by Calculated Risk on 9/02/2013 03:56:00 PM

Monday, September 02, 2013

WSJ: "FHA Cuts Waiting Period to 1 Year for Buyers Who Earlier Faced Foreclosure"

From Nick Timiraos at the WSJ: New Lifeline for Home Buyers

A recent rule change lets certain borrowers who have gone through a foreclosure, bankruptcy or other adverse event—but who have repaired their credit—become eligible to receive a new mortgage backed by the Federal Housing Administration after waiting as little as one year. Previously, they had to wait at least three years before they could qualify for a new government-backed loan.We started seeing "bounce back" buyers in 2011 (see: After Foreclosure: The Bounce Back Buyers). As Timiraos noted, the standard FHA waiting period is 3 years. The waiting period is 7 years for a conventional loan following a foreclosure (4 years for a conventional loan following a short sale).

To be eligible for the new FHA loans, borrowers must show that their foreclosure or bankruptcy was caused by a job loss or reduction in income that was beyond their control. Borrowers also must prove their incomes have had a "full recovery" and complete housing counseling before getting a new mortgage.

GDP drag from State and Local Governments

by Calculated Risk on 9/02/2013 11:30:00 AM

One of the reasons I expect GDP to pick up over the next few years is that state and local government spending will probably stop being a drag on GDP, and might even add a little to GDP going forward.

However the 2nd estimate of GDP showed state and local government spending was still a drag on GDP in Q2 (the advance estimate indicated a small positive contribution).

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 11 quarters (through Q2 2013).

However state and local government spending has made a negative contribution for 13 of the last 14 quarters.

The drag has diminished but is still ongoing. Based on recent news reports, I expect state and local governments to make small positive contributions to GDP going forward.

Note: Currently state and local government as a percent of GDP is back to 1970 levels!

Sunday, September 01, 2013

Population Distribution 1900-2060

by Calculated Risk on 9/01/2013 05:02:00 PM

Reader Druce put together the graphic below of the U.S population distribution, by age, from 1900 through 2060 using a slider. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

In 1900, the graph was fairly steep, but with improving health care, the graph has flattened out over the last 100 years.

Note: Prior to 1940, the oldest group was 75+. From 1940 through 1985, the oldest group was 85+. Starting in 1990, the oldest group is 100+.

Watch for:

1) the original baby bust preceding the baby boom (the decline in births prior to and during the Depression). Those are the people currently in retirement.

2) the Baby Boom is obvious.

3) By 2020 or 2025, the largest cohorts will all be under 40.

Update: Charts to Track Timing for QE3 Tapering

by Calculated Risk on 9/01/2013 10:08:00 AM

We can update three of the four charts that I'm using to track when the Fed will start tapering the QE3 purchases.

The September FOMC meeting is on the 17th and 18th. The only data relevant for these charts that will be released between now and the September FOMC meeting is the August unemployment rate that will be released this coming Friday.

At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

Click on graph for larger image.

Click on graph for larger image.The first graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

Combined the first and second quarter were below the FOMC projections. GDP would have to increase at a 2.8% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.3% rate to reach the higher projection.

The second graph is for the unemployment rate.

The second graph is for the unemployment rate.The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We only have data through July, and so far the unemployment rate is tracking in the middle of the forecast.

If the participation rate ends the year at 63.6% (level for the year), then job growth will have to pickup up a little in the 2nd half to meet the FOMC projections. See the Atlanta Fed's Jobs Calculator tool to estimate how many jobs per month will be needed to reach a certain unemployment level.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

So far PCE prices are close to this projection - however this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

PCE prices wouldn't have to increase much over the next five months to reach the upper FOMC projection.

This graph is for core PCE prices.

This graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

So far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.

With the upward revision to Q2 GDP, and the low expectations for inflation (significantly below target), it now looks the year-end data might be "broadly consistent" with the June FOMC projections.

Saturday, August 31, 2013

Unofficial Problem Bank list declines to 707 Institutions

by Calculated Risk on 8/31/2013 03:51:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 30, 2013.

Changes and comments from surferdude808:

This week, the FDIC finally released industry results for the second quarter and its enforcement actions through July. For the week, there were 11 removals and four additions. The changes leave the Unofficial Problem Bank List holding 707 institutions with assets of $250.6 billion. A year ago, the list held 891 institutions with assets of $331.5 billion. For the month, the list declined by a net 22 institutions and dropped $102 billion of assets. Monthly activity included six additions, one unassisted merger, four failures, and 23 action terminations, which was the most action terminations in a month since 25 cures in April 2012. With second quarter industry results, the FDIC said there are 559 institutions with assets of $192 billion on the Official Problem Bank List. The difference between the two lists dropped by one institution to 148. We had anticipated for the difference to narrow to about 135.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 707.

The FDIC terminated actions against Inland Bank and Trust, Oak Brook, IL ($1.0 billion); Highland Bank, Saint Michael, MN ($429 million); Community Bank of Oak Park River Forest, Oak Park, IL ($272 million); First Southwest Bank, Alamosa, CO ($237 million); Signature Bank, Bad Axe, MI ($224 million); The Union Bank, Marksville, LA ($219 million); Community Trust & Banking Company, Ooltewah, TN ($131 million); Metropolitan Bank, Oakland, CA ($128 million); Cambridge State Bank, Cambridge, MN ($69 million); Elysian Bank, Elysian, MN ($42 million); and Vermont State Bank, Vermont, IL ($17 million).

Additions this week include United International Bank, Flushing, NY ($177 million); State Bank of Taunton, Taunton, MN ($71 million); Allendale County Bank, Fairfax, SC ($59 million); and Citizens Bank of Chatsworth, Chatsworth, IL ($48 million).

Not much new to report on Capitol Bancorp Ltd. other than its outside counsel squawking at the FDIC labeling its actions "imprudent and counterproductive." Within an article published by SNL Securities - Capitol Bancorp legal rep slams FDIC's 'imprudent and counterproductive actions', Andrew Sandler, chairman of BuckleySandler LLP, said "The FDIC is operating with extraordinary powers and seems all too willing to ignore judges, experts and others in effecting closures." Five banks controlled by Capital Bancorp have failed, which have cost the bank insurance fund an estimated 48 million. The FDIC could utilize the cross-guaranty provisions of FIRREA to assess the cost of the failures against the remaining banks controlled by Capitol Bancorp, which could lead to their failure.

Schedule for Week of September 1st

by Calculated Risk on 8/31/2013 08:33:00 AM

The key report this week is the August employment report on Friday.

Other key reports include the ISM manufacturing report on Tuesday, the trade deficit on Wednesday, and August auto sales also on Wednesday.

All US markets will be closed in observance of the Labor Day holiday.

Early: The LPS July Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

9:00 AM: The Markit US PMI Manufacturing Index for August. The consensus is for the index to increase to 53.9 from 53.7 in July.

10:00 AM ET: ISM Manufacturing Index for August. The consensus is for an derease to 53.8 from 55.4 in July. Based on the regional surveys, a decrease in August seems likely.

10:00 AM ET: ISM Manufacturing Index for August. The consensus is for an derease to 53.8 from 55.4 in July. Based on the regional surveys, a decrease in August seems likely.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in 55.4% in July. The employment index was at 54.4%, and the new orders index was at 58.3%.

10:00 AM: Construction Spending for July. The consensus is for a 0.3% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 15.8 million SAAR in August (Seasonally Adjusted Annual Rate) from 15.7million SAAR in July.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to increase to 15.8 million SAAR in August (Seasonally Adjusted Annual Rate) from 15.7million SAAR in July.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. Imports decreased in June, and exports increased.

The consensus is for the U.S. trade deficit to increase to $39.0 billion in July from $34.2 billion in June.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 177,000 payroll jobs added in August, down from 200,000 in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 331 thousand last week.

10:00 AM: ISM non-Manufacturing Index for August. The consensus is for a reading of 55.0, down from 56.0 in July. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is for a 3.4% decrease in orders.

10:00 AM: Trulia Price Rent Monitors for August. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: Employment Report for August. The consensus is for an increase of 175,000 non-farm payroll jobs in August; the economy added 162,000 non-farm payroll jobs in June.

The consensus is for the unemployment rate to be unchanged at 7.4 in August.

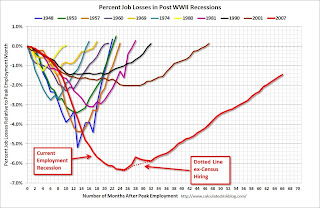

The following graph shows the percentage of payroll jobs lost during post WWII recessions through July.

The economy has added 7.3 million private sector jobs since employment bottomed in February 2010 (6.7 million total jobs added including all the public sector layoffs).

The economy has added 7.3 million private sector jobs since employment bottomed in February 2010 (6.7 million total jobs added including all the public sector layoffs).There are still 1.5 million fewer private sector jobs now than when the recession started in 2007.

Friday, August 30, 2013

Vehicle Sales: Another strong month in August

by Calculated Risk on 8/30/2013 08:30:00 PM

Note: The automakers will report August vehicle sales on Wednesday, Sept 4th.

According the Bureau of Economic Analysis (BEA), light vehicle sales in July were at a 15.7 million rate, on a seasonally adjusted annual rate (SAAR) basis. It looks like August sales will be in the same range.

Here are a few forecasts:

From Kelley Blue Book: Crossovers, Pickup Trucks Lift August Sales Nearly 14 Percent, According To Kelley Blue Book

In August, new light-vehicle sales, including fleet, are expected to hit 1,460,000 units, up 13.6 percent from August 2012 and up 11.0 percent from July 2013.Press Release: J.D. Power and LMC Automotive Report: August New-Vehicle Sales Reach Highest Level in Seven Years

The seasonally adjusted annual rate (SAAR) for August 2013 is estimated to be 15.6 million, up from 14.5 million in August 2012 and down from 15.8 million in July 2013.

With consistency in the fleet environment, total light-vehicle sales in August 2013 are also expected to increase by 12 percent from August 2012 to 1,495,400. Fleet sales are expected to account for 15 percent of total sales, with volume of 225,000 units.From TrueCar: August 2013 New Car Sales Expected to Be Up 14.4 Percent According to TrueCar; August 2013 SAAR at 15.75M, Highest August SAAR since 2007

PIN and LMC data show total sales reaching a 16 million unit SAAR in August, which is the highest since November 2007, with actual unit sales the highest since May 2007.

For August 2013, new light vehicle sales in the U.S. (including fleet) is expected to be 1,464,214 units, up 14.4 percent from August 2012 and up 11.8% percent from July 2013 (on an unadjusted basis).The analyst consensus is for sales of 15.8 million SAAR in August.

The August 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.75 million new car sales

Fannie Mae: Mortgage Serious Delinquency rate declined in July, Lowest since December 2008

by Calculated Risk on 8/30/2013 04:14:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in July to 2.70% from 2.77% in June. The serious delinquency rate is down from 3.50% in July 2012, and this is the lowest level since December 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 2.70% from 2.79% in June. Freddie's rate is down from 3.42% in July 2012, and this is the lowest level since April 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%..

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.8 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in just under 2 years. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in mid-2015.

Chemical Activity Barometer for August shows "Economy on the Upswing"

by Calculated Risk on 8/30/2013 01:09:00 PM

This is a new indicator that I'm following that appears to be a leading indicator for the economy.

From the American Chemistry Council: Leading Economic Indicator Shows U.S. Economy on the Upswing; Consumer-Driven Production Gains Strengthen

The pendulum of the U.S. economy remains on the upswing, according to the American Chemistry Council’s (ACC) monthly Chemical Activity Barometer (CAB), released today. The economic indicator, shown to lead U.S. business cycles by an average of eight months at cycle peaks, increased 0.1 percent over July on a three-month moving average (3MMA) basis, marking its fourth consecutive monthly gain. The barometer is now up 3.8 percent over a year ago, the largest year-over-year increase since September 2010. The index itself is at its highest point since June 2008. Prior CAB readings for March through July were all revised.

“As we approach the fourth quarter, the U.S. economy seems to be making strides, compared to the baby steps of earlier in the year,” said Dr. Kevin Swift, chief economist at the American Chemistry Council. “The Chemical Activity Barometer is showing a strengthening of year-over-year growth and suggests an economy which finally may be gaining momentum,” he added.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests that economic activity is increasing.

Final August Consumer Sentiment at 82.1

by Calculated Risk on 8/30/2013 09:55:00 AM

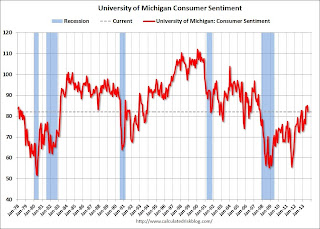

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for August was at 82.1, down from the July reading of 85.1, but up from the preliminary August reading of 80.0.

This was above the consensus forecast of 80.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. Unfortunately Congress is once again threatening to "not pay the bills" and that might impact sentiment (and consumer spending) late in September or in October.