by Calculated Risk on 10/23/2013 10:03:00 PM

Wednesday, October 23, 2013

Thursday: Unemployment Claims, Job Openings

From Neil Irwin at the WaPo: Another billionaire is predicting doom. Ignore him.

Hedge fund billionaire Stanley Druckenmiller is really, really worried about the future of the United States. He is doing an event at Georgetown next week making the case that entitlement spending will form the next mega-financial crisis, and not for the first time.I've read Druckenmiller's comments and Irwin is far too kind.

This kind of quasi-apocalyptic talk is breathtakingly common. His is of a thread with a lot of commentary that suggests that the whole world economy is just a shell game being propped up by profligate government spending and central bank money-printing, that it’s all a scam that will implode soon enough.

...

[T]here are Druckenmiller’s arguments on Social Security obligations as the trigger of the next global financial crisis. The poster advertising Druckenmiller's speech last week argues that the "true national debt" is more than $200 trillion. What the sponsor seems to be doing is looking at the liabilities side of the balance sheet, but not the asset side. Yes, Social Security and Medicare are on the hook to pay out a lot of money in the future. But they are also on track to collect many trillions in tax revenue in the future.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 358 thousand last week.

• At 9:30 AM, the Markit US PMI Manufacturing Index Flash for October. The consensus is for a decrease to 52.7 from 52.8 in September.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

Note: New Home sales for September - originally scheduled for tomorrow - will be released on December 4th

LA area Port Traffic in September

by Calculated Risk on 10/23/2013 03:45:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for September since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.4% in September compared to the rolling 12 months ending in August. Outbound traffic decreased slightly compared to August.

In general, inbound traffic has been increasing and outbound traffic had been declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

This suggests an increase in the trade deficit with Asia for September - and possibly a fairly strong retailer buying for the holiday season.

AIA: Architecture Billings Index Increases in September

by Calculated Risk on 10/23/2013 11:36:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Surges Higher

Showing a steady increase in the demand for design services, the Architecture Billings Index (ABI) continues to accelerate, as it reached its second highest level of the year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 54.3, up from a mark of 53.8 in August. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.6, down from the reading of 63.0 the previous month.

• Regional averages: West (60.6), South (54.1), Midwest (51.0), Northeast (50.7)

• Sector index breakdown: commercial / industrial (57.9), multi-family residential (55.6), mixed practice (55.4), institutional (50.4)

• Project inquiries index: 58.6

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.3 in September, up from 53.8 in August. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 12 of the last 13 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index is not as strong as during the '90s - or during the bubble years of 2004 through 2006 - but the increases in this index over the past year suggest some increase in CRE investment in 2014.

LPS: Mortgage Delinquency Rate increased in September, In-Foreclosure Rate lowest since February 2009

by Calculated Risk on 10/23/2013 09:14:00 AM

According to the First Look report for September to be released today by Lender Processing Services (LPS), the percent of loans delinquent increased seasonally in September compared to August, and declined about 13% year-over-year. Also the percent of loans in the foreclosure process declined further in September and were down 32% over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 6.46% from 6.20% in August. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.63% in September from 2.66% in August. The is the lowest level since February 2009.

The number of delinquent properties, but not in foreclosure, is down 434,000 properties year-over-year, and the number of properties in the foreclosure process is down 612,000 properties year-over-year.

LPS will release the complete mortgage monitor for September in early November.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| September 2013 | August 2013 | September 2012 | |

| Delinquent | 6.46% | 6.20% | 7.40% |

| In Foreclosure | 2.63% | 2.66% | 3.87% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,935,000 | 1,836,000 | 2,170,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,331,000 | 1,288,000 | 1,530,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,328,000 | 1,341,000 | 1,940,000 |

| Total Properties | 4,593,000 | 4,465,000 | 5,640,000 |

MBA: Mortgage Applications Unchanged in Latest Survey

by Calculated Risk on 10/23/2013 07:02:00 AM

From the MBA: Mortgage Applications Essentially Unchanged in Latest MBA Weekly Survey

Mortgage applications decreased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 18, 2013. This week’s results do not include an adjustment for the Columbus Day holiday. ...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.39 percent, the lowest rate since June 2013, from 4.46 percent, with points increasing to 0.41 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up over the last six weeks as rates have declined from the August levels.

However the index is still down 61% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down 4% from a year ago.

Tuesday, October 22, 2013

Wednesday: FHFA House Price Index, Architecture Billings Index

by Calculated Risk on 10/22/2013 07:44:00 PM

From Catherine Rampell at the NY Times: Weak Job Data May Weigh on Fed’s Decision on Stimulus

Weakness in the September hiring figures — coupled with the complications about the upcoming releases — is expected to further delay the Federal Reserve’s decision to start tapering its stimulus programs.It will be a few months until the data is back to normal.

“The labor market lost, rather than gained, momentum over the summer, leaving us with less than a desirable cushion just as the government was shuttered in response to political shenanigans,” said Diane Swonk, chief economist at Mesirow Financial.

While the Fed has been trying to stimulate the economy, fiscal policy has largely worked in the opposite direction, with multiple drags on growth resulting from a payroll tax hike that began in January, the across-the-board budget cuts of the so-called sequestration that began in March, and then the partial government shutdown and debt ceiling crisis in October. Even before the shutdown, the federal government had the lowest number of civilian employees on its payrolls since 1966, according to the September jobs report.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, the FHFA House Price Index for August 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase.

• During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

Weekly Update: Housing Tracker Existing Home Inventory up year-over-year on Oct 21st

by Calculated Risk on 10/22/2013 05:47:00 PM

I didn't post this yesterday because of the NAR existing home sales release. Here is another weekly update on housing inventory...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for September). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is increasing, and is now slightly above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confidence that inventory bottomed early this year, and I expect the seasonal decline to be less than usual at the end of the year - so the year-over-year change will continue to increase.

Inventory is still very low, but this increase in inventory should slow house price increases.

Employment Report Comments

by Calculated Risk on 10/22/2013 02:07:00 PM

Overall this was a weak employment report.

The decline in the unemployment rate to 7.2% in September, from 7.3% in August, was a little bit of good news, but the recent decline has been mostly due to declining participation.

If we look at the year-over-year change in employment - to minimize the monthly volatility - total nonfarm employment is up 2.225 million from September 2012, and private employment is up 2.290 million. That is essentially the same year-over-year gain as in August (2.215 million total, 2.282 million private year-over-year in August).

So the story mostly remains the same: slow and steady job growth.

Unfortunately the next employment report will be impacted by the government shutdown (both impacting employment and data gathering).

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The ratio was unchanged at 75.9% in September. This ratio should probably move close to 80% as the economy recovers, but that also requires an increase in the 25 to 54 participation rate.

The participation rate for this group declined to 80.9% in September. The decline in the participation rate for this age group is probably mostly due to economic weakness (as opposed to demographics) and this suggests the labor market is still very weak.

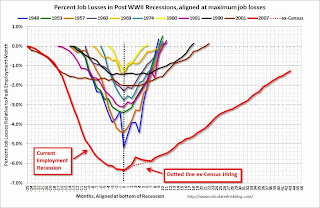

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was unchanged at 7.9 million in September. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased slightly in September to 7.926 million.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 13.6% in September from 13.7% in August. This is the lowest level for U-6 since December 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.146 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.290 million in August. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

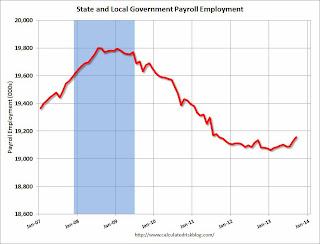

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In September 2013, state and local governments added 28,000 jobs, and state and local employment is up 82 thousand so far in 2013.

I think most of the state and local government layoffs are over, and state and local employment has probably bottomed. Of course Federal government layoffs are ongoing - and with many more layoffs expected.

Overall the labor market is still weak and millions of people are unemployed or underemployed.

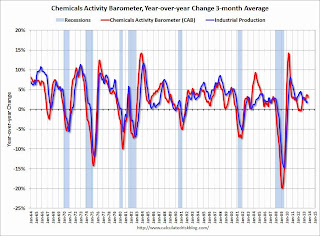

Chemical Activity Barometer for October Suggests Economic Activity Increasing

by Calculated Risk on 10/22/2013 12:32:00 PM

I'll have more on the employment report later, but this is a new indicator that I'm following that appears to be a leading indicator for the economy.

From the American Chemistry Council: Fourth Quarter to End Strong Shows Leading Economic Indicator

The partial shutdown of the federal government earlier this month didn’t take the steam out of the U.S. economy, according to the American Chemistry Council’s (ACC) monthly Chemical Activity Barometer (CAB), released today. The Chemical Activity Barometer is a leading economic indicator, shown to lead U.S. business cycles by an average of eight months at cycle peaks, and four months at cycle troughs. The barometer increased 0.3 percent over September on a three-month moving average (3MMA) basis, and remains up 3.1 percent over a year ago. It continues to be at its highest point since June 2008. Prior CAB readings for July through September were slightly revised.

“Despite the uncertainty being fueled by political gridlock in Washington, the fundamentals of our economy appear to be healthy,” said Dr. Kevin Swift, chief economist at the American Chemistry Council. This month’s Chemical Activity Barometer is up 0.3 percent and this follows upticks in August and September as well,” he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests that economic activity is increasing.

Construction Spending increased in August

by Calculated Risk on 10/22/2013 10:00:00 AM

The Census Bureau reported that overall construction spending increased in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2013 was estimated at a seasonally adjusted annual rate of $915.1 billion, 0.6 percent above the revised July estimate of $909.4 billion. The August figure is 7.1 percent above the August 2012 estimate of $854.0 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $640.5 billion, 0.7 percent above the revised July estimate of $636.1 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $274.5 billion, 0.4 percent above the revised July estimate of $273.4 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 50% below the peak in early 2006, and up 49% from the post-bubble low.

Non-residential spending is 27% below the peak in January 2008, and up about 34% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and up about 4% from the recent low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 26%. Non-residential spending is up 4% year-over-year. Public spending is down 2% year-over-year.

To repeat a few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. I expect private non-residential to start to increase.

3) Public construction spending increased in August and is now 4% above the low in April. It is possible that the drag from public construction spending is over. Public spending has declined to 2006 levels (not adjusted for inflation) and was a drag on the economy for 4 years. In real terms, public construction spending has declined to 2001 levels.