by Calculated Risk on 8/28/2013 10:00:00 AM

Wednesday, August 28, 2013

NAR: Pending Home Sales index declined 1.3% in July

From the NAR: July Pending Home Sales Slip

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 1.3 percent to 109.5 in July from 110.9 in June, but is 6.7 percent above July 2012 when it was 102.6; the data reflect contracts but not closings. Pending sales have stayed above year-ago levels for the past 27 months.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

...

The PHSI in the Northeast fell 6.5 percent to 81.5 in July but is 3.3 percent higher than a year ago. In the Midwest the index slipped 1.0 percent to 113.2 in July but is 14.5 percent above July 2012. Pending home sales in the South rose 2.6 percent to an index of 121.5 in July and are 7.7 percent higher than a year ago. The index in the West fell 4.9 percent in July to 108.6, and is 0.4 percent below July 2012.

Note: It appears some buyers pushed to close in July because of rising mortgage rates (People who signed contracts in May probably locked in mortgage rates, and they wanted to close before the lock expired). So I expect closed sales in August to decline more than the pending home sales index would indicate.

MBA: Mortgage Refinance Applications down, Purchase Applications Up in Recent Survey

by Calculated Risk on 8/28/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 23, 2013. ...

The Refinance Index decreased 5 percent from the previous week. The Refinance Index has fallen 64.2 percent from its recent peak the week of May 3, 2013. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

...

The refinance share of mortgage activity decreased to 60 percent of total applications from 61 percent the previous week, which is the lowest share observed since April 2011. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.80 percent, the highest rate since April 2011, from 4.68 percent, with points decreasing to 0.41 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity has fallen sharply, decreasing in 14 of the last 16 weeks.

This index is down 64.2% over the last 16 weeks. The last time the index declined this far was in late 2010 and early 2011 when mortgage increased sharply with the Ten Year Treasury rising from 2.5% to 3.5%. We've seen a similar increase over the last few months with the Ten Year Treasury yield up from 1.6% to over 2.7% today.

The second graph shows the MBA mortgage purchase index. The purchase index has increased for the last two weeks, and three of the last four.

The second graph shows the MBA mortgage purchase index. The purchase index has increased for the last two weeks, and three of the last four.The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 6.7% from a year ago.

Tuesday, August 27, 2013

Wednesday: Mortgage Applications, Pending Home Sales Index

by Calculated Risk on 8/27/2013 08:45:00 PM

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2012.

However convention attendance in 2012 was still about 21% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). The numbers for 2013 are a projection based on data through June.

So far this year - through June - there were 19.9 million visitors to Las Vegas - slightly less than for the first six months of 2012.

Convention attendance was at 2.9 million during the first half of 2013, for a pace over 5 million for the first time since 2008 - but still well below the record of 6.3 million in 2006.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. With higher mortgage rates, the refinance index has fallen sharply over the last few months. The key will be to watch the purchase application index.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for July. The consensus is for a 1.0% decrease in the index.

Lawler: Measuring Changes in Home Prices is Difficult!

by Calculated Risk on 8/27/2013 04:25:00 PM

From housing economist Tom Lawler:

Below is a table showing the latest YOY % changes in various entities’ home price indexes for the metro areas covered in today’s Case Shiller home price report, as well as “national” HPIs. The YOY changes are for the period ended in June, with Case-Shiller, FHFA expanded, and Zillow effectively being quarterly averages; CoreLogic a weighted 3-month moving average; and LPS and FNC being “June.” Zillow does not include foreclosure resales in constructing its HVI, while LPS’ HPI “reflects” non-distressed sales, as it “takes into account” price discounts for REO and short sales. FNC’s RPI is a “hedonic” price index, as is (pretty much) Zillow’s HVI. CoreLogic produces HPIs for all of the metro areas below, but only releases to the public the ones shown below. Note that in some cases (e.g., NY), Case-Shiller’s “metro area” definition differs from the other entities (it is broader).

The biggest “outliers” are the “hedonic” home price indexes, which attempt to take into account the characteristics of homes sold. FNC’s RPI for many metro areas seem “most strange” – the RPIs for DC and Portland showed virtually no change from a year ago, which just doesn’t seem right. And FNC’s “national” (100 metro area) RPI gain of 3.7% over the last year seems way too low.

Even if all of the metro/regional/state HPIs from these entities “matched up,” the various entities’ “national” HPIs would show different growth rates. Case-Shiller constructs a “national” HPI from Census division HPIs with weights based on each division’s share of the market value of the housing stock from Census 2000. FHFA constructs a “national” HPI using weights based on state shares of the housing stock in units using the latest available ACS data. CoreLogic does not “build up” a national HPI from regional HPIs, but instead aggregates all transactions across the county. Zillow’s HVI is a “median” home-value measure, I believe using all homes for which it has a “Zestimate.” I’m not rightly sure how LPS or FNC construct their “national” HPIs.

The method used to construct a “national” HPI from state/regional HPIs can have a material impact. As I noted last week, if CoreLogic used Census 2000 market value weight applied to its state HPIs, its “national” HPI for June would have been up 9.4% YOY, compared to the reported 11.9%. And if the FHFA had applied Census 2000 market value weights to its state HPIs, its “national” HPI for June would have bee up 8.1%, instead of the reported 7.6%. The Case Shiller “national” HPI for “June” (Q2) was up 10.1% YOY. Case-Shiller doesn’t produce state HPIs and doesn’t release its Census division HPIs to the public.

| YOY % Change, Various Home Price Indexes ("June"/Q2 2013) | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller | FHFA Expanded | CoreLogic | LPS | FNC | Zillow | |

| AZ-Phoenix | 19.8% | 21.2% | 17.1% | 16.6% | 27.5% | 22.0% |

| CA-Los Angeles | 19.9% | 18.3% | 20.7% | 18.8% | 7.8% | 19.7% |

| CA-San Diego | 19.3% | 17.5% | 19.9% | 18.0% | 9.1% | 21.8% |

| CA-San Francisco | 24.5% | 19.7% | 23.9% | 10.2% | 26.3% | |

| CO-Denver | 9.4% | 10.3% | 10.5% | 9.8% | 8.8% | 12.7% |

| DC-Washington | 5.7% | 9.9% | 9.4% | 7.7% | 0.8% | 7.0% |

| FL-Miami | 14.8% | 13.4% | 13.4% | 14.3% | 5.8% | 12.5% |

| FL-Tampa | 11.1% | 11.7% | 9.4% | 11.0% | 5.9% | 10.6% |

| GA-Atlanta | 19.0% | 18.6% | 16.1% | 13.0% | 2.7% | 6.5% |

| IL-Chicago | 7.3% | 6.7% | 4.6% | 6.8% | -1.0% | 1.1% |

| MA-Boston | 6.7% | 7.5% | 6.4% | 3.0% | 6.7% | |

| MI-Detroit | 16.4% | 15.2% | 11.3% | 6.3% | 15.1% | |

| MN-Minneapolis | 11.5% | 10.2% | 9.1% | 8.4% | 4.4% | 11.7% |

| NC-Charlotte | 7.8% | 8.5% | 6.3% | 5.3% | 1.9% | |

| NV-Las Vegas | 24.9% | 24.5% | 27.0% | 18.6% | 29.5% | |

| NY-New York | 3.3% | 2.6% | 7.2% | 4.2% | 0.2% | 1.8% |

| OH-Cleveland | 3.5% | 3.1% | 3.5% | 0.9% | 3.2% | |

| OR-Portland | 11.8% | 13.8% | 14.6% | 10.3% | 0.9% | 13.3% |

| TX-Dallas | 8.0% | 9.0% | 9.9% | 6.5% | 7.4% | 6.0% |

| WA-Seattle | 11.8% | 14.9% | 15.1% | 11.9% | 2.9% | 13.0% |

| “National” | 10.1% | 7.6% | 11.9% | 8.4% | 3.7% | 5.6% |

Richmond Fed: "Manufacturing Sector Strengthened, Hiring Remained Modest" in August

by Calculated Risk on 8/27/2013 01:44:00 PM

From the Richmond Fed: Manufacturing Sector Strengthened, Hiring Remained Modest

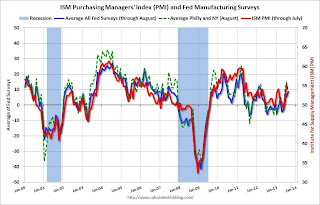

The composite index of manufacturing activity rebounded in August, climbing twenty-five points above the July reading to 14. The components of that index all rose this month, with the index for shipments jumping to 17 from the previous reading of −15 and the index for new orders moving to 16 from −15. ...Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The index for the number of employees moved up to 6 in August following a flat reading a month ago. The indicator for the average manufacturing workweek also gained, picking up six points to post a reading of 8. In addition, average wage growth intensified, pushing the index to 13 from July's reading of 8.

Manufacturers were decidedly upbeat about business prospects for the next six months. The index for expected shipments rose to 36 from July's reading of 24, and the indicator for the volume of new orders added nine points to last month's index to finish the month at a reading of 33. ...

...

Manufacturers planned to increase hiring in the six months ahead; the marker for the number of employees picked up four points to settle at 9, while the index for the average workweek moved up to 10 from last month's reading of 8. Employers also anticipated robust wage growth, pushing that index to 28 in August from 21.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

All of the regional surveys showed expansion in August, and overall at about the same pace as in July. The ISM index for July will be released next Tuesday, Sept 3rd.

Comment on House Prices: Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 8/27/2013 11:04:00 AM

Two key points:

• The Case-Shiller index released this morning was for June, and it is actually a 3 month of average prices in April, May and June. I think price increases have slowed recently based on agent reports (a combination of a little more inventory and higher mortgage rates), but this slowdown in price increases will not show up for several months in the Case-Shiller index because of the reporting lag and because of the three month average. I expect to see smaller year-over-year price increases going forward and some significant deceleration towards the end of the year.

• It appears the Case-Shiller index is currently overstating price increases for most homeowners, both because of the handling of distressed sales and the weighting of some coastal areas.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Earlier: Case-Shiller: Case-Shiller: Comp 20 House Prices increased 12.1% year-over-year in June

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2003 levels (and also back up to Q4 2008), and the Case-Shiller Composite 20 Index (SA) is back to April 2004 levels, and the CoreLogic index (NSA) is back to August 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2000 levels, the Composite 20 index is back to November 2001, and the CoreLogic index back to March 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 2000 levels, the Composite 20 index is back to April 2002 levels, and the CoreLogic index is back to December 2002.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 36% above January 2000. Two cities - Denver and Dallas - are at new highs (no other Case-Shiller Comp 20 city is close). Detroit prices are still below the January 2000 level.

Case-Shiller: Comp 20 House Prices increased 12.1% year-over-year in June

by Calculated Risk on 8/27/2013 09:05:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the Q2 National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Continue Climbing in June 2013 According to the S&P/Case-Shiller Home Price Indices

Data through June 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1Home Price Indices ... showed that prices continue to increase. The National Index grew 7.1% in the second quarter and 10.1% over the last four quarters. The 10-City and 20-City Composites posted returns of 2.2% for June and 11.9% and 12.1% over 12 months. ...

All 20 cities posted gains on a monthly and annual basis. However, in only six cities were prices rising faster this month than last, compared to ten in May. Dallas and Denver reached new all-time highs as they did last month, with returns of +1.7% each in June. ...

“Overall, the report shows that housing prices are rising but the pace may be slowing. Thirteen out of twenty cities saw their returns weaken from May to June. As we are in the middle of a seasonal buying period, we should expect to see the most gains. With interest rates rising to almost 4.6%, home buyers may be discouraged and sharp increases may be dampened." [says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices]

All 20 cities showed positive monthly returns for at least the third consecutive month. Six cities – Charlotte, Cleveland, Las Vegas, Minneapolis, New York and Tampa – showed acceleration. Atlanta took the lead with a return of 3.4% as San Francisco dropped to +2.7% in June from +4.3% in May. New York posted a gain of 2.1%, its highest since July 2002.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 24.1% from the peak, and up 1.1% in June (SA). The Composite 10 is up 15.1% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 23.4% from the peak, and up 0.9% (SA) in June. The Composite 20 is up 15.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 11.9% compared to June 2012.

The Composite 20 SA is up 12.1% compared to June 2012. This was the thirteen consecutive month with a year-over-year gain and it appears the YoY change might be starting to slow.

Prices increased (SA) in 15 of the 20 Case-Shiller cities in June seasonally adjusted. Prices in Las Vegas are off 50.2% from the peak, and prices in Denver and Dallas are at new highs.

This was close to the consensus forecast for a 12.2% YoY increase. I'll have more on prices later.

Monday, August 26, 2013

Tuesday: Case-Shiller House Prices, Consumer Confidence, Richmond Fed Mfg Survey

by Calculated Risk on 8/26/2013 09:31:00 PM

A very disappointing report from CNBC tonight: Obama source predicts Summers will be named Fed chief soon

A source from Team Obama told CNBC that Larry Summers will likely be named chairman of the Federal Reserve in a few weeks though he is "still being vetted" so it might take a little longer.I don't think Summers is a good choice for Fed Chair. Also I doubt any delay is because he is still being vetted, more likely they are still trying to find the confirmation votes in the Senate.

Tuesday:

• 9:00 AM ET, S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May, and June. The consensus is for a 12.2% year-over-year increase in the Composite 20 index (NSA) for June. The Zillow forecast is for the Composite 20 to increase 12.1% year-over-year, and for prices to increase 1.1% month-to-month seasonally adjusted.

• At 10:00 AM, Conference Board's consumer confidence index for August. The consensus is for the index to decrease to 78.0 from 80.3.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 0 for this survey, up from minus 11 in July (Above zero is expansion).

Weekly Update: Existing Home Inventory is up 21.4% year-to-date on Aug 26th

by Calculated Risk on 8/26/2013 06:00:00 PM

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for July). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.4%, and there might be some further increases over the next few weeks. It is important to remember that inventory is still very low, and is down 5.7% from the same week last year according to Housing Tracker.

This strongly suggests inventory bottomed early this year. I expect inventory to be up year-over-year very soon (maybe in September), and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory also means price increases will slow.

NY Times: "For Laid-Off Older Workers, Age Bias Is Pervasive"

by Calculated Risk on 8/26/2013 04:56:00 PM

A sad story from Michael Winerip at the NY Times: For Laid-Off Older Workers, Age Bias Is Pervasive

[A] substantial number of older workers who lost jobs — even those lucky enough to be re-employed — are still suffering. Two-thirds in that age group who found work again are making less than they did in their previous job; their median salary loss is 18 percent compared with a 6.7 percent drop for 20- to 24-year-olds.I think the age groups that are hit the hardest by a recession are those just entering the workforce, and those nearing retirement. For those entering the workforce, it is tough to find that first job - and they face a long period of lower wages. For those who are laid-off nearing retirement, it is very difficult to find a new job and learn new skills ... and the pay is usually substantially less.

The re-employment rate for 55- to 64-year-olds is 47 percent and 24 percent for those over 65, compared with 62 percent for 20- to 54-year-olds. And finding another job takes far longer: 46 weeks for boomers, compared with 20 weeks for 16- to 24-year-olds.