by Calculated Risk on 11/19/2013 10:14:00 AM

Tuesday, November 19, 2013

LA area Port Traffic in October

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for October since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was unchanged in October compared to the rolling 12 months ending in September. Outbound traffic decreased slightly compared to September.

In general, inbound traffic has been increasing and outbound traffic had been declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for October - and possibly a fairly strong retailer buying for the holiday season.

Monday, November 18, 2013

Tuesday: Bernanke

by Calculated Risk on 11/18/2013 06:41:00 PM

From the Senate Banking Committee: EXECUTIVE SESSION to Vote on the Nomination of The Honorable Janet L. Yellen to be Chairman of the Board of Governors of the Federal Reserve System

Thursday, November 21, 2013In an ideal world, the vote for Yellen would be unanimous. A few senators might vote against her, but she should be confirmed easily. Meanwhile Bernanke is still Fed Chairman and the focus will be on his speech tomorrow.

10:00 AM - 12:00 PM

538 Dirksen Senate Office Building

COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS will meet in EXECUTIVE SESSION to consider the nomination of The Honorable Janet L. Yellen, of California, to be Chairman of the Board of Governors of the Federal Reserve System.

Tuesday:

• At 7:00 PM ET, Speech, Fed Chairman Ben Bernanke, Communication and Monetary Policy, National Economists Club Annual Dinner: Herbert Stein Memorial Lecture

Note: Housing Starts would have been released on Tuesday, but due to the government shutdown, starts for September and October will be delayed until next week. From the Census Bureau:

"New Residential Construction (NRC) data for September 2013 will be released with the October data release, which has been rescheduled to November 26, 2013.

Data collection for estimates of housing starts and completions occurs in the field with resources that are shared with other critical surveys. Full data collection will occur in November but will require extra time; hence, the scheduled releases are much later than originally scheduled in November. Normal data collection and data releases will resume with the release of the November data in December."

Weekly Update: Housing Tracker Existing Home Inventory up slightly year-over-year on Nov 18th

by Calculated Risk on 11/18/2013 02:33:00 PM

Here is another weekly update on housing inventory ... for the fifth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early this year.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for September, October data will be released this Wednesday). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confident that inventory bottomed early this year, and I expect the seasonal decline to be less than usual at the end of the year - so the year-over-year change will continue to increase.

Inventory is still very low, but this increase in inventory should slow house price increases.

CoStar: Commercial Real Estate prices mostly unchanged in September, Up 8.4% Year-over-year

by Calculated Risk on 11/18/2013 12:31:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: CRE Prices Gain Traction Across All Property Types During Third Quarter 2013 Despite Uncertainty Over Economic Policy

CRE PRICES POST MODEST QUARTERLY GAINS DESPITE SEPTEMBER LULL: After posting modest gains throughout the third quarter of 2013, price growth for commercial property was mixed in September, reflecting the uncertainty that existed over economic policy and an uptick in interest rates. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—saw little movement for the month. The value-weighted index, which is influenced by larger transactions, expanded by 0.3% in September while the equal-weighted index, which reflects more numerous smaller transactions, dipped by 0.6% in September. However, both indices posted modest gains in the third quarter of 2013, and advanced 8.4% on an annual basis.

...

PRICE GROWTH ACCELERATING IN SECONDARY REGIONS AND PROPERTY TYPES: With pricing for multifamily assets in the Northeast and West regions approaching peak or near-peak levels, investors have continued to expand their search for yield beyond core gateway markets, leading to stronger price gains in the office, retail and industrial sectors in other regions, including the Midwest region. After bottoming more than a year later than in the other regions, the Midwest Composite Index has advanced by 15.7% from its trough in mid-2012, buoyed by impressive pricing growth in the multifamily and retail sectors.

DISTRESS SALES CONTINUE TO WANE: The percentage of commercial property selling at distressed prices dropped to 11.6% in September 2013 from more than 24% one year earlier, enabling banks and other lenders to focus on growth opportunities. The multifamily sector recorded the lowest level of distress in the third quarter of 2013 at 9.5%, which is a cumulative 77% decline from peak levels reached in 2010. The share of distress deals in the other property types ranges from 12.1% in the industrial sector to 15.8% in the office sector. On a regional basis, distress levels have largely worked through the system in the Northeast, with just 7.1% of deals selling at distressed prices, while the Midwest has the furthest to recover with over 23% of property still selling at distressed levels.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 48.8% from the bottom (showing the earlier and stronger demand for higher end properties) and up 8.4% year-over-year. However the Equal-Weighted index is only up 15.5% from the bottom, and also up 8.4% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

NAHB: Builder Confidence at 54 in November

by Calculated Risk on 11/18/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 54 in November, the same as in October (revised down from 55). Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Holds Steady in November

Builder confidence in the market for newly built, single-family homes was unchanged in November from a downwardly revised level of 54 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. This means that for the sixth consecutive month, more builders have viewed market conditions as good than poor.

...

The HMI index gauging current sales conditions in November held steady at 58. The component measuring expectations for future sales fell one point to 60 and the component gauging traffic of prospective buyers dropped one point to 42.

The HMI three-month moving average was mixed in the four regions. No movement was recorded in the South or West, which held unchanged at 56 and 60, respectively. The Northeast recorded a one-point gain to 39 and the Midwest fell three points to 60.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the August data for starts (September and October housing starts will be released in early December). This was below the consensus estimate of a reading of 55.

This chart shows that confidence and single family starts generally move in the same direction, but it doesn't tell us anything about the expected level of single family starts.

Probably a better comparison is to look at the year-over-year change in each series (Builder confidence and single family housing starts).

Probably a better comparison is to look at the year-over-year change in each series (Builder confidence and single family housing starts).Once again the year-over-year change tends to move in the same direction, but builder confidence has larger swings (especially lately).

I expect single family starts to continue to increase over the next few years, but I don't think we should use builder confidence to estimate the eventual level.

Sunday, November 17, 2013

Sunday Night Futures

by Calculated Risk on 11/17/2013 09:19:00 PM

From Professor Hamilton at Econbrowser: Lower gasoline prices

Americans are indeed facing the lowest gasoline prices in almost three years, but not by much. The price of gasoline last December was almost as low as it is now, as it also had been in December 2011. The fact is, U.S. gasoline prices are usually lower in the fall and winter than they are in the spring and summer due to seasonal variation in gasoline demand and fuel formulations.Monday:

...

So why hasn't the surge in U.S. production of crude oil brought any real decrease in the price of oil and gasoline? The answer is pretty simple. If you leave out the growth in shale oil production from the U.S. and oil sands production from Canada, total field production of crude oil from the rest of the world combined actually decreased between 2005 and 2012. Given the increase from the U.S. and Canada, global production managed to increase by 2 million barrels a day over the period, but that's less than the growth in consumption from the emerging economies and oil-producing countries over those same years. That's why the world price of oil went up, not down, despite the growth in production from the U.S. and Canada.

• 10:00 AM ET: The November NAHB homebuilder survey. The consensus is for a reading of 55, unchanged from October. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of November 17th

The Nikkei is up about 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3 and DOW futures are down 15 (fair value).

Oil prices are mixed with WTI futures at $93.60 per barrel and Brent at $108.32 per barrel.

Update: Recovery Measures

by Calculated Risk on 11/17/2013 05:06:00 PM

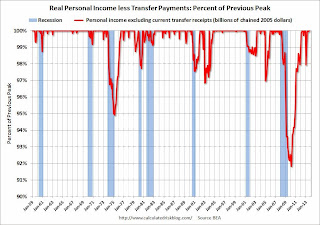

Here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

Two of the indicators are above pre-recession levels (GDP and Personal Income less Transfer Payments), and two indicators are still slightly below the pre-recession peaks (employment and industrial production).

Click on graph for larger image.

Click on graph for larger image.

The first graph is for real GDP through Q3 2013.

Real GDP returned to the pre-recession peak in Q2 2011, and has hit new post-recession highs for ten consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 4.3% from the 2007 peak.

The second graph shows real personal income less transfer payments as a percent of the previous peak through the September report.

The second graph shows real personal income less transfer payments as a percent of the previous peak through the September report.

This indicator was off 8.2% at the worst point.

Real personal income less transfer payments surged in December 2012 due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013 (I've left December out going forward). Real personal income less transfer payments declined sharply in January (as expected), and are now back above the pre-recession peak.

The third graph is for industrial production through October 2013.

The third graph is for industrial production through October 2013.

Industrial production was off 16.9% at the trough in June 2009, and was initially one of the stronger performing sectors during the recovery.

However industrial production is still 0.8% below the pre-recession peak. This indicator might return to the pre-recession peak in early 2014.

The final graph is for employment and is through October 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment and is through October 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 1.1% below the pre-recession peak and will probably be back to pre-recession levels in mid-2014.

Housing: Short Sales, Non-Recourse Loans and Tax Forgiveness

by Calculated Risk on 11/17/2013 11:19:00 AM

From Nick Timiraos at the WSJ: Why California Homeowners Could Avoid a Tax Hit (ht picosec)

The tax provision currently allows some homeowners—mostly those facing foreclosure—to avoid paying taxes on certain relief that they receive on their mortgages. The IRS considers debt forgiveness to be a form of taxable income. That means homeowners who sell their homes for less than the amount they owe in a short sale could face a tax bill.The key section in the IRS letter is:

In 2007, as the foreclosure crisis spread, Congress exempted some homeowners from counting certain kinds of forgiven mortgage debt as taxable income in order to encourage banks and borrowers to seek foreclosure alternatives. Congress retroactively extended the provision earlier this year, after it expired on Dec. 31, 2012. The provision is set to expire this coming Dec. 31 and there appears to be less urgency in Congress right now to pass an extension.

In the letter to Sen. Boxer, the IRS clarified that certain non-recourse debt forgiven by lenders wouldn’t typically be considered taxable income by the IRS. This means that for most California borrowers, the expiration of the tax provision may not have a meaningful effect.

"[I]f a property owner cannot be held personally liable for the difference between the loan balance and the sales price, we would consider the obligation as a nonrecourse obligation. In this situation, the owner would not treat the cancelled debt as income."Since California (and other states) passed anti-deficiency provisions, this means many loans will be considered nonrecourse by the IRS.

The number of short sales is already declining rapidly, and I was expecting short sales to fall off a cliff in January 2014. This letter suggests short sales will continue in certain states (the letter is only for California, but other states have similar statutes).

Saturday, November 16, 2013

Schedule for Week of November 17th

by Calculated Risk on 11/16/2013 04:38:00 PM

The key report this week will be October retail sales to be released on Wednesday. There are also two housing reports that will be released this week, the homebuilder confidence survey on Monday, and existing home sales on Wednesday (housing starts are delayed).

For manufacturing, the Philly and Kansas City Fed November surveys will be released this week. For prices, CPI will be released on Wednesday.

10:00 AM ET: The November NAHB homebuilder survey. The consensus is for a reading of 55, unchanged from October. Any number above 50 indicates that more builders view sales conditions as good than poor.

Note on delay in release of Housing Starts from the Census Bureau:

"New Residential Construction (NRC) data for September 2013 will be released with the October data release, which has been rescheduled to November 26, 2013.

Data collection for estimates of housing starts and completions occurs in the field with resources that are shared with other critical surveys. Full data collection will occur in November but will require extra time; hence, the scheduled releases are much later than originally scheduled in November. Normal data collection and data releases will resume with the release of the November data in December."

7:00 PM ET: Speech, Fed Chairman Ben Bernanke, Communication and Monetary Policy, National Economists Club Annual Dinner: Herbert Stein Memorial Lecture

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: Consumer Price Index for October. The consensus is for no change in CPI in October and for core CPI to increase 0.2%.

8:30 AM ET: Retail sales for October will be released.

8:30 AM ET: Retail sales for October will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 28.5% from the bottom, and now 12.6% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be unchanged in October, and to increase 0.1% ex-autos.

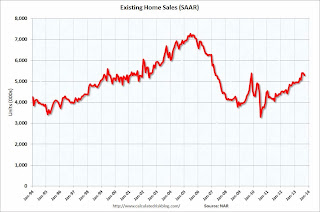

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 5.13 million on seasonally adjusted annual rate (SAAR) basis. Sales in September were at a 5.29 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.08 million.

A key will be inventory and months-of-supply.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.3% increase in inventories.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of October 29-30, 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 339 thousand last week.

8:30 AM: Producer Price Index for October. The consensus is for a 0.2% decrease in producer prices (0.1% increase in core).

10:00 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 15.5, down from 19.8 last month (above zero indicates expansion).

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 3.883 million from 3.808 million in July. The number of job openings (yellow) is up 6.9% year-over-year compared to August 2012.

Quits were up in August, and quits are up about 10.5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2013

11:00 AM: the Kansas City Fed manufacturing survey for November. The consensus is for a reading of 6, unchanged from last month (above zero indicates expansion).

Unofficial Problem Bank list declines to 655 Institutions

by Calculated Risk on 11/16/2013 08:55:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 15, 2013.

Changes and comments from surferdude808:

The OCC released its enforcement action activity through mid-September 2013. A few actions were modified and they terminated six orders. The changes reduce the Unofficial Problem Bank list to 655 institutions with assets of $223.2 billion. This week, assets figures were updated through third quarter. As a result, updated figures were responsible for $3.2 billion of the $5.7 billion decline in assets this week. A year ago, the list held 857 institutions with assets of $329.2 billion.

The OCC terminated actions against The Conway National Bank Conway, SC ($959 million Ticker: CNBW); Continental Bank, Plymouth Meeting, PA ($654 million); Middlesex Federal Savings, F.A., Somerville, MA ($337 million); National Bank of New York City, Flushing, NY ($188 million); Traders National Bank, Tullahoma, TN ($158 million); and Santa Clara Valley Bank, National Association, Santa Paula, CA ($134 million).

Next week, the FDIC may release industry results for the third quarter, which will include an update on the aggregate count of institutions on the Official Problem bank List. Prior to the third quarter of 2010, the Official List count was higher than the Unofficial List, with a peak of 157 at fourth quarter 2009. In subsequent quarters it has reversed to be lower than the Unofficial List count with the difference reaching a high of 185 at first quarter of 2012. The difference has trended down to 148. There is a chance the difference could narrow to around 120 when the third quarter figures are released.

There is some news on Capitol Bancorp, LTD. to pass along. The bad first. The New Mexico State Banking Department reissued a notice in order to close Sunrise Bank of Albuquerque, Albuquerque, NM ($42 million) because the bank's regulatory capital ratio has fallen below a required threshold. A previous closure notice issued in September 2012 was averted after a $1 million capital injection by Capitol Bancorp. Now the possible good news. According to a report by SNL Securities (Capitol Bancorp, FDIC to end dispute over failed-bank cross-guaranty liability), the company has reached an agreement whereby the FDIC would receive 85% of any proceeds from the pending sell of several units. The bankruptcy court has agreed to these terms as well, which could allow the sale of four units to Talmer Bancorp, Inc. to proceed. Perhaps the saga of Capitol Bancorp is nearing an end, which has been one of the longest resolutions in FDIC's history.