by Calculated Risk on 8/22/2013 03:41:00 PM

Thursday, August 22, 2013

Freddie Mac: Mortgage Rates at highest level since 2011

From Freddie Mac today: Mortgage Rates up on Taper Timing Speculation

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates following bond yields higher, and reaching new highs for the year, with the expectant release of the Fed's comments around taper timing of its bond purchase program. ...

30-year fixed-rate mortgage (FRM) averaged 4.58 percent with an average 0.8 point for the week ending August 22, 2013, up from last week when it averaged 4.40 percent. A year ago at this time, the 30-year FRM averaged 3.66 percent.

15-year FRM this week averaged 3.60 percent with an average 0.7 point, up from last week when it averaged 3.44 percent. A year ago at this time, the 15-year FRM averaged 2.89 percent.

Click on graph for larger image.

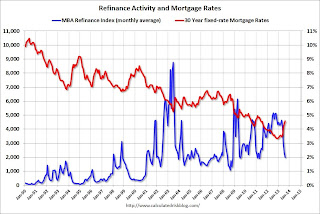

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index has dropped sharply recently (down 62% over the last 3 months) and will probably decline further if rates stay at this level.

The second graph shows mortgage rates and new home sales since 1971. I'll have more on this soon.

The second graph shows mortgage rates and new home sales since 1971. I'll have more on this soon.