by Calculated Risk on 10/21/2013 12:16:00 PM

Monday, October 21, 2013

Comments on Existing Home Sales

As expected, existing home sales declined in September, and I expect further declines over the next several months. From the NAR:

NAR President Gary Thomas, broker-owner of Evergreen Realty in Villa Park, Calif., said there are far-ranging consequences from the repeating stalemates in Washington. “Just one impact of the recent government shutdown – delays in tax transcripts needed for approval of mortgage loans – put a monkey wrench in the transaction process and could negatively impact sales closings in next month’s report,” he said.But lower existing home sales, and slower price appreciation, doesn't mean the housing recovery is over. What matters for jobs and the economy are new home sales, not existing home sales. And I expect the housing recovery to continue.

emphasis added

The big story in the NAR release this morning was that inventory was now up 1.8% year-over-year in September. Inventory is still very low, but year-over-year inventory has now turned positive, and I expect inventory to continue to increase. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Click on graph for larger image.

Click on graph for larger image.The NAR does not seasonally adjust inventory, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory (see graph of NAR reported and seasonally adjusted).

This shows that inventory bottomed in January (on a seasonally adjusted basis), and is now up about 7.5% from the bottom. On a seasonally adjusted basis, inventory was up 2.3% in September, even though the NAR reported inventory was flat (usually inventory declines in September).

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 10.7% from September 2012, but conventional sales are probably up close to 25% from September 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 14 percent of September sales, up from 12 percent in August, which was the lowest share since monthly tracking began in October 2008; they were 24 percent in September 2012.Although this survey isn't perfect, if total sales were up 10.7% from September 2012, and distressed sales declined to 14% of total sales (14% of 5.29 million) from 24% (24% of 4.78 million in September 2012), this suggests conventional sales were up sharply year-over-year - a good sign.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in September (red column) are above the sales for 2007 through 2012, however sales are well below the bubble years of 2005 and 2006.

Earlier:

• Existing Home Sales in September: 5.29 million SAAR, Inventory up 1.8% Year-over-year

Existing Home Sales in September: 5.29 million SAAR, Inventory up 1.8% Year-over-year

by Calculated Risk on 10/21/2013 10:00:00 AM

The NAR reports: Existing-Home Sales Down in September but Prices Rise

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 1.9 percent to a seasonally adjusted annual rate of 5.29 million in September from a downwardly revised 5.39 million in August, but are 10.7 percent above the 4.78 million-unit pace in September 2012.

Total housing inventory at the end of September was unchanged at 2.21 million existing homes available for sale, which represents a 5.0-month supply at the current sales pace, compared with a 4.9-month supply in August. Unsold inventory is 1.8 percent above a year ago, when there was a 5.4-month supply

Click on graph for larger image.

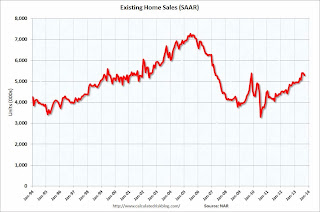

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2013 (5.29 million SAAR) were 1.9% lower than last month, and were 10.7% above the September 2012 rate.

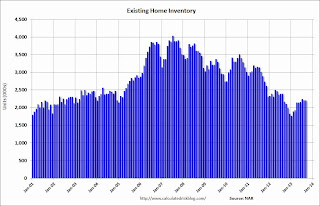

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was unchanged at 2.21 million in September. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory was unchanged at 2.21 million in September. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 1.8% year-over-year in September compared to September 2012. This is the first year-over-year increase since early 2011 and indicates inventory bottomed earlier this year.

Inventory increased 1.8% year-over-year in September compared to September 2012. This is the first year-over-year increase since early 2011 and indicates inventory bottomed earlier this year.Months of supply was at 5.0 months in September.

This was at expectations of sales of 5.30 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Sunday, October 20, 2013

Monday: Existing Home Sales

by Calculated Risk on 10/20/2013 09:05:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for September was scheduled for release. This is a composite index of other data and will probably be delayed.

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.30 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.48 million SAAR. Economist Tom Lawler is estimating the NAR will report sales of 5.26 million SAAR for September. As always, the key will be inventory.

Weekend:

• Schedule for Week of October 20th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are up slightly (fair value).

Oil prices are flat with WTI futures at $100.86 per barrel and Brent at $110.05 per barrel.

The Nikkei has opened up about 1% according to MarketWatch:

Japanese stocks rose in early Monday trading, with weaker-than-expected trade data pushing the yen lower, which in turn helped some export stocks. The Nikkei Stock Average added 1% to 14,704.36, with the broader Topix up 0.8%, also enjoying support from gains Friday in the U.S.

Builder Confidence and Single Family Starts

by Calculated Risk on 10/20/2013 07:04:00 PM

Last week the National Association of Home Builders (NAHB) reported the housing market index (HMI) declined in October to 55 from 57 in September.

Here is the press release from the NAHB: Builder Confidence Down in October; NAHB Estimates Sept. Housing Starts will Approach 900,000 Units

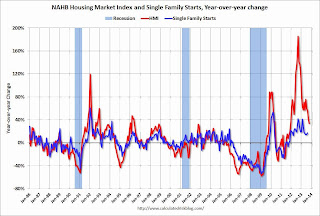

For some time I've been posting a graph with both builder confidence and single family starts (first graph below). This chart shows that confidence and single family starts generally move in the same direction, but it doesn't tell us anything about the expected level of single family starts.

Click on graph for larger image.

Click on graph for larger image.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts.

Builder confidence is based on a survey by the NAHB, and is designed so that any number above 50 indicates that more builders view sales conditions as good than poor. Since sales have picked up, builders are now more confident - and the surviving builders view sales as "good" - even though single family starts are still historically very low.

Probably a better comparison is to look at the year-over-year change in each series (Builder confidence and single family housing starts).

Probably a better comparison is to look at the year-over-year change in each series (Builder confidence and single family housing starts).

Once again the year-over-year change tends to move in the same direction, but builder confidence has larger swings (especially lately).

I expect single family starts to continue to increase over the next few years, but I don't think we should builder confidence to estimate the eventual level.

EIA Forecast: Gasoline Prices down sharply Year-over-year, Expected to Decline Further in 2014

by Calculated Risk on 10/20/2013 10:41:00 AM

Gasoline prices are down about 46 cents year-over-year at $3.43 per gallon nationally compared to $3.89 on October 15, 2012. This is a positive for the overall economy.

Prices are expected to decline further in Q4 and in 2014 according to the current EIA forecast:

Brent crude oil spot prices fell from a recent peak of $117 per barrel in early September to $108 per barrel at the end of the month as some crude oil production restarted in Libya and concerns over the conflict in Syria moderated. EIA expects the Brent crude oil price to continue to weaken, averaging $107 per barrel during the fourth quarter of 2013 and $102 per barrel in 2014. Projected West Texas Intermediate (WTI) crude oil prices average $101 per barrel during the fourth quarter of 2013 and $96 per barrel during 2014.WTI oil prices have declined recently, with WTI at $100.81 per barrel. Brent is at $109.94 per barrel. A year ago, WTI was around $90s, and Brent was around $112 per barrel.

...

The weekly U.S. average regular gasoline retail price fell by 18 cents per gallon during September, ending the month at $3.43 per gallon. EIA’s forecast for the regular gasoline retail price averages $3.34 per gallon in the fourth quarter of 2013. The annual average regular gasoline retail price, which was $3.63 per gallon in 2012, is expected to be $3.52 per gallon in 2013 and $3.40 per gallon in 2014.

emphasis added

Some of the year-over-year gasoline price decline is related to slightly lower Brent oil prices, but most of decline is because there were refinery and pipeline issues last year. In California, prices spiked last September and were still very high in October (put Los Angeles into the graph below to see the huge spike last year).

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, October 19, 2013

Schedule for Week of October 20th

by Calculated Risk on 10/19/2013 01:02:00 PM

Special Note: With the government shutdown, some economic data was delayed. Some of the delayed data has been rescheduled to be released this week, and it is possible additional data will be released later this week (not yet scheduled).

The key report this week is the delayed September employment report on Tuesday.

Other key reports this week are September Existing Home Sales on Monday, and New Home sales on Thursday (not confirmed release).

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for October will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data and will probably be delayed.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.30 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.48 million SAAR. Economist Tom Lawler is estimating the NAR will report sales of 5.26 million SAAR for September.

A key will be inventory and months-of-supply.

8:30 AM: Employment Report for September. The consensus is for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August.

The consensus is for the unemployment rate to be unchanged at 7.3% in September.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through July.

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).There are still 1.4 million fewer private sector jobs now than when the recession started in 2007.

9:00 AM: Chemical Activity Barometer (CAB) for October from the American Chemistry Council. This appears to be a leading economic indicator.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for August 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 358 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash for October. The consensus is for a decrease to 52.7 from 52.8 in September.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.689 million, down from 3.869 million in June. number of job openings (yellow) is up 5.4% year-over-year compared to July 2012.

Quits were up in July, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for a decrease in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 420 thousand in August.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 74.8, down from the preliminary reading of 75.2, and down from the September reading of 77.5.

Unofficial Problem Bank list declines to 677 Institutions

by Calculated Risk on 10/19/2013 09:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for October 18, 2013.

Changes and comments from surferdude808:

The OCC released its enforcement action activity through mid-September 2013 this week. The release led to many changes to the Unofficial Problem Bank List. In all, there were seven removals and one addition that leave the list holding 677 institutions with assets of $236.8 billion. A year ago, the list held 865 institutions with assets of $333.2 billion.

The OCC terminated actions against Golden Bank, National Association, Houston, TX ($566 million); First National Banking Company, Ash Flat, AR ($374 million); Valley National Bank, Tulsa, OK ($211 million); United Fidelity Bank, fsb, Evansville, IN ($170 million); Mutual Federal Savings Bank, A FSB, Sidney, OH ($112 million); Heritage First Bank, Rome, GA ($99 million); and Mutual Federal Bank, Chicago, IL ($75 million).

Added this week was The First National Bank of Sullivan, Sullivan, IL ($65 million).

Capitol Bancorp, Ltd. was in the news this week for agreeing to sell four of its banking subsidiaries to Talmer Bancorp, Troy, MI ($3.8 billion), which controls an Ohio-based thrift and a Michigan-based commercial bank. The units being sold are Michigan Commerce Bank , Ann Arbor, MI ($612 million); Bank of Las Vegas, Henderson, NV ($235 million); Indiana Community Bank, Goshen, IN ($97 million); and Sunrise Bank Of Albuquerque, Albuquerque, NM ($47 million). Talmer Bancorp is backed by Wilbur Ross and the deal is contingent upon the FDIC granting cross-guarantee waivers for each bank.

Friday, October 18, 2013

Data Schedule Update: CBO Will Release Budgetary Results for Fiscal Year 2013 in Early November

by Calculated Risk on 10/18/2013 04:33:00 PM

A few items:

• From CBO: CBO's Next Monthly Budget Review Will Be Published Early in November

Because CBO largely shut down its operations during the recent lapse in appropriated funds, the agency will not issue its Monthly Budget Review in October. The next issue of that report will come out early in November and will discuss the budgetary results for fiscal year 2013.No schedule on Fiscal 2013 results from Treasury yet.

• From the BEA: 2013 Release Schedule Revision

BEA is currently assessing the impact of the government shutdown on our release schedule and will post revisions to the release schedule as soon as possible.• From the BLS yesterday: Updated Schedule of BLS News Releases. Here is a partial table of rescheduled BLS releases:

| Release | Reference Period | Previously Scheduled Release Date | Revised Release Date |

|---|---|---|---|

| Metropolitan Area Employment and Unemployment | Aug-13 | Wednesday, October 02, 2013 | Monday, October 21, 2013 |

| Employment Situation | Sep-13 | Friday, October 04, 2013 | Tuesday, October 22, 2013 |

| U.S. Import and Export Price Indexes | Sep-13 | Thursday, October 10, 2013 | Wednesday, October 23, 2013 |

| Job Openings and Labor Turnover Survey | Aug-13 | Tuesday, October 08, 2013 | Thursday, October 24, 2013 |

| Producer Price Index | Sep-13 | Friday, October 11, 2013 | Tuesday, October 29, 2013 |

| Consumer Price Index | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Real Earnings | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Employment Situation | Oct-13 | Friday, November 01, 2013 | Friday, November 08, 2013 |

• No update yet from the Census Bureau (Housing Starts, New Home sales, etc)

CoStar: Commercial Real Estate prices mostly flat in August, Up 9% Year-over-year

by Calculated Risk on 10/18/2013 01:22:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Pricing Growth Levels Off in August Amid Uncertainty over Fed Tapering and Rising Interest Rates

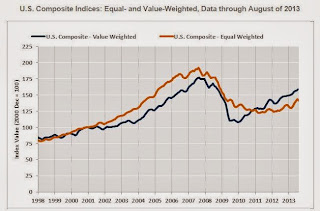

PRICING GROWTH FOR COMMERCIAL PROPERTY SLOWED IN AUGUST AMID ANXIETY OVER FED’S TAPERING OF BOND PURCHASES AND RISE IN INTEREST RATES: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted and the equal-weighted versions of the U.S. Composite Index—saw mixed movements for the month. The equal-weighted index, which reflects the pricing impact of more numerous smaller transactions, edged downward by 1.1% in August, while the value-weighted index, which is influenced by larger transactions, expanded by 1.6% during the same time period. On an annual basis, both indices advanced by nearly 10%. Despite investor reassurance following the Fed’s decision in September to delay the tapering of its quantitative easing policies, further economic uncertainty, largely stemming from the U.S. government shutdown and debt ceiling debate, may lead to further volatility in pricing in the near term.

POSITIVE ABSORPTION IN BOTH INVESTMENT GRADE AND GENERAL COMMERCIAL SEGMENTS SUPPORTS BROAD PRICING RECOVERY: Net absorption of available space across the three major commercial property types – office, retail and warehouse – continues to improve. For the first three quarters of 2013 net absorption among these three property types totaled more than 240 million square feet, the highest level for the first three quarters of a year since 2008. ...

TRANSACTION VOLUME REMAINS STEADY: The number of repeat sale transactions through August 2013 increased 15% from the same period one year ago, while the value of those transactions increased 17%. The percentage of commercial property selling at distressed prices remains near a four-and-a-half year low.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 47.5% from the bottom (showing the earlier and stronger demand for higher end properties) and up 9.0% year-over-year. However the Equal-Weighted index is only up 15.7% from the bottom, and up 10.0% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in September

by Calculated Risk on 10/18/2013 10:03:00 AM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in September.

Comments from CR: Tom Lawler has been sending me this table every month for a couple of years (or longer). I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us.

Look at the first two columns in the table for Short Sales Share. Short sales are down sharply from a year ago, and will probably really decline in early 2014. It appears that the Mortgage Debt Relief Act of 2007 will not be extended again next year. Usually cancelled debt is considered income, but a provision of the 2007 Debt Relief Act allowed borrowers "to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief." (excerpt from IRS). This relief expires on Dec 31, 2013. As I've written before, plan to complete all short sales by the end of this year!

Total "Distressed" Share. In most areas the share of distressed sales is down year-over-year (Hampton Roads is an exception). Also there has been a decline in foreclosure sales in all of these cities except Springfield, Ill.

The All Cash Share is declining in some cities (Phoenix, Las Vegas, Sacramento, Orlando), but steady in other areas. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep-13 | Sep-12 | Sep-13 | Sep-12 | Sep-13 | Sep-12 | Sep-13 | Sep-12 | |

| Las Vegas | 23.0% | 44.8% | 7.4% | 13.6% | 30.4% | 58.4% | 47.2% | 54.8% |

| Reno | 20.0% | 41.0% | 5.0% | 12.0% | 25.0% | 53.0% | ||

| Phoenix | 8.8% | 27.0% | 8.0% | 12.9% | 16.8% | 39.9% | 33.4% | 44.0% |

| Sacramento | 12.1% | 35.4% | 3.9% | 15.4% | 16.0% | 50.8% | 23.6% | 35.9% |

| Minneapolis | 6.0% | 9.9% | 15.9% | 25.0% | 21.9% | 34.9% | ||

| Mid-Atlantic | 7.7% | 12.4% | 8.2% | 9.4% | 15.9% | 21.8% | 18.4% | 18.8% |

| Orlando | 17.6% | 28.4% | 18.2% | 23.7% | 35.8% | 52.1% | 43.4% | 53.0% |

| Bay Area CA* | 8.6% | 27.5% | 3.6% | 14.1% | 12.2% | 41.6% | 24.0% | 28.4% |

| So. California* | 13.1% | 28.0% | 6.3% | 16.6% | 19.4% | 44.6% | 27.6% | 32.2% |

| Hampton Roads | 26.1% | 25.4% | ||||||

| Northeast Florida | 34.9% | 44.1% | ||||||

| Chicago | 31.0% | 41.0% | ||||||

| Hampton Roads | 26.1% | 25.4% | ||||||

| Toledo | 38.1% | 35.9% | ||||||

| Tucson | 29.8% | 29.7% | ||||||

| Omaha | 19.1% | 15.8% | ||||||

| Pensacola | 27.3% | 34.4% | ||||||

| Des Moines | 19.2% | 19.9% | ||||||

| Houston | 7.4% | 16.1% | ||||||

| Memphis* | 18.4% | 26.6% | ||||||

| Birmingham AL | 20.9% | 26.6% | ||||||

| Springfield IL | 14.2% | 13.5% | ||||||

| *share of existing home sales, based on property records | ||||||||