Shifting to Apartments

It is hard to overstate the benefits of rising prices to the economy broadly and to homeowners, banks and home builders specifically after years of declines. Price gains have pulled more Americans from the brink of foreclosure and given home buyers more confidence that they won't get stuck with an asset whose value will decline.

But those gains have a painful edge, too, especially because prices have bounced back so strongly. The increases have rekindled concerns about affordability, particularly for first-time buyers, and could damp the gains of a housing rebound still in its early stages.

"Prices ran up so fast in 2013, it hurt first-timers' ability to become homeowners," said John Burns, chief executive of a home-building consulting firm in Irvine, Calif. "It's going to be a slower recovery than people had hoped because a number of people have been priced out of the market."

The share of new homes being built as rental apartments is at the highest level in at least four decades, as an improving jobs picture spurs younger Americans to form their own households but tighter lending standards make it more difficult to buy.Weekend:

• Schedule for Week of March 9th

• Mortgage Equity Withdrawal Still Negative in Q4

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 25 (fair value).

Oil prices are down slightly with WTI futures at $102.45 per barrel and Brent at $108.71 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.47 per gallon (up sharply over the last month, but down significantly from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Mortgage Equity Withdrawal Still Negative in Q4

by Calculated Risk on 3/09/2014 11:24:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q4 2013, the Net Equity Extraction was minus $46 billion, or a negative 1.5% of Disposable Personal Income (DPI).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding decreased by $10.8 billion in Q4. Compared to recent years, this was a small decrease in mortgage debt and following Q3 when mortgage debt increased for the first time since Q1 2008

The Flow of Funds report also showed that Mortgage debt has declined by over $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again soon.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Saturday, March 08, 2014

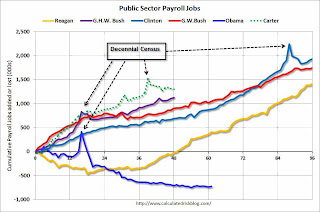

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 3/08/2014 08:17:00 PM

By request, here is an update on an earlier post through the February employment report.

Note: I added President Carter.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is just starting the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Just over one year into Mr. Obama's second term, there are now 4,451,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 728,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level. Right now I'm expecting some increase in public employment in 2014.

Schedule for Week of March 9th

by Calculated Risk on 3/08/2014 09:31:00 AM

The key report this week is February retail sales on Thursday.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for February.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of job openings (yellow) were up 10.5% year-over-year in December compared to December 2012, and Quits increased in December and were up about 12% year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.4% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM ET: the Monthly Treasury Budget Statement for February.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand.

8:30 AM ET: Retail sales for February will be released.

8:30 AM ET: Retail sales for February will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales decreased 0.4% from December to January (seasonally adjusted), and sales were up 2.6% from January 2013.

The consensus is for retail sales to increase 0.2% in February, and to increase 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.4% increase in inventories.

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.2% increase in prices.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 81.8, up from 81.6 in February.

Friday, March 07, 2014

Unofficial Problem Bank list declines to 564 Institutions

by Calculated Risk on 3/07/2014 09:25:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 7, 2014.

Changes and comments from surferdude808:

Not many changes to report this week to the Unofficial Problem Bank List. After two removals, the institution count and asset total dropped to 564 and $180.1 billion. A year ago, the list held 805 institutions with assets of $296.4 billion.

Totals have declined for the past 67 consecutive weeks.

Removals include an action termination against Bank of Hampton Roads, Virginia Beach, VA ($1.6 billion Ticker: HMPR) and a merger for Park Cities Bank, Dallas, TX ($406 million). Next week should be quiet as well as the OCC likely will not release its update until March 21st.

Fannie, Freddie and FHA REO Inventory

by Calculated Risk on 3/07/2014 04:53:00 PM

Note: The FHA has stopped releasing REO inventory on a monthly basis. I was able to obtain data for February as show on the graph below.

I'm still trying to get Quarter ending data from the FHA.

In their Q4 SEC filing, Fannie reported their Real Estate Owned (REO) increased to 103,229 single family properties, up from 100,941 at the end of Q3.

Freddie reported their REO increased to 47,308 in Q4, up from 44,623 at the end of Q3.

The FHA reported their REO decreased to 25,306 in February 2014, down from 32,226 in October 2013.

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA decreased to 175,843, down from 180,286 at the end of Q3 2013 (note: FHA data is not for Quarter end). The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions (declined in Q4), VA and more. REO has been declining for those categories.

REO for Fannie and Freddie has increased a little over the last two quarters and is still elevated, but REO for the FHA is apparently back to normal levels.

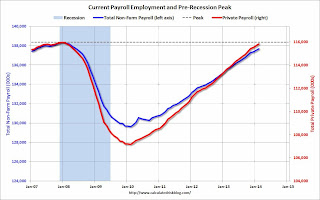

When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 3/07/2014 01:19:00 PM

Payroll employment is getting very close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow), but reaching new highs in employment will be a significant milestone in the recovery.

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

Click on graph for larger image.

Click on graph for larger image.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.699 million total non-farm payroll jobs, or 666 thousand fewer than the pre-recession peak.

At the recent annual pace (about 2.2 million jobs added per year), total non-farm payroll will be at a new high in June 2014.

The pre-recession peak for private payroll employment was 115.977 million. Currently there are 115.848 million total non-farm payroll jobs, or 129 thousand fewer than the pre-recession peak. It seems likely private sector employment that will be at a new high in March.

Trade Deficit increased in January to $39.1 Billion

by Calculated Risk on 3/07/2014 12:20:00 PM

The Department of Commerce reported this morning:

[T]otal January exports of $192.5 billion and imports of $231.6 billion resulted in a goods and services deficit of $39.1 billion, up from $39.0 billion in December, revised. January exports were $1.2 billion more than December exports of $191.3 billion. January imports were $1.3 billion more than December imports of $230.3 billion.The trade deficit was close to the consensus forecast of $39.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2014.

Click on graph for larger image.

Click on graph for larger image.Imports and exports increased in January.

Exports are 15% above the pre-recession peak and up 3% compared to January 2013; imports are at the pre-recession peak, and up about 1% compared to January 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $90.21 in January, down from $91.34 in December, and down from $94.08 in January 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China was mostly unchanged at $27.84 billion in January, from $27.79 billion in January 2013. A majority of the trade deficit is related to China.

Overall it appears trade is picking up a little.

Comments on Employment Report

by Calculated Risk on 3/07/2014 09:50:00 AM

First, a milestone for next month: Private payroll employment increased 162 thousand in February and private employment is now just 129 thousand below the previous peak (total employment is still 666 thousand below the peak in January 2008). It seems very likely that private employment will be at a new high in March.

Total non-farm employment will probably be at a new high this summer (all the government layoff have held back total employment).

This was a better employment report than the previous two months with 175,000 jobs added in February (and 25,000 in upward revisions to prior months). Hopefully job growth will be averaging over 200,000 jobs per month again soon (I expect stronger employment growth in 2014 than in 2013 even with the poor start to this year).

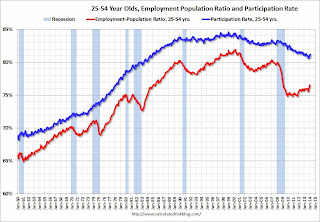

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in February to 81.2% from 81.1%, and the 25 to 54 employment population ratio was unchanged at 76.5%. As the recovery continues, I expect the participation rate for this group to increase.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels mid-year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 7.2 million in February. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.This is the lowest level for part time workers since October 2008.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 12.6% in February. This is the lowest level for U-6 since November 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.849 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 3.646 in January. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In February 2014, state and local governments added 19,000 jobs.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.

All things considered, this was a decent report. Hopefully the severe weather is behind us, and the pace of employment growth will pick up.