by Calculated Risk on 2/28/2014 08:38:00 AM

Friday, February 28, 2014

BEA: Q4 GDP Revised down to 2.4%

From the BEA: Gross Domestic Product, Fourth Quarter and Annual 2013 (second estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.4 percent in the fourth quarter of 2013 (that is, from the third quarter to the fourth quarter), according to the "second" estimate released by the Bureau of Economic Analysis. ...Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 3.3% to 2.6%. Government spending was a larger drag than originally estimated (-5.6% vs -4.9%).

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 3.2 percent. ...

The second estimate of the fourth-quarter percent change in real GDP is 0.8 percentage point, or $32.7 billion, less than the advance estimate issued last month, primarily reflecting downward revisions to personal consumption expenditures (PCE), to private inventory investment, to exports, and to state and local government spending that were partly offset by an upward revision to nonresidential fixed investment.

Thursday, February 27, 2014

Friday: 2nd Estimate Q4 GDP, Chicago PMI, Consumer Sentiment, Pending Home Sales

by Calculated Risk on 2/27/2014 08:16:00 PM

File under the new LA skyline ... another high rise is planned, from Roger Vincent at the LA Times: New high-rise on Broadway would be one of tallest in Southland

[A] 34-story apartment skyscraper more than twice as tall as most other buildings in the historic core of downtown L.A.Friday:

To be built at a cost of nearly $150 million, the apartment and retail complex called Broadway @ 4th would house 450 units and fill in a key block in gentrifying downtown L.A.

• At 8:30 AM ET, the second estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.5% annualized in Q4, revised down from the advance estimate of 3.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for February. The consensus is for a decrease to 57.8, down from 59.6 in January.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 81.2, unchanged from the preliminary reading of 81.2, and unchanged from the January reading.

• At 10:00 AM, Pending Home Sales Index for January. The consensus is for a 2.7% increase in the index.

Freddie Mac Results, REO Inventory increases in Q4

by Calculated Risk on 2/27/2014 02:10:00 PM

From Freddie Mac: FREDDIE MAC REPORTS NET INCOME OF $48.7 BILLION FOR FULL-YEAR 2013;

COMPREHENSIVE INCOME OF $51.6 BILLION

• Full-year net income and comprehensive income totaled $48.7 billion and $51.6 billion, respectivelyThere were significant one time gains (tax assets, legal settlements).

• Fourth quarter net income and comprehensive income totaled $8.6 billion and $9.8 billion, respectively – the company’s ninth consecutive quarter of positive net income and comprehensive income

• Financial results were positively impacted by the following significant items:

• Full-year tax benefit of $23.3 billion driven by release of deferred tax asset valuation allowance• Recent level of earnings is not sustainable over the long term

• Pre-tax benefit of legal settlements of $6.0 billion for fourth quarter and $7.7 billion for full year

• Continued improvement in home prices which contributed to reduced loan loss provisioning

• Fair value gains on derivative portfolio and non-agency mortgage-related securities

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie REO. This was the second consecutive quarterly increase in REO.

Freddie’s SF REO inventory declined over the year, and the recent increase might be seasonal. From Freddie:

In 2013, REO inventory declined primarily due to lower single-family foreclosure activity as a result of Freddie Mac’s loss mitigation efforts and a declining amount of delinquent loans.

Freddie Mac experienced an increase in REO acquisitions during 2013 compared to 2012 in the Northeast region and REO acquisitions remained high in the Southeast region. High REO acquisition volumes in these regions were primarily due to higher foreclosure volume in Maryland, Pennsylvania and Florida.

Kansas City Fed: Regional Manufacturing increased "slightly" in February

by Calculated Risk on 2/27/2014 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing was Slightly Positive

Growth in Tenth District manufacturing activity was slightly positive in February, and although producers’ expectations moderated somewhat they remained at solid levels overall. Several contacts continued to cite delays and slowdowns caused by severe winter weather issues. Price indexes were mostly stable or slightly lower.This is the last of the regional surveys. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The month-over-month composite index was 4 in February, similar to the reading of 5 in January and up from -3 in December ... The new orders, employment, and capital expenditures indexes were mostly unchanged.

“The story in February was similar to January. Regional factory activity was held back somewhat by unusually harsh weather, but still managed to grow modestly.” [said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City]

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

This suggests another weak reading for the February ISM survey to be released Monday, March 3rd.

Black Knight: Mortgage Serious Delinquency Rate lowest in over five years, Foreclosures Lowest since November 2008

by Calculated Risk on 2/27/2014 09:31:00 AM

According to Black Knight (formerly LPS) First Look report for January, the percent of loans delinquent decreased in January compared to November, and declined by more than 10% year-over-year.

Also the percent of loans in the foreclosure process declined further in January and were down 31% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 6.27% from 6.47% in December. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.35% in January from 2.48% in December. The is the lowest level since late 2008.

The number of delinquent properties, but not in foreclosure, is down 365,000 properties year-over-year, and the number of properties in the foreclosure process is down 528,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for January in early March.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| January 2014 | December 2013 | January 2013 | |

| Delinquent | 6.27% | 6.47% | 7.03% |

| In Foreclosure | 2.35% | 2.48% | 3.41% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,851,000 | 1,964,000 | 1,974,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,289,000 | 1,280,000 | 1,531,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,175,000 | 1,244,000 | 1,703,000 |

| Total Properties | 4,315,000 | 4,488,000 | 5,208,000 |

Weekly Initial Unemployment Claims increase to 348,000

by Calculated Risk on 2/27/2014 08:35:00 AM

The DOL reports:

In the week ending February 22, the advance figure for seasonally adjusted initial claims was 348,000, an increase of 14,000 from the previous week's revised figure of 334,000. The 4-week moving average was 338,250, unchanged from the previous week's revised average.The previous week was revised down from 336,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 338,250.

This was above the consensus forecast of 335,000. Mostly moving sideways ...

Wednesday, February 26, 2014

Thursday: Yellen Testimony, Weekly Unemployment Claims, Durable Goods Orders

by Calculated Risk on 2/26/2014 08:13:00 PM

From Kris Hudson at the WSJ: Builder Borrowing Picks Up

Bank lending for land development and construction is turning up after hitting a 14-year low early last year, a sign that the supply crunch for new homes could ease in coming months.In 2013, homebuilders pushed prices. I think prices for new homes will increase less this year (possibly flat or down in some areas), and the builders will deliver more homes.

Data released Wednesday by the Federal Deposit Insurance Corp. show that the outstanding balance on loans for land acquisition, development and construction rose in the fourth quarter to $209.9 billion, compared with $206 billion in the third quarter. While that's a relatively small gain, economists note that if the overall balance is growing it means that originations of new loans are likely rising even faster. It was the third consecutive quarter of growth.

An increase in lending would spur additional home construction and possibly put downward pressure on prices, which have been rising rapidly over the past two years and weighing on the housing recovery.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 336 thousand.

• Also at 8:30 AM, Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

• At 10:00 AM, Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

• At 11:00 AM, the Kansas City Fed manufacturing survey for February. This is the last of the regional Fed surveys for February.

Vehicle Sales Forecasts: Decent sales in February; Some weather impact

by Calculated Risk on 2/26/2014 04:55:00 PM

Note: The automakers will report January vehicle sales on Monday, March 3rd.

Here are a couple of forecasts:

From Kelley Blue Book: New-Car Sales To Report Sixteenth Consecutive Month Above 15 Million SAAR According To Kelley Blue Book

New-vehicle sales are expected to hit a total of 1.19 million units, and an estimated 15.3 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ... While a 15.3 million SAAR is flat compared to February 2013, it marks the sixteenth month in a row above 15 million.From J.D. Power: Healthy New-Vehicle Demand Exists Despite Severe Winter Weather

"For the second consecutive month, winter storms and unusually cold weather in many parts of the country are expected to negatively impact sales," said Alec Gutierrez, senior analyst for Kelley Blue Book. "However, it is likely these purchases have only been delayed and many lost sales will be recorded in March or April."

"Although severe weather impacted sales in early February, the negative effect should be somewhat mitigated since the majority of vehicle sales occur in the second half of the month," said John Humphrey, senior vice president of the global automotive practice at J.D. Power. "The industry is on track to reach its highest-ever average transaction price for the month of February, with prices exceeding $29,000. This beats the previous record from February 2013 by more than $400."It appears sales in February were OK.

In addition to forecasting a record transaction price for the month of February, the firms expect new-vehicle sales to increase 5% over the same month in 2013. LMC Automotive is also holding steady its prediction that annual sales will reach 16.2 million units, despite the bitterly cold winter weather and slow start to the year. However, LMC Automotive does note that all automakers except for Subaru are experiencing bloated inventories. If they are unsuccessful at resolving the situation by summer, production cuts may loom during the second half of the year.

New Home Sales: Don't read too much into January Sales Rate

by Calculated Risk on 2/26/2014 01:27:00 PM

Earlier: New Home Sales at 468,000 Annual Rate in January, Highest since 2008

Even though the Census Bureau reported that new home sales rebounded in January from the low December rate (and the December sales rate was revised up), January and December are seasonally weak months - and there is a large margin of error to the initial release - so I wouldn't read too much into one month of data. Also reported sales were only up 2% year-over-year (not much).

In 2013, January was reported as the strongest sales rate of the year - so maybe the seasonal factor is off a little. So even though this was a decent start to 2014 (highest sales rate since 2008), the key months are ahead of us.

Note: Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the 468 thousand sales rate in January. So I expect the housing recovery to continue.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through January 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some (distressed sales will slowly decline and be partially offset by more conventional sales). And I expect this gap to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down - and is currently at the lowest level since November 2008. I expect this ratio to continue to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

FDIC: Earnings increased for insured institutions, Fewer Problem banks, Residential REO Declines in Q4

by Calculated Risk on 2/26/2014 11:30:00 AM

The FDIC released the Quarterly Banking Profile for Q4 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $40.3 billion in the fourth quarter of 2013, a $5.8 billion (16.9 percent) increase from the $34.4 billion in earnings that the industry reported a year earlier. This is the 17th time in the last 18 quarters — since the third quarter of 2009 — that earnings have registered a year-over-year increase. The improvement in earnings was mainly attributable to an $8.1 billion decline in loan-loss provisions. Lower income stemming from reduced mortgage activity and a drop in trading revenue contributed to a year-over-year decline in net operating revenue (the sum of net interest income and total noninterest income). More than half of the 6,812 insured institutions reporting (53 percent) had year-over-year growth in quarterly earnings. The proportion of banks that were unprofitable fell to 12.2 percent, from 15 percent in the fourth quarter of 2012.The FDIC reported the number of problem banks declined:

emphasis added

The number of "problem banks" fell for the 11th consecutive quarter. The number of banks on the FDIC's "Problem List" declined from 515 to 467 during the quarter. The number of "problem" banks is down by almost half from the recent high of 888 at the end of the first quarter of 2011. Two FDIC-insured institutions failed in the fourth quarter of 2013, down from eight in the fourth quarter of 2012. For all of 2013, there were 24 failures, compared to 51 in 2012.

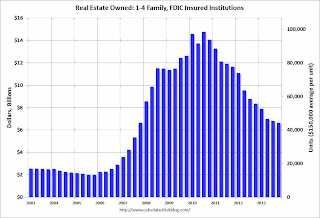

Click on graph for larger image.

Click on graph for larger image.The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $6.79 billion in Q3 2013 to $6.64 billion in Q4. This is the lowest level of REOs since Q3 2007. Even in good times, the FDIC insured institutions have about $2.5 billion in residential REO.

This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.