by Calculated Risk on 12/18/2013 11:46:00 AM

Wednesday, December 18, 2013

Comments: Housing Starts and Mortgage Index

A few comments:

• The MBA purchase index is down about 10% year-over-year, and this has led to some articles like this from CNBC: Mortgage applications plummet amid uncertainty

Purchase applications though are down 10 percent, mirroring a slowdown in home sales in many previously hot markets.The slowdown in existing home sales is mostly due to less investor buying and fewer distressed sales (fewer cash buyers). Declining distressed sales, but increasing conventional sales - even if total sales decline - is a good sign!

And an important note on the Purchase Index: the index is probably understating purchase activity due to a change in the mix of lenders. There are more small lenders that focus on purchase loans (and sell to Fannie and Freddie), and these lenders are underrepresented in the purchase index. I discussed this two weeks ago with the MBA's Mike Fratantoni, and he told me:

[I]n the last couple of years ... independent mortgage bankers have accounted for a fast growing share of the purchase market ... We have actively recruited independents and smaller banks to get better coverage of the purchase market. ... It is likely that many of the lenders not in the survey have a higher purchase share and lower refi share.The MBA index is useful, but housing starts and new home sales provide better information.

• Overall the housing starts report was encouraging with total starts at a 1.09 million rate on a seasonally adjusted annual rate basis (SAAR) in November. This was well above the consensus forecast of 952 thousand SAAR.

• And the increase wasn't just in the volatile multi-family sector; single family starts were at the highest level since early 2008.

• Also housing starts are up significantly from the same period last year. Over the first eleven months of 2013, total starts are up over 19% compared to the same period in 2012. The increases in starts slowed in the 2nd half of 2013, but this has been a solid year for residential investment growth.

• Even with another significant year-over-year increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. This suggests significantly more growth in housing starts over the next few years.

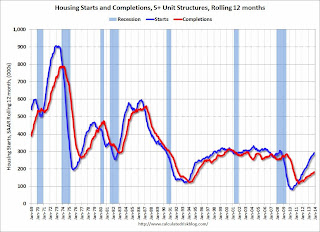

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind. It is interesting that completions have lagged so far behind starts, and this suggests completions will increase significantly in 2014 (completions lag starts by about 12 months).

However the level of multi-family starts over the last 12 months - close to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

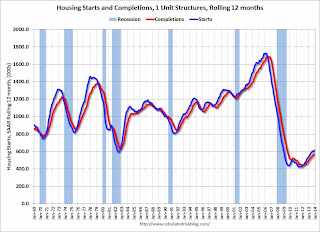

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.