by Calculated Risk on 12/07/2013 08:36:00 AM

Saturday, December 07, 2013

Unofficial Problem Bank list declines to 643 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 6, 2013.

Changes and comments from surferdude808:

There were only two removals this week to the Unofficial Problem Bank List, which now stand at 643 institutions with assets of $219.8 billion. A year ago, the list held 849 institutions with assets of $316.2 billion.Note on the unofficial list:

The Federal Reserve terminated the Written Agreement against Peoples Bank, Lawrence, KS ($412 million). Metropolitan National Bank, Little Rock, AR ($973 million) merged with Simmons First National Bank, Pine Bluff, AR to exit the list.

There is nothing new to report on the status of the banking subsidiaries controlled by Capitol Bancorp, Ltd. Next week should be fairly quiet as we do not anticipate the OCC releasing its latest action activity until December 20th.

Because the FDIC does not publish the official list, a proxy or unofficial list can be developed by reviewing press releases and published formal enforcement actions issued by the three federal banking regulators, reviewing SEC filings, or through media reports and company announcements describing that the bank is under a formal enforcement action. For the most part, the official problem bank list is comprised of banks with a safety & soundness CAMELS composite rating of 4 or 5 (the banking regulators use the FFIEC rating system known as CAMELS, which stands for the components that receive a rating including Capital adequacy, Asset quality, Management quality, Earnings strength, Liquidity strength, and Sensitivity to market risk. A composite rating is assigned from the components, but it does not result from a simple average of the components. The composite and component rating scale is from 1 to 5, with 1 being the strongest). Customarily, a banking regulator will only issue a safety & soundness formal enforcement when a bank has a composite CAMELS rating of 4 or 5, which reflects an unsafe & unsound financial condition that if not corrected could result in failure. There is high positive correlation between banks with a safety & soundness composite rating of 4 or worse and those listed on the official list. For example, many safety & soundness enforcement actions state in their preamble that an unsafe & sound condition exists, which is the reason for action issuance.

Since 1991, the banking regulators have statutorily been required to publish formal enforcement actions. For many reasons, the banking regulators have a general discomfort publishing any information on open banks especially formal enforcement actions, so not much energy is expended on their part ensuring the completeness of information in the public domain or making its retrieval simple. Given the difficulty for easy retrieval of all banks operating under a safety & soundness formal enforcement action, the unofficial list fills this void as a matter of public interest.

All of the banks on the unofficial list have received a safety & soundness formal enforcement action by a federal banking regulator or there is other information in the public domain such as an SEC filing, media release, or company statement that describe the bank being issued such an action. No confidential or non-public information supports any bank listed and a hypertext link to the public information is provided in the spreadsheet listing. The publishers make every effort to ensure the accuracy of the unofficial list and welcome all feedback and any credible information to support removal of any bank listed erroneously.

Friday, December 06, 2013

AAR: Rail Traffic increased in November

by Calculated Risk on 12/06/2013 08:53:00 PM

From the Association of American Railroads (AAR): AAR Reports Increased Intermodal, Carload Traffic for November

The Association of American Railroads (AAR) today reported increased U.S. rail traffic for November 2013 over November 2012. Intermodal traffic in November totaled 1,007,549 containers and trailers, up 7.8 percent (73,004 units) compared with November 2012. The weekly average of 251,887 intermodal containers and trailers per week in November 2013 was the highest weekly average for any November in history. Carloads originated in November 2013 totaled 1,145,353, up 1.3 percent (14,931 carloads) compared with the same month last year.

...

Excluding coal, U.S. carloads were up 5.3 percent, or 34,988 carloads, in November 2013 compared with November 2012. Excluding coal and grain, U.S. carloads were up 3.3 percent, or 19,303 carloads, in November.

“U.S. rail traffic in November 2013 saw a big decline in coal carloads that was more than offset by gains in carloads of grain and petroleum products,” said AAR Senior Vice President John T. Gray. “Carload traffic continues to be consistent with an economy that’s growing at a moderate pace. Meanwhile, rail intermodal volume was extremely strong in November, demonstrating the tremendous value that intermodal has become for rail customers.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

U.S. rail carloads were up 1.3% (14,931 carloads) in November 2013 over November 2012, totaling 1,145,353 carloads for the month. That’s the fourth consecutive year-over-year monthly increase, the first time that’s happened in two years. The weekly average in November 2013 was 286,338 carloads ...

Among the 20 commodity categories tracked by the AAR each month, grain had by far the biggest carload gain in November, with grain carloads up 15,685 (20.6%) over the same month last year. ... Carloads of petroleum and petroleum products averaged 14,532 per week in November 2013, up 20.0% over November 2012.

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.The second graph is for intermodal traffic (using intermodal or shipping containers):

Intermodal traffic is on track for a record year in 2013.

U.S. railroads originated an average of 251,887 intermodal containers and trailers per week in November 2013, easily the highest weekly average for any November in history and up 7.8% (73,004 intermodal units) over November 2012. That’s the biggest year-over-year percentage change in nine months.Rail traffic and the economy usually grow together, so this is a good sign for the overall economy.

To date, the peak full year for U.S. rail intermodal volume is 2006, when originations totaled 12.3 million containers and trailers. In order for 2013 not to set an annual record, intermodal volume in December 2013 would have to average no more than approximately 102,000 units per week. So far in 2013, the weekly average has been more than 247,000 units, so it’s a safe bet that next month in this space we’ll be reporting that 2013 was a record year for intermodal.

CBO: Federal Deficit declined Sharply in October and November compared to last year

by Calculated Risk on 12/06/2013 05:26:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for November 2013

The federal government ran a budget deficit of $231 billion for the first two months of fiscal year 2014, $61 billion less than the shortfall recorded in October and November of last year, CBO estimates.The most recent CBO projection put the fiscal 2014 deficit at 3.3% of GDP, down from 4.1% in fiscal 2013. These monthly deficits suggest even more improvement in fiscal 2014 than originally forecast.

...

Receipts for the first two months of fiscal year 2014 totaled $380 billion, CBO estimates—$34 billion more than receipts during the same period last year.

...

Outlays for the first two months of fiscal year 2014 were $27 billion less than they were during the same period last year, CBO estimates. That decrease would have been slightly larger if not for shifts in the timing of certain payments from December to November (because December 1 fell on a weekend in both years). Without those timing shifts, CBO estimates, spending would have declined by $29 billion (or 5 percent).

Personal Income decreased 0.1% in October, Spending increased 0.3%

by Calculated Risk on 12/06/2013 02:52:00 PM

Still catching up ... the BEA released the Personal Income and Outlays report for October:

Personal income decreased $10.8 billion, or 0.1 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $32.7 billion, or 0.3 percent.On inflation, the PCE price index decreased at a 0.4% annual rate in October, and core PCE prices increased at a 0.9% annual rate. This is very low and far below the Fed's 2% target.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in October, compared with an increase of 0.1 percent in September. ... The price index for PCE decreased less than 0.1 percent in October, in contrast to an increase of 0.1 percent in September. The PCE price index, excluding food and energy, increased 0.1 percent in October, the same increase as in September.

The following graph shows real Personal Consumption Expenditures (PCE) through October 2013 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

This is just one month of Q4, but this suggests an increase in the PCE contribution to growth (compared to Q3). Also Q4 this year should be better than Q4 2012 (there was essentially no growth in Q4 2012).

I expect the change in private inventories to be a negative in Q4 2013 (inventories subtracted 2.0 percentage points in Q4 2012), but we won't see the large negative contribution from government this year (subtracted 1.3 percentage points in Q4 2012).

Preliminary December Consumer Sentiment increased to 82.5

by Calculated Risk on 12/06/2013 12:14:00 PM

Catching up ...

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for December was at 82.5, up from the November reading of 75.1.

This was well above the consensus forecast of 75.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. The decline in October and early November was probably also due to the government shutdown and another threat to "not pay the bills".

As usual sentiment rebounds fairly quickly following event driven declines, and I expect to see sentiment at post-recession highs very soon.

Employment Report: Decent Report, Solid Seasonal Retail Hiring

by Calculated Risk on 12/06/2013 10:13:00 AM

A few key points:

• Most of the employment impact from the government shutdown was reversed in the November report.

• Earlier I noted four items that the Fed would probably be looking at to taper in December. Here were the two related to employment:

1) "If the unemployment rate declines back to 7.2% or so in November (the September rate), then the FOMC might taper." Since the unemployment rate declined to 7.0%, this was met.

2) "If the year-over-year change in employment is still around 2.2 million for November, the FOMC might taper." Employment was up 2.293 million year-over-year in November.

The other two items for the Fed are inflation (core PCE is only up 1.1% year-over-year), and a budget agreement by next week (seems likely). At this point, inflation is the question mark for the Fed.

• Seasonal retail hiring remained solid. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

Seasonal Retail Hiring

Click on graph for larger image.

Click on graph for larger image.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 471 thousand workers (NSA) net in November. This was just below the level in 2012, and suggests that retailers expect decent holiday sales. Note: this is NSA (Not Seasonally Adjusted).

Note: There is a decent correlation between seasonal retail hiring and holiday retail sales.

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

These numbers declined sharply in October due to the government shutdown, and bounced back in the November report.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 331,000 to 7.7 million in November. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.This more than reversed the increase in part time workers that happened in October due to the government shutdown.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 13.2% in November from 13.8% in October.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.066 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 4.063 million in October. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In November 2013, state and local governments added 14,000 jobs, and state and local employment is up 76 thousand so far in 2013.

I think state and local employment has bottomed. Of course Federal government layoffs are ongoing.

Overall this was a decent employment report.

November Employment Report: 203,000 Jobs, 7.0% Unemployment Rate

by Calculated Risk on 12/06/2013 08:30:00 AM

From the BLS:

The unemployment rate declined from 7.3 percent to 7.0 percent in November, and total nonfarm payroll employment rose by 203,000, the U.S. Bureau of Labor Statistics reported today. ...The headline number was above expectations of 180,000 payroll jobs added.

...

Both the number of unemployed persons, at 10.9 million, and the unemployment rate, at 7.0 percent, declined in November. Among the unemployed, the number who reported being on temporary layoff decreased by 377,000. This largely reflects the return to work of federal employees who were furloughed in October due to the partial government shutdown.

...

The civilian labor force rose by 455,000 in November, after declining by 720,000 in October. The labor force participation rate changed little (63.0 percent) in November. Total employment as measured by the household survey increased by 818,000 over the month, following a decline of 735,000 in the prior month. This over-the-month increase in employment partly reflected the return to work of furloughed federal government employees. The employment-population ratio increased by 0.3 percentage point to 58.6 percent in November, reversing a decline of the same size in the prior month.

...

The change in total nonfarm payroll employment for September was revised from +163,000 to +175,000, and the change for October was revised from +204,000 to +200,000. With these revisions, employment gains in September and October combined were 8,000 higher than previously reported.

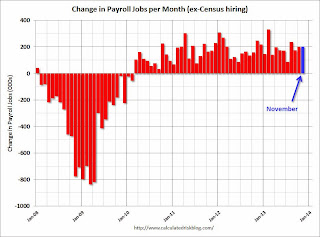

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is less than 1% below the pre-recession peak.

NOTE: The second graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

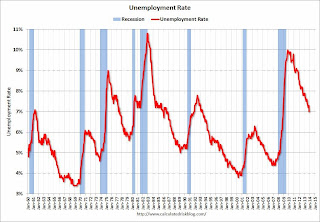

The third shows the unemployment rate.

The unemployment rate decreased in November to 7.0% from 7.3% in October.

This increase in the unemployment rate in October was related to the government shutdown - and was reversed in the November employment report.

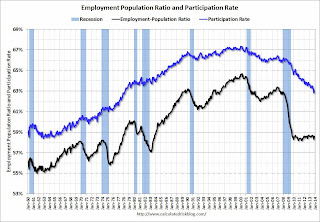

This increase in the unemployment rate in October was related to the government shutdown - and was reversed in the November employment report.The fourth graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in November to 63.0% from 62.8% in October (October decline was partially related to shutdown). This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio increased in November to 58.6% from 58.3% in October (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

This was another solid employment report. Many of the negatives in the October report were related to the government shutdown and were mostly reversed in the November report. I'll have much more later ...

Thursday, December 05, 2013

Friday: Employment Report, Personal Income and Outlays

by Calculated Risk on 12/05/2013 06:57:00 PM

A couple more employment previews, first from David Mericle at Goldman Sachs:

We expect a 175k gain in both nonfarm payrolls and private payrolls in November, a bit below consensus expectations of 185k and a modest slowdown from the 204k gain seen in October. ... We expect that the unemployment rate will decline to 7.1% in November, reflecting both employment gains and the possibility that some of the decline in participation seen in October's distorted household survey will persist this month.And from Merrill Lynch:

We are looking for job growth of 175,000 in November, a slight slowdown from the 204,000 pace in October. The unemployment rate should fall to 7.2% from 7.3% while the workweek holds steady at 34.4 hours. ... Looking back at the recent history, when Thanksgiving is late in the month, there seems to be a downward bias in retail jobs in November and a reversal in December. The reverse is the case when the Thanksgiving holiday is early in the month, as it was last year. This could account for a swing of as many as 40,000 jobs. ... The household survey was distorted in the October report, leading to a sharp decline in the labor force and in the number of employed workers. This bias will be reversed in November as people returned to work after the shutdown. We therefore expect the participation rate to jump back to 63.1%, nearly returning to the September pace.Friday:

• At 8:30 AM ET, the Employment Report for November. The consensus is for an increase of 180,000 non-farm payroll jobs in November, down from the 204,000 non-farm payroll jobs added in October. The consensus is for the unemployment rate to decrease to 7.2% in November from 7.3% in October. A key will be if the participation rate increases too, reversing the sharp decline last month.

• Also at 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 75.5, up from 75.1 in November.

• At 3:00 PM, Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $15.0 billion in October.

Comments on Q3 GDP and Investment

by Calculated Risk on 12/05/2013 02:05:00 PM

The BEA revised up Q3 GDP to 3.6% (from 2.8% in the advance release). The main reason for the upward revision was more investment in inventory (the contribution from "Change in private inventories" was revised up from 0.83 percentage points in the advance release to 1.68 percentage in the second release).

The change in private inventories tends to bounce around, and this will probably be a drag on Q4 GDP.

Note: The BEA provides a summary of revisions Real Gross Domestic Product and Related Measures: Percent Change From Preceding Period and Contributions to Percent Change in Real Gross Domestic Product.

Personal consumption expenditures (PCE) was revised down from a 1.5% annual rate to 1.4%, and residential investment (RI) was revised down from 14.6% to 13.0%. This is weak final demand (PCE and RI contributed 1.34 percentage point to GDP growth in Q3). This is the weakest final demand since Q2 2011.

The good news is PCE will probably increase in 2014 with most of the impact of tax increases and budget cuts ending. But Q4 2013 will probably be another weak quarter impacted by the government shutdown, a negative contribution from private inventories, and still weak final demand.

The following graph shows the contribution to GDP from residential investment, equipment and software, intellectual properties, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q3 for the twelfth consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory.

Now RI is contributing - a good sign going forward since RI is historically still very low.

Overall this was another weak GDP report, but it does look like GDP will pickup in 2014.

Employment Preview for November

by Calculated Risk on 12/05/2013 10:58:00 AM

In October I was looking for an Upside Payroll Surprise. For November, my guess is closer to the consensus forecast of 180,000 payroll jobs added. The consensus is for the unemployment rate to decrease to 7.2% in November from 7.3% in October.

The October employment report was impacted by the government shutdown, and the unemployment rate increased in October to 7.3% from 7.2% in September. Even worse, the participation rate declined sharply in October to 62.8% from 63.2% in September. One of the keys for the November report will be if those ugly October numbers are reversed.

Here is a summary of recent data:

• The ADP employment report showed an increase of 215,000 private sector payroll jobs in November. This was above expectations of 185,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in November to 56.5%, from 53.2% in October. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 15,000 in November. The ADP report indicated a 18,000 increase for manufacturing jobs in November.

The ISM non-manufacturing employment index decreased in November to 52.5% from 56.2% in October. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 140,000 in November.

Taken together, these surveys suggest around 155,000 jobs added in November - below the consensus forecast.

• Initial weekly unemployment claims averaged close to 322,000 in November. This was down sharply from an average of 358,000 in October, but up from the 305,000 average in September. However there were some computer problems in California, and claims in October were probably too high, and claims in September were probably too low.

This was below the level in August (when the BLS reported 238,000 payroll jobs added), and far below the level of November 2012 when the BLS reported 247,000 jobs added (after revisions). This suggests fewer layoffs, and possibly more net payroll jobs added than the consensus forecast.

• The final November Reuters / University of Michigan consumer sentiment index increased to 75.1 from the October reading of 73.2. This is frequently coincident with changes in the labor market, but in this case sentiment is recovering from the government shutdown.

• The small business index from Intuit showed a 10,000 increase in small business employment in November. This is the largest increase in this index since May and June, and suggests a pickup in small business hiring.

• Conclusion: As usual the data was mixed. The ADP report was higher in November than in October, however the ISM surveys suggest a slower increase in payrolls. Weekly claims for the reference week were at the lowest level this year excluding September when there were computer issues (the reference week includes the 12th of the month), and consumer sentiment increased (recovering from government shutdown). Also the Intuit small business index showed a pickup in hiring.

There is always some randomness to the employment report. My guess is the report will be close to the consensus forecast of 180,000 nonfarm payrolls jobs added in November.