by Calculated Risk on 9/09/2013 03:56:00 PM

Monday, September 09, 2013

Hovnanian: Higher Home Prices, Rising Mortgage Rates Dampened Home Sales in July and August

From housing economist Tom Lawler:

Hovnanian Enterprises, the seventh largest US home builder, reported that net home orders in the quarter ended July 31, 2013 totaled 1,568, up 1.8% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 18% last quarter, compared to 21% a year ago. Home deliveries last quarter totaled 1,502, up 3.8% from the comparable quarter of 2012, at an average sales price of $358,899, up 8.0% from a year ago. The company’s order backlog at the end of July totaled 2,893, up 18.0% from a year ago.

CEO Ara Hovnanian noted that while the company was “pleased” that the company was able to “raise home prices, grow revenues, and increase (its) gross margin, higher home prices combined with rising mortgage rates “dampened home sales in July and August.” In its “Review of Financial Results” presentation, which includes net contracts for August, the company showed that net contracts in July and August of this year were down 12.7% from July and August of last year.

CR Note: I expect new home sales to continue to increase over the next few years, but it looks like July and August were fairly weak for Hovnanian.

CBO: Monthly Budget Review for August 2013

by Calculated Risk on 9/09/2013 02:46:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for August 2013

The federal government ran a budget deficit of roughly $750 billion for the first 11 months of fiscal year 2013, CBO estimates—a reduction of more than $400 billion from the shortfall recorded for the same period last year. Revenues have risen significantly, accounting for more than two-thirds of the decline in the deficit. The deficit for all of fiscal year 2013 is expected to be smaller than the 11-month figure, as revenues are likely to outpace outlays in September.The surplus in September should be around $100 billion ($75 billion in Sept 2012), putting the annual deficit close to $650 billion (very close to the most recent CBO estimate):

...

Receipts for the first 11 months of fiscal year 2013 totaled $2,472 billion, CBO estimates—$284 billion more than receipts for the same period last year.

...

Outlays for the first 11 months of fiscal year 2013 were $127 billion less than spending during the same period last year, CBO estimates.

If the current laws that govern federal taxes and spending do not change, the budget deficit will shrink this year to $642 billion, the Congressional Budget Office (CBO) estimates, the smallest shortfall since 2008. Relative to the size of the economy, the deficit this year—at 4.0 percent of gross domestic product (GDP)—will be less than half as large as the shortfall in 2009, which was 10.1 percent of GDP.

Update: When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 9/09/2013 11:35:00 AM

Almost two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through August 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked just below the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in mid-2014.

Currently there are about 1.9 million fewer payroll jobs than before the recession started, and at the recent pace of job growth it will take just under 11 months to reach the previous peak. Note: I expect another upward adjustment when the annual benchmark revision is released in January, so we will probably reach the previous peak in fewer than 11 months.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

Note: There are 1.366 million fewer private sector payroll jobs than before the recession started. At the recent pace of private sector job growth - plus a positive benchmark revision in January - the private sector could be back at the pre-recession peak in early 2014.

Conforming Loan Limits and House Prices

by Calculated Risk on 9/09/2013 09:17:00 AM

As a follow-up to Nick Timiraos' article in the WSJ: Loan Size to Be Cut for Fannie, Freddie, here is a graph that shows the conforming loan limit compared to three house prices indexes (Corelogic, Case-Shiller National, and FHFA).

Click on graph for larger image.

In general the conforming loan limit has moved with house prices, however the conforming limit didn't rise as fast as house prices during the bubble.

Of course the conforming loan limit was held at $417,000 since 2006 - the limit wasn't reduced as house prices declined.

Using a comparison between house prices and the conforming loan limit for the period 1980 to 2000 (not distorted by the bubble), it appears the standard limit should be in the $385,000 range. I suspect the high cost limit will be continued - and will remain close to the current level.

Here are the historical conforming loan limits. And here are the current limits.

Sunday, September 08, 2013

WSJ Report: Fannie, Freddie to lower Conforming Loan Limits in January

by Calculated Risk on 9/08/2013 09:14:00 PM

From Nick Timiraos at the WSJ: Loan Size to Be Cut for Fannie, Freddie

Federal officials are preparing to reduce the maximum size of home-mortgage loans eligible for backing by Fannie Mae FNMA and Freddie Mac ... Currently, Fannie and Freddie Mac can back mortgages that have balances as high as $417,000 in most parts of the country and up to $625,500 in expensive housing markets, including parts of California and New York, and as much as $721,050 in Hawaii. Mortgages within the limits are called "conforming" loans; mortgages that exceed them are called "jumbo" mortgages.Monday:

The Federal Housing Finance Agency, which regulates Fannie and Freddie, hasn't announced how far it will drop the loan limits, which would take effect Jan. 1, 2014, and a spokeswoman declined to elaborate on specifics. But in a statement, the agency said a "gradual reduction in loan limits is an appropriate and effective approach to reducing taxpayers' mortgage-risk exposure…and expanding the role of private capital in mortgage finance."

• 3:00 PM, Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $12.3 billion in July.

Weekend:

• Schedule for Week of September 8th

The Nikkei is up about 2.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and DOW futures are up 12 (fair value).

Oil prices are up recently with the Syria situation. WTI futures are at $109.96 per barrel and Brent at $115.75 per barrel. This will probably push up gasoline prices soon. See Hamilton's Syria and the world oil market

Below is a graph from Gasbuddy.com for nationwide gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update on "eminent domain" for mortgages: North Las Vegas rejects "hair-brained scheme"

by Calculated Risk on 9/08/2013 06:21:00 PM

I haven't written much about the use of "eminent domain" to buy mortgages because it is such a dumb idea - and I expect it to go away fairly quickly (the city of Richmond is proposing to use eminent domain to help individual homeowners who are underwater - who may or may not be able to afford their mortgage - obviously not an intended use of eminent domain).

The North Las Vegas city council rejected the use of "eminent domain" 5-0 last week. Here is a funny quote from the Nevada Association of REALTORS® President Patty Kelley:

“Their rejection of the contract with MRP is in stark contrast to the decision of the previous council on this matter, and is a reflection of the serious ramifications associated with this hair-brained scheme foisted on the council by MRP officials."And on Richmond from the Contra Costa Times: Both sides in Richmond eminent domain plan set for showdown at City Council meeting

emphasis added

[B]ackers of a plan that would make Richmond the first city in the nation to seize underwater mortgages using eminent domain are set to make a furious push for survival. ...What a surprise - no one wants to insure an almost certain legal loser.

[T]he city can't secure insurance protection to shield it from a potential court judgment if the plan is found unlawful.

emphasis added

An appropriate public policy to help underwater homeowners would be cramdowns in bankruptcy (see Tanta's Just Say Yes To Cram Downs), but having cities use "eminent domain" is obviously not.

I still don't understand why the Obama Administration didn't push for cramdowns in early 2009. Oh well ...

NY Times on Shortage of Buildable Lots

by Calculated Risk on 9/08/2013 10:08:00 AM

This is a follow-up to the NAHB survey released a few days ago showing a shortage of buildable lots in many areas.

From Shaila Dewan at the NY Times: Prices Are Rising for New Homes, and the Land They Are Built On

The latest land rush is in full swing, as developers realize that they have failed to feed the zoning, permitting and mapping pipeline, which can take months or years to turn raw fields into buildable lots. ...Several years ago we discussed how, during a housing bust, land prices usually fall faster than house prices (no one wanted land a few years ago). As an example, back in 2008 I spoke with a buyer who purchased land in the SoCal Inland Empire for $0.15 on the dollar from a homebuilder. And that was improved land. Now land prices are rising quickly.

After builders across the country spent decades feeding acre after acre of raw land into the maw of demand for single-family homes, the housing crash left them with a land surplus so large that lots were selling for pennies on the dollar. At the peak of supply, in 2009, there were enough lots to last almost eight years, according to MetroStudy, a firm that tracks housing data. Now there is less than four year’s worth, and only about a quarter of that is in the more desirable A- or B-rated locations.

“We have gone from a situation where five years ago everyone was saying, ‘There’s too many lots,’ to today, builders are literally crying on our shoulder saying, ‘There’s not enough lots. We can’t find any,’” said Bradley F. Hunter, the chief economist at MetroStudy.

The land developers are scrambling to catch up since it takes time to obtain all the entitlements and this could be an issue for some home buiders next year too.

Saturday, September 07, 2013

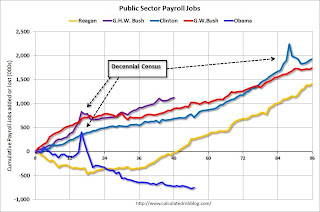

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 9/07/2013 04:57:00 PM

Note: This is an update on an earlier post through the August employment report.

In April, I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush). Below are updates through the August report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a better comparison might be to look at the percentage change, but this gives an overall view of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the first year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton (light blue) and 14,688,000 under President Reagan (yellow).

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. At this early point in Mr. Obama's second term, there are now 3,254,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 752,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level.

Schedule for Week of September 8th

by Calculated Risk on 9/07/2013 12:49:00 PM

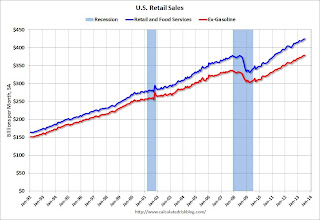

The key report this week will be August retail sales to be released on Friday.

3:00 PM: Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $12.3 billion in July.

7:30 AM ET: NFIB Small Business Optimism Index for August.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 3.936 million, up from 3.907 million in May. The number of job openings (yellow) is the highest since 2008, but openings are only up 4% year-over-year compared to June 2012.

Quits were down in June, and quits are up about 1% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.3% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand last week.

2:00 PM ET: Monthly Treasury Statement for August.

8:30 AM ET: Retail sales for August will be released.

8:30 AM ET: Retail sales for August will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail Retail sales are up 28.1% from the bottom, and now 12.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.5% in August, and to increase 0.3% ex-autos.

8:30 AM: Producer Price Index for August. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 82.0, down from 82.1 in August.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.3% increase in inventories.

Unofficial Problem Bank list declines to 704 Institutions

by Calculated Risk on 9/07/2013 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 6, 2013.

Changes and comments from surferdude808:

Quiet week for changes to the Unofficial Problem Bank List with only three removals. After the changes, the list has 704 institutions with assets of $249.8 billion. A year ago, the list held 887 institutions with assets of $330.7 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. Less than two years later the list peaked at 1,002 institutions. Now, more than two years after the peak, the list is down to 704 (the list increased faster than it is decreasing - but it is steadily decreasing as regulators terminate actions).

Actions were terminated against Midwest Independent Bank, Jefferson City, MO ($342 million) and Idaho First Bank, McCall, ID ($87 million) while The Foster Bank, Chicago, IL ($380 million) found a merger partner.

There is nothing new of significance to report on the status of banks controlled by Capitol Bancorp, Ltd. Next week will likely be as quiet as it will be too early for the OCC to release its actions through mid-August 2013.