by Calculated Risk on 12/12/2013 08:36:00 AM

Thursday, December 12, 2013

Weekly Initial Unemployment Claims increase to 368,000

The DOL reports:

In the week ending December 7, the advance figure for seasonally adjusted initial claims was 368,000, an increase of 68,000 from the previous week's revised figure of 300,000. The 4-week moving average was 328,750, an increase of 6,000 from the previous week's revised average of 322,750.The previous week was up from 298,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 328,750.

Weekly claims are frequently volatile around the holidays (Thanksgiving), and the level of the four week average of weekly claims suggests an improving labor market.

Wednesday, December 11, 2013

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 12/11/2013 08:42:00 PM

Something to be aware of from Victoria McGrane And Jon Hilsenrath at the WSJ: Fed Moves Toward New Tool for Setting Rates

An experimental bond-trading program being run at the Federal Reserve Bank of New York could fundamentally change the way the central bank sets interest rates.Thursday:

Fed officials see the program, known as a "reverse repo" facility, as a potentially critical tool when they want to raise short-term rates in the future to fend off broader threats to the economy.

...

"The Federal Reserve has never tightened monetary policy, or even tried to maintain short-term interest rates significantly above zero, with such abundant amounts of liquidity in the financial system," according to a draft of a new research paper by Brian Sack, the former head of the New York Fed's markets group, and Joseph Gagnon, an economist at the Peterson Institute for International Economics and a former Fed economist.

...

When it does want to raise rates, the Fed under the repo program would use securities it accumulated through its bond-buying programs as collateral for loans from money-market mutual funds, banks, securities dealers, government-sponsored enterprises and others.

The rates it sets on these loans, in theory, could become a new benchmark for global credit markets.

• 8:30 AM ET, 8he initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 298 thousand last week.

• Also at 8:30 AM, Retail sales for November will be released. The consensus is for retail sales to be 0.6% in November, and to increase 0.3% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.3% increase in inventories.

Lawler on Fed Note: “Business Investor Activity in the Single-Family-Housing Market”

by Calculated Risk on 12/11/2013 04:37:00 PM

Economist Tom Lawler writes:

A “FEDS Note” (by Fed economists Malloy and Zarutskie), available on the Federal Reserve’s website, Business Investor Activity in the Single-Family-Housing Market, is a brief note on purchases of SF homes by “business investors” over the past few years. The data are based on an analysis of CoreLogic real estate transactions by analysts at Amherst Holdings. While the note does not give details on how a “business investor” was determined, the note says that this determination was made by looking at the names of the buyers of record. A link to the chart says that “(b)usiness investors are defined as business entities identified as purchasing homes for primarily for the purpose of earning a financial return.”

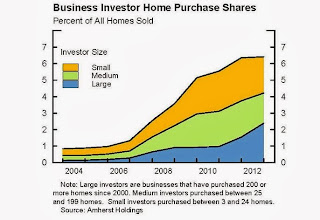

Here is a chart from the report on the Business Investor share of national home purchases.

As noted above, this chart only reflects the BUSINESS INVESTOR” share of home purchases, and does not include INDIVIDUAL investors. Back in 2004 and 2005 the investor share of mortgage-financed home purchases was extremely high, with such purchases mainly being by individuals (many of whom purchased multiple properties.)

At first glance this share increase, while noticeable, may not seem “large.” However, these shares suggest that business investor purchase of SF homes from 2010 to 2013 (using full-year estimates for 2013) totaled over 950,000, more than double the total number of business investor purchases over the previous SIX years (2004-2009). If the bulk of these business investor purchases were bought with the intent to rent the properties out for “several” years, then the sharp decline in the number of residential properties from 2010 to early 2013 seems a bit more “explainable.”

The note has a table showing the business-investor share of SF home purchases for selected metro areas.

CR Note: The metro areas with the largest share of investor buying in 2012 were Atlanta at 16.43%, Phoenix at 13.99% and Las Vegas at 10.97%.

Mortgage Equity Withdrawal Slightly Negative in Q3

by Calculated Risk on 12/11/2013 11:54:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q3 2013, the Net Equity Extraction was minus $24 billion, or a negative 0.8% of Disposable Personal Income (DPI). This is the smallest negative equity extraction since Q1 2008.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $10.0 billion in Q3. This was the first increase in mortgage debt since Q1 2008. Since some mortgage debt is related to new home purchases, net negative equity extraction was still slightly negative in Q3.

The Flow of Funds report also showed that Mortgage debt has declined by over $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again soon.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Update: Looking for Stronger Economic Growth in 2014

by Calculated Risk on 12/11/2013 11:01:00 AM

Six weeks ago I wrote: Comment: Looking for Stronger Economic Growth in 2014. I listed several reasons for a positive outlook, and if anything, I'm a little more optimistic now. Here are a few reasons:

1) The apparent budget deal takes a key downside risk off the table, and reduces the impact of the sequester.

2) Household balance sheets are in much better shape - and it appears that in the aggregate, household deleveraging is over. The Fed just reported the first increase in total mortgage debt since Q1 2008. See: Fed's Q3 Flow of Funds: Household Mortgage Debt increased slightly, First Mortgage Debt increase since Q1 2008, NY Fed: Household Debt increased in Q3, Delinquency Rates Improve, and Fed: Household Debt Service Ratio near lowest level in 30+ years

3) State and local government austerity is over (in the aggregate).

4) The housing recovery should continue. Housing has slowed recently (new home sales, housing starts), but the overall level is still very low and I expect further growth in 2014.

5) Commercial real estate (CRE) investment will probably make a small positive contribution in 2014.

Eliminating drags is important. The drag from state and local governments is over. The drag from household deleveraging (in the aggregate) is ending. The threats of a government shutdown, not "paying the bills", and mindless austerity is over (assuming the budget deal is approved). And CRE investments are starting to appear.

All of these were impediments to growth over the last few years.

Yes, growth in the auto industry will slow in 2014, and housing has slowed recently (but I think we will see more growth in 2014). However, overall it appears 2014 will probably be the best growth year for the recovery (the best was 2012 with 2.8% real GDP growth), and possibly the best year since Clinton was President.

MBA: Mortgage Applications Increase in Latest Survey

by Calculated Risk on 12/11/2013 07:03:00 AM

From the MBA: Mortgage Applications Fall During Holiday-Shortened Week

Mortgage applications increased 1.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 6, 2013. The previous week’s results included an adjustment for the Thanksgiving holiday. ...

The Refinance Index increased 2 percent from the previous week and was 16 percent lower than the week prior to Thanksgiving. The seasonally adjusted Purchase Index increased 1 percent from one week earlier and was 3 percent lower than the week prior to Thanksgiving. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.61 percent, the highest rate since September, from 4.51 percent, with points decreasing to 0.26 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

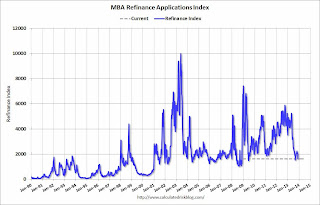

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 68% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 8% from a year ago.

Note: It appears these small independent lenders (not included in the MBA survey) are focusing on the purchase market. A result of this change in market share is the Purchase Index is probably understating the increase in purchase activity.

Tuesday, December 10, 2013

Update: Budget Deal is Reached

by Calculated Risk on 12/10/2013 08:10:00 PM

Some good news ...

From the NY Times: Congressional Negotiators Reach Budget Deal

The agreement eliminates about $65 billion in across-the-board domestic and defense cuts while adding an additional $25 billion in deficit reduction by extending a 2 percent cut to Medicare through 2022 and 2023, two years beyond the cuts set by the Budget Control Act of 2011.And from the WSJ: House, Senate Negotiators Announce Budget Deal

...

Under the agreement, military and domestic spending for the current fiscal year that is under the annual discretion of Congress would rise to just over $1 trillion, from the $967 billion level it would hit if spending cuts known as sequestration were imposed next month. Spending would be capped at $1 trillion in fiscal year 2015 as well.

Revenues to fund the higher spending would come from changes to federal employee and military pension programs, and higher fees for airline passengers, among other sources. An extension of long-term unemployment benefits, sought by Democrats, wasn't included.In 2013, the key downside risk to the economy was Congress (specifically the House), and unfortunately they delivered. Hopefully this eliminates that risk for 2014.

On the economics, the sequester cuts were a disaster (they probably hurt the economy more than it helped reduce the deficit), so reducing the sequester cuts for 2014 is a positive. I'd like to see an extension of emergency unemployment benefits for another 6 months or a year, but that isn't included in this deal.

The bottom line: Although this deal was expected (and I expect the bill to pass), this is another reason to be optimistic about 2014. Also - even though Fed officials will deny it - I think this increases the odds of the Fed tapering in December or January 2014.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in November

by Calculated Risk on 12/10/2013 05:54:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in November. First, from Lawler on November sales:

"While I do not have enough reports to produce an accurate estimate of existing home sales for November, reports I’ve seen so far suggest that home sales declined again on a seasonally adjusted basis last month."From CR: This is just a few markets, but total "distressed" share is down significantly, mostly because of a decline in short sales. Foreclosure are down in most areas too.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back in markets the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | Nov-13 | Nov-12 | |

| Las Vegas | 21.0% | 41.2% | 7.0% | 10.7% | 28.0% | 51.9% | 43.7% | 52.7% |

| Reno | 17.0% | 41.0% | 6.0% | 9.0% | 23.0% | 50.0% | ||

| Phoenix | 7.8% | 23.2% | 8.0% | 12.9% | 15.8% | 36.1% | ||

| Mid-Atlantic | 7.5% | 11.9% | 8.1% | 8.7% | 15.7% | 20.6% | 19.6% | 20.0% |

| Tucson | 32.2% | 33.8% | ||||||

| Toledo | 37.2% | 40.9% | ||||||

| Omaha | 21.6% | 19.8% | ||||||

| Spokane | 16.0% | 9.1% | ||||||

| Memphis* | 20.4% | 24.4% | ||||||

| Springfield IL | 17.0% | 15.8% | ||||||

| *share of existing home sales, based on property records | ||||||||

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 12/10/2013 02:35:00 PM

By request, here is an update on an earlier post through the November employment report.

In April, I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush). Below are updates through the September report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the first year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton (light blue) and 14,688,000 under President Reagan (yellow).

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. At this early point in Mr. Obama's second term, there are now 3,860,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 726,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level - but overall public employment will probably start increasing soon.

Las Vegas Real Estate in November: Year-over-year Non-contingent Inventory up 77.4%

by Calculated Risk on 12/10/2013 12:11:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports home prices, sales, supply dip heading into holidays

GLVAR said the total number of existing local homes, condominiums and townhomes sold in November was 2,694. That’s down from 3,192 in October and down from 3,293 total sales in November 2012. Compared to October, single-family home sales during November decreased by 16.2 percent, while sales of condos and townhomes decreased by 12.7 percent. Compared to one year ago, single-family home sales were down 17.9 percent, while condo and townhome sales were down 19.3 percent. ...There are several key trends that we've been following:

...

In November, 21 percent of all existing home sales were short sales, unchanged from October. Another 7 percent of all November sales were bank-owned properties, up from 6 percent in October. The remaining 72 percent of all sales were the traditional type, down from 73 percent in October.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service decreased in November, with 14,240 single-family homes listed for sale at the end of the month. That’s down 5.1 percent from 15,011 single-family homes listed for sale at the end of October and down 8.9 percent from one year ago. ...

By the end of November, GLVAR reported 6,830 single-family homes listed without any sort of offer. That’s down 3.4 percent from 7,072 such homes listed in October, but still up 77.4 percent from one year ago. For condos and townhomes, the 2,192 properties listed without offers in November represented a 2.4 percent decrease from 2,247 such properties listed in October, but an 80.0 percent increase from one year ago.

emphasis added

1) Sales were down again in November, and down about 17.9% year-over-year.

2) Conventional sales are up solidly. In November 2012, only 48.1% of all sales were conventional. This year, in November 2013, 72.0% were conventional. That is an increase in conventional sales of about 23% year-over-year.

3) Most distressed sales are short sales instead of foreclosures (3 to 1). Both foreclosures and short sales are down sharply year-over-year.

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 77.4% year-over-year!

Inventory has clearly bottomed in Las Vegas (A major theme for housing in 2013). And fewer distressed sales and more inventory means price increases will slow.