by Calculated Risk on 11/13/2013 10:31:00 AM

Wednesday, November 13, 2013

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in October

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in October. First, from Lawler on October sales:

While I don’t yet have enough local data to produce a precise estimate of national existing home sales for October, my “best guess” right now based on the data I have is that existing home sales (as measured by the NAR) ran at a seasonally adjusted annual rate of 5.08 million in October, down 4.0% from September’s seasonally-adjusted pace.On short sales from CR: Look at the first two columns in the table for Short Sales Share. Short sales are down sharply from a year ago, and will probably really decline in early 2014. It appears that the Mortgage Debt Relief Act of 2007 will not be extended again next year. Usually cancelled debt is considered income, but a provision of the 2007 Debt Relief Act allowed borrowers "to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief." (excerpt from IRS). This relief expires on Dec 31, 2013. Complete all short sales by the end of this year!

It’s worth noting that pending sales in most areas showed substantially slower YOY growth in October compared to September, and quite a few areas showed a YOY drop – suggesting that November sales could be weak/down as well.

Total "Distressed" Share. In most areas that have reported distressed sales so far, the share of distressed sales is down year-over-year. Also there has been a significant decline in foreclosure sales in all of these cities.

The All Cash Share (last two columns) is mostly declining year-over-year. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | Oct-13 | Oct-12 | |

| Las Vegas | 21.0% | 44.7% | 6.0% | 11.6% | 27.0% | 56.3% | 44.9% | 54.1% |

| Reno | 16.0% | 40.0% | 4.0% | 12.0% | 20.0% | 52.0% | ||

| Phoenix | 8.4% | 26.2% | 6.9% | 12.9% | 15.3% | 39.1% | 31.6% | 43.9% |

| Sacramento | 11.4% | 35.7% | 5.1% | 12.0% | 16.5% | 47.7% | 23.9% | 36.9% |

| Minneapolis | 5.1% | 10.4% | 16.4% | 24.9% | 21.5% | 35.3% | ||

| Mid-Atlantic | 7.9% | 9.1% | 8.2% | 13.0% | 16.1% | 22.1% | 19.9% | 20.0% |

| So. California* | 12.9% | 27.2% | 6.3% | 16.3% | 19.2% | 43.5% | 27.5% | 32.8% |

| Toledo | 37.0% | 38.6% | ||||||

| Tucson | 32.9% | 31.8% | ||||||

| Omaha | 20.0% | 20.4% | ||||||

| SE Michigan | 34.5% | 44.3% | ||||||

| Memphis* | 18.4% | 22.9% | ||||||

| Birmingham AL | 21.0% | 30.8% | ||||||

| *share of existing home sales, based on property records | ||||||||

MBA: Mortgage Applications decrease 1.8% in Latest Weekly Survey

by Calculated Risk on 11/13/2013 09:31:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 8, 2013. This week's results are compared to a revised level from last week. That decline, initially reported as -7.0 percent, was revised to -2.8 percent....

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.44 percent, the highest level in a month, from 4.32 percent, with points increasing to 0.44 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up slightly over the last two months as rates have declined from the August levels.

However the index is still down 59% from the levels in early May.

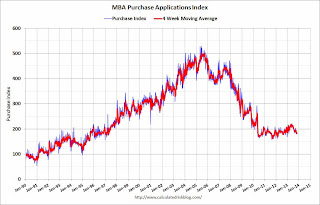

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down about 2% from a year ago.

Tuesday, November 12, 2013

The Cranes of Miami

by Calculated Risk on 11/12/2013 07:00:00 PM

Earlier I posted some photos of some new construction in California: The Return of the Cranes. Several people wrote to me about their part of the country, but I think Miami is the winner.

Here are two photos of the cranes of Miami:

Maybe we should have a "count the cranes" contest for the first photo. Wow - looks like China!

Lawler on Homebuilders: Net Orders Last Quarter Down From Year Ago

by Calculated Risk on 11/12/2013 03:22:00 PM

D.R. Horton, the nation’s largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 5,160, down 2.2% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 31%, up from 27% a year ago. Home closings totaled 6,866 last quarter, up 23.2% from the comparable quarter of 2012, at an average sales price of $262,463, up 13.6% from a year ago. The company’s order backlog at the end of September was 8,205, up 13.3% from last September.

In its conference call, Horton officials attributed the increase in home prices both to increased pricing power and an increased “mix” of larger homes sold to trade-up buyers. Officials also said that the drop in sales orders reflected a “moderation” in demand that began in mid-May and continued through September, and attributed the drop in demand both to higher mortgage rates and higher home prices. The officials noted that the pace of orders had improved in October, and also said that home prices increases have “moderated.”

Officials also noted that its previous rapid increase in its land/lot inventory (see next page) meant that it had “sufficient inventories of homes and finished lots” to meet what it hoped to be improved demand over the next year, and that the company expected to reduce its land purchases next year.

Here are some summary stats for nine large, publicly-traded builders for the quarter ended September 30th.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg |

| D.R. Horton | 5,160 | 5,276 | -2.2% | 6,866 | 5,575 | 23.2% | $262,453 | $231,085 | 13.6% |

| Pulte Group | 3,781 | 4,544 | -16.8% | 4,817 | 4,418 | 9.0% | $310,000 | $279,000 | 11.1% |

| NVR | 2,381 | 2,558 | -6.9% | 3,342 | 2,656 | 25.8% | $349,200 | $321,700 | 8.5% |

| The Ryland Group | 1,592 | 1,507 | 5.6% | 1,883 | 1,322 | 42.4% | $298,000 | $264,000 | 12.9% |

| Beazer Homes | 1,192 | 1,110 | 7.4% | 1,657 | 1,608 | 3.0% | $263,200 | $228,600 | 15.1% |

| Standard Pacific | 1,110 | 989 | 12.2% | 1,217 | 861 | 41.3% | $420,000 | $369,000 | 13.8% |

| Meritage Homes | 1,300 | 1,204 | 8.0% | 1,418 | 1,197 | 18.5% | $341,000 | $280,000 | 21.8% |

| MDC Holdings | 924 | 1,008 | -8.3% | 1,257 | 1,039 | 21.0% | $345,000 | $320,647 | 7.6% |

| M/I Homes | 869 | 757 | 14.8% | 937 | 746 | 25.6% | $284,000 | $266,000 | 6.8% |

| Total | 18,309 | 18,953 | -3.4% | 23,394 | 19,422 | 20.5% | $305,805 | $271,672 | 12.6% |

As the above table indicates, while overall settlements for their builders last quarter were up 20.6% from a year ago, and average sales prices were up 12.6% YOY, net sales orders were down 3.4% YOY – the first YOY drop for this group of builders since the first quarter of 2011.

These builder results indicate that the combination of higher mortgage rates and aggressive home price increases resulted in a significant slowdown in new home sales last quarter. While the relationship between large builder results and Census estimates for new home sales is far from perfect (partly reflecting market-share changes but also reflecting methodological and timing differences), these builder results suggest that Census estimates for new SF home sales for September (re-scheduled for release, along with estimates for October, on December 4th), could be down sharply from August.

Sacramento Housing: Total Sales down 25% Year-over-year in October, Conventional Sales up 19%, Active Inventory increases 93%

by Calculated Risk on 11/12/2013 01:10:00 PM

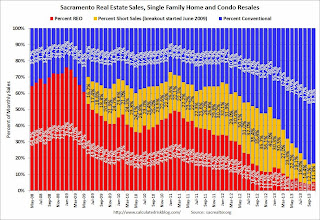

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In October 2013, 16.7% of all resales (single family homes) were distressed sales. This was up slightly from 16.0% last month, and down from 47.7% in October 2012.

The percentage of REOs was at 5.3%, and the percentage of short sales decreased to 11.3%. (the lowest percentage for short sales since Sacramento started tracking short sales in June 2009).

Note on Short Sales: I expect short sales will really decline next year with the expiration of Cancelled Mortgage Debt Relief provision of the Mortgage Debt Relief Act of 2007.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 93.2% year-over-year in October. This is the sixth consecutive month with a year-over-year increase in inventory - and inventory has now almost doubled from a year ago.

Cash buyers accounted for 23.9% of all sales, up slightly from 23.6% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 25% from October 2012, but conventional sales were up 18% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

The Return of the Cranes

by Calculated Risk on 11/12/2013 10:56:00 AM

Back in 2009, Michael C. sent me some photos of rabbits hiding in a field of steel. The steel was intended for a construction project that was on hold. Now Michael has sent me some more photos.

The photos below are of 100 Van Ness in San Francisco, Samsung’s New Corporate HQ, the Transbay Center (Jay Paul the developer / owner for the fields of steel post is also putting a high rise on this site along with the huge office tower), and more.

Michael writes:

[In] SF and the place is on fire with 20 tower cranes across the city. [My company sent] me to Phoenix ... and they are going like gangbusters on residential housing! Also remember the Easter bunny in the field of steel? Well the are going to start on that again ... presumably there is some demand for office space in San Diego finally.Photo credits: Michael C.

[As to] the fields of steel from Easter a few years ago, this was the original project. Only one of the buildings got built and the steel for the three of the next 11 to be built was ordered and left on site. It can still be seen here on google maps. ... Looks like the bunny will be homeless by Easter.

Chicago Fed: "Economic activity slightly improved in September"

by Calculated Risk on 11/12/2013 09:22:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity slightly improved in September

The Chicago Fed National Activity Index (CFNAI) increased to +0.14 in September from +0.13 in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to –0.03 in September from –0.15 in August, marking its seventh consecutive reading below zero. September’s CFNAI-MA3 suggests that growth in national economic activity was slightly below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly below the historical trend in September (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

NFIB: Small Business Optimism Index Declines in October

by Calculated Risk on 11/12/2013 07:31:00 AM

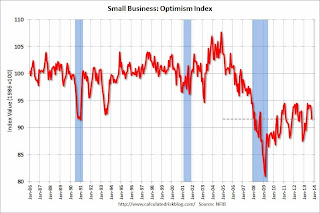

From the National Federation of Independent Business (NFIB): October Small Business Optimism Takes a Tumble

Fall arrived literally this month, as small-business optimism dropped from 93.9 to 91.6, largely due to a precipitous decline in hiring plans and expectations for future small-business conditions. ... The stalemate in early October over funding the government ... left 68 percent of owners feeling that the current period is a bad time to expand; 37 percent of those owners identified the political climate in Washington as the culprit—a record high level.

Job Creation. Job creation was up in October. NFIB owners increased employment by an average of 0.11 workers per firm in October after September’s decline

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 91.6 in October from 93.9 in September.

This decline was expected due to the shutdown of the government, and optimism will probably increase again in November or December.

Monday, November 11, 2013

Tuesday: Small Business Optimism Index (or more likely Pessimism)

by Calculated Risk on 11/11/2013 08:18:00 PM

Trom the NY Times: Skeptics See Euro as Working Against European Unity

[T]he big worry lately is the specter of deflation, a doom loop of falling prices, wages and profits that, once under way, is a tailspin hard to pull out of. The fear of years of stagnation was the main impetus for the European Central Bank’s decision to reduce interest rates, over the objections of Germany, which worries that looser money will only encourage profligacy by its weaker euro neighbors.Not only has austerity in Europe been a dismal failure, but policymakers still haven't addressed the fundamental issues in the Eurozone.

It is not evident, though, that anything has been gained by the austerity policies that Germany long preached, which have been a drag on economic growth; government debt in the euro zone has risen sharply over the last half decade.

Perhaps worst of all, the various economic afflictions have reinforced the kind of nationalism and xenophobia that the broader European Union project was supposed to chase away.

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for October. Expect a decline in optimism.

• At 8:30 AM, the Chicago Fed National Activity Index for September. This is a composite index of other data.

Weekly Update: Housing Tracker Existing Home Inventory up 2.2% year-over-year on Nov 11th

by Calculated Risk on 11/11/2013 03:44:00 PM

Here is another weekly update on housing inventory ... for the fourth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early this year.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for September). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confident that inventory bottomed early this year, and I expect the seasonal decline to be less than usual at the end of the year - so the year-over-year change will continue to increase.

Inventory is still very low, but this increase in inventory should slow house price increases.