by Calculated Risk on 10/13/2013 08:43:00 PM

Sunday, October 13, 2013

Sunday Night Futures: The Shutdown and the Damage Done

From MarketWatch: Shutdown puts health of economy on ice

Some economists figure the dispute will only shave a few ticks off growth in the fourth quarter, which began at the start of October. Others see a deeper impact owing to the hesitancy of consumers and businesses to spend in the midst of yet another episode of political brinkmanship.Total damage has to be in the billions already ... where do we send the bill?

The scarcity of economic data also makes it harder for the Federal Reserve to figure out its next step.

Weekend:

• Schedule for Week of October 13th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 13 and DOW futures are down 101 (fair value).

Oil prices are down with WTI futures at $101.55 per barrel and Brent at $111.03 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.37 per gallon. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Reports: Some Progress on Deal to Open Government, Still discussing Length of Agreement, Senate Adjourned until Monday

by Calculated Risk on 10/13/2013 05:02:00 PM

From Kasie Hunt of NBC News:

Senate is adjourned until 2 p.m. Monday.From John Harwood of CNBC:

Aide: Senate D leaders optimistic of deal after "productive" Reid-McConnell talk. Haggling over length of CR/debt hike but expect to resolveCurrently the Democrats want a shorter deal (like 6 weeks) for both a continuing resolution (CR) and to pay-the-bills (aka raise "debt ceiling"). The reason for a shorter deal is the Democrats are concerned about sequestration cuts in the Budget Control Act of 2011 (BCA) that will take effect in 2014.

Report: Office Vacancy Rate falling, "nowhere near the low vacancy that will result in new construction of office space"

by Calculated Risk on 10/13/2013 09:46:00 AM

From Roger Vincent at the LA Times: Southern California office rental market improves slightly

Office vacancy in Los Angeles, Orange, Riverside and San Bernardino counties was 17.5% at the end of the third quarter, Cushman & Wakefield said, down from 18.4% a year earlier. Landlords asked for average monthly rents of $2.33 per square foot, an increase of 5 cents from the same period last year.This is an important point - the vacancy rate for office buildings is slowly declining, however it is not close to the level that will lead to significant more investment (important for employment and GDP).

...

"I don't see a significant demand for additional office space and increasing rents in coming quarters," [broker David Kutzer of Newmark Grubb Knight Frank] said. "We're not turning the corner to what we consider really healthy markets, and we're nowhere near the low vacancy that will result in new construction of office space."

Note: Reis reported the national office vacancy rate (large cities) declined in Q3 to 16.9% from 17.0% in Q2. I'd post a graph comparing the office vacancy rate and private fixed investment in offices, but the data for office investment is currently not available due to the government shutdown.

Saturday, October 12, 2013

California State Controller: Revenue and Spending Tracking Budget, Warns on impact from Shutdown

by Calculated Risk on 10/12/2013 03:07:00 PM

From California State Controller: Bottom Line: What the Numbers Mean

State coffers welcomed a jump in revenues in September that offset shortfalls in the prior two months. With spending holding in line with estimates, California ended the first quarter of its fiscal year on track with estimates contained in the 2013-14 Budget Act.The 4+ year drag from the cutbacks at the state and local governments levels are mostly over. However the Federal government shutdown could start negatively impacting state budgets soon. Just as the states are starting to recover ... the House pulls the football away.

September saw total revenues move past expectations by $427 million, or 5.3%. Personal income taxes, which are California’s dominant revenue source, lurched past monthly projections by 9.5%. ... Retail sales tax receipts also beat budget estimates by close to double digits in September, as California consumers resumed shopping with the support of more jobs, higher home prices, and a rising stock market.

...

California has completed the first leg of the fiscal year with a good pace. Both revenues and state spending have stayed close within their designated lanes, almost exactly matching estimates contained in the 2013-14 Budget Act. Revenue collections could be challenged in the coming months by any negative developments related to jobs, interest rates, stock prices, and home values. Spending will be impacted by demands for education, health care, social services, and other line items. Decisions or a stalemate in Washington related to defense outlays, research funds, Medicare, and other federal programs could ripple back to California in major ways.

emphasis added

Schedule for Week of October 13th

by Calculated Risk on 10/12/2013 09:55:00 AM

Special Note: With the government shutdown, some economic data has been delayed. The last section below is a list of delayed reports so far. If the shutdown ends, some of these delayed reports might be released this week.

The key event this week will be the probable agreement on paying the bills and opening the government.

There are two housing reports that were scheduled to be released this week, housing starts on Thursday, and homebuilder confidence survey on Wednesday.

For manufacturing, September Industrial Production (DELAYED), and the NY Fed (Empire State) and Philly Fed October surveys are scheduled to be released this week. For prices, CPI (DELAYED) was scheduled to be released on Wednesday.

All US markets are open on Columbus Day holiday.

9:00 PM ET: Speech by Fed Chairman Ben Bernanke, Celebrating 20 Years of Mexican Central Bank Independence, At the Conference Sponsored by the Bank of Mexico: Central Bank Independence – Progress and Challenges, Mexico City, Mexico

8:30 AM: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of 7.0, up from 6.3 in September (above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for September. The consensus is for a 0.2% increase in CPI in September and for core CPI to increase 0.2%.

10:00 AM ET: The October NAHB homebuilder survey. The consensus is for a reading of 57, down from 58 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 374 thousand last week. This data is gathered by the states and will continue to be released.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts were at 891 thousand (SAAR) in August. Single family starts were at 628 thousand SAAR in August.

The consensus is for total housing starts to increase to 913 thousand (SAAR) in September.

9:15 AM: The Fed was scheduled to release Industrial Production and Capacity Utilization for September. From the Fed:

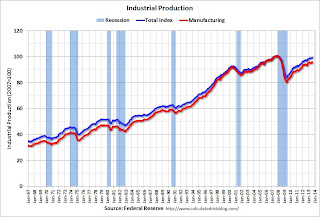

9:15 AM: The Fed was scheduled to release Industrial Production and Capacity Utilization for September. From the Fed: The industrial production indexes that are published in the G.17 Statistical Release on Industrial Production and Capacity Utilization incorporate a range of data from other government agencies, the publication of which has been delayed as a result of the federal government shutdown. Consequently, the G.17 release will not be published as scheduled on October 17, 2013. After the reopening of the federal government, the Federal Reserve will announce a publication date for the G.17 release.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.1%.

10:00 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 15.0, down from 22.3 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for September. The consensus is for a 0.6% increase in this index.

Delayed: Construction Spending for August. The consensus is for a 0.4% increase in construction spending.

Delayed: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 0.2% increase in orders.

Delayed: Employment Report for September. The consensus is for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August. The consensus is for the unemployment rate to be unchanged at 7.3% in September.

Delayed: Trade Balance report for August from the Census Bureau.

Delayed: Trade Balance report for August from the Census Bureau. Imports increased in July, and exports decreased.

The consensus is for the U.S. trade deficit to increase to $40.0 billion in August from $39.1 billion in July.

Delayed: Job Openings and Labor Turnover Survey for August from the BLS.

Delayed: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.689 million, down from 3.869 million in June. number of job openings (yellow) is up 5.4% year-over-year compared to July 2012.

Quits were up in July, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Delayed: Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.4% increase in inventories.

Delayed: Retail sales for September.

Delayed: Retail sales for September.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 28.7% from the bottom, and now 12.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be unchanged in September, and to increase 0.4% ex-autos.

Delayed: Producer Price Index for September. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

Delayed: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.2% increase in inventories.

Friday, October 11, 2013

Shutdown End Guess: Congress doesn't want to miss Recess!

by Calculated Risk on 10/11/2013 08:39:00 PM

My Guess:

Since Monday, October 14th is Columbus Day (A Federal holiday), and the week of October 14th through October 18th is a "Constituent Work Week" (aka recess), it makes sense that the agreement will be reached late Monday (the stock market is open on Monday).

Take it to the limit, and than tell the constituents how hard you worked for them.

Besides, members of Congress hate to miss recess!

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in September

by Calculated Risk on 10/11/2013 03:23:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in September.

First, on short sales from CR: Look at the first two columns in the table for Short Sales Share. Short sales are down sharply from a year ago, and will probably really decline in early 2014. It appears that the Mortgage Debt Relief Act of 2007 will not be extended again next year. Usually cancelled debt is considered income, but a provision of the 2007 Debt Relief Act allowed borrowers "to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief." (excerpt from IRS). This relief expires on Dec 31, 2013. Complete all short sales by the end of this year!

Total "Distressed" Share. In most areas that have reported distressed sales so far, the share of distressed sales is down year-over-year (Hampton Roads is an exception). Also there has been a decline in foreclosure sales in all of these cities except Springfield, Ill.

The All Cash Share is declining in some cities (Phoenix and Las Vegas), but steady in other areas. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep-13 | Sep-12 | Sep-13 | Sep-12 | Sep-13 | Sep-12 | Sep-13 | Sep-12 | |

| Las Vegas | 23.0% | 44.8% | 7.4% | 13.6% | 30.4% | 58.4% | 47.2% | 54.8% |

| Reno | 20.0% | 41.0% | 5.0% | 12.0% | 25.0% | 53.0% | ||

| Phoenix | 8.8% | 27.0% | 8.0% | 12.9% | 16.8% | 39.9% | 33.4% | 44.0% |

| Minneapolis | 6.0% | 9.9% | 15.9% | 25.0% | 21.9% | 34.9% | ||

| Mid-Atlantic MRIS | 7.7% | 12.4% | 8.2% | 9.4% | 15.9% | 21.8% | 18.4% | 18.8% |

| Hampton Roads | 26.1% | 25.4% | ||||||

| Toledo | 38.1% | 35.9% | ||||||

| Tucson | 29.8% | 29.7% | ||||||

| Des Moines | 19.2% | 19.9% | ||||||

| Omaha | 19.1% | 16.8% | ||||||

| Memphis* | 18.4% | 26.6% | ||||||

| Springfield IL | 14.2% | 13.5% | ||||||

| *share of existing home sales, based on property records | ||||||||

WSJ: Shutdown starting to Hit Private Businesses

by Calculated Risk on 10/11/2013 01:41:00 PM

From the WSJ: Prospect of Longer Federal Shutdown Worries Workers, Firms

Many workers and businesses, including thousands with no direct government funding, are now bracing for a stark reality: protracted financial pressure if the federal government remains closed for longer.Yesterday I posted some information on the impact on hotels. The shutdown is also hurting restaurants and retailers.

The prospect of an extended disruption—as House Republicans' latest proposal Thursday could allow—is starting to sink in as people across the U.S. already face lost wages and profits from the nearly two-week shutdown.

"We're just going to limp along," said Rebekah Klein , owner of Emma's Tea Room, a cafe in Huntsville, Ala., which serves many workers with jobs at the nearby Army operations and NASA's Marshall Space Flight Center and which has lost business as a result of the federal closure.

...

Nationally, economists forecast each week of a shutdown will subtract about 0.1 to 0.2 percentage point from this quarter's annualized pace of economic growth, which has been running at about 2% a year.

But communities across the U.S. are facing a more substantial impact. In Huntsville, for instance, federal employees account for almost 18% of all wages, according to an analysis of government data by Jed Kolko, chief economist at the real-estate firm Trulia.

It is time for the House to end the shutdown. They are hurting the economy.

UPDATE: Another article from the Financial Times: Shutdown starts to bite for US businesses

The evidence is anecdotal, in part because many government statistical agencies have themselves shut down, but the falling sales are real.

Costco, the warehouse retailer, said that it had seen “some effect downward” on sales around Washington ... Richard Galanti, Costco’s chief financial officer, told analysts this week that the company was “scratching our head in disbelief” over the political deadlock. One analyst replied: “We’re all getting bald doing that.”

posted with permission

Zandi Testimony: Economy Poised for Growth, Congress must Fund the Government and Pay the Bills

by Calculated Risk on 10/11/2013 10:34:00 AM

Economist Mark Zandi is providing testimony this morning to the Joint Economic Committee: Written Testimony of Mark Zandi Chief Economist and Co-Founder Moody’s Analytics

The impasse in Washington over funding the federal government and increasing the Treasury debt ceiling is significantly damaging the economy. Stock prices are grinding lower and consumer confidence is weakening. The economic harm will mount significantly each day the government remains shut and the debt ceiling is not raised. If policymakers are unable to reach agreement on these issues by the end of October, the economy will face another severe recession.And his conclusion:

To resolve the budget impasse, policymakers should not add to the significant fiscal austerity already in place, which is set to last through mid-decade. Tax increases and government spending cuts over the past three years have put a substantial drag on economic growth. In 2013, this fiscal drag is as large as it has been since the defense drawdown after World War II.

Moreover, because of fiscal austerity and the economic recovery, the federal government’s fiscal situation has improved markedly. The budget deficit in just-ended fiscal 2013 was less than half its size at the recession’s deepest point in 2009. Under current law and using reasonable economic assumptions, the deficit will continue to narrow through mid-decade, causing the debt-to-GDP ratio to stabilize.

As part of any budget deal, lawmakers should reverse the sequester. The second year of budget sequestration will likely have greater consequences than the first, affecting many government programs in ways that nearly all agree are not desirable. A sizable share of the sequestration cuts to date has involved one-off adjustments, but future cuts will have to come from lasting reductions in operational budgets.

It would of course also be desirable for lawmakers to address the nation’s long-term fiscal challenges. Although the fiscal situation should be stable through the end of this decade, the long-term outlook remains disconcerting. If Congress does not make significant changes to the entitlement programs and tax code, rising healthcare costs and an aging population will swamp the budget in the 2020s and 2030s. Both cuts in government spending and increases in tax revenues will be necessary to reasonably solve these long-term fiscal problems.

Washington’s recent budget battles have been painful to watch and harmful to the economy. Political brinkmanship creates significant uncertainty and anxiety among consumers, businesses and investors, weighing on their willingness to spend, hire and invest.A Republican advisor giving testimony to Congress, and telling Congress they are the problem. Ouch.

Despite this, the economic recovery is more than four years old, and the private economy has made enormous strides. Business balance sheets are about as strong as they have ever been, the banking system is well capitalized, and households have significantly reduced their debt loads. The private economy is on the verge of stronger growth, more jobs and lower unemployment.

The key missing ingredient is Congress’ willingness to fund the government and make sure all its bills can be paid. If policymakers can find a way to do these things in the next few days, almost regardless of how awkward the process is, the still-fragile recovery will quickly become a self-sustaining expansion.

We are close to finally breaking free from the black hole of the Great Recession. All it takes is for Washington to come together.

emphasis added

Preliminary October Consumer Sentiment decreases to 75.2

by Calculated Risk on 10/11/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for October was at 75.2, down from the September reading of 77.5.

This was close to the consensus forecast of 75.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

This decline is probably due to the government shutdown and another threat to "not pay the bills".