by Calculated Risk on 1/17/2014 08:30:00 AM

Friday, January 17, 2014

Housing Starts at 999 Thousand Annual Rate in December

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 999,000. This is 9.8 percent below the revised November estimate of 1,107,000, but is 1.6 percent above the December 2012 rate of 983,000.

Single-family housing starts in December were at a rate of 667,000; this is 7.0 percent below the revised November figure of 717,000. The December rate for units in buildings with five units or more was 312,000.

An estimated 923,400 housing units were started in 2013. This is 18.3 percent above the 2012 figure of 780,600.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 986,000. This is 3.0 percent below the revised November rate of 1,017,000, but is 4.6 percent above the December 2012 estimate of 943,000.

Single-family authorizations in December were at a rate of 610,000; this is 4.8 percent below the revised November figure of 641,000. Authorizations of units in buildings with five units or more were at a rate of 350,000 in December.

Click on graph for larger image.

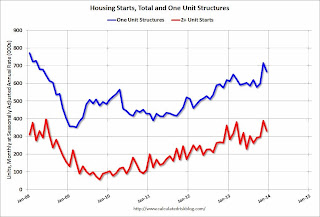

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in December (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in December following the sharp increase in November.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was slightly above expectations of 985 thousand starts in December. I'll have more later ... but this was a solid year with starts up 18.3 percent from 2012.

Thursday, January 16, 2014

Friday: Housing Starts, Industrial Production, Consumer Sentiment, JOLTS

by Calculated Risk on 1/16/2014 09:00:00 PM

First, here is a price index for commercial real estate that I follow. From CoStar: Commercial Real Estate Prices Post Steady Gains in November

COMMERCIAL PROPERTY PRICES CONTINUED THEIR STEADY UPWARD TRAJECTORY IN NOVEMBER: With the U.S. economy on more solid footing during the fourth quarter of 2013 and demand for commercial real estate space on the rise, pricing continued on a steady upward trajectory in November 2013. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—advanced by 0.8% and 1.1%, respectively in November 2013, and rose by a more robust 10.9% and 7.8%, respectively, over the last year.Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

...

ABSORPTION EXPANDS AT FASTEST RATE SINCE 2007: Tenants occupied an additional 380 million square feet of office, retail and industrial space throughout the U.S. in 2013, the largest annual gain in net absorption over the past six years. The Investment Grade segment of the market continued to dominate in space absorption. However, the pace of absorption in the General Commercial segment has improved significantly as the recovery is accelerating in the secondary and tertiary markets. The General Commercial segment’s share of total net absorption increased from being less than 30% for the last several years to 32% in 2013.

...

DISTRESS SALES REMAIN LOW: The percentage of commercial property selling at distressed prices was slightly more than 13% in November 2013, down roughly two-thirds from the peak in 2011. Technology and energy-driven markets including Houston, Denver, Dallas, and Austin have experienced some of the strongest declines in the share of distress property sales activity over the last year, with a reduction of 80% or more.

emphasis added

Friday:

• At 8:30 AM ET, Housing Starts for December. The consensus is for total housing starts to decrease to 985 thousand (SAAR) in December.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.1%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 83.5, up from 82.5 in December.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for November from the BLS.

NMHC Survey: Apartment Market Conditions Softer in Q4

by Calculated Risk on 1/16/2014 01:44:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Soften Slightly According to NMHC Survey

Apartment market conditions weakened a bit in January compared with three months earlier. The market tightness (41), sales volume (41) and debt financing (42) indexes were all a little below the breakeven level of 50, although the equity financing index rebounded to 50.

“Apartment markets are little changed from October,” said Mark Obrinsky, NMHC’s Senior Vice President for Research and Chief Economist. “At least half of our respondents to each of our four main questions reported conditions as unchanged from three months earlier. Although markets are a little looser than in October, this is largely seasonal; overall markets remain fairly tight.

“New supply is finally starting to arrive at levels that will more closely match overall demand. In a few markets, we are seeing completions a little higher than absorptions, but this is likely to be short term in nature. Fundamentally, demand for apartment homes should be strong for the rest of the decade (and beyond) – provided only that the economy remains on track.”

...

The Market Tightness Index declined to 41 from 46. Slightly more than half (56 percent) of respondents reported unchanged conditions, and approximately one-third (31 percent) saw conditions as looser than three months ago. The index last indicated overall improving conditions in July 2013. Some respondents noted that the decline was typical for this time of year and that conditions remain fairly tight.

emphasis added

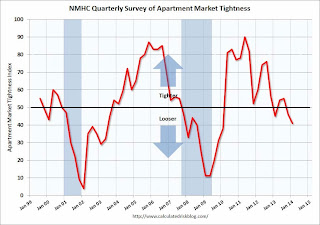

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates loosening from the previous quarter. The quarterly decrease was small, but indicates looser market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates are near a bottom.

Key Measures Shows Low Inflation in December

by Calculated Risk on 1/16/2014 12:38:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.1% annualized rate) in December. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for December here. Fuel oil and motor fuels increased sharply in December.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.6% annualized rate) in December. The CPI less food and energy increased 0.1% (1.3% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.7%. Core PCE is for November and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 3.1% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI increased 1.3% annualized.

These measures suggest inflation remains below the Fed's target.

NAHB: Builder Confidence declines to 56 in January

by Calculated Risk on 1/16/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 56 in January, down from 57 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Slips One Notch in January

Builder confidence in the market for newly built, single-family homes fell one point to 56 in January from a revised December reading of 57 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

All three HMI components declined in January. The index gauging current sales conditions edged one point lower to 62, while the index gauging expectations for future sales fell two points to 60. The index gauging traffic of prospective buyers fell three points to 40.

Looking at the three-month moving averages for regional HMI scores, the Northeast and West each rose four points to 42 and 63, respectively, while the South held steady at 56. The Midwest fell a single point to 58.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

“Rising home prices, historically low mortgage rates and significant pent-up demand will drive a continuing, gradual recovery in the year ahead,” said NAHB Chief Economist David Crowe.

Weekly Initial Unemployment Claims decline to 326,000

by Calculated Risk on 1/16/2014 08:35:00 AM

The DOL reports:

In the week ending January 11, the advance figure for seasonally adjusted initial claims was 326,000, a decrease of 2,000 from the previous week's revised figure of 328,000. The 4-week moving average was 335,000, a decrease of 13,500 from the previous week's revised average of 348,500.The previous week was revised down from 330,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 335,000.

The current week (next report) will be the BLS reference period for the employment report.

Wednesday, January 15, 2014

Thursday: Unemployment Claims, CPI, Philly Fed Mfg Survey, Homebuilder Confidence

by Calculated Risk on 1/15/2014 09:05:00 PM

Comment: Extending emergency unemployment benefits has always been a non-partisan issue when so many Americans are unemployed - especially when so many have been unemployed for a long period. Extending the benefits should happen immediately. This is good policy, good economics - and has always received the support of both parties. Hopefully this will be extended soon.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decline to 327 thousand from 330 thousand.

• Also at 8:30 AM, the Consumer Price Index for December. The consensus is for a 0.3% increase in CPI in December and for core CPI to increase 0.1%.

• At 10:00 AM, the Philly Fed manufacturing survey for January. The consensus is for a reading of 8.7, up from 7.0 last month (above zero indicates expansion).

• Also at 10:00 AM, the January NAHB homebuilder survey. The consensus is for a reading of 57.5, down from 58.0 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

Sacramento Housing: Total Sales down 20% Year-over-year in December, Conventional Sales up 33%, Active Inventory increases 44%

by Calculated Risk on 1/15/2014 05:46:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In December 2013, 18.8% of all resales (single family homes) were distressed sales. This was up from 15.5% last month, and down from 51.5% in December 2012.

The percentage of REOs was at 7.1%, and the percentage of short sales decreased to 11.7%. The increase in December was seasonal (happens at the end of every year).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 44.2% year-over-year in December. This is the eighth consecutive month with a year-over-year increase in inventory.

Cash buyers accounted for 19.5% of all sales, down from 25.0% a year ago (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 20% from December 2012, but conventional sales were up 33% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Fed's Beige Book: Economic activity increased "at a moderate pace" in Most Districts

by Calculated Risk on 1/15/2014 03:04:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Boston and based on information collected on or before January 6, 2014."

Reports from the twelve Federal Reserve Districts suggest economic activity continued to expand across most regions and sectors from late November through the end of the year. Nine Districts indicated the local economy was expanding at a moderate pace; among these, the Atlanta and Chicago Districts saw conditions improve compared with the previous reporting period. Boston and Philadelphia cited modest growth, while Kansas City reported the economy held steady in December. The economic outlook is positive in most Districts, with some reports citing expectations of "more of the same" and some expecting a pickup in growth.And on real estate:

Most Districts reported increases in home sales in the closing months of 2013 compared with last year, but the Atlanta, Cleveland, and Kansas City Districts indicated that year-over-year residential sales growth had slowed relative to earlier quarters in 2013. The Boston, Philadelphia, Minneapolis, and Dallas reports noted that at least some areas within those Districts saw home sales below year-earlier levels. Home selling prices continued their upward trend in the Boston, Atlanta, Chicago, Minneapolis, Kansas City, and San Francisco Districts, while remaining stable in the Cleveland and Richmond Districts; New York noted mixed changes in sale prices across the District. Residential construction saw slight to moderate increases in most Districts; by contrast, Dallas cited a slight decline, New York reported no change, and Cleveland cited strong growth. Notwithstanding its decrease in overall residential construction, the Dallas District noted elevated construction levels for multi-family units; the Atlanta, Cleveland, and Chicago Districts also cited strong multifamily construction. Reporting Districts indicated that residential real estate contacts remained optimistic looking forward, while voicing concerns about declining inventory and potential changes in the mortgage market. The Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco Districts reported that contacts expected residential construction to pick up in the near term.Some pretty positive comments on real estate. This is a minor upgrade to the previous beige book.

District reports on commercial real estate contained much good news, although performance within some Districts was uneven across locations and property types. ... Excepting the New York and Dallas Districts, which gave no information on recent construction, all other Districts reported increases in commercial construction activity in recent weeks. In the Boston and Richmond Districts, construction activity increased in the education and healthcare sectors. A significant number of commercial high-rise structures are being built (or planned) in the San Francisco District. Information concerning the commercial real estate outlook was largely positive where it was reported. Contacts in the Boston, Atlanta, and Kansas City Districts were optimistic that commercial real estate fundamentals would continue to improve at least slowly in 2014. The outlook for commercial construction activity was positive in the Philadelphia, Cleveland, Minneapolis, and Dallas Districts.

emphasis added

DataQuick: Bay Area Home Sales Drop to Six-Year Low in December

by Calculated Risk on 1/15/2014 01:42:00 PM

This decline in sales - due to fewer distressed sales - is an important theme. This is a step towards a more normal housing market, NOT a sign that the housing recovery is faltering.

From DataQuick: Bay Area Home Sales Drop to Six-Year Low; Prices Still Up Sharply Yr/Yr

Last month’s Bay Area home sales were the slowest for a December in six years, the result of a constrained supply of homes for sale. ...Even though overall sales declined, conventional sales were up about 15% year-over-year. Also, as prices increase, more inventory should come on the market.

A total of 6,714 new and resale houses and condos sold in the nine-county Bay Area last month. That was the lowest for any December since 2007, when 5,065 homes sold. Last month’s sales were up 0.8 percent from 6,659 in November, and down 12.7 percent from 7,688 in December 2012, according to San Diego-based DataQuick.

Sales almost always increase from November to December, usually around 8 percent. Last month’s sales were 21.3 percent below the December average of 8,529 since 1988, when when DataQuick’s statistics begin. ...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 4.5 percent of resales in December, up from 3.7 percent the month before, and down from 12.1 percent a year ago. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 10.5 percent of Bay Area resales last month. That was up from an estimated 9.5 percent in November and down from 23.6 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 23.0 percent of all Bay Area homes. That was up from November’s revised 20.6 percent and down from 26.0 percent in December 2012. Absentee buyers paid a median $439,000 last month, up 35.1 percent from $325,000 a year earlier.