by Calculated Risk on 12/11/2013 07:03:00 AM

Wednesday, December 11, 2013

MBA: Mortgage Applications Increase in Latest Survey

From the MBA: Mortgage Applications Fall During Holiday-Shortened Week

Mortgage applications increased 1.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 6, 2013. The previous week’s results included an adjustment for the Thanksgiving holiday. ...

The Refinance Index increased 2 percent from the previous week and was 16 percent lower than the week prior to Thanksgiving. The seasonally adjusted Purchase Index increased 1 percent from one week earlier and was 3 percent lower than the week prior to Thanksgiving. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.61 percent, the highest rate since September, from 4.51 percent, with points decreasing to 0.26 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

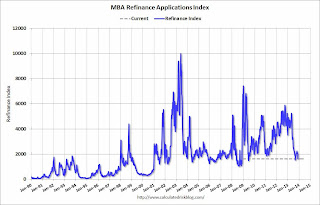

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 68% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 8% from a year ago.

Note: It appears these small independent lenders (not included in the MBA survey) are focusing on the purchase market. A result of this change in market share is the Purchase Index is probably understating the increase in purchase activity.