by Calculated Risk on 9/10/2013 09:19:00 AM

Tuesday, September 10, 2013

CoreLogic: 2.5 Million Fewer Properties with Negative Equity in Q2 2013

From CoreLogic: CoreLogic reports 2.5 Million More Residential Properties Return to Positive Equity in Second Quarter

CoreLogic ... today released new analysis showing approximately 2.5 million more residential properties returned to a state of positive equity during the second quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 41.5 million. The analysis shows that 7.1 million homes, or 14.5 percent of all residential properties with a mortgage, were still in negative equity at the end of the second quarter of 2013. This figure is down from 9.6 million homes, or 19.7 percent of all residential properties with a mortgage, at the end of the first quarter of 2013

... Of the 41.5 million residential properties with positive equity, 10.3 million have less than 20 percent equity. Borrowers with less than 20 percent equity, referred to as “under-equitied,” may have a more difficult time obtaining new financing for their homes due to underwriting constraints. Under-equitied mortgages accounted for 21.1 percent of all residential properties with a mortgage nationwide in the second quarter of 2013. At the end of the second quarter of 2013, 1.7 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“Equity rebuilding continued in the second quarter of this year as the share of underwater mortgaged homes fell to 14.5 percent,” said Dr. Mark Fleming, chief economist for CoreLogic. “In just the first half of 2013 almost three and a half million homeowners have returned to positive equity, but the pace of improvement will likely slow as price appreciation moderates in the second half.”

emphasis added

Click on graph for larger image.

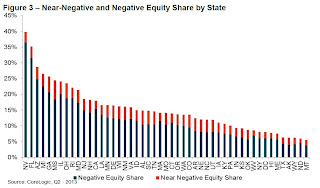

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 36.4 percent, followed by Florida (31.5 percent), Arizona (24.7 percent), Michigan (22.5 percent), and Georgia (20.7 percent). These top five states combined account for 34.9 percent of negative equity in the U.S."

The second graph shows the distribution of home equity in Q2 compared to Q1. Under 6% of residential properties have 25% or more negative equity, down from over 8% in Q1. It will be long time before those borrowers have positive equity.

The second graph shows the distribution of home equity in Q2 compared to Q1. Under 6% of residential properties have 25% or more negative equity, down from over 8% in Q1. It will be long time before those borrowers have positive equity.But many other borrowers are close (less than 10% negative equity).

NFIB: Small Business Optimism Index "flat" in August

by Calculated Risk on 9/10/2013 08:49:00 AM

From the National Federation of Independent Business (NFIB): Optimism Doesn’t Budge

Small-business optimism remained flat in August, dropping 0.1 points from July for a final reading of 94.0. While the total reading showed essentially no change over the month prior, a look at the individual indicators reveals incongruent details. Job creation plans leapt to a level not seen since before the recession and sales expectations improved; but this optimism would appear to contravene the dramatic deterioration in quarter to quarter sales and profit trends. The favorable employment plans also contrasted sharply with the increasingly negative expectations for improved general business conditions. The month’s performance proved poor, but expectations, pre-Syria, were looking up. ...Small business hiring plans increased in the August survey to a reading of 16 from 9 in July (zero is neutral). This is a very strong reading.

Job Creation. August marked the fourth consecutive month of negative job growth for small-business owners. The average increase in employment for small firms surveyed was negative 0.3 workers per firm. Dramatic employment reductions have ceased but hiring has not resumed at normal levels.

In another small sign of good news, only 17% of owners reported weak sales as the top problem (lack of demand). This was down from 20% a year ago, and half the peak of 34% during the recession. During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

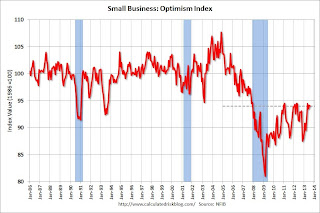

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 94.0 in August from 94.1 in July. This is still low, but just below the post-recession high.

Monday, September 09, 2013

Tuesday: Job Openings, Small Business Confidence

by Calculated Risk on 9/09/2013 08:49:00 PM

An interesting paper from Elizabeth Laderman at the San Francisco Fed: Small Businesses Hit Hard by Weak Job Gains. An excerpt:

During the recent recession and recovery, small businesses experienced disproportionate job losses (see Burgen and Aliprantis 2012, Tasci and Burgen 2012, and Sahin et al. 2011). Between 2007 and 2012, their share of total net job losses was nearly double their 30% share of total employment. From the employment peak immediately before the recession through March 2009, the recession low point for private nonfarm employment, jobs at small businesses declined about 11%, according to the Business Employment Dynamics (BED) database of the U.S. Bureau of Labor Statistics. By contrast, payrolls at businesses with 50 or more employees shrank about 7%.Tuesday:

What explains the disparity between job losses at small and large businesses? Financial factors appear to have played a part. The financial crisis that accompanied the 2007–09 recession restrained the supply of credit to businesses. Banks severely tightened lending standards and raised interest rates for business loans during the crisis, according to evidence from the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices. Survey participants reported that the degree of tightening was about the same for businesses of all sizes. However, large companies can more easily tap public credit markets, while smaller companies depend more on bank credit. Indeed, Duygan-Bump et al. (2011) found empirical evidence that financing constraints for small businesses were important in explaining unemployment during the Great Recession. Other potential sources of small business finance were similarly hard hit. Small business owners often rely on personal credit for financing, such as home equity loans, especially if they are just starting out. Thus, falling house prices may have restricted their access to financing. Research has found an especially low rate of business formation during the Great Recession (see Shane 2011). Another study found that the employment decline at newer small businesses was especially large in states with sharp house price declines (Fort et al. 2013).

Weak demand for small business products and services may also have played a role in the pace of job losses. During the recession, the most important small business concern was poor sales, not limited credit availability, according to survey data from the National Federation of Independent Business (NFIB). Although sales of small and large businesses both took hits early in the recession, sales of large businesses recovered more quickly (Sahin et al. 2011). Using state-level NFIB data, Atif Mian and Amir Sufi (2013) showed that the degree of concern about poor sales among a state’s small businesses was strongly correlated with the decline of employment in that state. Mian and Sufi’s result may help explain outsized job losses among small businesses. These businesses have relatively few opportunities to benefit from geographic diversification, which means that their fortunes tend to be closely tied to economic conditions in their home states. By contrast, larger businesses typically serve broader, more diverse geographic markets.

• At 7:30 AM ET, the NFIB Small Business Optimism Index for August.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings increased in June to 3.936 million, but openings were only up 4% year-over-year compared to June 2012.

Weekly Update: Existing Home Inventory is up 20.6% year-to-date on Sept 9th

by Calculated Risk on 9/09/2013 04:49:00 PM

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for July). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 20.6%. There might be some further increases over the next few weeks, but then inventory should start declining seasonally.

It is important to remember that inventory is still very low, and is down 4.0% from the same week last year according to Housing Tracker.

The second graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2012 and 2013.

Inventory in 2013 is still 4.0% below the same week in 2012, but the inventory level is getting close to last year.

Inventory in 2013 is still 4.0% below the same week in 2012, but the inventory level is getting close to last year.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory should mean price increases will slow.

Hovnanian: Higher Home Prices, Rising Mortgage Rates Dampened Home Sales in July and August

by Calculated Risk on 9/09/2013 03:56:00 PM

From housing economist Tom Lawler:

Hovnanian Enterprises, the seventh largest US home builder, reported that net home orders in the quarter ended July 31, 2013 totaled 1,568, up 1.8% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 18% last quarter, compared to 21% a year ago. Home deliveries last quarter totaled 1,502, up 3.8% from the comparable quarter of 2012, at an average sales price of $358,899, up 8.0% from a year ago. The company’s order backlog at the end of July totaled 2,893, up 18.0% from a year ago.

CEO Ara Hovnanian noted that while the company was “pleased” that the company was able to “raise home prices, grow revenues, and increase (its) gross margin, higher home prices combined with rising mortgage rates “dampened home sales in July and August.” In its “Review of Financial Results” presentation, which includes net contracts for August, the company showed that net contracts in July and August of this year were down 12.7% from July and August of last year.

CR Note: I expect new home sales to continue to increase over the next few years, but it looks like July and August were fairly weak for Hovnanian.

CBO: Monthly Budget Review for August 2013

by Calculated Risk on 9/09/2013 02:46:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for August 2013

The federal government ran a budget deficit of roughly $750 billion for the first 11 months of fiscal year 2013, CBO estimates—a reduction of more than $400 billion from the shortfall recorded for the same period last year. Revenues have risen significantly, accounting for more than two-thirds of the decline in the deficit. The deficit for all of fiscal year 2013 is expected to be smaller than the 11-month figure, as revenues are likely to outpace outlays in September.The surplus in September should be around $100 billion ($75 billion in Sept 2012), putting the annual deficit close to $650 billion (very close to the most recent CBO estimate):

...

Receipts for the first 11 months of fiscal year 2013 totaled $2,472 billion, CBO estimates—$284 billion more than receipts for the same period last year.

...

Outlays for the first 11 months of fiscal year 2013 were $127 billion less than spending during the same period last year, CBO estimates.

If the current laws that govern federal taxes and spending do not change, the budget deficit will shrink this year to $642 billion, the Congressional Budget Office (CBO) estimates, the smallest shortfall since 2008. Relative to the size of the economy, the deficit this year—at 4.0 percent of gross domestic product (GDP)—will be less than half as large as the shortfall in 2009, which was 10.1 percent of GDP.

Update: When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 9/09/2013 11:35:00 AM

Almost two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through August 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked just below the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in mid-2014.

Currently there are about 1.9 million fewer payroll jobs than before the recession started, and at the recent pace of job growth it will take just under 11 months to reach the previous peak. Note: I expect another upward adjustment when the annual benchmark revision is released in January, so we will probably reach the previous peak in fewer than 11 months.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

Note: There are 1.366 million fewer private sector payroll jobs than before the recession started. At the recent pace of private sector job growth - plus a positive benchmark revision in January - the private sector could be back at the pre-recession peak in early 2014.

Conforming Loan Limits and House Prices

by Calculated Risk on 9/09/2013 09:17:00 AM

As a follow-up to Nick Timiraos' article in the WSJ: Loan Size to Be Cut for Fannie, Freddie, here is a graph that shows the conforming loan limit compared to three house prices indexes (Corelogic, Case-Shiller National, and FHFA).

Click on graph for larger image.

In general the conforming loan limit has moved with house prices, however the conforming limit didn't rise as fast as house prices during the bubble.

Of course the conforming loan limit was held at $417,000 since 2006 - the limit wasn't reduced as house prices declined.

Using a comparison between house prices and the conforming loan limit for the period 1980 to 2000 (not distorted by the bubble), it appears the standard limit should be in the $385,000 range. I suspect the high cost limit will be continued - and will remain close to the current level.

Here are the historical conforming loan limits. And here are the current limits.

Sunday, September 08, 2013

WSJ Report: Fannie, Freddie to lower Conforming Loan Limits in January

by Calculated Risk on 9/08/2013 09:14:00 PM

From Nick Timiraos at the WSJ: Loan Size to Be Cut for Fannie, Freddie

Federal officials are preparing to reduce the maximum size of home-mortgage loans eligible for backing by Fannie Mae FNMA and Freddie Mac ... Currently, Fannie and Freddie Mac can back mortgages that have balances as high as $417,000 in most parts of the country and up to $625,500 in expensive housing markets, including parts of California and New York, and as much as $721,050 in Hawaii. Mortgages within the limits are called "conforming" loans; mortgages that exceed them are called "jumbo" mortgages.Monday:

The Federal Housing Finance Agency, which regulates Fannie and Freddie, hasn't announced how far it will drop the loan limits, which would take effect Jan. 1, 2014, and a spokeswoman declined to elaborate on specifics. But in a statement, the agency said a "gradual reduction in loan limits is an appropriate and effective approach to reducing taxpayers' mortgage-risk exposure…and expanding the role of private capital in mortgage finance."

• 3:00 PM, Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $12.3 billion in July.

Weekend:

• Schedule for Week of September 8th

The Nikkei is up about 2.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and DOW futures are up 12 (fair value).

Oil prices are up recently with the Syria situation. WTI futures are at $109.96 per barrel and Brent at $115.75 per barrel. This will probably push up gasoline prices soon. See Hamilton's Syria and the world oil market

Below is a graph from Gasbuddy.com for nationwide gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update on "eminent domain" for mortgages: North Las Vegas rejects "hair-brained scheme"

by Calculated Risk on 9/08/2013 06:21:00 PM

I haven't written much about the use of "eminent domain" to buy mortgages because it is such a dumb idea - and I expect it to go away fairly quickly (the city of Richmond is proposing to use eminent domain to help individual homeowners who are underwater - who may or may not be able to afford their mortgage - obviously not an intended use of eminent domain).

The North Las Vegas city council rejected the use of "eminent domain" 5-0 last week. Here is a funny quote from the Nevada Association of REALTORS® President Patty Kelley:

“Their rejection of the contract with MRP is in stark contrast to the decision of the previous council on this matter, and is a reflection of the serious ramifications associated with this hair-brained scheme foisted on the council by MRP officials."And on Richmond from the Contra Costa Times: Both sides in Richmond eminent domain plan set for showdown at City Council meeting

emphasis added

[B]ackers of a plan that would make Richmond the first city in the nation to seize underwater mortgages using eminent domain are set to make a furious push for survival. ...What a surprise - no one wants to insure an almost certain legal loser.

[T]he city can't secure insurance protection to shield it from a potential court judgment if the plan is found unlawful.

emphasis added

An appropriate public policy to help underwater homeowners would be cramdowns in bankruptcy (see Tanta's Just Say Yes To Cram Downs), but having cities use "eminent domain" is obviously not.

I still don't understand why the Obama Administration didn't push for cramdowns in early 2009. Oh well ...