by Calculated Risk on 11/22/2013 12:23:00 PM

Friday, November 22, 2013

BLS: State unemployment rates were "little changed" in October

From the BLS: Regional and state unemployment rates were little changed in October

Regional and state unemployment rates were little changed in October. Twenty-eight states had unemployment rate decreases from September, 11 states and the District of Columbia had increases, and 11 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in October, 9.3 percent. The next highest rates were in Rhode Island, 9.2 percent, and Michigan, 9.0 percent. North Dakota continued to have the lowest jobless rate, 2.7 percent.

Click on graph for larger image in graph gallery.

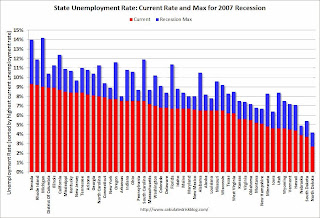

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, Nevada and Florida have seen the largest declines and many other states have seen significant declines.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in three states: Nevada, Rhode Island and Michigan.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently three states have an unemployment rate at or above 9% (purple), thirteen states at or above 8% (light blue), and 23 states at or above 7% (blue).

Kansas City Fed: Manufacturing Survey shows Activity Growing at "Moderate Rate"

by Calculated Risk on 11/22/2013 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Continued to Grow

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to grow, and producers’ expectations for future activity improved moderately.In aggregate the regional surveys have suggested slower growth in November. The last of the regional Fed manufacturing surveys for November will be released early next week (Richmond and Dallas Fed).

“Factory activity in our region continues to hum along at a moderate rate of growth” said Wilkerson. “The marked improvement in hiring plans was a nice development"

...

The month-over-month composite index was 7 in November, up from 6 in October and 2 in September ... The new orders index jumped from 3 to 15 ...

emphasis added

BLS: Job Openings "little changed" in September

by Calculated Risk on 11/22/2013 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

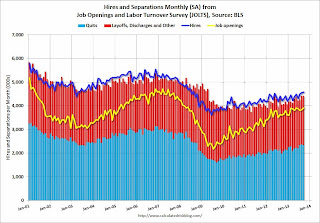

There were 3.9 million job openings on the last business day of September, little changed from August, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.4 percent) and separations rate (3.2 percent) were little changed in September. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in September for total nonfarm and total private, and was little changed for government. The number of quits rose in several industries. Over the year, quits increased in the Midwest, South, and West regions.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in September to 3.913 million from 3.844 million in August. The number of job openings (yellow) is up 8.6% year-over-year compared to September 2012 and openings are at the highest level since early 2008.

Quits were mostly unchanged in September and are up about 18% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

LPS: Mortgage Delinquency Rate declined in October, In-Foreclosure Rate lowest since 2008

by Calculated Risk on 11/22/2013 08:44:00 AM

According to the First Look report for October to be released today by Lender Processing Services (LPS), the percent of loans delinquent decreased in October compared to September, and declined about 11% year-over-year. Also the percent of loans in the foreclosure process declined further in October and were down 30% over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 6.28% from 6.46% in September. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.54% in October from 2.63% in September. The is the lowest level since late 2008.

The number of delinquent properties, but not in foreclosure, is down 348,000 properties year-over-year, and the number of properties in the foreclosure process is down 524,000 properties year-over-year.

LPS will release the complete mortgage monitor for October in early December.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| October 2013 | September 2013 | October 2012 | |

| Delinquent | 6.28% | 6.46% | 7.03% |

| In Foreclosure | 2.54% | 2.63% | 3.61% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,869,000 | 1,935,000 | 1,957,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,283,000 | 1,331,000 | 1,543,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,276,000 | 1,328,000 | 1,800,000 |

| Total Properties | 4,427,000 | 4,593,000 | 5,300,000 |

Thursday, November 21, 2013

Friday: JOLTS, Kansas City Mfg Survey

by Calculated Risk on 11/21/2013 07:53:00 PM

From the Financial Times: Fed chair nominee Janet Yellen wins Senate committee backing

US Federal Reserve chair nominee Janet Yellen received approval by the Senate banking committee on Thursday, clearing the way for a full Senate vote possibly before the end of the year.And here is a clueless comment from Senator Marco Rubio:

"While Dr Yellen is an accomplished individual, I will be voting against her nomination to chair the Fed because of her role as a lead architect in authoring monetary policies that threaten the short and long-term prospects of strong economic growth and job creation."That is complete nonsense and shows Rubio (and many others) do not understand monetary policy. Larry Summers is correct: Summers Says History Will Favor Fed's QE `98 to 2'

Friday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for September from the BLS. This results of this survey has been mentioned by Fed Chair nominee Janet Yellen. In general, the number of job openings has been increasing.

• Also at 10:00 AM, the Regional and State Employment and Unemployment (Monthly) for October 2013.

• At 11:00 AM, the Kansas City Fed manufacturing survey for November. The consensus is for a reading of 6, unchanged from last month (above zero indicates expansion).

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in October (including Florida)

by Calculated Risk on 11/21/2013 04:49:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and cash buyers for several selected cities in October.

Lawler writes: "Note the low share of short sales relative to foreclosure sales in Florida last month, which reflects the “very aged” nature of the “distressed” property inventory."

From CR: Also note that foreclosures have declined significantly in most areas - but not in Florida. This is probably because of the large backlog of foreclosures in the judicial system.

The All Cash Share (last two columns) is mostly declining year-over-year. However in certain areas of Florida there is still a significant amount of cash buying (frequently investors, but in Florida this might be foreigners - and maybe some drug related buying).

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | |

| Las Vegas | 21.0% | 44.7% | 6.0% | 11.6% | 27.0% | 56.3% | 44.9% | 54.1% |

| Reno | 16.0% | 40.0% | 4.0% | 12.0% | 20.0% | 52.0% | ||

| Phoenix | 8.4% | 26.2% | 6.9% | 12.9% | 15.3% | 39.1% | 31.6% | 43.9% |

| Sacramento | 11.4% | 35.7% | 5.1% | 12.0% | 16.5% | 47.7% | 23.9% | 36.9% |

| Minneapolis | 5.1% | 10.4% | 16.4% | 24.9% | 21.5% | 35.3% | ||

| Mid-Atlantic | 7.9% | 9.1% | 8.2% | 13.0% | 16.1% | 22.1% | 19.9% | 20.0% |

| Orlando | 15.1% | 29.8% | 20.7% | 23.2% | 35.8% | 53.0% | ||

| California* | 12.6% | 26.7% | 6.6% | 17.1% | 19.2% | 43.8% | ||

| Bay Area CA* | 10.3% | 22.9% | 3.6% | 11.7% | 13.9% | 34.6% | 22.8% | 29.6% |

| So. California* | 12.9% | 27.2% | 6.3% | 16.3% | 19.2% | 43.5% | 27.5% | 32.8% |

| Florida SF | 12.0% | 22.6% | 19.3% | 17.9% | 31.3% | 40.5% | 44.4% | 46.5% |

| Florida C/TH | 9.5% | 18.4% | 17.3% | 16.7% | 26.9% | 35.1% | 68.7% | 74.3% |

| Miami MSA SF | 16.0% | 24.2% | 14.9% | 16.9% | 30.9% | 41.1% | 46.9% | 44.1% |

| Miami MSA C/TH | 11.4% | 20.4% | 19.5% | 16.9% | 30.9% | 37.4% | 73.4% | 78.3% |

| Northeast Florida | 35.7% | 44.2% | ||||||

| Chicago | 34.0% | 43.0% | ||||||

| Hampton Roads | 25.5% | 28.3% | ||||||

| Toledo | 37.0% | 38.6% | ||||||

| Tucson | 32.9% | 31.8% | ||||||

| Memphis | 39.2% | 39.6% | ||||||

| Wichita | 30.5% | 27.2% | ||||||

| Des Moines | 20.2% | 21.7% | ||||||

| Peoria | 21.1% | 23.7% | ||||||

| Omaha | 20.0% | 20.4% | ||||||

| SE Michigan | 34.5% | 44.3% | ||||||

| Spokane | 13.8% | 8.4% | ||||||

| Houston | 7.5% | 15.5% | ||||||

| Memphis* | 18.4% | 22.9% | ||||||

| Birmingham AL | 21.0% | 30.8% | ||||||

| Springfield IL | 15.3% | 18.4% | ||||||

| *share of existing home sales, based on property records | ||||||||

Zillow: Negative Equity declines sharply in Q3

by Calculated Risk on 11/21/2013 12:37:00 PM

From Zillow: U.S. Negative Equity Rate Falls at Fastest Pace Ever in Q3

According to the third quarter Zillow Negative Equity Report, the national negative equity rate fell at its fastest pace in the third quarter, dropping to 21% of all homeowners with a mortgage underwater from 31.4% at its peak in the first quarter of 2012. In the third quarter of 2013, more than 1.4 million American homeowners were freed from negative equity, and 4.9 million mortgaged homeowners have been freed since the beginning of 2012. However, roughly 10.8 million homeowners with a mortgage still remain underwater. Moreover, the effective negative equity rate nationally — where the loan-to-value ratio is more than 80%, making it difficult for a homeowner to afford the down payment on another home — is 39.2% of homeowners with a mortgage. While not all of these homeowners are underwater, they have relatively little equity in their homes, and therefore selling and buying a new home while covering all of the associated costs (real estate agent fees, closing costs and a new down payment) would be difficult. Of all homeowners – roughly one-third of homeowners do not have a mortgage and own their homes free and clear – 14.7% are underwater.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q3 2013 compared to Q3 2012.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Figure 7 shows the loan-to-value (LTV) distribution for homeowners with a mortgage in 2013 Q3 vs. 2012 Q3. Even though many homeowners are still underwater and haven’t crossed the 100% LTV threshold to enter into positive equity, they are moving in the right direction. The good news is that, with these high rates of appreciation, negative equity has been reduced at a fast pace in the near-term. However, we expect negative equity rate reduction to slow in the fourth quarter and next year as home value appreciation is already moderating and will continue to do so later this year and into the next. ... On average, a U.S. homeowner in negative equity owes $74,632 more than what the house is worth, or 41.8% more than the home’s value. While roughly a fifth of homeowners with a mortgage are underwater, 92% of these homeowners are current on their mortgage payments.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (the light red columns). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or the loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 7.3% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q3 negative equity report in the next couple of weeks. For Q2, CoreLogic reported there were 7.1 million properties with negative equity, and that will be down further in Q3.

Philly Fed Manufacturing Survey indicates Slower Expansion in November

by Calculated Risk on 11/21/2013 10:00:00 AM

From the Philly Fed: November Manufacturing Survey

Manufacturing growth in the region continued in November but did not match the pace of growth in the preceding month, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, shipments, and employment were positive, signifying growth, but readings for each fell from October. The survey's indicators of future activity also moderated but continue to suggest general optimism about growth over the next six months.This was below the consensus forecast of a reading of 15.5 for November.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, declined from 19.8 in October to 6.5 this month. The index has now been positive for six consecutive months.

Labor market indicators showed little improvement this month. The current employment index fell 14 points from its reading in October (which was at a two-year high), to 1.1.

emphasis added

Click on graph for larger image.

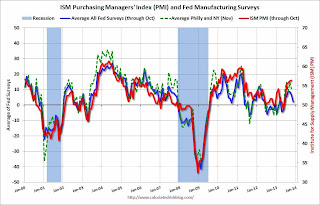

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through November. The ISM and total Fed surveys are through October.

The average of the Empire State and Philly Fed surveys has been positive for six consecutive months. This suggests slower expansion in the ISM report for November.

Also Market released their Flash PMI for November this morning that suggests faster manufacturing expansion:

At 54.3, the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1, which is based on approximately 85% of usual monthly survey replies, rose to an eight-month high in November. This was up from a one-year low of 51.8 in October.

Weekly Initial Unemployment Claims decline to 323,000

by Calculated Risk on 11/21/2013 08:36:00 AM

The DOL reports:

In the week ending November 16, the advance figure for seasonally adjusted initial claims was 323,000, a decrease of 21,000 from the previous week's revised figure of 344,000. The 4-week moving average was 338,500, a decrease of 6,750 from the previous week's revised average of 345,250.The previous week was up from 339,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 338,500.

Some of the recent volatility in weekly claims was due to processing problems in California (now resolved).

Wednesday, November 20, 2013

Thursday: Unemployment Claims, PPI, Philly Fed Mfg Survey

by Calculated Risk on 11/20/2013 08:10:00 PM

No big surprises in the FOMC minutes. From the WSJ: Bond Buying Likely to Be Pared 'in Coming Months,' but Conveying Thinking on Low Rates Proves Vexing

Federal Reserve officials still expect to start pulling back on the central bank's $85 billion-a-month bond-buying program "in coming months," but they are looking for ways to stress that they will keep short-term interest rates low for a long time after it ends.The short version: the Fed will start to "taper" soon, but the Fed Funds rate will be low for a long long time.

...

Officials discussed the possibility of linking any changes to the forward guidance to cuts to the bond-buying program. The changes in the guidance could be made "either to improve clarity or to add to policy accommodation, perhaps in conjunction with a reduction in the pace of asset purchases as part of a rebalancing of the Committee's tools," the minutes said

Fed officials also contemplated reassuring market participants that short-term interest rates are likely to stay near zero long after the 6.5% threshold is crossed, a message Fed Chairman Ben Bernanke delivered in a speech Tuesday night. They also discussed adding language to their policy statement indicating that even after the first increase in their benchmark short-term rate, they "anticipated keeping the rate below its longer-run equilibrium value for some time, as economic headwinds were likely to diminish only slowly."

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 339 thousand last week.

• Also at 8:30 AM, the Producer Price Index for October. The consensus is for a 0.2% decrease in producer prices (0.1% increase in core).

• At 10:00 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 15.5, down from 19.8 last month (above zero indicates expansion).