by Calculated Risk on 9/16/2013 11:47:00 AM

Monday, September 16, 2013

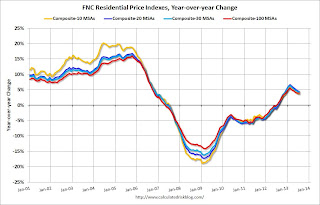

FNC: House prices increased 3.9% year-over-year in July

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Continue to Rise, Up 0.7% in July

The latest FNC Residential Price Index™ (RPI) shows that U.S. home prices continue to climb higher, rising 0.7% in July. The index is reaching a three-year high as the housing recovery continues. The rapid declines in foreclosure sales and new foreclosure filings have diminished the impact of distressed properties on home prices. ...As of July, foreclosure sales nationwide are approaching the pre-crisis levels. Foreclosure sales accounted for 12.2% of total home sales, down from 17.3% a year ago.The 100-MSA composite was up 3.9% compared to July 2012 (about the same YoY change as in June). The FNC index turned positive on a year-over-year basis in July, 2012.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that July home prices increased from the previous month at a seasonally unadjusted rate of 0.7%. On a year-over-year basis, home prices were up a modest 3.9% from a year ago. The two narrower indices exhibit similar month-over-month and year-over-year trends.

...

FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes. As a gauge of underlying home values, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts, reflecting poor property conditions.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 27.3% from the peak.

I expect all of the housing price indexes to start showing lower year-over-year price gains as price increases slow.

Fed: Industrial Production increased 0.4% in August

by Calculated Risk on 9/16/2013 09:40:00 AM

From the Fed: Industrial production and Capacity Utilization

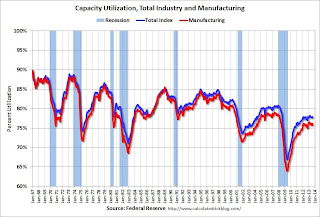

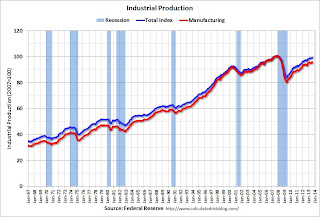

Industrial production advanced 0.4 percent in August after having been unchanged in July; the gains in August were broadly based. Following a decrease in July of 0.4 percent, which was steeper than previously reported, manufacturing production rose 0.7 percent in August. The output of mines moved up 0.3 percent, its fifth consecutive monthly increase, and the production of utilities fell 1.5 percent, its fifth consecutive monthly decrease. At 99.4 percent of its 2007 average, total industrial production in August was 2.7 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in August to 77.8 percent, a rate 0.6 percentage point above its level of a year earlier and 2.4 percentage points below its long-run (1972-2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.4 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.4% in August to 99.4. This is 18.3% above the recession low, but still 1.5% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.5% increase in Industrial Production in August, and for Capacity Utilization to increase to 77.9%.

NY Fed: Empire State Manufacturing Activity expands at slower pace in September

by Calculated Risk on 9/16/2013 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

The September 2013 Empire State Manufacturing Survey suggests that conditions for New York manufacturers improved modestly for the fourth straight month. The general business conditions index edged down two points but, at 6.3, remained in positive territory. The new orders index inched up two points to 2.4 ...This is the first of the regional surveys for September. The general business conditions index was below the consensus forecast of a reading of 9.0, but shows continued modest expansion.

Labor market conditions were mostly steady; the index for number of employees retreated three points to 7.5 and the average workweek index edged down to a neutral reading of 1.1. Indexes for the six-month outlook revealed increasingly widespread optimism about future business activity. The future general business conditions index rose for the third straight month, climbing three points to 40.6, its highest level since the spring of 2012.

emphasis added

Sunday, September 15, 2013

Monday: Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 9/15/2013 08:41:00 PM

From the WSJ: Summers Withdraws Name for Fed Chairmanship

One leading candidate is Janet Yellen, the Fed's current vice chairwoman, who has garnered substantial support among Democrats in Congress and among economists. But the public lobbying on her behalf appears to have annoyed the president, say administration insiders, and may lead him to look elsewhere.There is no way President Obama is that small of a person. Janet Yellen played no role in the lobbying on her behalf; it was spontaneous and widespread because she is an excellent choice. She was the leading candidate long before any other candidate was ever mentioned.

From Ezra Klein at the WaPo: Five reasons Obama should name Janet Yellen to chair the Federal Reserve

[T]he line from the White House has never been that Yellen is bad choice. In fact, they've been at pains to say she's absolutely terrific — an incredible candidate who they'd be thrilled to name ... Yellen ... is a consensus pick. She's Wall Street's favorite. She the monetary policy world's favorite. She's favored by congressional Democrats and organized labor. So far as anybody knows, she has nearly no enemies — at least outside the White House. It's rare that in a race that's been so angrily contested, either candidate can actually be a consensus pick. But because this race more or less pitted the White House's preference for Summers against the rest of the world's preference for Yellen, the Obama administration can end this with a pick most everyone is happy with.Monday:

• 8:30 AM ET, the NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 9.0, up from 8.2 in August (above zero is expansion).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

Weekend:

• Schedule for Week of Sept 15th

• FOMC Projections Preview: Some Modest Tapering is Possible

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 19 and DOW futures are up 189 (fair value).

Oil prices have declined slightly with WTI futures at $107.30 per barrel and Brent at $110.68 per barrel. Below is a graph from Gasbuddy.com for nationwide gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Projections Preview: Some Modest Tapering is Possible

by Calculated Risk on 9/15/2013 02:01:00 PM

The FOMC meets on Tuesday and Wednesday of this week. It seems some modest "tapering" of monthly asset purchases is possible, although not certain. Perhaps the Fed will reduce their purchases to $75 billion per month from $85 billion per month. If purchases are reduced, it seems likely that the Fed will continue to purchase agency mortgage-backed securities at the current rate ($40 billion per month), but reduce their purchases of longer-term Treasury securities from $45 billion to $35 billion per month.

In June, most FOMC participants (14 out of 19) judged that the first increase in the federal funds rate would occur in 2015. Three participants judged 2014 would be appropriate, and only one in 2016. It is possible that more participants will move out a little (maybe a few more will think 2016 is appropriate, or fewer think 2014).

In the press conference on Wednesday, I expect Fed Chairman Ben Bernanke will probably make it clear that the Fed will not raise rates for a "considerable" time after the end of QE, and it seems likely he will express concern about the low level of inflation.

On the projections, it looks like GDP will be downgraded again, and the projections for the unemployment rate might be reduced slightly.

Note: March 2012 projections included to show the trend (TBA: To be announced). The projections this month will be the first for 2016.

GDP increased at a 1.8% annual rate in the first half of 2013. GDP would have to increase at a 2.8% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.3% rate to reach the higher projection.

Early forecasts for Q3 are that GDP will increase at around a 1.5% annual rate, so I expect a decrease in the GDP projections for 2013 at this meeting. We might see the projections revised down from the 2.3% to 2.6% range in June to 1.8% to 2.2% or so.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 | |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 | |

The unemployment rate was at 7.3% in August and the Q4 projections might be revised down a little. This really depends on if participants think the employment participation rate will continue to decline - or if it will bounce back a little.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 | |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 | |

Projections for inflation will probably be unchanged. Currently inflation is tracking close to the June projections (as is core inflation). The current concern is that the inflation projection is below the Fed's target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 | |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 | |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 | |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 | |

Conclusion: I expect another downgrade to the GDP projections and possibly some reduction in asset purchases (but not certain). It does seem odd that the FOMC would start reducing asset purchases while downgrading GDP, and also expressing concern about the downside risks from fiscal policy. With the unemployment rate too high, and inflation too low, there is a strong argument to wait a few more months before starting to taper asset purchases.

Goldman and Merrill economists on "Tapering"

by Calculated Risk on 9/15/2013 09:40:00 AM

From economists Jan Hatzius and Sven Jari Stehn of Goldman Sachs:

• Fed officials will review three key pieces of information next week: (1) economic activity and labor market indicators that have been modestly encouraging, (2) a stabilization in core inflation at levels well below the 2% target, and (3) a tightening of financial conditions since the last meeting, mainly because of higher long-term interest rates.From the Merrill Lynch economic team:

• We believe the news is consistent with a shift in the mix of monetary policy instruments away from asset purchases and toward forward guidance. ...

• Regarding the asset purchase program, we expect a tapering of $10bn, all in Treasuries, as well as confirmation from Chairman Bernanke that the committee still expects to end QE3 in mid-2014.

• Regarding the forward guidance, we expect a clarification that the 6.5% unemployment threshold is conditional on a return of inflation

emphasis added

We expect the Fed to delay tapering at its September 17-18 meeting, but a “token taper” of $10 bn is also quite possible. More important, we expect a market-friendly message from the Fed, underscoring a slow, data-dependent exit.

Saturday, September 14, 2013

Sacramento: Conventional Sales up Sharply Year-over-year in August, Active Inventory increases 47% year-over-year

by Calculated Risk on 9/14/2013 09:07:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In August 2013, 19.0% of all resales (single family homes) were distressed sales. This was down from 23.1% last month, and down from 52.0% in August 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs was at 4.6% (the lowest since the data was tracked), and the percentage of short sales decreased to 14.4%. (the lowest percentage for short sales since Sacramento started tracking short sales in June 2009).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 46.8% year-over-year in July. This is the fourth consecutive month with a year-over-year increase in inventory - clearly inventory has bottomed in Sacramento.

Cash buyers accounted for 25.4% of all sales, down from 25.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 12% from August 2012, but conventional sales were up 48% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales.

If this data is a hint at what will happen in other areas, we can expect: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales. 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Hedge Fund Risk and Andy Lo's "Capital Decimation Partners"

by Calculated Risk on 9/14/2013 06:31:00 PM

Professor Krugman writes: Heads They Win, Tails We Lose

Many years ago MIT’s Andy Lo made a simple point (weirdly, I haven’t been able to track down the paper) about the distortion of incentives inherent in financial-industry compensation. Suppose you’re a hedge fund manager, getting 2 and 20 — fees of 2 percent of investors’ money, plus 20 percent of profits. What you want to do is load up on as much leverage as possible, and make high-risk, high return investments. This more or less guarantees that your fund will eventually go bust — but in the meantime you’ll have raked in huge personal earnings, and can walk away filthy rich from the wreckage.Andy Lo's article was published in the Financial Analysts Journal in 2001: Risk Management for Hedge Funds: Introduction and Overview. An online copy is available here.

But surely, you say, investors will see through this strategy. They can’t consistently be that stupid or naive, can they?

Hahahaha.

Jim Hamilton at Econbrowser has a nice summary from 2005: Hedge fund risk

[L]et me tell you about one fund I do know about called CDP, which was described by MIT Professor Andrew Lo in an article published in Financial Analysts Journal in 2001.Of course the strategy would eventually go bust, but the managers would be rich!!!

1992-1999 was a good time to be in stocks-- a strategy of buying and holding the S&P 500 would have earned you a 16% annual return, with $100 million invested in 1992 growing to $367 million by 1999. As nice as this was, it pales in comparison to CDP's strategy, which would have turned $100 million into $2.7 billion, a 41% annual compounded return, with a positive return in every single year.

Schedule for Week of September 15th

by Calculated Risk on 9/14/2013 01:01:00 PM

The key event this week will be the FOMC statement and press conference on Wednesday. It is possible that the FOMC will start to reduce the monthly purchases of assets. I'll post a preview soon.

There are three key housing reports that will be released this week, housing starts on Wednesday, homebuilder confidence survey on Tuesday, and existing home sales on Thursday.

For manufacturing, August Industrial Production, and the NY Fed (Empire State) and Philly Fed September surveys will be released this week. For prices, CPI will be released on Tuesday.

8:30 AM: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 9.0, up from 8.2 in August (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

8:30 AM: Consumer Price Index for August. The consensus is for a 0.1% increase in CPI in August and for core CPI to increase 0.2%.

10:00 AM ET: The September NAHB homebuilder survey. The consensus is for a reading of 59, the same as in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts were at 896 thousand (SAAR) in July. Single family starts were at 591 thousand SAAR in July.

The consensus is for total housing starts to increase to 915 thousand (SAAR) in August.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. It is possible the FOMC will start to reduce QE purchases following this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 341 thousand from 292 thousand last week.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 5.25 million on seasonally adjusted annual rate (SAAR) basis. Sales in July were at a 5.39 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 10.0, up from 9.3 last month (above zero indicates expansion).

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2013

Unofficial Problem Bank list declines to 700 Institutions

by Calculated Risk on 9/14/2013 08:10:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 13, 2013.

Changes and comments from surferdude808:

The FDIC shuttered two banks this Friday to keep things interesting. The failures and two action terminations caused the Unofficial Problem Bank List to drop to 700 institutions with assets of $246.0 billion. A year ago, the list held 866 institutions with assets of $330.5 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. Less than two years later the list peaked at 1,002 institutions. Now, more than two years after the peak, the list is down to 700 (the list increased faster than it is decreasing - but it is steadily decreasing as regulators terminate actions and close a few more banks).

Actions were terminated against Nextier Bank, National Association, Evans City, PA ($510 million) and Seattle Bank, Seattle, WA ($223 million). Failures this week were First National Bank, Edinburg, TX ($3.1 billion) and The Community's Bank, Bridgeport, CT ($26 million). The failure in Connecticut is only the second in FDIC's Boston Region since the onset of the financial crisis. In this region, proactive local supervision leadership contributed to the comparatively stellar failure performance as reflected by the low number of failed institutions and low volume of failed bank assets.

According to a report published by SNL Securities (Bankruptcy judge will not permit Capitol Bancorp's FDIC 'fishing expedition') on September 12th, the presiding bankruptcy judge denied the holding company's request to conduct discovery to determine if the FDIC has not acted in good faith by not approving cross-guarantee waivers. An FDIC attorney said the agency would reach a decision on the waivers "as quickly as it can." So the saga of Capitol Bancorp continues.

Next week, we anticipate the OCC will release its actions through mid-August.