by Calculated Risk on 8/23/2013 10:00:00 AM

Friday, August 23, 2013

New Home Sales decline sharply to 394,000 Annual Rate in July

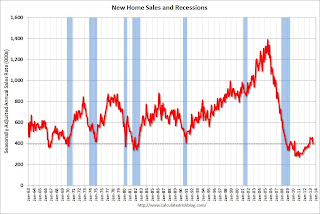

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 394 thousand. This was down from 455 thousand SAAR in June (June sales were revised down from 497 thousand).

April sales were revised down from 453 thousand to 446 thousand, and May sales were revised down from 459 thousand to 439 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in July 2013 were at a seasonally adjusted annual rate of 394,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 13.4 percent below the revised June rate of 455,000, but is 6.8 percent above the July 2012 estimate of 369,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply increased in July to 5.2 months from 4.3 months in June.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of July was 171,000. This represents a supply of 5.2 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is near the record low. The combined total of completed and under construction is increasing, but still very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In July 2013 (red column), 35 thousand new homes were sold (NSA). Last year 33 thousand homes were sold in July. The high for July was 117 thousand in 2005, and the low for July was 26 thousand in 2010.

This was well below expectations of 487,000 sales in July, and a very weak report. I'll have more later today.

Jackson Hole Economic Symposium Agenda

by Calculated Risk on 8/23/2013 08:26:00 AM

Note: the presented papers are usually posted to the Kansas City Fed's site fairly quickly. On twitter.

2013 Economic Symposium: Global Dimensions of Unconventional Monetary Policy. Times listed on program are Mountain Standard Time.

Friday Aug 23rd

Chair: Stanley Fischer, former Governor, Bank of Israel

8:00 AM: “The Natural Rate of Interest, Financial Crises and the Zero Lower Bound,” presented by Robert E. Hall, Stanford University, Discussant: Hyun Song Shin, professor, Princeton University

9:00 AM" “The Transmission of Unconventional Monetary Policy” presented by Arvind Krishnamurthy, Northwestern University

Discussant: Anil Kashyap, professor, University of Chicago

10:25 AM: Panel on Monetary Policy Options and Tools. Panelists: Augustin Carstens, Governor, Bank of Mexico, David Daokui Li, professor, Tsinghua University, Frank Smets, Director General of Directorate General Research, European Central Bank

12:15 PM: Luncheon Address by Christine Lagarde, Managing Director, International Monetary Fund

Saturday Aug 24th

Chair: Janet Yellen, vice chair, Board of Governors of the Federal Reserve System

8:00 AM: “Global Liquidity” presented by Jean-Pierre Landau, fellow, Sciences Po, Discussant: Claudio Borio, Bank of International Settlements

9:00 AM: “Cross-Border Capital Flows” presented by Helene Rey, professor, London Business School, Discussant: Terrence Checki, executive vice president, New York Fed

10:25 AM: Overview Panel. Panelists: Charles Bean, deputy governor, Bank of England, Haruhiko Kuroda, governor, Bank of Japan

Thursday, August 22, 2013

Friday: New Home Sales

by Calculated Risk on 8/22/2013 07:09:00 PM

An excellent review of Bernanke's years at the Federal Reserve from Binyamin Appelbaum at the NY Times: Bernanke, the Audacious Pragmatist. A few excerpts:

The recession, prompted by the collapse of the housing bubble that Mr. Bernanke — and most other experts — failed to see coming, ended an era of minimalism in central banking. And there is no better marker than the views of Mr. Bernanke, the world’s most influential central banker, who now argues that the Fed needs to consider a range of previously unthinkable actions, including trying to pop bubbles when necessary, because sometimes the cost of doing nothing is worse.Some random comments: I think Bernanke was slow to recognize the problem, but once he did he was effective (see my post from Feb 2011: I come to praise Bernanke).

Mr. Bernanke, who plans to step down in January after eight years as Fed chairman, will be remembered for helping to arrest the collapse of the financial system in 2008. This shy, methodical economist who had been expected to serve as the keeper of Alan Greenspan’s flame — to preserve the Fed’s hard-won success in moderating inflation — emerged under pressure as perhaps the most innovative and daring leader in the Fed’s history.

But what Mr. Bernanke did after the crisis may prove to have even more enduring influence. For almost three decades, the Fed focused on moderating inflation in the belief that this was the best and only way to help the economy. In the wake of the crisis, Mr. Bernanke forged a broader vision of the Fed’s responsibilities, starting experimental, incomplete campaigns to reduce unemployment and to prevent future crises.

“The thing I think he’ll be known for, if it lasts, is depersonalizing the institution,” Professor Gertler said.

I don't know about "most" experts missing the housing bubble, but clearly most people in government missed the bubble (I wrote Speculation is the Key in April 2005 - and housing was almost all I wrote about during that period - I was very worried). There were quite a few other people warning about the bubble too (Tom Lawler, Dean Baker, Paul Krugman, and many others).

I argued in the '90s that the Fed should try to "pop" the stock bubble by a combination of speeches, increases in interest rates, and increases in margin requirements. I made similar arguments in the mid-00s about housing (I urged regulators to push for tighter lending standards). Not all bubbles are obvious, but the stock and housing bubbles were pretty clear - and I'm glad to see the thinking at the Fed has changed.

Also as Professor Gertler noted, Bernanke did a good job of "depersonalizing the institution" (hopefully we won't go back to a Greenspan type personality). Also the changes at the Fed - to be more open, hold press conferences (I think there should be a presser after every FOMC meeting), setting a formal 2% inflation target, stress testing the banks - in addition to the monetary policy response, have all improved the institution.

There will be many more laudatory articles for Chairman Bernanke - well deserved. The bottom line is we were lucky to have him as Fed Chair during the worst of the crisis (there is still work to be done).

Friday:

• At 8:30 AM ET, New Home Sales for July from the Census Bureau. The consensus is for a decrease in sales to 487 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 497 thousand in June. Based on the homebuilder reports, there will probably be some downward revisions to sales for previous months.

Freddie Mac: Mortgage Rates at highest level since 2011

by Calculated Risk on 8/22/2013 03:41:00 PM

From Freddie Mac today: Mortgage Rates up on Taper Timing Speculation

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates following bond yields higher, and reaching new highs for the year, with the expectant release of the Fed's comments around taper timing of its bond purchase program. ...

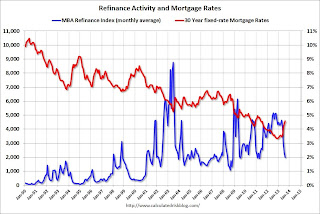

30-year fixed-rate mortgage (FRM) averaged 4.58 percent with an average 0.8 point for the week ending August 22, 2013, up from last week when it averaged 4.40 percent. A year ago at this time, the 30-year FRM averaged 3.66 percent.

15-year FRM this week averaged 3.60 percent with an average 0.7 point, up from last week when it averaged 3.44 percent. A year ago at this time, the 15-year FRM averaged 2.89 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index has dropped sharply recently (down 62% over the last 3 months) and will probably decline further if rates stay at this level.

The second graph shows mortgage rates and new home sales since 1971. I'll have more on this soon.

The second graph shows mortgage rates and new home sales since 1971. I'll have more on this soon.

Philly Fed: State Coincident Indexes increased in 34 states in July

by Calculated Risk on 8/22/2013 01:12:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2013. In the past month, the indexes increased in 34 states, decreased in nine states, and remained stable in seven, for a one-month diffusion index of 50. Over the past three months, the indexes increased in 38 states, decreased in nine, and remained stable in three, for a three-month diffusion index of 58.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In July, 38 states had increasing activity, the same as in June (including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.There are several states with declining activity again.

Kansas City Fed: Regional Manufacturing Activity "Improved Further" in August

by Calculated Risk on 8/22/2013 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Improved Further

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity improved further, and producers’ expectations also edged higher after easing last month.A few industry comments from the survey:

“Although some District firms noted weakness in August associated with federal spending cuts and difficulties finding workers, we were encouraged to see another solid gain in our composite index and most of its components,” said Wilkerson

The month-over-month composite index was 8 in August, up from 6 in July and -5 in June ... production index remained solid at 21, and the new orders and order backlog indexes also rose moderately. The new orders for exports index edged higher from 2 to 4, and the employment index moved into positive territory for the first time in six months.

emphasis added

“More projects are being delayed by government-related entities.”Earlier today Markit released their Flash PMI: Manufacturing recovery gains momentum as order growth hits seven-month high

“Our defense business is down significantly.”

“Sequestration is hitting us very hard. The heavy infrastructure market is way down due to lack of federal spending.”

The Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) signalled the strongest improvement in manufacturing business conditions in five months during August. The flash PMI index, which is based on approximately 85% of usual monthly replies, was up slightly from July’s 53.7 to 53.9, and suggested a moderate expansion of the manufacturing sector.The Dallas and Richmond Fed regional surveys for August will be released early next week. So far the regional surveys (and the Markit Flash PMI) suggest continued expansion for manufacturing in August.

Firms received a larger volume of new orders in August, with a number of companies linking this to greater demand and new client wins. Moreover, the rate of growth was strong and, having accelerated for the fourth month running, the fastest since January.

...

Manufacturing employment increased for the second month running in August. The rate of job creation was moderate and, having quickened slightly since July, the fastest in four months. Firms that hired additional staff generally cited increased workloads.

Weekly Initial Unemployment Claims increase to 336,000, Four Week Average Lowest since November 2007

by Calculated Risk on 8/22/2013 08:30:00 AM

The DOL reports:

In the week ending August 17, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 13,000 from the previous week's revised figure of 323,000. The 4-week moving average was 330,500, a decrease of 2,250 from the previous week's revised average of 332,750.

The previous week was revised up from 320,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 330,500.

The 4-week average is at the lowest level since November 2007 (before the recession started). Claims were above the 329,000 consensus forecast.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

Wednesday, August 21, 2013

Thursday: Unemployment Claims

by Calculated Risk on 8/21/2013 09:13:00 PM

Probably the key sentences in the FOMC minutes released today were:

In considering the likely path for the Committee's asset purchases, members discussed the degree of improvement in the labor market outlook since the purchase program began last fall. The unemployment rate had declined considerably since then, and recent gains in payroll employment had been solid. However, other measures of labor utilization--including the labor force participation rate and the numbers of discouraged workers and those working part time for economic reasons--suggested more modest improvement, and other indicators of labor demand, such as rates of hiring and quits, remained low. While a range of views were expressed regarding the cumulative improvement in the labor market since last fall, almost all Committee members agreed that a change in the purchase program was not yet appropriate.This is a reminder that the FOMC is looking at more than improvement in the headline payroll numbers and the unemployment rate.

emphasis added

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 329 thousand from 320 thousand last week.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash for August. The consensus is for an increase to 53.5 from 53.2 in July.

• Also at 9:00 AM, the FHFA House Price Index for June 2013. This was originally a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.6% increase.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5 for this survey, down from 6 in July (Above zero is expansion).

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in July

by Calculated Risk on 8/21/2013 06:32:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for selected cities in July.

From CR: Look at the two columns in the table for Total "Distressed" Share. The share of distressed sales is down year-over-year in every area.

Also there has been a decline in foreclosure sales in all of these areas (except Springfield, Ill).

And short sales are now declining year-over-year too! This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly staying steady or declining slightly. The all cash share will probably decline as investors decrease their buying.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | |

| Las Vegas | 28.0% | 40.0% | 8.0% | 20.7% | 36.0% | 60.7% | 54.5% | 54.8% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 11.5% | 29.5% | 9.4% | 14.6% | 20.8% | 44.1% | 35.8% | 44.9% |

| Sacramento | 19.7% | 31.0% | 7.3% | 23.2% | 27.0% | 54.2% | 25.5% | 31.1% |

| Minneapolis | 5.6% | 9.3% | 15.0% | 24.5% | 20.6% | 33.8% | ||

| Mid-Atlantic | 7.2% | 11.3% | 6.6% | 8.7% | 13.8% | 20.0% | 16.1% | 17.9% |

| Orlando | 12.8% | 28.2% | 17.3% | 23.4% | 30.1% | 51.6% | 47.6% | 49.7% |

| California (DQ)* | 14.6% | 26.0% | 8.4% | 21.7% | 23.0% | 47.7% | ||

| Bay Area CA (DQ)* | 10.0% | 23.7% | 4.8% | 15.1% | 14.8% | 38.8% | 24.0% | 27.6% |

| So. California (DQ)* | 14.5% | 26.2% | 7.8% | 20.7% | 22.3% | 46.9% | 29.4% | 31.8% |

| Florida SF | 13.8% | 21.6% | 15.9% | 17.5% | 29.7% | 39.2% | 42.5% | 42.8% |

| Florida C/TH | 11.0% | 19.2% | 15.4% | 17.5% | 26.5% | 36.8% | 70.0% | 72.9% |

| Miami MSA SF | 17.4% | 23.0% | 12.6% | 16.5% | 30.0% | 39.5% | 44.0% | 43.1% |

| Miami MSA C/TH | 12.8% | 20.5% | 17.5% | 19.6% | 30.3% | 40.1% | 75.5% | 78.3% |

| Northeast Florida | 32.5% | 42.6% | ||||||

| Chicago | 29.0% | 36.0% | ||||||

| Rhode Island | 13.9% | 24.7% | ||||||

| Charlotte | 9.5% | 13.8% | ||||||

| Toledo | 35.0% | 36.5% | ||||||

| Wichita | 24.1% | 25.3% | ||||||

| Knoxville | 25.7% | 26.5% | ||||||

| Des Moines | 15.1% | 18.0% | ||||||

| Peoria | 18.6% | 20.7% | ||||||

| Tucson | 29.1% | 33.1% | ||||||

| Omaha | 15.9% | 15.6% | ||||||

| Pensacola | 30.0% | 31.2% | ||||||

| Akron | 25.5% | 30.0% | ||||||

| Houston | 7.8% | 16.3% | ||||||

| Memphis* | 16.7% | 26.9% | ||||||

| Birmingham AL | 17.2% | 27.2% | ||||||

| Springfield IL | 13.1% | 13.0% | ||||||

| *share of existing home sales, based on property records | ||||||||

AIA: "Positive Trend Continues for Architecture Billings Index" in July

by Calculated Risk on 8/21/2013 04:18:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Positive Trend Continues for Architecture Billings Index

The Architecture Billings Index (ABI) saw a jump of more than a full point last month, indicating acceleration in the growth of design activity nationally. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 52.7, up from a mark of 51.6 in June. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 66.7, up dramatically from the reading of 62.6 the previous month.

"There continues to be encouraging signs that the design and construction industry continues to improve,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But we also hear a wide mix of business conditions all over the country, ranging from outstanding and booming to slowly improving to flat. In fact, plenty of architecture firms are reporting very weak business conditions as well, so it is premature to declare the entire sector has entered an expansion phase.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.7 in July, up from 51.6 in June. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 11 of the last 12 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The increases in this index over the past year suggest some increase in CRE investment in the second half of 2013.