by Calculated Risk on 1/28/2014 06:48:00 PM

Tuesday, January 28, 2014

Zillow: Case-Shiller House Price Index expected to show 13.5% year-over-year increase in December

The Case-Shiller house price indexes for November were released today. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. It looks like another very strong month ...

From Zillow: Case-Shiller Forecast: Apprieciation Remains Strong

The Case-Shiller data for November came out this morning, and based on this information and the December 2013 Zillow Home Value Index (ZHVI, released January 22) we predict that next month’s Case-Shiller data (December 2013) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 13.5 and 13.6 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from November to December will be 0.7 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for December will not be released until Tuesday, Feb. 25.The following table shows the Zillow forecast for the December Case-Shiller index.

The Zillow Home Value Index continues to show slow moderation in home value appreciation, as well as a fair amount of volatility in home value growth as the housing recovery continues. Case-Shiller indices have shown very little slowing in monthly appreciation and have not yet recorded monthly declines (at least not in their seasonally-adjusted monthly numbers). Even when the Case-Shiller indices do begin to show monthly depreciation in some areas, they will continue to show an inflated picture of home prices, especially when considering year-over-year growth. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed.

In contrast, the ZHVI does not include foreclosure resales and shows home values for December 2013 up 6.4 percent from year-ago levels. More on the differences between a repeat sales index, including the Case-Shiller indices, and an imputed hedonic index like the ZHVI can be found here. We expect home value appreciation to continue to moderate through the end of 2013 and into 2014, rising 4.8 percent between December 2013 and December 2014 — a rate much more in line with historic appreciation rates.

| Zillow December Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Dec 2012 | 158.60 | 159.28 | 146.08 | 146.75 |

| Case-Shiller (last month) | Nov 2013 | 180.15 | 179.7 | 165.80 | 165.41 |

| Zillow Forecast | YoY | 13.6% | 13.6% | 13.5% | 13.5% |

| MoM | 0.0% | 0.7% | 0.0% | 0.7% | |

| Zillow Forecasts1 | 180.2 | 180.9 | 165.8 | 166.6 | |

| Current Post Bubble Low | 146.45 | 149.67 | 134.07 | 136.91 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 23.0% | 20.9% | 23.7% | 21.7% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Lawler: D.R. Horton sales up slightly year-over-year

by Calculated Risk on 1/28/2014 03:06:00 PM

From housing economist Tom Lawler:

D.R. Horton, the largest US home builder, reported that net home orders in the quarter ended December 31, 2013 totaled 5,454, up 3.7% from the comparable quarter of 2012, and up “contra-seasonal” 5.7% from the previous quarter’s weak level. The average net order price last quarter was $275,600, up 10.3% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 23% last quarter, up slightly from 22% a year ago. Home deliveries totaled 6,188 last quarter, up 19.4% from the comparable quarter of 2012, at an average home sales price of $263,542 up 11.6% from a year ago. The company’s order backlog at the end of last year was 7,684, up 5.0% from the end of 2012, at an average order price of $275,052, up 14.4% from a year earlier. The company said that its average community count last quarter was up 13% from the comparable quarter of 2012.

Horton noted in its press release that its weekly sales pace “accelerated” in January. In its press conference, officials noted that the strong home price gains last year reflected both increased pricing power in most of its markets and a higher mix of larger homes and sales to “move-up” buyers. Officials said that of the purchase mortgages closed by Horton’s mortgage subsidiary last quarter, 41% were to first-time home buyers, down from 50% in the comparable quarter of 2012 – suggesting that sales to first-time home buyers were weak last quarter.

According to officials, Horton’s gross margin last quarter was at its highest level since 2006. Officials were “very optimistic” about the 2014 “spring” (really winter/spring) selling season, and said that they were “well-positioned” from a community count and “spec inventory” position to take advantage of strong sales. Based on these expectations officials said they expected to “hold” these exceptionally high margins, but officials noted that home price gains in 2014 were likely to be much more modest in 2014. Given Horton’s elevated margins and “strong” spec inventory position, weaker-than-expected sales over the next few months could lead to flat to slightly lower home prices.

In response to a question in the Q&A session, a Horton official noted that home prices in Phoenix, which increased about 25% last year, had begun to “plateau,” and the official expected prices in Phoenix this year to be flat to slightly down.

At the end of December Horton owned or controlled 175,000 lots, down slightly from 177,300 at the end of 2012, but up significantly from 120,600 at the end of 2011.

emphasis added

Comment on House Prices: Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 1/28/2014 12:22:00 PM

I've been hearing some reports of a slowdown in house price increases (more than the usual seasonal slowdown), but this slowdown in price increases is not showing up yet in the Case-Shiller index. I expect to see smaller year-over-year price increases going forward.

There was a small Not Seasonally Adjusted decline in November, but that decline was smaller than usual - and prices are still increasing fairly quickly on a seasonally adjusted basis.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (about 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Earlier: Case-Shiller: Case-Shiller: Comp 20 House Prices increased 13.7% year-over-year in November

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2004 levels (and also back up to Q3 2008), and the Case-Shiller Composite 20 Index (SA) is back to June 2004 levels, and the CoreLogic index (NSA) is back to October 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2001 levels, the Composite 20 index is back to May 2002, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 2000 levels, the Composite 20 index is back to Aug 2002 levels, and the CoreLogic index is back to February 2003.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 44% above January 2000 (44% nominal gain in 14 years).

These are nominal prices, and as I noted above real prices (adjusted for inflation) are up about 38% since January 2000 - so the increase in Phoenix from January 2000 until now is just a little above the change in overall prices due to inflation.

Two cities - Denver (up 45% since Jan 2000) and Dallas (up 32% since Jan 2000) - are at new highs (no other Case-Shiller Comp 20 city is very close). Denver is up slightly more than inflation over that period, and Dallas slightly less. Detroit prices are still below the January 2000 level.

BLS: State unemployment rates were "generally lower" in December

by Calculated Risk on 1/28/2014 10:40:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in December. Thirty-nine states and the District of Columbia had unemployment rate decreases from November, two states had increases, and nine states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island had the highest unemployment rate among the states in December, 9.1 percent. The next highest rates were in Nevada, 8.8 percent, and Illinois, 8.6 percent. North Dakota continued to have the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

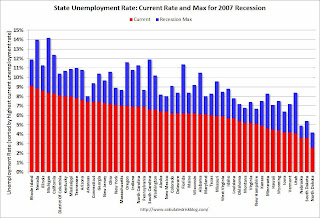

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, Nevada and Florida have seen the largest declines and many other states have seen significant declines.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at 9% in only one state: Rhode Island.

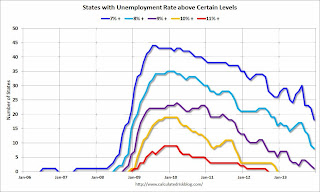

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently one state has an unemployment rate at or above 9% (purple), eight states at or above 8% (light blue), and 18 states at or above 7% (blue).

Case-Shiller: Comp 20 House Prices increased 13.7% year-over-year in November

by Calculated Risk on 1/28/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Winter Shows No Signs of Cooling in Home Prices According to the S&P/Case-Shiller Home Price Indices

Data through November 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that the 10-City and 20-City Composites increased 13.8% and 13.7% year-over-year. Dallas posted its highest annual return of 9.9% since its inception in 2000. Chicago also stood out with an annual rate of 11.0%, its highest since December 1988.

For the month of November, the two Composites declined 0.1%. After nine consecutive months of gains, this marks the first decrease since November 2012. Nine out of 20 cities recorded positive monthly returns ...

“November was a good month for home prices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Despite the slight decline, the 10-City and 20-City Composites showed their best November performance since 2005. Prices typically weaken as we move closer to the winter. Las Vegas, Los Angeles and Phoenix stand out as they have posted 20 or more consecutive monthly gains.

“Beginning June 2012, we saw a steady rise in year-over-year increases. November continued that trend with another strong month although the rate of increase slowed. Looking at the year-over-year returns, the Sun Belt continues to push ahead with Atlanta, Las Vegas, Los Angeles, Miami, Phoenix, San Diego, San Francisco and Tampa taking eight of the top nine spots. Detroit continues to recover but remains the only city with prices below its 2000 level."

Click on graph for larger image.

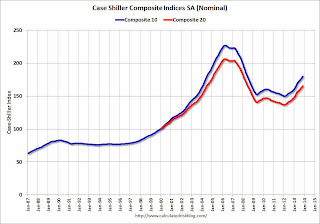

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 20.8% from the peak, and up 0.9% in November (SA). The Composite 10 is up 20.1% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 19.9% from the peak, and up 0.9% (SA) in November. The Composite 20 is up 20.8% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.9% compared to November 2012.

The Composite 20 SA is up 13.7% compared to November 2012.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in November seasonally adjusted. (Prices increased in 9 of the 20 cities NSA) Prices in Las Vegas are off 45.8% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was at the consensus forecast for a 13.7% YoY increase. I'll have more on prices later.

Black Knight: Mortgage Delinquency Rate increased in December, Down almost 10% year-over-year

by Calculated Risk on 1/28/2014 07:01:00 AM

According to the Black Knight (formerly LPS) First Look report for December, the percent of loans delinquent increased seasonally in December compared to November, and declined about 9.9% year-over-year.

Also the percent of loans in the foreclosure process declined further in December and were down 28% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 6.47% from 6.45% in November. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.48% in December from 2.50% in November. The is the lowest level since late 2008.

The number of delinquent properties, but not in foreclosure, is down 332,000 properties year-over-year, and the number of properties in the foreclosure process is down 472,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for December in early February.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| December 2013 | November 2013 | December 2012 | |

| Delinquent | 6.47% | 6.45% | 7.17% |

| In Foreclosure | 2.48% | 2.50% | 3.44% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,964,000 | 1,958,000 | 2,031,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,280,000 | 1,283,000 | 1,545,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,244,000 | 1,256,000 | 1,716,000 |

| Total Properties | 4,488,000 | 4,497,000 | 5,292,000 |

Monday, January 27, 2014

Tuesday: Case-Shiller House Prices, Durable Goods, Richmond Fed Mfg Survey and More

by Calculated Risk on 1/27/2014 08:34:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight (formerly LPS): U.S. Home Prices Up 0.3 Percent for the Month; Up 8.5 Percent Year-Over-Year

oday, the Data & Analytics division of Black Knight Financial Services (formerly the LPS Data & Analytics division) released its latest Home Price Index (HPI) report, based on November 2013 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increase was slightly less in November than in October. The LPS HPI is off 13.9% from the peak in June 2006.

Tuesday:

• At 8:30 AM ET, the Durable Goods Orders report for December from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for November. The consensus is for a 13.7% year-over-year increase in the Composite 20 index (NSA) for August.

• Also at 9:00 AM, the Chemical Activity Barometer (CAB) for January from the American Chemistry Council. This appears to be a leading economic indicator.

• At 10:00 AM, the Conference Board's consumer confidence index for January. The consensus is for the index to increase to 79.0 from 78.1.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed surveys for January. The consensus is a reading of 10, down from 13 in December (above zero is expansion).

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for December 2013.

Weekly Update: Housing Tracker Existing Home Inventory up 1.8% year-over-year on Jan 27th

by Calculated Risk on 1/27/2014 05:30:00 PM

Here is another weekly update on housing inventory ... for the 15th consecutive week housing inventory is up year-over-year (but not by much). This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for December). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 1.8% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

New Home Prices: New Record for Average and Median in 2013

by Calculated Risk on 1/27/2014 03:25:00 PM

Here are two graphs I haven't for some time ...

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in December 2013 was $270,200; the average sales price was $311,400."

The following graph shows the median and average new home prices.

Click on graph for larger image.

Click on graph for larger image.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer foreclosures now, it appears the builders have moved to higher price points.

The average price in 2013 was $320,900, above the previous high of $313,600 in 2007. The median price in 2013 was $265,800, above the previous high of $247,900 in 2009.

The second graph shows the percent of new home sales by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 39%. And less than 10% were under $150K in 2013.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 39%. And less than 10% were under $150K in 2013.

Earlier on New Home Sales:

• New Home Sales at 414,000 Annual Rate in December

• New Home Sales: Weak Finish, Solid Growth in 2013

New Home Sales: Weak Finish, Solid Growth in 2013

by Calculated Risk on 1/27/2014 11:35:00 AM

Earlier: New Home Sales at 414,000 Annual Rate in December

Although sales in December were weak, the Census Bureau reported annual sales were up 16.4% from 2012. This was the highest level for sales since 2008, but still the sixth worst year on record.

Sales would have been higher in 2013, except some homebuilders were land constrained (not enough entitled land), and many homebuilders pushed prices sacrificing a little volume. Still a 16% annual increase in sales is solid growth.

This table shows the annual sales rate for the last ten years.

| Annual New Home Sales | ||

|---|---|---|

| Year | Sales (000s) | Change in Sales |

| 2004 | 1,203 | 10.8% |

| 2005 | 1,283 | 6.7% |

| 2006 | 1,051 | -18.1% |

| 2007 | 776 | -26.2% |

| 2008 | 485 | -37.5% |

| 2009 | 375 | -22.7% |

| 2010 | 323 | -13.9% |

| 2011 | 306 | -5.3% |

| 2012 | 368 | 20.3% |

| 2013 | 428 | 16.4% |

Even with the sharp increase in sales over the last two years, 2013 was the sixth worst year for new home sales since 1963.

The sales rate was only lower than 2013 in the worst housing bust years of 2009 through 2012, and the worst year of early '80s recession (1982).

| Worst Years for New Home Sales since 1963 | ||

|---|---|---|

| Rank | Year | New Home Sales (000s) |

| 1 | 2011 | 306 |

| 2 | 2010 | 323 |

| 3 | 2012 | 368 |

| 4 | 2009 | 375 |

| 5 | 1982 | 412 |

| 6 | 2013 | 428 |

| 7 | 1981 | 436 |

| 8 | 1969 | 448 |

| 9 | 1966 | 461 |

| 10 | 1970 | 485 |

| 11 | 2008 | 485 |

Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the 428 thousand sales in 2013. This suggests significant upside over the next several years. So I expect the housing recovery to continue.

Note: Inventories of completed and "under construction" homes are still historically low. The Census Bureau reported 40 thousand completed homes for sale, just above the record low set in June 2013. And there were 97 thousand homes "under construction" in December, well below the median of 185 thousand over the last 40 years. So there are no concerns about too much inventory (inventory is probably too low in some areas).

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some (distressed sales will slowly decline and be partially offset by more conventional sales). And I expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.