by Calculated Risk on 10/22/2013 09:01:00 AM

Tuesday, October 22, 2013

September Employment Report: 148,000 Jobs, 7.2% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 148,000 in September, and the unemployment rate was little changed at 7.2 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was below expectations of 180,000 payroll jobs added.

...

The change in total nonfarm payroll employment for July was revised from +104,000 to +89,000, and the change for August was revised from +169,000 to +193,000. With these revisions, employment gains in July and August combined were 9,000 more than previously reported.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate declined in September to 7.2% from 7.3% in August.

This is the lowest level for the unemployment rate since November 2008.

This is the lowest level for the unemployment rate since November 2008.The unemployment rate is from the household report.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in September at 63.2%. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was unchanged in September at 58.6% from (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another weaker than expected employment report. I'll have much more later ...

Monday, October 21, 2013

Tuesday: Jobs, Jobs, Jobs

by Calculated Risk on 10/21/2013 09:22:00 PM

With the jobs report release, it is going to feel like Friday tomorrow!

Unfortunately many reports will really be delayed. The Census Bureau released their Revised Economic Indicator Calendar today. As an example, the New Home sales report for September will not be released until December 4th (originally scheduled this week). They will release both September and October at the same time..

The BEA also announced some update release dates today: 2013 News Release Schedule. The Q3 advance estimate for Gross Domestic Product (GDP) will now be released on November 7th (originally scheduled for October 30th).

Tuesday:

• At 8:30 AM ET, the Employment Report for September will be released. The consensus is for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August. The consensus is for the unemployment rate to be unchanged at 7.3% in September.

• At 9:00 AM, the Chemical Activity Barometer (CAB) for October from the American Chemistry Council will be released. This appears to be a leading economic indicator.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for October.

• Also at 10:00 AM, Construction Spending for August. The consensus is for a 0.4% increase in construction spending.

NMHC Survey: Apartment Market Conditions Loosen in Q3

by Calculated Risk on 10/21/2013 03:17:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Retreat in Third Quarter NMHC Survey

All four indexes of the National Multi Housing Council’s (NMHC) October Survey of Apartment Market Conditions dipped below 50 for the first time since July 2009. Market Tightness (46), Sales Volume (46), Equity Financing (39) and Debt Financing (41) all indicated declining conditions from the previous quarter.

“After four years of almost continuous improvement across all indicators, apartment markets have taken a small step back,” said Mark Obrinsky, NMHC’s Vice President of Research and Chief Economist.

...

Market Tightness Index fell to 46 from 55. Two-thirds of respondents (67 percent) saw no change in market tightness (higher rents and/or occupancy rates) compared with three months ago. One-fifth of respondents (up from 14 percent in July) felt that markets were looser than three months ago, while 13 percent saw tighter markets.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates loosening from the previous quarter. The quarterly decrease was small, but indicates looser market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates are near a bottom, although apartment markets are still tight, so rents will probably continue to increase.

Comments on Existing Home Sales

by Calculated Risk on 10/21/2013 12:16:00 PM

As expected, existing home sales declined in September, and I expect further declines over the next several months. From the NAR:

NAR President Gary Thomas, broker-owner of Evergreen Realty in Villa Park, Calif., said there are far-ranging consequences from the repeating stalemates in Washington. “Just one impact of the recent government shutdown – delays in tax transcripts needed for approval of mortgage loans – put a monkey wrench in the transaction process and could negatively impact sales closings in next month’s report,” he said.But lower existing home sales, and slower price appreciation, doesn't mean the housing recovery is over. What matters for jobs and the economy are new home sales, not existing home sales. And I expect the housing recovery to continue.

emphasis added

The big story in the NAR release this morning was that inventory was now up 1.8% year-over-year in September. Inventory is still very low, but year-over-year inventory has now turned positive, and I expect inventory to continue to increase. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Click on graph for larger image.

Click on graph for larger image.The NAR does not seasonally adjust inventory, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory (see graph of NAR reported and seasonally adjusted).

This shows that inventory bottomed in January (on a seasonally adjusted basis), and is now up about 7.5% from the bottom. On a seasonally adjusted basis, inventory was up 2.3% in September, even though the NAR reported inventory was flat (usually inventory declines in September).

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 10.7% from September 2012, but conventional sales are probably up close to 25% from September 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 14 percent of September sales, up from 12 percent in August, which was the lowest share since monthly tracking began in October 2008; they were 24 percent in September 2012.Although this survey isn't perfect, if total sales were up 10.7% from September 2012, and distressed sales declined to 14% of total sales (14% of 5.29 million) from 24% (24% of 4.78 million in September 2012), this suggests conventional sales were up sharply year-over-year - a good sign.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in September (red column) are above the sales for 2007 through 2012, however sales are well below the bubble years of 2005 and 2006.

Earlier:

• Existing Home Sales in September: 5.29 million SAAR, Inventory up 1.8% Year-over-year

Existing Home Sales in September: 5.29 million SAAR, Inventory up 1.8% Year-over-year

by Calculated Risk on 10/21/2013 10:00:00 AM

The NAR reports: Existing-Home Sales Down in September but Prices Rise

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 1.9 percent to a seasonally adjusted annual rate of 5.29 million in September from a downwardly revised 5.39 million in August, but are 10.7 percent above the 4.78 million-unit pace in September 2012.

Total housing inventory at the end of September was unchanged at 2.21 million existing homes available for sale, which represents a 5.0-month supply at the current sales pace, compared with a 4.9-month supply in August. Unsold inventory is 1.8 percent above a year ago, when there was a 5.4-month supply

Click on graph for larger image.

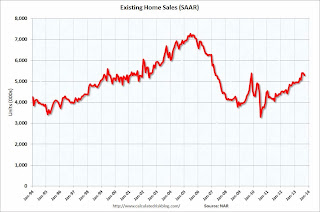

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2013 (5.29 million SAAR) were 1.9% lower than last month, and were 10.7% above the September 2012 rate.

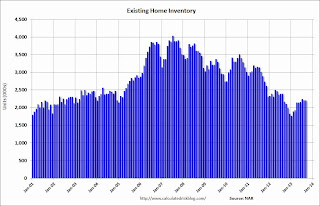

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was unchanged at 2.21 million in September. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory was unchanged at 2.21 million in September. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 1.8% year-over-year in September compared to September 2012. This is the first year-over-year increase since early 2011 and indicates inventory bottomed earlier this year.

Inventory increased 1.8% year-over-year in September compared to September 2012. This is the first year-over-year increase since early 2011 and indicates inventory bottomed earlier this year.Months of supply was at 5.0 months in September.

This was at expectations of sales of 5.30 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Sunday, October 20, 2013

Monday: Existing Home Sales

by Calculated Risk on 10/20/2013 09:05:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for September was scheduled for release. This is a composite index of other data and will probably be delayed.

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.30 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.48 million SAAR. Economist Tom Lawler is estimating the NAR will report sales of 5.26 million SAAR for September. As always, the key will be inventory.

Weekend:

• Schedule for Week of October 20th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are up slightly (fair value).

Oil prices are flat with WTI futures at $100.86 per barrel and Brent at $110.05 per barrel.

The Nikkei has opened up about 1% according to MarketWatch:

Japanese stocks rose in early Monday trading, with weaker-than-expected trade data pushing the yen lower, which in turn helped some export stocks. The Nikkei Stock Average added 1% to 14,704.36, with the broader Topix up 0.8%, also enjoying support from gains Friday in the U.S.

Builder Confidence and Single Family Starts

by Calculated Risk on 10/20/2013 07:04:00 PM

Last week the National Association of Home Builders (NAHB) reported the housing market index (HMI) declined in October to 55 from 57 in September.

Here is the press release from the NAHB: Builder Confidence Down in October; NAHB Estimates Sept. Housing Starts will Approach 900,000 Units

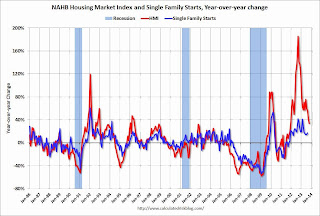

For some time I've been posting a graph with both builder confidence and single family starts (first graph below). This chart shows that confidence and single family starts generally move in the same direction, but it doesn't tell us anything about the expected level of single family starts.

Click on graph for larger image.

Click on graph for larger image.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts.

Builder confidence is based on a survey by the NAHB, and is designed so that any number above 50 indicates that more builders view sales conditions as good than poor. Since sales have picked up, builders are now more confident - and the surviving builders view sales as "good" - even though single family starts are still historically very low.

Probably a better comparison is to look at the year-over-year change in each series (Builder confidence and single family housing starts).

Probably a better comparison is to look at the year-over-year change in each series (Builder confidence and single family housing starts).

Once again the year-over-year change tends to move in the same direction, but builder confidence has larger swings (especially lately).

I expect single family starts to continue to increase over the next few years, but I don't think we should builder confidence to estimate the eventual level.

EIA Forecast: Gasoline Prices down sharply Year-over-year, Expected to Decline Further in 2014

by Calculated Risk on 10/20/2013 10:41:00 AM

Gasoline prices are down about 46 cents year-over-year at $3.43 per gallon nationally compared to $3.89 on October 15, 2012. This is a positive for the overall economy.

Prices are expected to decline further in Q4 and in 2014 according to the current EIA forecast:

Brent crude oil spot prices fell from a recent peak of $117 per barrel in early September to $108 per barrel at the end of the month as some crude oil production restarted in Libya and concerns over the conflict in Syria moderated. EIA expects the Brent crude oil price to continue to weaken, averaging $107 per barrel during the fourth quarter of 2013 and $102 per barrel in 2014. Projected West Texas Intermediate (WTI) crude oil prices average $101 per barrel during the fourth quarter of 2013 and $96 per barrel during 2014.WTI oil prices have declined recently, with WTI at $100.81 per barrel. Brent is at $109.94 per barrel. A year ago, WTI was around $90s, and Brent was around $112 per barrel.

...

The weekly U.S. average regular gasoline retail price fell by 18 cents per gallon during September, ending the month at $3.43 per gallon. EIA’s forecast for the regular gasoline retail price averages $3.34 per gallon in the fourth quarter of 2013. The annual average regular gasoline retail price, which was $3.63 per gallon in 2012, is expected to be $3.52 per gallon in 2013 and $3.40 per gallon in 2014.

emphasis added

Some of the year-over-year gasoline price decline is related to slightly lower Brent oil prices, but most of decline is because there were refinery and pipeline issues last year. In California, prices spiked last September and were still very high in October (put Los Angeles into the graph below to see the huge spike last year).

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, October 19, 2013

Schedule for Week of October 20th

by Calculated Risk on 10/19/2013 01:02:00 PM

Special Note: With the government shutdown, some economic data was delayed. Some of the delayed data has been rescheduled to be released this week, and it is possible additional data will be released later this week (not yet scheduled).

The key report this week is the delayed September employment report on Tuesday.

Other key reports this week are September Existing Home Sales on Monday, and New Home sales on Thursday (not confirmed release).

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for October will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data and will probably be delayed.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.30 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.48 million SAAR. Economist Tom Lawler is estimating the NAR will report sales of 5.26 million SAAR for September.

A key will be inventory and months-of-supply.

8:30 AM: Employment Report for September. The consensus is for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August.

The consensus is for the unemployment rate to be unchanged at 7.3% in September.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through July.

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).There are still 1.4 million fewer private sector jobs now than when the recession started in 2007.

9:00 AM: Chemical Activity Barometer (CAB) for October from the American Chemistry Council. This appears to be a leading economic indicator.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for August 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 358 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash for October. The consensus is for a decrease to 52.7 from 52.8 in September.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.689 million, down from 3.869 million in June. number of job openings (yellow) is up 5.4% year-over-year compared to July 2012.

Quits were up in July, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for a decrease in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 420 thousand in August.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 74.8, down from the preliminary reading of 75.2, and down from the September reading of 77.5.

Unofficial Problem Bank list declines to 677 Institutions

by Calculated Risk on 10/19/2013 09:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for October 18, 2013.

Changes and comments from surferdude808:

The OCC released its enforcement action activity through mid-September 2013 this week. The release led to many changes to the Unofficial Problem Bank List. In all, there were seven removals and one addition that leave the list holding 677 institutions with assets of $236.8 billion. A year ago, the list held 865 institutions with assets of $333.2 billion.

The OCC terminated actions against Golden Bank, National Association, Houston, TX ($566 million); First National Banking Company, Ash Flat, AR ($374 million); Valley National Bank, Tulsa, OK ($211 million); United Fidelity Bank, fsb, Evansville, IN ($170 million); Mutual Federal Savings Bank, A FSB, Sidney, OH ($112 million); Heritage First Bank, Rome, GA ($99 million); and Mutual Federal Bank, Chicago, IL ($75 million).

Added this week was The First National Bank of Sullivan, Sullivan, IL ($65 million).

Capitol Bancorp, Ltd. was in the news this week for agreeing to sell four of its banking subsidiaries to Talmer Bancorp, Troy, MI ($3.8 billion), which controls an Ohio-based thrift and a Michigan-based commercial bank. The units being sold are Michigan Commerce Bank , Ann Arbor, MI ($612 million); Bank of Las Vegas, Henderson, NV ($235 million); Indiana Community Bank, Goshen, IN ($97 million); and Sunrise Bank Of Albuquerque, Albuquerque, NM ($47 million). Talmer Bancorp is backed by Wilbur Ross and the deal is contingent upon the FDIC granting cross-guarantee waivers for each bank.