by Calculated Risk on 12/16/2013 08:10:00 PM

Monday, December 16, 2013

FNC: House prices increased 6.5% year-over-year in October

Tuesday:

• 8:30 AM ET, Consumer Price Index for November. The consensus is for no change in CPI in November and for core CPI to increase 0.1%.

• 10:00 AM, the December NAHB homebuilder survey. The consensus is for a reading of 55, up from 54.0 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: October Home Prices Up; Pace Slows

The latest FNC Residential Price Index™ (RPI) shows October home prices are up, albeit at a slower pace than previous months. The index, constructed to gauge underlying property value based on non-distressed home sales, showed a 0.3% month-over-month increase from September to October—its weakest acceleration in eight months.The 100-MSA composite was up 6.5% compared to October 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

The deceleration in the pace of price increase is expected as the housing market heads into the winter low season after strong growth in the spring and summer. Sustained by moderate economic growth and job creation, housing market fundamentals are expected to improve continually as indicators of distressed mortgages and home foreclosures continue to point to new lows. As of October, completed foreclosure sales nationwide contributed 13.9% to total home sales, up slightly from September’s 13.4% but down from 17.0% a year ago. The uptick in completed foreclosure sales is primarily a seasonal trend as banks tend to dispose of distressed properties more quickly in winter months. In another sign of slower housing activity and weakening price growth, the average asking-price discount has been trending higher in recent months....

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that October home prices increased from the previous month at a seasonally unadjusted rate of 0.3%. The two narrower RPI indices (30- and 10-MSA composites) also rose at a slower pace than previous months. On a year-over-year basis (YOY), home prices continue to accelerate moderately, up 6.5% from the same period a year ago, the fastest growth in more than seven years. (August 2006 was the last time the YOY growth measured similar magnitude.) The 30-MSA and 10-MSA composites recorded slightly faster YOY price appreciation.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 25.2% from the peak.

I expect all of the housing price indexes to show lower year-over-year price gains soon.

Lawler: Early Read on Existing Home Sales in November

by Calculated Risk on 12/16/2013 05:03:00 PM

From housing economist Tom Lawler:

Based on realtor/MLS reports I’ve seen across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.98 million in November, down 3.7% from October’s SA pace, and up just 0.4% from last November’s SA pace. I estimate that unadjusted existing home sales last month were down about 2.9% from last November’s pace – the first YOY decline since June 2011. This November, however, had one fewer business day than last November, and as such this November’s will be lower than last November’s (meaning that the YOY change in seasonally adjusted sales will exceed that of unadjusted sales).

While difficult to quantify, the 16-day government shutdown in October appears to have negatively impacted November home closings, through three channels: (1) delays in various loan-application verifications associated with the IRS/SSA being closed for the first half of October; (2) adverse impacts on “confidence” related to the government shutdown; and (3) temporary direct adverse impacts on potential buyers (e.g., furloughed government workers). It is worth noting that sales in the DC metro area, which in October showed a YOY increase of 19.1%, were down 13.7% YOY in November.

There also appears to have been a significantly slowdown in investor buying in many parts of the country in November, in large part reflecting lower inventories of homes priced “attractively enough” for rental/investment purchases (as opposed to overall inventories). E.g., in Phoenix and Orlando overall home listings were up both on the month and from year-ago levels, home sales were down sharply YOY. Here is how the Orlando Regional Realtor Association “explained” the significant decline in Orlando home sales last month.

"We’re seeing fewer investor and institutional buyers in the Orlando market due to the dramatic gains in median prices we’ve experienced,” Merchant says. "In addition, we’re experiencing another effect of the governmental shutdown, which understandably dampened buyers’ willingness to commit to a home purchase in October. Since it takes about four weeks to move from contract to closing, the expected result is a drop in completed sales in November.”The rapid increase in home prices over the last year in several markets, combined with increases in mortgage rates from earlier this year, has also dampened “traditional” home buying, according to several realtor sources.

To be sure, not all areas showed weakness in home sales this November vs. last November. Charlotte and the Triangle area of North Carolina, e.g., both showed double-digit YOY sales gains, and MLS sales in Long Island were up 25.5% from a year ago (though sales last November were adversely impacted by Hurricane Sandy). By the same token, however, there were double-digit YOY declines in sales in several areas of the country, including but not limited to the DC metro area, Phoenix, Vegas, quite a few California areas, and several key Florida area.

On the inventory front, home listings typically drop seasonally by a significant amount in November in most (though not all) parts of the country, and most realtor/MLS reported sizable monthly declines in inventories (exceptions include Phoenix, Arizona, and several Florida markets.) Based on realtor/MLS reports as well as reports from entities that track regional listings, my “best guess” is that the NAR’s estimate of the number of existing homes for sale at the end of November will be down 4.7% from October, and up 2.0% from last November.

Finally, I estimate that the NAR’s estimate of the median existing SF home sales price in November will be about 9.0% higher than last November.

CR Note: The NAR is scheduled to report November existing home sales on Thursday, Dec 19th.

DataQuick on SoCal: November Home Sales Down 10.4% year-over-year, Foreclosure Resales lowest since May 2007

by Calculated Risk on 12/16/2013 03:08:00 PM

From DataQuick: Southland Home Sales Drop; Median Sale Price Edges Sideways - Again

Southern California’s housing market downshifted last month, with sales falling well below a year earlier as investor activity waned again and buyers continued to struggle with higher prices and a thin supply of homes for sale. ... A total of 17,283 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 14.2 percent from 20,150 sales in October, and down 10.4 percent from 19,285 sales in November 2012, according to San Diego-based DataQuick.Both distress sales and investor buying is declining - and this is dragging down overall sales (plus inventory is still very low). However conventional sales are up about 25% year-over-year (a positive sign).

Last month’s sales were 19.8 percent below the average number of sales – 21,559 – in the month of November. Southland sales haven’t been above average for any particular month in more than seven years. November sales have ranged from a low of 13,173 in November 2007 to high of 31,987 in November 1988.

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.3 percent of the Southland resale market in November. That was the same as in October and was down from 15.4 percent a year earlier. The October/November foreclosure resale rate was the lowest since it was 5.5 percent in May 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 12.7 percent of Southland resales last month. That was the lowest since October 2008, when it was also 12.7 percent. Last month’s short sale figure was down from an estimated 12.9 percent the month before and down from 26.6 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 26.1 percent of the Southland homes sold last month. That’s the lowest share for any month since it was 25.1 percent in November 2011. Last month’s absentee level was down from a revised 27.1 percent the month before and down from 28.7 percent a year earlier. The absentee share has trended lower almost every month this year since hitting a record 32.4 percent this January. The monthly average since 2000, when the absentee data begin, is 18.5 percent.

emphasis added

Weekly Update: Housing Tracker Existing Home Inventory up 1.9% year-over-year on Dec 16th

by Calculated Risk on 12/16/2013 12:07:00 PM

Here is another weekly update on housing inventory ... for the ninth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for October; November data will be released later this week). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now 1.9% above the same week in 2012 (red is 2013, blue is 2012).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? I'll post some thoughts on inventory at the end of the year.

Fed: Industrial Production increased 1.1% in November, Above Pre-recession Peak

by Calculated Risk on 12/16/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in November after having edged up 0.1 percent in October; output was previously reported to have declined 0.1 percent in October. The gain in November was the largest since November 2012, when production rose 1.3 percent. Manufacturing output increased 0.6 percent in November for its fourth consecutive monthly gain. Production at mines advanced 1.7 percent to more than reverse a decline of 1.5 percent in October. The index for utilities was up 3.9 percent in November, as colder-than-average temperatures boosted demand for heating. At 101.3 percent of its 2007 average, total industrial production was 3.2 percent above its year-earlier level. In November, industrial production surpassed for the first time its pre-recession peak of December 2007 and was 21 percent above its trough of June 2009. Capacity utilization for the industrial sector increased 0.8 percentage point in November to 79.0 percent, a rate 1.2 percentage points below its long-run (1972-2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.0 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.0% is still 1.2 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

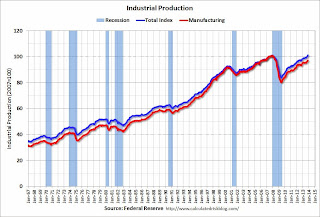

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 1.1% in November to 101.3. This is 21% above the recession low, and slightly above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations. The consensus was for a 0.6% increase in Industrial Production in November, and for Capacity Utilization to be at 78.4%.

NY Fed: Empire State Manufacturing Activity "flat" in December

by Calculated Risk on 12/16/2013 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The December 2013 Empire State Manufacturing Survey indicates that manufacturing conditions were flat for New York manufacturers. The general business conditions index rose three points but, at 1.0, indicated that activity changed little over the month. The new orders index inched up, but remained negative at -3.5 ...This is the first of the regional surveys for December. The general business conditions index was below the consensus forecast of a reading of 4.5, and shows little expansion.

Labor market conditions remained weak, with the index for number of employees holding at 0.0 for a second month in a row and the average workweek index dropping six points to -10.8. Indexes for the six-month outlook generally conveyed a fair degree of optimism about future conditions ... emphasis added

Sunday, December 15, 2013

Sunday Night Futures: Time for Taper?

by Calculated Risk on 12/15/2013 08:22:00 PM

Monday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 4.5, up from -2.2 in November (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 78.4%.

This will be a busy week for economic data, and the focus will be on Fed Chairman Ben Bernanke's last FOMC meeting and press conference on Wednesday.

From Pedro Nicolaci da Costa and Jon Hilsenrath at the WSJ: Tough Question for Fed: Time to Act?

Fed Chairman Ben Bernanke in June set out a three-part test—based on employment, growth and inflation—for reducing the $85 billion in monthly bond buys. He said the Fed's policy committee wants to see progress in the job market, supported by improving economic activity and an inflation rate rising toward its 2% target.Weekend:

"If the incoming data are broadly consistent with this forecast, the committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year," Mr. Bernanke said at a news conference.

Recent data show progress on the first two criteria, but not on the third. The inflation rate has been persistently below the Fed's objective and reflects weak consumption and wage growth, which bode poorly for the economic recovery. Fed officials will likely differ on whether the gains overall are good enough to clear Mr. Bernanke's hurdles.

• Schedule for Week of December 15th

• FOMC Projections Preview: To Taper, or Not to Taper

The Nikkei is down about 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 20 (fair value).

Oil prices have mostly been moving sideways with WTI futures at $96.71 per barrel and Brent at $109.48 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.22 per gallon. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Projections Preview: To Taper, or Not to Taper

by Calculated Risk on 12/15/2013 11:11:00 AM

The FOMC meets on Tuesday and Wednesday of this week. It seems some modest "tapering" of monthly asset purchases is possible, although the consensus is the Fed will wait until January or March of next year.

Here is some analysis, first from Merrill Lynch:

Once again, market anticipation is rising ahead of a Fed meeting. In our view, this meeting will be defined by what the Fed doesn’t do: we see a low chance of the start to tapering or meaningful changes to forward guidance. Rather, we look to Chairman Bernanke’s final press conference for a broad discussion of Fed policy options into next year. He is likely to signal both that tapering could start early next year — conditional on the data — and that the Fed will be patient and gradual as it winds down its purchase program. We also expect him to indicate that the Fed will strengthen its forward guidance if needed, but keep his options open. The overall tone should be modestly dovish, especially relative to market expectations of potential start to tapering. We expect him to reiterate that the Fed intends to keep policy accommodative well into the future in order to support a broader and more sustained recovery.And from economist David Mericle at Goldman Sachs:

Fed officials face a more difficult decision at their meeting next week, as the employment and growth data have picked up since the October meeting. But our central forecast for the first tapering move remains March, with January possible as well. We see a decision to taper next week as unlikely for three reasons.My view is the data is broadly consistent with the FOMC's projections in June and September. Inflation is too low, but the FOMC was projecting low inflation - and they are expecting inflation to pick up in 2014. Most analysts expect the FOMC to wait until 2014, but a small taper this week should not be a surprise.

First, the case for tapering on the basis of the data since October is mixed at best. The strongest argument in favor is the improvement in the trend rate of payroll growth to the 200k level. However, we expect that Fed officials will also put considerable weight on inflation, which has fallen further in recent months. At current spot and projected inflation rates, a tightening move would be quite unusual by historical standards.

Second, we continue to expect that tapering will be offset by a strengthening of the forward guidance, but we doubt the FOMC is ready to take this step. While some eventual strengthening or clarifying of the forward guidance is now a consensus expectation, the October minutes and recent Fed commentary suggest little agreement on what form this should take.

Third, while consensus expectations now place greater probability on a December taper, it remains a minority view. We suspect that this makes a move less likely, as Fed officials will be reluctant to deliver a hawkish surprise that could tighten financial conditions and raise doubts about their commitment to the inflation target.

If the Fed does reduce their asset purchases, the "taper" will probably be small - perhaps to $75 or $80 billion per month from the current $85 billion per month. If purchases are reduced, it seems likely that the Fed will continue to purchase agency mortgage-backed securities at the current rate ($40 billion per month), but reduce their purchases of longer-term Treasury securities from $45 billion per month.

In the press conference on Wednesday, I expect Fed Chairman Ben Bernanke will probably make it clear that the Fed will not raise rates for a "considerable" time after the end of QE, and it seems likely he will express more concern about the low level of inflation.

On the projections, it looks like GDP will be mostly unchanged, and the projections for the unemployment rate might be reduced, and PCE inflation will be reduced. Note: I've included earlier projections to show the trend (TBA: To be announced).

Early forecasts for Q4 are that real GDP will increase at around a 1.7% annual rate, and that would put 2013 real GDP growth at 2.2% or so - right in the FOMC's September range. A key will be any changes to the 2014 GDP projections.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 2.0 to 2.3 | 2.9 to 3.1 | 3.0 to 3.5 | 2.5 to 3.3 |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 | |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 | |

The unemployment rate was at 7.0% in November (and 7.3% in October) and the projections for the Q4 average might be revised down a little.

I also expect the FOMC to project lower unemployment rates in 2014 and 2015.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 7.1 to 7.3 | 6.4 to 6.8 | 5.9 to 6.2 | 5.4 to 5.9 |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 | |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 | |

Projections for inflation will probably be lower. PCE inflation through October was only up 0.7%, although PCE inflation should be up a little more year-over-year in November and December (because prices declined in November and December last year). I expect the FOMC to revised down 2013 inflation to 1.0% or so.

A key will be the FOMC's projections for inflation in 2014 and 2015. If the FOMC thinks low inflation is transitory, they will be more willing to taper at this meeting. If not - if they think low inflation will persist - then they will want to wait to reduce asset purchases

The current concern is that inflation is too low and well below the Fed's target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 1.1 to 1.2 | 1.3 to 1.8 | 1.6 to 2.0 | 1.7 to 2.0 |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 | |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 | |

Core inflation was up 1.1% year-over-year in October, and will probably be a little higher in November and December. The FOMC might revise core inflation down slightly for 2013, but the key will be 2014.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 | |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 | |

Conclusion: In September I wrote "It does seem odd that the FOMC would start reducing asset purchases while downgrading GDP, and also expressing concern about the downside risks from fiscal policy". In some ways the reverse is true now. GDP and unemployment will meet or exceed the FOMC's September projections, and core inflation will be close. And fiscal policies appear resolved for 2014.

Clearly the data is broadly consistent with the September FOMC projections, so a small taper should not be a surprise (even if most analysts think the FOMC will wait until early 2014).

Saturday, December 14, 2013

Schedule for Week of December 15th

by Calculated Risk on 12/14/2013 11:45:00 AM

The key event this week will be the FOMC statement and press conference on Wednesday. It is possible that the FOMC will start to reduce the monthly purchases of assets (aka "taper QE3"). I'll post a preview soon.

There are three key housing reports that will be released this week, housing starts for September, October, and November on Wednesday, homebuilder confidence survey on Tuesday, and existing home sales on Thursday.

For manufacturing, Industrial Production for November, and the NY Fed (Empire State), Philly Fed, and Kansas City Fed December surveys will be released this week. For prices, CPI will be released on Tuesday.

8:30 AM: NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 4.5, up from -2.2 in November (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 78.4%.

8:30 AM: Consumer Price Index for November. The consensus is for no change in CPI in November and for core CPI to increase 0.1%.

10:00 AM ET: The December NAHB homebuilder survey. The consensus is for a reading of 55, up from 54.0 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for September, October and November.

8:30 AM: Housing Starts for September, October and November. Total housing starts were at 891 thousand (SAAR) in August. Single family starts were at 628 thousand SAAR in August.

The consensus is for total housing starts to increase to 952 thousand (SAAR) in November.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. It is possible the FOMC will start to reduce QE purchases following this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 337 thousand from 368 thousand last week.

10:00 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 10.0, up from 6.5 last month (above zero indicates expansion).

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 5.02 million on seasonally adjusted annual rate (SAAR) basis. Sales in October were at a 5.12 million SAAR.

As always, a key will be inventory of homes for sale.

8:30 AM: Q3 GDP (third estimate). This is the third estimate of Q3 GDP from the BEA. The consensus is that real GDP increased 3.6% annualized in Q3, unchanged from the second estimate.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2013

11:00 AM: the Kansas City Fed manufacturing survey for December.

Unofficial Problem Bank list declines to 641 Institutions

by Calculated Risk on 12/14/2013 09:45:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 13, 2013.

Changes and comments from surferdude808:

The first failure in six weeks and an action termination caused two removals from the Unofficial Problem Bank List this week. After removal, the list includes 641 institutions with assets of $219.4 billion. A year ago, the list held 845 institutions with assets of $312.97 billion.Note on the unofficial list:

Texas Community Bank, National Association, The Woodlands, TX ($159 million) failed this week. A media report stated that the Consent Order against Town & Country Bank and Trust Company, Bardstown, KY ($250 million) had been terminated. Next Friday, we anticipate for the OCC to provide an update of its enforcement action activity through mid-November 2013.

Because the FDIC does not publish the official list, a proxy or unofficial list can be developed by reviewing press releases and published formal enforcement actions issued by the three federal banking regulators, reviewing SEC filings, or through media reports and company announcements describing that the bank is under a formal enforcement action. For the most part, the official problem bank list is comprised of banks with a safety & soundness CAMELS composite rating of 4 or 5 (the banking regulators use the FFIEC rating system known as CAMELS, which stands for the components that receive a rating including Capital adequacy, Asset quality, Management quality, Earnings strength, Liquidity strength, and Sensitivity to market risk. A composite rating is assigned from the components, but it does not result from a simple average of the components. The composite and component rating scale is from 1 to 5, with 1 being the strongest). Customarily, a banking regulator will only issue a safety & soundness formal enforcement when a bank has a composite CAMELS rating of 4 or 5, which reflects an unsafe & unsound financial condition that if not corrected could result in failure. There is high positive correlation between banks with a safety & soundness composite rating of 4 or worse and those listed on the official list. For example, many safety & soundness enforcement actions state in their preamble that an unsafe & sound condition exists, which is the reason for action issuance.

Since 1991, the banking regulators have statutorily been required to publish formal enforcement actions. For many reasons, the banking regulators have a general discomfort publishing any information on open banks especially formal enforcement actions, so not much energy is expended on their part ensuring the completeness of information in the public domain or making its retrieval simple. Given the difficulty for easy retrieval of all banks operating under a safety & soundness formal enforcement action, the unofficial list fills this void as a matter of public interest.

All of the banks on the unofficial list have received a safety & soundness formal enforcement action by a federal banking regulator or there is other information in the public domain such as an SEC filing, media release, or company statement that describe the bank being issued such an action. No confidential or non-public information supports any bank listed and a hypertext link to the public information is provided in the spreadsheet listing. The publishers make every effort to ensure the accuracy of the unofficial list and welcome all feedback and any credible information to support removal of any bank listed erroneously.