by Calculated Risk on 9/17/2013 12:14:00 PM

Tuesday, September 17, 2013

Key Measures Show Low Inflation in August

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for August here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.1% annualized rate) in August. The CPI less food and energy increased 0.1% (1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, the CPI rose 1.5%, and the CPI less food and energy rose 1.8%. Core PCE is for July and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.5% annualized, and core CPI increased 1.5% annualized. Also core PCE for July increased 0.9% annualized.

These measures indicate inflation is below the Fed's target.

NAHB: Builder Confidence unchanged in September at 58

by Calculated Risk on 9/17/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged in September at 58. Any number above 50 indicates that more builders view sales conditions as good than poor. (August was revised down from 59 to 58).

From the NAHB: Builder Confidence Unchanged in September

Following four consecutive months of improvement, builder confidence in the market for newly built, single-family homes held unchanged in September with a reading of 58 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Following a solid run up in builder confidence over the past year, we are seeing a pause in the momentum as consumers wait to see where interest rates settle and as the headwinds of tight credit, shrinking supplies of lots for development and increasing labor costs continue,” noted NAHB Chief Economist David Crowe.

...

HMI component indexes were mixed in September. While the component gauging current sales conditions held unchanged at 62, the component gauging sales expectations in the next six months declined three points to 65 and the component gauging traffic of prospective buyers increased one point, to 47.

All four regions posted gains in their three-month moving average HMI scores in September, including a two-point gain to 41 in the Northeast, a four-point gain to 64 in the Midwest, a two-point gain to 56 in the South and a four-point gain to 61 in the West, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the September release for the HMI and the July data for starts (August housing starts will be released tomorrow). This was just below the consensus estimate of a reading of 59.

CPI increases 0.1% in August, Core CPI 0.1%

by Calculated Risk on 9/17/2013 08:30:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - June 2013

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment.On a year-over-year basis, CPI is up 1.5 percent, and core CPI is up also up 1.8 percent. Both are below the Fed's target. This was close to the consensus forecast of a 0.2% increase for CPI, and a 0.1% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in August after increasing 0.2 percent in each of the three previous months. ... The index for all items less food and energy increased 1.8 percent for the 12 months ending August.

emphasis added

Note: CPI-W (used for cost of living adjustment, COLA) is also up 1.5% year-over-year in August. The COLA is calculated using the average Q3 data (July, August, and September).

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.5 percent over the last 12 months to an index level of 230.359 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Monday, September 16, 2013

Tuesday: CPI, Homebuilder Confidence

by Calculated Risk on 9/16/2013 10:50:00 PM

From the NY Times: Push for Yellen To Lead at Fed Gathers Steam

Janet L. Yellen told friends in recent weeks that she did not expect to be nominated as the next chairman of the Federal Reserve. Although she had been the Fed’s vice chairman since 2010 and would make history as the first woman to hold the job, President Obama’s aides made clear throughout the summer that he wanted Lawrence H. Summers, his former chief economic adviser.I expect Yellen to be nominated for Fed Chair, probably next week.

... the president’s advisers insisted throughout the summer that Mr. Obama was not averse to Ms. Yellen but simply more comfortable with Mr. Summers, a former Treasury secretary to President Bill Clinton who was Mr. Obama’s chief White House economic adviser through the height of the financial crisis and recession in 2009 and 2010. ...

Tuesday:

• 8:30 AM ET, the Consumer Price Index for August will be released. The consensus is for a 0.1% increase in CPI in August and for core CPI to increase 0.2%.

• At 10:00 AM, The September NAHB homebuilder survey. The consensus is for a reading of 59, the same as in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekly Update: Existing Home Inventory is up 21.1% year-to-date on Sept 16th

by Calculated Risk on 9/16/2013 06:55:00 PM

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for July). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.1%. There might be some further increases over the next few weeks, but then inventory should start declining seasonally.

It is important to remember that inventory is still very low, and is down 3.6% from the same week last year according to Housing Tracker.

The second graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2012 and 2013.

Inventory in 2013 is still 3.6% below the same week in 2012, but the inventory level is getting close to last year.

Inventory in 2013 is still 3.6% below the same week in 2012, but the inventory level is getting close to last year.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory should slow house price increases.

Lawler: Early Look at Existing Home Sales in August

by Calculated Risk on 9/16/2013 04:58:00 PM

From housing economist Tom Lawler:

Based on publicly-released reports from various regional realtor associations/MLS, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.35 million in August, down 0.7% from July’s pace. Folks who track local realtor reports but just focus on YOY trends might find this estimate surprisingly high, as the raw data suggest a sizable slowdown in YOY home sales growth in August compared to July (about 9 1/2% for August, compared to 20.7% for July). However, one must recall that (1) last August seasonally adjusted existing home sales were 5.2% higher than last July’s pace; and (2) there was one fewer business day this August compared to last August, while this July had one more business day than last July.

While not enough local realtors/MLS report new pending home sales to the public for me to derive an accurate estimate for national pending sales, many (though not all) that do reported significant (and larger than seasonal) declines in pending sales last month. My “gut” based on the data I’ve seen is that the NAR’s pending home sales index in August will be down about 5% from July.

On the inventory front, based on data from listings trackers and, local realtor association/MLS reports I estimate that the NAR’s estimate of the number of existing homes for sale at the end of August will be 2.31 million, up 1.5% from July and down 3.75% from last August.

CR Note: The NAR is scheduled to report August existing home sales on Thursday, Sept 19th. The consensus is for sales of 5.25 million on seasonally adjusted annual rate (SAAR) basis.

Based on Tom's estimates of a 5.35 million sales rate, and inventory at around 2.31 million for August, months-of-supply will be around 5.2 (up from 5.1 months in July). This would still be a very low level of inventory - probably the lowest for August since 2003 or so - also a 3.8% year-over-year decline in inventory would be the smallest year-over-year decline since March 2011. Note: In July inventory was down 5.0% compared to July 2012. These smaller year-over-year declines suggest inventory bottomed earlier this year.

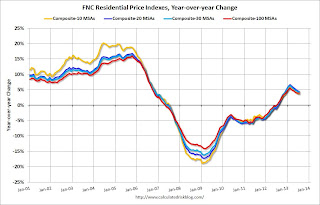

FNC: House prices increased 3.9% year-over-year in July

by Calculated Risk on 9/16/2013 11:47:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Continue to Rise, Up 0.7% in July

The latest FNC Residential Price Index™ (RPI) shows that U.S. home prices continue to climb higher, rising 0.7% in July. The index is reaching a three-year high as the housing recovery continues. The rapid declines in foreclosure sales and new foreclosure filings have diminished the impact of distressed properties on home prices. ...As of July, foreclosure sales nationwide are approaching the pre-crisis levels. Foreclosure sales accounted for 12.2% of total home sales, down from 17.3% a year ago.The 100-MSA composite was up 3.9% compared to July 2012 (about the same YoY change as in June). The FNC index turned positive on a year-over-year basis in July, 2012.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that July home prices increased from the previous month at a seasonally unadjusted rate of 0.7%. On a year-over-year basis, home prices were up a modest 3.9% from a year ago. The two narrower indices exhibit similar month-over-month and year-over-year trends.

...

FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes. As a gauge of underlying home values, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts, reflecting poor property conditions.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 27.3% from the peak.

I expect all of the housing price indexes to start showing lower year-over-year price gains as price increases slow.

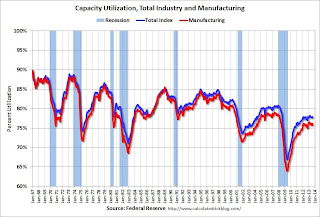

Fed: Industrial Production increased 0.4% in August

by Calculated Risk on 9/16/2013 09:40:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production advanced 0.4 percent in August after having been unchanged in July; the gains in August were broadly based. Following a decrease in July of 0.4 percent, which was steeper than previously reported, manufacturing production rose 0.7 percent in August. The output of mines moved up 0.3 percent, its fifth consecutive monthly increase, and the production of utilities fell 1.5 percent, its fifth consecutive monthly decrease. At 99.4 percent of its 2007 average, total industrial production in August was 2.7 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in August to 77.8 percent, a rate 0.6 percentage point above its level of a year earlier and 2.4 percentage points below its long-run (1972-2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.4 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

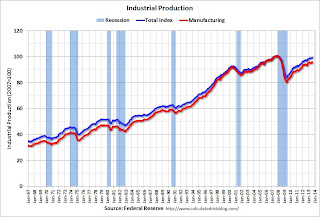

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.4% in August to 99.4. This is 18.3% above the recession low, but still 1.5% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.5% increase in Industrial Production in August, and for Capacity Utilization to increase to 77.9%.

NY Fed: Empire State Manufacturing Activity expands at slower pace in September

by Calculated Risk on 9/16/2013 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

The September 2013 Empire State Manufacturing Survey suggests that conditions for New York manufacturers improved modestly for the fourth straight month. The general business conditions index edged down two points but, at 6.3, remained in positive territory. The new orders index inched up two points to 2.4 ...This is the first of the regional surveys for September. The general business conditions index was below the consensus forecast of a reading of 9.0, but shows continued modest expansion.

Labor market conditions were mostly steady; the index for number of employees retreated three points to 7.5 and the average workweek index edged down to a neutral reading of 1.1. Indexes for the six-month outlook revealed increasingly widespread optimism about future business activity. The future general business conditions index rose for the third straight month, climbing three points to 40.6, its highest level since the spring of 2012.

emphasis added

Sunday, September 15, 2013

Monday: Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 9/15/2013 08:41:00 PM

From the WSJ: Summers Withdraws Name for Fed Chairmanship

One leading candidate is Janet Yellen, the Fed's current vice chairwoman, who has garnered substantial support among Democrats in Congress and among economists. But the public lobbying on her behalf appears to have annoyed the president, say administration insiders, and may lead him to look elsewhere.There is no way President Obama is that small of a person. Janet Yellen played no role in the lobbying on her behalf; it was spontaneous and widespread because she is an excellent choice. She was the leading candidate long before any other candidate was ever mentioned.

From Ezra Klein at the WaPo: Five reasons Obama should name Janet Yellen to chair the Federal Reserve

[T]he line from the White House has never been that Yellen is bad choice. In fact, they've been at pains to say she's absolutely terrific — an incredible candidate who they'd be thrilled to name ... Yellen ... is a consensus pick. She's Wall Street's favorite. She the monetary policy world's favorite. She's favored by congressional Democrats and organized labor. So far as anybody knows, she has nearly no enemies — at least outside the White House. It's rare that in a race that's been so angrily contested, either candidate can actually be a consensus pick. But because this race more or less pitted the White House's preference for Summers against the rest of the world's preference for Yellen, the Obama administration can end this with a pick most everyone is happy with.Monday:

• 8:30 AM ET, the NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 9.0, up from 8.2 in August (above zero is expansion).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

Weekend:

• Schedule for Week of Sept 15th

• FOMC Projections Preview: Some Modest Tapering is Possible

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 19 and DOW futures are up 189 (fair value).

Oil prices have declined slightly with WTI futures at $107.30 per barrel and Brent at $110.68 per barrel. Below is a graph from Gasbuddy.com for nationwide gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |