by Calculated Risk on 11/16/2013 04:38:00 PM

Saturday, November 16, 2013

Schedule for Week of November 17th

The key report this week will be October retail sales to be released on Wednesday. There are also two housing reports that will be released this week, the homebuilder confidence survey on Monday, and existing home sales on Wednesday (housing starts are delayed).

For manufacturing, the Philly and Kansas City Fed November surveys will be released this week. For prices, CPI will be released on Wednesday.

10:00 AM ET: The November NAHB homebuilder survey. The consensus is for a reading of 55, unchanged from October. Any number above 50 indicates that more builders view sales conditions as good than poor.

Note on delay in release of Housing Starts from the Census Bureau:

"New Residential Construction (NRC) data for September 2013 will be released with the October data release, which has been rescheduled to November 26, 2013.

Data collection for estimates of housing starts and completions occurs in the field with resources that are shared with other critical surveys. Full data collection will occur in November but will require extra time; hence, the scheduled releases are much later than originally scheduled in November. Normal data collection and data releases will resume with the release of the November data in December."

7:00 PM ET: Speech, Fed Chairman Ben Bernanke, Communication and Monetary Policy, National Economists Club Annual Dinner: Herbert Stein Memorial Lecture

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: Consumer Price Index for October. The consensus is for no change in CPI in October and for core CPI to increase 0.2%.

8:30 AM ET: Retail sales for October will be released.

8:30 AM ET: Retail sales for October will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 28.5% from the bottom, and now 12.6% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be unchanged in October, and to increase 0.1% ex-autos.

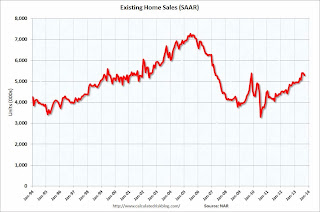

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 5.13 million on seasonally adjusted annual rate (SAAR) basis. Sales in September were at a 5.29 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.08 million.

A key will be inventory and months-of-supply.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.3% increase in inventories.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of October 29-30, 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 339 thousand last week.

8:30 AM: Producer Price Index for October. The consensus is for a 0.2% decrease in producer prices (0.1% increase in core).

10:00 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 15.5, down from 19.8 last month (above zero indicates expansion).

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 3.883 million from 3.808 million in July. The number of job openings (yellow) is up 6.9% year-over-year compared to August 2012.

Quits were up in August, and quits are up about 10.5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2013

11:00 AM: the Kansas City Fed manufacturing survey for November. The consensus is for a reading of 6, unchanged from last month (above zero indicates expansion).