by Calculated Risk on 1/01/2014 08:42:00 PM

Wednesday, January 01, 2014

Thursday: Unemployment Claims, ISM Mfg Index, Construction Spending

Happy New Year!

Here are eight of the ten questions for 2014 with a few predictions (two more to come):

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 338 thousand.

• At 9:00 AM, the Markit US PMI Manufacturing Index for December. The consensus is for an decrease to 54.5 from 54.7 in November.

• At 10:00 AM, the ISM Manufacturing Index for December. The consensus is for a decrease to 57.0 from 57.3 in November. The ISM manufacturing index indicated expansion in November at 57.3%. The employment index was at 56.5%, and the new orders index was at 63.6%.

• Also at 10:00 AM, Construction Spending for November. The consensus is for a 1.0% increase in November construction spending.

Question #3 for 2014: What will the unemployment rate be in December 2014?

by Calculated Risk on 1/01/2014 04:35:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2014.

Here is a review of the Ten Economic Questions for 2013.

3) Unemployment Rate: The unemployment rate is still elevated at 7.0% in November. For the last three years I've been too pessimistic on the unemployment rate because I was expecting some minor bounce back in the participation rate. Instead the participation rate continued to decline. Maybe 2014 will be the year the participation rate increases a little, or at least stabilizes. What will the unemployment rate be in December 2014?

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate. Note: The participation rate is the percent of the working age population (16 and over) that is in the labor force.

Policy matters in 2014 too. The Emergency Unemployment Compensation (EUC) benefits expired on December 28, 2013. With the very high level of long term unemployed, not extending EUC is unprecedented, bad economics and ... well, cruel. So maybe Congress will pass an extension. This matters for the unemployment rate - if there is no extension, the unemployment rate will probably decline 0.2 to 0.3 percentage points in the first quarter just due to people dropping out of the labor force (or taking minimum wage jobs to survive). I'd guess Congress will be shamed into taking action, but you never know.

And on participation: We can be pretty certain that the participation rate will decline over the next couple of decades based on demographic trends, but it is uncertain what will happen in 2014. The participation rate could bounce back or at least stabilize. Or the participation rate could decline further as has happened over the last few years.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Decline in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | 1.2 | 9.9% |

| 2010 | 64.3% | 0.3 | 9.3% |

| 2011 | 64.0% | 0.3 | 8.5% |

| 2012 | 63.6% | 0.4 | 7.8% |

| 20131 | 63.0% | 0.6 | 7.0% |

| 1This is the November 2013 participation and unemployment rate. | |||

My guess is the participation rate will stabilize or only decline slightly in 2014 (less than in 2012 and 2013), unless the EUC isn't extended. Without an extension of the EUC, we might see a 0.3 to 0.5 percentage decline in the participation rate in 2014.

Even if the participation rate stabilizes, the unemployment rate will probably decline for the right reason in 2014; a pickup in job growth.

Depending on the estimate for job growth (next question), it appears the unemployment rate will decline to the low-to-mid 6% range by December 2014.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Question #4 for 2014: Will too much inflation be a concern in 2014?

by Calculated Risk on 1/01/2014 01:49:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2014. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2013.

4) Inflation: The Fed has made it clear they will tolerate a little more inflation, but currently the inflation rate is running well below the Fed's 2% target. Will the inflation rate rise in 2014? Will too much inflation be a concern in 2014?

Although there are different measure for inflation (including some private measures) they all show that inflation is at or below the Fed's 2% inflation target.

Note: I agree with the FOMC view, that "inflation persistently below its 2 percent objective could pose risks to economic performance". Some people think there should be zero inflation, I think this is incorrect and there are clear reasons that a little inflation is good for the economy.

I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change for these four key measures of inflation through November. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 1.6%, the CPI rose 1.2%, and the CPI less food and energy rose 1.7%. Core PCE is for October and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.2% annualized, and core CPI increased 1.9% annualized.

For some technical reasons, core PCE has been lower than the other measures. Goldman Sachs chief economist Jan Hatzius addressed this recently:

"almost half of the slowdown in core PCE inflation in 2013 was due to the slowdown in healthcare cost growth. Although a significant part of this slowdown is likely to persist, some of it—specifically the Medicare reimbursement cut related to the federal sequester—is likely to reverse in 2014 and this will likely add 0.1-0.2 percentage points to core PCE inflation."So core PCE will probably move up a little year-over-year, but with all the slack still in the system (and little wage growth), I expect the other measures of inflation to stay at or below the Fed's target in 2014. If the unemployment rate continues to decline - and wage growth picks up - maybe inflation will be an issue in 2015 or 2016.

So currently I think inflation (year-over-year) will increase a little in 2014 as growth picks up, but too much inflation will not be a concern in 2014.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Tuesday, December 31, 2013

Market Update: Happy New Year!

by Calculated Risk on 12/31/2013 09:38:00 PM

Click on graph for larger image.

By request - following the huge market rally in 2013 - here are a couple of stock market graphs. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The market was up 29.6% in 2013 plus dividends.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

Happy 2014 to all.

Fannie Mae: Mortgage Serious Delinquency rate declined in November, Lowest since December 2008

by Calculated Risk on 12/31/2013 04:13:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in November to 2.44% from 2.48% in October. The serious delinquency rate is down from 3.30% in November 2012, and this is the lowest level since December 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in November to 2.43% from 2.48% in October. Freddie's rate is down from 3.25% in November 2012, and is at the lowest level since March 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.86 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in less than 2 years. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Restaurant Performance Index increases in November

by Calculated Risk on 12/31/2013 03:03:00 PM

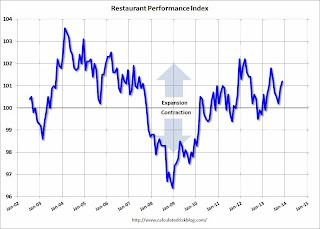

From the National Restaurant Association: Restaurant Performance Index Hit a Five-Month High in November

Driven by improving same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) hit a five-month high in November. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.2 in November, up 0.3 percent from October and the strongest level since June. In addition, the RPI stood above 100 for the ninth consecutive month, which signifies expansion in the index of key industry indicators.

“Recent growth in the RPI was fueled in large part by improving same-store sales and customer traffic levels,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “In addition, restaurant operators are somewhat more confident that sales levels will improve, and a majority plan to make a capital expenditure in the next six months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 101.2 in November – up 0.3 percent from a level of 100.9 in October and the highest level in six months. ...

Fifty-seven percent of restaurant operators reported a same-store sales gain between November 2012 and November 2013, up from 54 percent in October and the highest level in six months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.2 in November, up from 100.9 in October. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is fairly positive.

Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

by Calculated Risk on 12/31/2013 12:58:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2014. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2013.

5) Monetary Policy: It appears the Fed's current plan is to reduce their monthly asset purchases by about $10 billion at each FOMC meeting in 2014. That would put the monthly purchases at close to zero in December 2014. Will the Fed complete QE3 in 2014? Or will the Fed continue to buy assets in 2015?

Although the Fed is not on auto-pilot - the FOMC is still data dependent - I think it is very likely that QE3 will be completed by the end of 2014. There are 8 meetings during the year, and I expect the FOMC to reduce the pace of asset purchases at about $10 billion per meeting. In January, the Fed will purchase $75 billion in assets and I expect that to be reduced to $65 billion in February (following the meeting on January 28th and 29th). And a similar reduction at each meeting all year.

It appears they will only slow the taper if inflation declines sharply - or if the economy stalls (I think both are unlikely).

It also seems unlikely they will accelerate the pace of the taper significantly.

So even though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Case-Shiller: Press Release and Graphs

by Calculated Risk on 12/31/2013 09:59:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Stage Advance According to the S&P/Case-Shiller Home Price Indices

Data through October 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that the 10-City and 20-City Composites posted year-over-year gains of 13.6%. This is their highest gain since February 2006 and marks the seventeenth consecutive month that both Composites increased on an annual basis.

In October 2013, the two Composites showed a small gain of 0.2% for the month. Eighteen cities posted lower monthly rates in October than in September. After 19 months of gains, San Francisco showed a slightly negative return. Phoenix held onto its streak and posted its 25th consecutive increase.

“Home prices increased again in October,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Both Composites’ annual returns have been in double-digit territory since March 2013 and increasing; now up 13.6% in the year ending in October. However, monthly numbers show we are living on borrowed time and the boom is fading.

“The year-over-year figures increased slightly from last month. Thirteen cities and both Composites posted double-digit annual returns. Cities at the top of the range (Las Vegas, San Diego and San Francisco) saw smaller annual increases. On the other hand, cities that have been relatively underperforming (Cleveland, New York and Washington) saw their annual gains grow. Miami showed the most improvement. Chicago recorded its highest annual rate (+10.9%) since December 1988. Charlotte and Dallas posted annual increases of 8.8% and 9.7%, their highest since the inception of their indices in 1987 and 2000.

“The key economic question facing housing is the Fed’s future course to scale back quantitative easing and how this will affect mortgage rates. Other housing data paint a mixed picture suggesting that we may be close to the peak gains in prices. However, other economic data point to somewhat faster growth in the new year. Most forecasts for home prices point to single digit growth in 2014.”

In October 2013, ten cities posted positive monthly returns. Las Vegas showed the largest gain with an increase of 1.2%, followed by Miami with a 1.1% monthly gain. Atlanta, Boston, Chicago, Cleveland, Dallas, Denver, San Francisco, Seattle and Washington were the nine cities that declined month-over-month; two of them, Denver and Dallas, are slightly off their peak set last month. New York remained flat. Only Charlotte and Miami accelerated on a monthly basis.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 21.5% from the peak, and up 1.0% in October (SA). The Composite 10 is up 19.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 20.7% from the peak, and up 1.0% (SA) in October. The Composite 20 is up 19.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.6% compared to October 2012.

The Composite 20 SA is up 13.6% compared to October 2012. This was the seventeenth consecutive month with a year-over-year gain.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in October seasonally adjusted. Prices in Las Vegas are off 46.6% from the peak, and prices in Denver and Dallas are at new highs.

This was slightly below the consensus forecast for a 13.7% YoY increase. I'll have more on prices later.

Case-Shiller: Comp 20 House Prices increased 13.6% year-over-year in October

by Calculated Risk on 12/31/2013 09:24:00 AM

Note: I'm having difficulties with the S&P website. I'll some graphs soon ...

From Reuters: US home prices notch big annual gain: S&P/Case-Shiller

The S&P/Case Shiller composite index of 20 metropolitan areas gained 0.2 percent in October on a non-seasonally adjusted basis ... On a seasonally-adjusted basis, prices were up 1 percent.This was close to the consensus forecast of a 13.7% year-over-year increase.

Compared to a year earlier, prices were up 13.6 percent ...

the more subdued monthly gains "show we are living on borrowed time and the boom is fading," David Blitzer, chairman of the index committee at S&P Dow Jones Indices, said in a statement.

Monday, December 30, 2013

Tuesday: Case-Shiller House Prices, Chicago PMI

by Calculated Risk on 12/30/2013 08:50:00 PM

I've posted some thoughts (and a few predictions) on half of my ten questions for 2014. There will be more to come (I've also received some thoughtful disagreements - I don't have a crystal ball, I just try to outline my current views):

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for a 13.7% year-over-year increase in the Composite 20 index (NSA) for October.

• At 9:45 AM, the Chicago Purchasing Managers Index for December. The consensus is for a decrease to 61.3, down from 63.0 in November.

• At 10:00 AM, the Conference Board's consumer confidence index for December. The consensus is for the index to increase to 76.8 from 70.4.