by Calculated Risk on 9/16/2013 10:50:00 PM

Monday, September 16, 2013

Tuesday: CPI, Homebuilder Confidence

From the NY Times: Push for Yellen To Lead at Fed Gathers Steam

Janet L. Yellen told friends in recent weeks that she did not expect to be nominated as the next chairman of the Federal Reserve. Although she had been the Fed’s vice chairman since 2010 and would make history as the first woman to hold the job, President Obama’s aides made clear throughout the summer that he wanted Lawrence H. Summers, his former chief economic adviser.I expect Yellen to be nominated for Fed Chair, probably next week.

... the president’s advisers insisted throughout the summer that Mr. Obama was not averse to Ms. Yellen but simply more comfortable with Mr. Summers, a former Treasury secretary to President Bill Clinton who was Mr. Obama’s chief White House economic adviser through the height of the financial crisis and recession in 2009 and 2010. ...

Tuesday:

• 8:30 AM ET, the Consumer Price Index for August will be released. The consensus is for a 0.1% increase in CPI in August and for core CPI to increase 0.2%.

• At 10:00 AM, The September NAHB homebuilder survey. The consensus is for a reading of 59, the same as in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekly Update: Existing Home Inventory is up 21.1% year-to-date on Sept 16th

by Calculated Risk on 9/16/2013 06:55:00 PM

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for July). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.1%. There might be some further increases over the next few weeks, but then inventory should start declining seasonally.

It is important to remember that inventory is still very low, and is down 3.6% from the same week last year according to Housing Tracker.

The second graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2012 and 2013.

Inventory in 2013 is still 3.6% below the same week in 2012, but the inventory level is getting close to last year.

Inventory in 2013 is still 3.6% below the same week in 2012, but the inventory level is getting close to last year.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory should slow house price increases.

Lawler: Early Look at Existing Home Sales in August

by Calculated Risk on 9/16/2013 04:58:00 PM

From housing economist Tom Lawler:

Based on publicly-released reports from various regional realtor associations/MLS, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.35 million in August, down 0.7% from July’s pace. Folks who track local realtor reports but just focus on YOY trends might find this estimate surprisingly high, as the raw data suggest a sizable slowdown in YOY home sales growth in August compared to July (about 9 1/2% for August, compared to 20.7% for July). However, one must recall that (1) last August seasonally adjusted existing home sales were 5.2% higher than last July’s pace; and (2) there was one fewer business day this August compared to last August, while this July had one more business day than last July.

While not enough local realtors/MLS report new pending home sales to the public for me to derive an accurate estimate for national pending sales, many (though not all) that do reported significant (and larger than seasonal) declines in pending sales last month. My “gut” based on the data I’ve seen is that the NAR’s pending home sales index in August will be down about 5% from July.

On the inventory front, based on data from listings trackers and, local realtor association/MLS reports I estimate that the NAR’s estimate of the number of existing homes for sale at the end of August will be 2.31 million, up 1.5% from July and down 3.75% from last August.

CR Note: The NAR is scheduled to report August existing home sales on Thursday, Sept 19th. The consensus is for sales of 5.25 million on seasonally adjusted annual rate (SAAR) basis.

Based on Tom's estimates of a 5.35 million sales rate, and inventory at around 2.31 million for August, months-of-supply will be around 5.2 (up from 5.1 months in July). This would still be a very low level of inventory - probably the lowest for August since 2003 or so - also a 3.8% year-over-year decline in inventory would be the smallest year-over-year decline since March 2011. Note: In July inventory was down 5.0% compared to July 2012. These smaller year-over-year declines suggest inventory bottomed earlier this year.

FNC: House prices increased 3.9% year-over-year in July

by Calculated Risk on 9/16/2013 11:47:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Continue to Rise, Up 0.7% in July

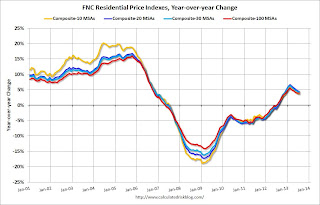

The latest FNC Residential Price Index™ (RPI) shows that U.S. home prices continue to climb higher, rising 0.7% in July. The index is reaching a three-year high as the housing recovery continues. The rapid declines in foreclosure sales and new foreclosure filings have diminished the impact of distressed properties on home prices. ...As of July, foreclosure sales nationwide are approaching the pre-crisis levels. Foreclosure sales accounted for 12.2% of total home sales, down from 17.3% a year ago.The 100-MSA composite was up 3.9% compared to July 2012 (about the same YoY change as in June). The FNC index turned positive on a year-over-year basis in July, 2012.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that July home prices increased from the previous month at a seasonally unadjusted rate of 0.7%. On a year-over-year basis, home prices were up a modest 3.9% from a year ago. The two narrower indices exhibit similar month-over-month and year-over-year trends.

...

FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes. As a gauge of underlying home values, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts, reflecting poor property conditions.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 27.3% from the peak.

I expect all of the housing price indexes to start showing lower year-over-year price gains as price increases slow.

Fed: Industrial Production increased 0.4% in August

by Calculated Risk on 9/16/2013 09:40:00 AM

From the Fed: Industrial production and Capacity Utilization

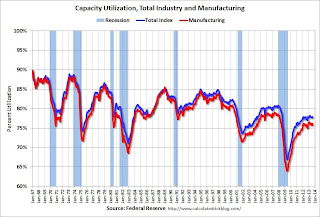

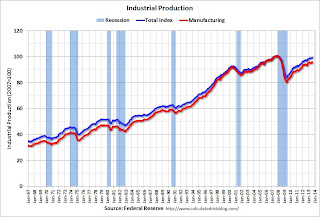

Industrial production advanced 0.4 percent in August after having been unchanged in July; the gains in August were broadly based. Following a decrease in July of 0.4 percent, which was steeper than previously reported, manufacturing production rose 0.7 percent in August. The output of mines moved up 0.3 percent, its fifth consecutive monthly increase, and the production of utilities fell 1.5 percent, its fifth consecutive monthly decrease. At 99.4 percent of its 2007 average, total industrial production in August was 2.7 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in August to 77.8 percent, a rate 0.6 percentage point above its level of a year earlier and 2.4 percentage points below its long-run (1972-2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.4 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.4% in August to 99.4. This is 18.3% above the recession low, but still 1.5% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.5% increase in Industrial Production in August, and for Capacity Utilization to increase to 77.9%.

NY Fed: Empire State Manufacturing Activity expands at slower pace in September

by Calculated Risk on 9/16/2013 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

The September 2013 Empire State Manufacturing Survey suggests that conditions for New York manufacturers improved modestly for the fourth straight month. The general business conditions index edged down two points but, at 6.3, remained in positive territory. The new orders index inched up two points to 2.4 ...This is the first of the regional surveys for September. The general business conditions index was below the consensus forecast of a reading of 9.0, but shows continued modest expansion.

Labor market conditions were mostly steady; the index for number of employees retreated three points to 7.5 and the average workweek index edged down to a neutral reading of 1.1. Indexes for the six-month outlook revealed increasingly widespread optimism about future business activity. The future general business conditions index rose for the third straight month, climbing three points to 40.6, its highest level since the spring of 2012.

emphasis added

Sunday, September 15, 2013

Monday: Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 9/15/2013 08:41:00 PM

From the WSJ: Summers Withdraws Name for Fed Chairmanship

One leading candidate is Janet Yellen, the Fed's current vice chairwoman, who has garnered substantial support among Democrats in Congress and among economists. But the public lobbying on her behalf appears to have annoyed the president, say administration insiders, and may lead him to look elsewhere.There is no way President Obama is that small of a person. Janet Yellen played no role in the lobbying on her behalf; it was spontaneous and widespread because she is an excellent choice. She was the leading candidate long before any other candidate was ever mentioned.

From Ezra Klein at the WaPo: Five reasons Obama should name Janet Yellen to chair the Federal Reserve

[T]he line from the White House has never been that Yellen is bad choice. In fact, they've been at pains to say she's absolutely terrific — an incredible candidate who they'd be thrilled to name ... Yellen ... is a consensus pick. She's Wall Street's favorite. She the monetary policy world's favorite. She's favored by congressional Democrats and organized labor. So far as anybody knows, she has nearly no enemies — at least outside the White House. It's rare that in a race that's been so angrily contested, either candidate can actually be a consensus pick. But because this race more or less pitted the White House's preference for Summers against the rest of the world's preference for Yellen, the Obama administration can end this with a pick most everyone is happy with.Monday:

• 8:30 AM ET, the NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 9.0, up from 8.2 in August (above zero is expansion).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

Weekend:

• Schedule for Week of Sept 15th

• FOMC Projections Preview: Some Modest Tapering is Possible

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 19 and DOW futures are up 189 (fair value).

Oil prices have declined slightly with WTI futures at $107.30 per barrel and Brent at $110.68 per barrel. Below is a graph from Gasbuddy.com for nationwide gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Projections Preview: Some Modest Tapering is Possible

by Calculated Risk on 9/15/2013 02:01:00 PM

The FOMC meets on Tuesday and Wednesday of this week. It seems some modest "tapering" of monthly asset purchases is possible, although not certain. Perhaps the Fed will reduce their purchases to $75 billion per month from $85 billion per month. If purchases are reduced, it seems likely that the Fed will continue to purchase agency mortgage-backed securities at the current rate ($40 billion per month), but reduce their purchases of longer-term Treasury securities from $45 billion to $35 billion per month.

In June, most FOMC participants (14 out of 19) judged that the first increase in the federal funds rate would occur in 2015. Three participants judged 2014 would be appropriate, and only one in 2016. It is possible that more participants will move out a little (maybe a few more will think 2016 is appropriate, or fewer think 2014).

In the press conference on Wednesday, I expect Fed Chairman Ben Bernanke will probably make it clear that the Fed will not raise rates for a "considerable" time after the end of QE, and it seems likely he will express concern about the low level of inflation.

On the projections, it looks like GDP will be downgraded again, and the projections for the unemployment rate might be reduced slightly.

Note: March 2012 projections included to show the trend (TBA: To be announced). The projections this month will be the first for 2016.

GDP increased at a 1.8% annual rate in the first half of 2013. GDP would have to increase at a 2.8% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.3% rate to reach the higher projection.

Early forecasts for Q3 are that GDP will increase at around a 1.5% annual rate, so I expect a decrease in the GDP projections for 2013 at this meeting. We might see the projections revised down from the 2.3% to 2.6% range in June to 1.8% to 2.2% or so.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 | |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 | |

The unemployment rate was at 7.3% in August and the Q4 projections might be revised down a little. This really depends on if participants think the employment participation rate will continue to decline - or if it will bounce back a little.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 | |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 | |

Projections for inflation will probably be unchanged. Currently inflation is tracking close to the June projections (as is core inflation). The current concern is that the inflation projection is below the Fed's target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 | |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 | |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 | |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 | |

Conclusion: I expect another downgrade to the GDP projections and possibly some reduction in asset purchases (but not certain). It does seem odd that the FOMC would start reducing asset purchases while downgrading GDP, and also expressing concern about the downside risks from fiscal policy. With the unemployment rate too high, and inflation too low, there is a strong argument to wait a few more months before starting to taper asset purchases.

Goldman and Merrill economists on "Tapering"

by Calculated Risk on 9/15/2013 09:40:00 AM

From economists Jan Hatzius and Sven Jari Stehn of Goldman Sachs:

• Fed officials will review three key pieces of information next week: (1) economic activity and labor market indicators that have been modestly encouraging, (2) a stabilization in core inflation at levels well below the 2% target, and (3) a tightening of financial conditions since the last meeting, mainly because of higher long-term interest rates.From the Merrill Lynch economic team:

• We believe the news is consistent with a shift in the mix of monetary policy instruments away from asset purchases and toward forward guidance. ...

• Regarding the asset purchase program, we expect a tapering of $10bn, all in Treasuries, as well as confirmation from Chairman Bernanke that the committee still expects to end QE3 in mid-2014.

• Regarding the forward guidance, we expect a clarification that the 6.5% unemployment threshold is conditional on a return of inflation

emphasis added

We expect the Fed to delay tapering at its September 17-18 meeting, but a “token taper” of $10 bn is also quite possible. More important, we expect a market-friendly message from the Fed, underscoring a slow, data-dependent exit.

Saturday, September 14, 2013

Sacramento: Conventional Sales up Sharply Year-over-year in August, Active Inventory increases 47% year-over-year

by Calculated Risk on 9/14/2013 09:07:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In August 2013, 19.0% of all resales (single family homes) were distressed sales. This was down from 23.1% last month, and down from 52.0% in August 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs was at 4.6% (the lowest since the data was tracked), and the percentage of short sales decreased to 14.4%. (the lowest percentage for short sales since Sacramento started tracking short sales in June 2009).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 46.8% year-over-year in July. This is the fourth consecutive month with a year-over-year increase in inventory - clearly inventory has bottomed in Sacramento.

Cash buyers accounted for 25.4% of all sales, down from 25.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 12% from August 2012, but conventional sales were up 48% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales.

If this data is a hint at what will happen in other areas, we can expect: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales. 3) Less investor buying, 4) more inventory, and 5) slower price increases.