by Calculated Risk on 10/10/2013 07:43:00 PM

Thursday, October 10, 2013

Friday: Consumer Sentiment, DELAYED: Retail Sales, PPI

From Professor Menzie Chinn at Econbrowser: Flying Blind

The House Republicans' insistence on keeping the government closed means that it is likely that we will be conducting macroeconomic policymaking with increasingly sparse or mismeasured data. If one doesn’t believe in expertise and information, then this is not a problem. If one believes that knowledge should inform decisionmaking, it is.CR: Dr. Chinn brings up a key point - data collection for the October employment report would normally start next week. If the government is still closed, the October report might not be useful.

So far, we have missed the employment situation, the international trade, wholesale trade, and import/export prices releases. As of Friday, we will have missed the PPI, retail sales, and business inventories releases. Assuming the shutdown continues through Wednesday (Monday is a holiday), the CPI and Treasury International Capital figures will be missed.

The Longer the Shutdown Goes on, the Blinder We Will Be

It’s well known that we don’t have a read on the September figures, although the underlying statistics are sitting in computers at the BLS. What is less well known is that surveys regarding the October employment situation begin the week of October 13. If the current trajectory is for sustained closure of the Federal government, then these surveys will be delayed, so as to distort the resulting output. ...

Now, it might be that the intent behind the government closure is to hobble information gathering, so that people can make the craziest statements (I can already hear “inflation is soaring – we just don’t know it!”). But I remain hopeful that ignorance is not the objective, and that the current data blackout is merely collateral damage.

I enjoyed the comment on inflation - some people (and politicians) have been wrong on inflation for years, and right now we can't refute their absurd claims.

Thursday:

• DELAYED: Retail sales for September. The consensus is for retail sales to be unchanged in September, and to increase 0.4% ex-autos.

• DELAYED: Producer Price Index for September. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

• At 9:55 AM ET, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 75.0, down from 77.5 in September. Other sentiment indicators have shown a sharp decline.

• DELAYED: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.2% increase in inventories.

Report: No Agreement on Paying the Bills or Government Shutdown

by Calculated Risk on 10/10/2013 06:36:00 PM

From the NY Times: Obama Rejects G.O.P. Offer of Short-Term Debt Limit Plan

President Obama on Thursday rejected a proposal from politically besieged House Republican leaders to extend the nation’s borrowing authority for six weeks because it would not also reopen the government. Yet both parties saw it as the first break in Republicans’ brinkmanship and a step toward a fiscal truce.It is hard to believe anyone thinks the government doesn't have to pay-the-bills. Those members of Congress are clearly ignorant. Otherwise this sounds like slow progress ...

Twenty Republicans, led by Speaker John A. Boehner, went to the White House at Mr. Obama’s invitation after a day of fine-tuning their offer to increase the Treasury Department’s authority to borrow money to pay existing obligations through Nov. 22. In exchange, they sought the president’s commitment to negotiate a deal for long-term deficit reduction and a tax overhaul.

Mr. Boehner and his colleagues left after about an hour and a half without speaking to waiting reporters.

The Republican proposal could come to a vote as soon as Friday. But the White House and Congressional Democrats remained skeptical that House Republican leaders could pass the proposal. A large faction of Tea Party conservatives campaigned on promises never to vote to increase the nation’s debt limit, and say they do not believe the warnings — including from Republican business allies — that failing to act could provoke a default and economic chaos globally. And House Democrats vowed not to support the proposal without a companion measure to fully fund a government now shuttered for 10 days.

Arriving back at the Capitol, the House Republicans huddled in Mr. Boehner’s office for further discussion.

“We had a very useful meeting, and we expect further conversations tonight,” said Representative Eric Cantor of Virginia, the majority leader.

Freddie Mac: Fixed Mortgage Rates Little Changed

by Calculated Risk on 10/10/2013 02:16:00 PM

From Freddie Mac today: Fixed Mortgage Rates Little Changed

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates changing little for the week amid the federal debt impasse in Washington, D.C. and a light week of economic data releases. ...The high this year for 30 year rates in the Freddie Mac survey was 4.58%, and the high for 15 year rates was 3.60%.

30-year fixed-rate mortgage (FRM) averaged 4.23 percent with an average 0.7 point for the week ending October 10, 2013, up from last week when it averaged 4.22 percent. A year ago at this time, the 30-year FRM averaged 3.39 percent.

15-year FRM this week averaged 3.31 percent with an average 0.7 point, up from last week when it averaged 3.29 percent. A year ago at this time, the 15-year FRM averaged 2.70 percent.

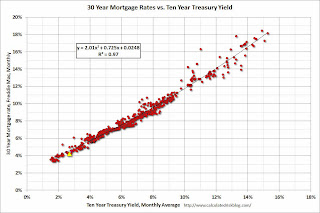

Here is an update to a graph that shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.69% and 30 year mortgage rates are at 4.23% (according to Freddie Mac). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 5% when 10-year Treasury yields are around 3.33% (not happen any time soon).

Note: The yellow marker is the current (last week) relationship.

Report: Hotel Occupancy Rate declines due to Government Shutdown

by Calculated Risk on 10/10/2013 11:07:00 AM

From HotelNewsNow.com: STR: US results for week ending 5 October

In year-over-year measurements, the industry’s occupancy declined 1.2% to 64.7%; ADR edged up 1.4% to $111.67; and RevPAR increased 0.1% to $72.29.The 4-week average of the occupancy rate is close to normal levels.

The relatively flat performances across the board can be attributed to the partial shutdown of the U.S. government on 1 October, said Brad Garner, senior VP for STR. ...

Washington D.C. and Norfolk-Virginia Beach, Virginia, were among the markets most affected during the week. Garner said each market experienced a progressive decline in occupancy during the week. Washington ended the week with a 12.1 percent decline in occupancy, a flat ADR and a 12.1-percent drop in RevPAR. The Norfolk-Virginia Beach market finished the week with a 9.9-percent fall in occupancy, a 2.4-percent decrease in ADR and a 12.1-percent decline in RevPAR.

“Several variables factor into the performance for the week, and overall there were challenges for a number of markets,” Garner said. “Long-term effects of the shutdown remain to be seen, but in the early going it clearly had an impact on the overall hotel industry.”

emphasis added

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Through October 5th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking just above the pre-recession levels. The 4-week average of the occupancy rate would usually increase seasonally over the next several weeks, before declining during the holidays.

This has been a decent year for the hotel industry before the shutdown. Now the occupancy rate is down year-over-year, and this decline will also show up in airlines, rental cars, restaurants and more. Just as the hotel industry is almost back on solid footing, Congress pulls the football away again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims increase sharply

by Calculated Risk on 10/10/2013 08:30:00 AM

The DOL reports:

In the week ending October 5, the advance figure for seasonally adjusted initial claims was 374,000, an increase of 66,000 from the previous week's unrevised figure of 308,000. The 4-week moving average was 325,000, an increase of 20,000 from the previous week's unrevised average of 305,000.The previous week was unrevised at 308,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 325,000.

Some of this sharp increase is related to the government shutdown.

Note: This information is collected by the states and will continue to be released.

Wednesday, October 09, 2013

Thursday: Unemployment Claims

by Calculated Risk on 10/09/2013 09:02:00 PM

Maybe the message will get through - from the NY Times: Business Groups Urge Congress to Reopen as Shutdown Drags On

House Republicans, facing the ninth day of a government shutdown, appeared increasingly isolated on Wednesday from even their strongest backers, with business groups demanding the immediate reopening of the government and benefactors such as Koch Industries publicly distancing themselves from the shutdown fight.From Gallup: Republican Party Favorability Sinks to Record Low

...

On Wednesday, the National Retail Federation joined other business groups like the U.S. Chamber of Commerce and the National Association of Manufacturers in asking House Republicans to relent.

[T]he Republican Party is now viewed favorably by 28% of Americans, down from 38% in September. This is the lowest favorable rating measured for either party since Gallup began asking this question in 1992.Thursday:

..

More than six in 10 Americans (62%) now view the GOP unfavorably, a record high.

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 308 thousand last week. This data is gathered by the states and will continue to be released

Lawler: Declining all-cash share in Vegas and Phoenix suggests slowdown in investor buying

by Calculated Risk on 10/09/2013 05:34:00 PM

From housing economist Tom Lawler:

The declining all-cash share in Vegas and (more dramatically) in Phoenix suggests slowdown in investor buying. [Here is some data]

The Arizona Regional MLS reported that residential home sales by realtors in the Greater Phoenix, Arizona area totaled 6,314 in September, down 2.5% from last September’s pace. Lender-owned properties were 8.0% of last month’s sales, down from 12.9% last September, while last month’s short-sales share was 8.8%, down from 27.0% a year ago. All-cash transactions were 33.4% last month, down from 43.9% last September. Active listings in September totaled 23,384, up 9.4% from August and up 7.3% from a year ago. The median home sales price last month was $185,000, up 23.3% from last September. Contracts signed last month were down 17.0% from a year ago.

The Greater Las Vegas Association of Realtors reported that residential home sales by realtors in the Greater Las Vegas, Nevada area totaled 3,259 in September, down 1.2% from last September’s pace. All-cash transactions were 47.2% of last month’s sales, down from 54.8% last August. Active listings in September totaled 18,253, up 1.4% from August but down 11.3% from a year ago. The median SF home sales price last month was $180,000, up 28.6% from last September.

emphasis added

CR Note: We've been seeing some decline in the "all cash share" for the last few months, and this decline looks significant. Of course not all "all cash" buyers are investors, but it is probably reasonable to use this for the trend in investor buying. I expect Tom to provide me with a table of selected cities in September (here is the data for August). This data is suggesting a slowdown in investor buying in many areas.

FOMC Minutes: "Considerable risks surrounding fiscal policy"

by Calculated Risk on 10/09/2013 02:00:00 PM

There was a significant debate on asset purchases at the last FOMC meeting. Those who didn't want to reduce asset purchases expressed several reasons including "Considerable risks surrounding fiscal policy" (no kidding!).

Even those who wanted to reduce asset purchases "indicated that they favored a relatively small reduction to signal the Committee's intention to proceed cautiously".

From the Fed: Minutes of the Federal Open Market Committee, September 17-18, 2013 . A few excerpts on asset purchases:

In their discussion of the path for monetary policy, participants debated the advantages and disadvantages of reducing the pace of the Committee's asset purchases at this meeting, focusing importantly on whether the conditions presented to the public in June for reducing the pace of asset purchases had yet been met. In general, those who preferred to maintain for now the pace of purchases viewed incoming data as having been on the disappointing side and, despite clear improvements in labor market conditions since the purchase program's inception in September 2012, were not yet adequately confident of continued progress. Many of these participants had revised down their forecasts for economic activity or pointed to near-term risks and uncertainties. For example, questions were raised about the effects on the housing sector and on the broader economy of the tightening in financial conditions in recent months, as well as about the considerable risks surrounding fiscal policy. Moreover, the announcement of a reduction in asset purchases at this meeting might trigger an additional, unwarranted tightening of financial conditions, perhaps because markets would read such an announcement as signaling the Committee's willingness, notwithstanding mixed recent data, to take an initial step toward exit from its highly accommodative policy. As a result of such concerns, a number of participants thought that risk-management considerations called for a cautious approach and that, in light of the ambiguous cast of recent readings on the economy, it would be prudent to await further evidence of progress before reducing the pace of asset purchases. Consistent with the framework discussed by the Chairman during the June press conference, asset purchases were contingent on the Committee's ongoing assessment of the economic outlook and were not on a preset course; this approach implied a need to adapt and to adjust asset purchases in response to changes in economic conditions in order to preserve the Committee's credibility. With many outside observers expecting a decision to reduce purchases at this meeting, some participants emphasized a need to clearly communicate the rationale behind any decision not to do so, in order to avoid conveying a message of pessimism regarding the economic outlook or to reinforce the distinction between decisions concerning the pace of purchases and those concerning the federal funds rate. One participant suggested that postponing the reduction in the pace of asset purchases would also allow time for the Committee to further discuss and to implement a clarification or strengthening of its forward guidance for the federal funds rate, which could temper the risk that a future downward adjustment in asset purchases would cause an undesirable tightening of financial conditions.

The participants who spoke in favor of moderating the pace of securities purchases at this meeting also cited the incoming data, but viewed those data as broadly consistent with the Committee's outlook for the labor market at the time of the June FOMC meeting when the contingent expectation that the pace of asset purchases would be reduced later in the year was first presented to the public. Moreover, they highlighted what they saw as meaningful cumulative progress in labor market conditions since the purchase program began. Those participants generally were satisfied that investors had come to understand the data-dependent nature of the Committee's thinking about asset purchases, and, because they judged that the conditions laid out in June had been met, they believed that the credibility of the Committee would best be served by announcing a downward adjustment in asset purchases at this meeting. With the markets apparently viewing a cut in purchases as the most likely outcome, it was noted that the postponement of such an announcement to later in the year or beyond could have significant implications for the effectiveness of Committee communications. In particular, concerns were expressed that a delay could potentially undermine the credibility or predictability of monetary policy by, for example, increasing uncertainty about the Committee's reaction function and about its commitment to the forward guidance for the federal funds rate, with the result of an increase in volatility in financial markets. Moreover, maintaining the pace of purchases could be perceived as a sign that the FOMC had turned more pessimistic about the economic outlook. Finally, it was noted that if the Committee did not pare back its purchases in these circumstances, it might be difficult to explain a cut in coming months, absent clearly stronger data on the economy and a swift resolution of federal fiscal uncertainties. Most of the participants leaning toward a downward adjustment in the pace of asset purchases also indicated that they favored a relatively small reduction to signal the Committee's intention to proceed cautiously.

With regard to adjustments in the pace of asset purchases, whether at this or a future meeting, a few participants expressed a preference for not cutting MBS purchases but reducing purchases only of Treasury securities initially, with the intent of continuing to support the recovery in the housing sector. However, the appeal of including both types of securities in any reduction was also mentioned. In addition, in an effort to reduce uncertainty about how the Committee might adjust its purchases in response to economic developments and to alleviate some of the related communications issues, one participant suggested an approach that would mechanically link the reduction in asset purchases to numerical values for the unemployment rate, with the goal of ending the program when the unemployment rate reached a stated level.

emphasis added

Comment: Politics, Policy, Deadbeats and Default

by Calculated Risk on 10/09/2013 10:13:00 AM

A quick comment: Politics baffles me. I know the prime directive is for politicians is to get reelected, but they do and say the damnedest things.

However if we just focus on policy, the situation is easier to analyze.

First, on the deficit. In 2000 the U.S. had a unified surplus of 2.4% of GDP. Then through a series of bad policy choices (all of which I opposed), the Federal government incurred a large structural deficit - and then with the housing bubble and bust - piled a large cyclical deficit on top of the structural deficit. In the fiscal year starting in October 2008 (Bush's last budget), the U.S. deficit had reached 10.1% of GDP.

From a 2.4% surplus to a 10.1% deficit in a few years. Ouch!!!

Since then, the deficit has declined from 10.1% to 4.0% of GDP in fiscal 2013. Congratulations! If anything, the deficit has declined too quickly (slowing economic growth).

Based on current policy, the deficit should continue to fall over the next couple of years, and remain in the 2% range for several years. Then the deficit will slowly start to increase primarily due to healthcare costs.

This suggests we don't need any more fiscal tightening right now or for the next couple of years. However we need a longer term plan to primarily address rising healthcare costs.

Shutting down the government just adds to short term costs (pushing up the short term deficit). Dumb.

Smart policy would be to eliminate the so-called "debt ceiling" (really just about paying bills already occurred), and pass the Continuing Resolution (CR) that was negotiated between both parties (and agreed to by both parties except the House added an absurd policy rider).

In addition, smart policy would be to think of ways to address the long term issues. This isn't pressing, and damaging the economy now is not the answer. Perhaps another super-committee with long term consequences if the committee fails (not more short term cuts like the sequester). The consequences should be distasteful to both parties - and both cut spending and raise revenue in the long term so there is some motivation for the committee to reach agreement.

And on deadbeats and defaults: There are certain politicians who think it is OK to not pay the bills as long as the U.S. makes interest and principal payments on the debt. This is crazy talk. There is a name for people who don't pay their bills: deadbeats. If politicians don't pay their personal bills, they are deadbeats. But if they stop the government from paying the bills, we are all deadbeats. And there will be serious economic consequences for not paying the bills on time. The consequences will build over time, but by November not "paying the bills" will ripple through the entire economy.

How does that reduce the deficit (the goal)? It doesn't.

It is time to end the shutdown and agree to pay-the-bills.

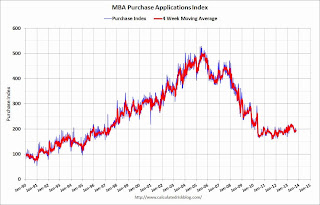

MBA: Mortgage Applications Increase in Latest Weekly Survey, Mortgage Rates Lowest since mid-June

by Calculated Risk on 10/09/2013 07:01:00 AM

From the MBA: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 4, 2013. ...

The Refinance Index increased 3 percent from the previous week and is at its highest level since the week ending August 9, 2013. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ... For the second consecutive week, the unadjusted Purchase Index was lower compared to the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.42 percent, the lowest rate since mid-June, from 4.49 percent, with points increasing to 0.44 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up over the last four weeks as rates have declined.

However the index is still down 61% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is only up slightly from a year ago.