by Calculated Risk on 12/19/2013 08:24:00 PM

Thursday, December 19, 2013

Friday: Q3 GDP, State Employment, Kansas City Fed Mfg

Here we go again, from the LA Times: Lew warns Congress debt limit must be raised no later than early March

Treasury will be able to use so-called extraordinary measures to extend the nation's borrowing ability until "late February or early March," Lew wrote in a letter to House and Senate leaders.If Congress passes a budget with a deficit, the amount borrowed will have to increase.

...

"The creditworthiness of the United States is an essential underpinning of our strength as a nation; it is not a bargaining chip to be used for partisan political ends," Lew wrote.

We have a budget. The budget has a deficit (although the deficit has been declining rapidly). The deficit has to be borrowed to pay the bills. The smart move would be to eliminate the so-called "debt ceiling". It is solely for political posturing.

My prediction: The bills will be paid (debt ceiling increased), with no material concessions.

Friday:

• At 8:30 AM, Q3 GDP (third estimate). This is the third estimate of Q3 GDP from the BEA. The consensus is that real GDP increased 3.6% annualized in Q3, unchanged from the second estimate.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for November 2013.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

LA area Port Traffic up solidly year-over-year in November

by Calculated Risk on 12/19/2013 04:12:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for November since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 1.0% compared to the rolling 12 months ending in October. Outbound traffic increased 1.3% compared to 12 months ending in October.

In general, inbound traffic has been increasing and outbound traffic had been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Inbound traffic was up 13% compared to November 2012 and outbound traffic was up 17%.

This suggests a pickup in trade in November.

Comments on Existing Home Sales

by Calculated Risk on 12/19/2013 12:48:00 PM

As expected, existing home sales declined in November. But lower existing home sales, and slower price appreciation, doesn't mean the housing recovery is over. What matters for jobs and the economy are new home sales, not existing home sales. And I expect the housing recovery to continue.

A key story in the NAR release this morning was that inventory was up 5.0% year-over-year in November. Inventory is still very low, but year-over-year inventory has now turned positive, and I expect inventory to continue to increase. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Click on graph for larger image.

Click on graph for larger image.

The NAR does not seasonally adjust inventory, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory (see graph of NAR reported and seasonally adjusted).

This shows that inventory bottomed in January (on a seasonally adjusted basis), and is now up about 8.4% from the bottom. On a seasonally adjusted basis, inventory was up 1.7% in November, even though the NAR reported inventory declined NSA.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 1.2% from November 2012, but conventional sales were probably up from November 2012, and distressed sales down. The NAR reported that 14% of sales were distressed in November (from a survey that isn't perfect):

Nine percent of November sales were foreclosures, and 5 percent were short sales.Last year the NAR reported that 22% of sales were distressed sales. So total sales were down slightly, distressed sales down sharply and conventional sales were up. That is a positive sign.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in November (red column) were above the sales for 2007, 2008 and 2010, 2011. Sales were below 2012 (fewer distressed sales), and below 2009 (boosted by tax credit).

Overall this was a solid report.

Earlier:

• Existing Home Sales in November: 4.90 million SAAR, Inventory up 5.0% Year-over-year

Existing Home Sales in November: 4.90 million SAAR, Inventory up 5.0% Year-over-year

by Calculated Risk on 12/19/2013 10:00:00 AM

The NAR reports: Existing-Home Sales Decline in November, but Strong Price Gains Continue

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 4.3 percent to a seasonally adjusted annual rate of 4.90 million in November from 5.12 million in October, and are 1.2 percent below the 4.96 million-unit pace in November 2012. This is the first time in 29 months that sales were below year-ago levels.

...

Total housing inventory at the end of November declined 0.9 percent to 2.09 million existing homes available for sale, which represents a 5.1-month supply at the current sales pace, compared with 4.9 months in October. Unsold inventory is 5.0 percent above a year ago, when there was a 4.8-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2013 (4.90 million SAAR) were 4.3% lower than last month, and were 1.2% below the November 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was declined to 2.09 million in November from 2.11 million in October. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory was declined to 2.09 million in November from 2.11 million in October. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 5.0% year-over-year in November compared to November 2012. The year-over-year change for October was revised down to unchanged, so this is the first year-over-year increase in inventory since early 2011 and indicates inventory bottomed earlier this year.

Inventory increased 5.0% year-over-year in November compared to November 2012. The year-over-year change for October was revised down to unchanged, so this is the first year-over-year increase in inventory since early 2011 and indicates inventory bottomed earlier this year.Months of supply was at 5.1 months in November.

This was below to expectations of sales of 5.04 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Weekly Initial Unemployment Claims increase to 379,000

by Calculated Risk on 12/19/2013 08:36:00 AM

The DOL reports:

In the week ending December 14, the advance figure for seasonally adjusted initial claims was 379,000, an increase of 10,000 from the previous week's figure of 369,000. The 4-week moving average was 343,500, an increase of 13,250 from the previous week's revised average of 330,250.The previous week was revised up from 368,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 343,500.

This is the second consecutive week with elevated claims, but this might be impacted by the holidays.

Wednesday, December 18, 2013

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 12/18/2013 08:32:00 PM

A prediction: When the NAR releases the November existing home sales report tomorrow showing a decline in sales, some reporters will question the "housing recovery".

First, for jobs and GDP, the housing recovery is about "residential investment", and that mostly means housing starts and new home sales. Second, a decline in existing home sales could be good news, if the decline is mostly related to fewer distressed sales - and if conventional sales are increasing.

I've been pounding on those two themes for some time, but not everyone got the memo :-).

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 337 thousand from 368 thousand last week.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 5.02 million on seasonally adjusted annual rate (SAAR) basis. Sales in October were at a 5.12 million SAAR. Economist Tom Lawler is forecasting the NAR will report sales of 4.98 million SAAR in November.

• Also at 10:00 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 10.0, up from 6.5 last month (above zero indicates expansion).

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 12/18/2013 07:02:00 PM

In addition to housing starts for November, the Census Bureau also released the Q3 "Started and Completed by Purpose of Construction" report this morning.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 120,000 single family starts, built for sale, in Q3 2013, and that was above the 90,000 new homes sold for the same quarter, so inventory increased in Q3 (Using Not Seasonally Adjusted data for both starts and sales).

This was the biggest gap between sales and starts since 2006, but one quarter isn't very worrisome.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 17% compared to Q3 2012. This is still very low, but the highest for Q3 since 2007.

Owner built starts were up 8% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' had increased significantly, but the year-over-year growth has slowed to about 15%.

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling (although they started significantly more than they sold in Q3), and the inventory of under construction and completed new home sales is still very low. This gap will only be concerning if it persists.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

FOMC Projections and Press Conference

by Calculated Risk on 12/18/2013 02:13:00 PM

The key sentences in the announcement were: "In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to modestly reduce the pace of its asset purchases. Beginning in January, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month."

And on forward guidance: "The Committee now anticipates, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal."

Rates will be low for a long long time ...

As far as the "Appropriate timing of policy firming", the participants moved out a little with three participants now seeing the first increase in 2016.

Bernanke press conference here or watch below.

Free desktop streaming application by Ustream

On the projections, GDP was mostly unrevised, the unemployment rate was revised down slightly, and inflation was revised down.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | 2.2 to 2.3 | 2.8 to 3.2 | 3.0 to 3.4 | 2.5 to 3.2 |

| Sept 2013 Meeting Projections | 2.0 to 2.3 | 2.9 to 3.1 | 3.0 to 3.5 | 2.5 to 3.3 |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 | |

The unemployment rate was at 7.0% in November.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | 7.0 to 7.1 | 6.3 to 6.6 | 5.8 to 6.1 | 5.3 to 5.8 |

| Sept 2013 Meeting Projections | 7.1 to 7.3 | 6.4 to 6.8 | 5.9 to 6.2 | 5.4 to 5.9 |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 | |

The FOMC believes inflation will stay significantly below target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | 0.9 to 1.0 | 1.4 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

| Sept 2013 Meeting Projections | 1.1 to 1.2 | 1.3 to 1.8 | 1.6 to 2.0 | 1.7 to 2.0 |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 | |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | 1.1 to 1.2 | 1.4 to 1.6 | 1.6 to 2.0 | 1.8 to 2.0 |

| Sept 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 | |

FOMC Statement: Taper!

by Calculated Risk on 12/18/2013 02:00:00 PM

Information received since the Federal Open Market Committee met in October indicates that economic activity is expanding at a moderate pace. Labor market conditions have shown further improvement; the unemployment rate has declined but remains elevated. Household spending and business fixed investment advanced, while the recovery in the housing sector slowed somewhat in recent months. Fiscal policy is restraining economic growth, although the extent of restraint may be diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will pick up from its recent pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for the economy and the labor market as having become more nearly balanced. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

Taking into account the extent of federal fiscal retrenchment since the inception of its current asset purchase program, the Committee sees the improvement in economic activity and labor market conditions over that period as consistent with growing underlying strength in the broader economy. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to modestly reduce the pace of its asset purchases. Beginning in January, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate

. The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. The Committee also reaffirmed its expectation that the current exceptionally low target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee now anticipates, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Charles L. Evans; Esther L. George; Jerome H. Powell; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Eric S. Rosengren, who believes that, with the unemployment rate still elevated and the inflation rate well below the federal funds rate target, changes in the purchase program are premature until incoming data more clearly indicate that economic growth is likely to be sustained above its potential rate.

emphasis added

Comments: Housing Starts and Mortgage Index

by Calculated Risk on 12/18/2013 11:46:00 AM

A few comments:

• The MBA purchase index is down about 10% year-over-year, and this has led to some articles like this from CNBC: Mortgage applications plummet amid uncertainty

Purchase applications though are down 10 percent, mirroring a slowdown in home sales in many previously hot markets.The slowdown in existing home sales is mostly due to less investor buying and fewer distressed sales (fewer cash buyers). Declining distressed sales, but increasing conventional sales - even if total sales decline - is a good sign!

And an important note on the Purchase Index: the index is probably understating purchase activity due to a change in the mix of lenders. There are more small lenders that focus on purchase loans (and sell to Fannie and Freddie), and these lenders are underrepresented in the purchase index. I discussed this two weeks ago with the MBA's Mike Fratantoni, and he told me:

[I]n the last couple of years ... independent mortgage bankers have accounted for a fast growing share of the purchase market ... We have actively recruited independents and smaller banks to get better coverage of the purchase market. ... It is likely that many of the lenders not in the survey have a higher purchase share and lower refi share.The MBA index is useful, but housing starts and new home sales provide better information.

• Overall the housing starts report was encouraging with total starts at a 1.09 million rate on a seasonally adjusted annual rate basis (SAAR) in November. This was well above the consensus forecast of 952 thousand SAAR.

• And the increase wasn't just in the volatile multi-family sector; single family starts were at the highest level since early 2008.

• Also housing starts are up significantly from the same period last year. Over the first eleven months of 2013, total starts are up over 19% compared to the same period in 2012. The increases in starts slowed in the 2nd half of 2013, but this has been a solid year for residential investment growth.

• Even with another significant year-over-year increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. This suggests significantly more growth in housing starts over the next few years.

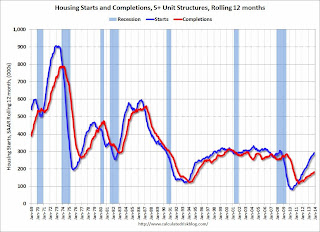

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind. It is interesting that completions have lagged so far behind starts, and this suggests completions will increase significantly in 2014 (completions lag starts by about 12 months).

However the level of multi-family starts over the last 12 months - close to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

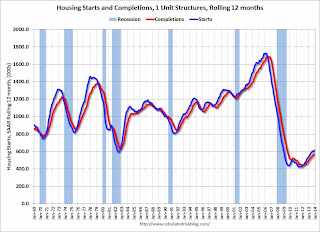

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.