by Calculated Risk on 8/15/2013 02:59:00 PM

Thursday, August 15, 2013

FNC: House prices increased 3.7% year-over-year in June

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Up 0.6% in June; Signs of Sustainable Recovery At Large

The latest FNC Residential Price Index™ (RPI) shows that the U.S. housing recovery continues to take hold with home prices nationwide rising a modest 0.6% in June. The index is reaching a two-year high after rising 16 straight months. The 16-month rising streak has lifted home prices by 7.6% since February 2012─the month in which the housing market bottomed out.Note: This increase is partially seasonal. This year prices were up 0.6% in June (from May). Last year, in June 2012, prices were up 0.9% - so this is slower seasonal price appreciation this year.

According to the FNC RPI, the pace of the price improvement in the ongoing recovery is much more modest than indicated by a number of other closely watched home price indices, with some of the largest differences seen in the San Francisco, Los Angeles, Atlanta, Miami, Chicago, Minneapolis, Seattle, and Washington D.C. markets. The difference may be due to these other indices being based on pairs of repeat sales, many of which are distressed properties in a prior sale. Other factors that may impact this divergence include the growing influence of new home sales, which are not included in repeat sales indices, and a disproportionate number of low value home sales relative to the housing stock. As an indicator of the underling home price trend, the FNC RPI excluded distressed sales and includes new home sales.

Housing market fundamentals continue to improve amid a moderately improving economy. Foreclosure sales have dropped to the 2007 levels before the collapse of the housing market—a strong indicator of strengthening conditions on the supply side. In June, foreclosure sales accounted for 13.5% of total home sales, down from 14.3% in May and 18.6% a year ago.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that June home prices increased from the previous month at a seasonally unadjusted rate of 0.6%. 1On a year-over-year basis, home prices were up a modest 3.7% from a year ago. FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes.

emphasis added

The year-over-year change slowed in June, with the 100-MSA composite up 3.7% compared to June 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals. Even with the recent increase, the FNC composite 100 index is still off 27.9% from the peak.

I expect all of the housing price indexes to start showing lower year-over-year prices gains as price increases slow.

Key Measures Show Low Inflation in July

by Calculated Risk on 8/15/2013 01:00:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for July here. Motor fuel increased at a 2% annualized rate in July, but will probably show a decrease in August.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (1.9% annualized rate) in July. The CPI less food and energy increased 0.2% (1.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.8%, the CPI rose 2.0%, and the CPI less food and energy rose 1.7%. Core PCE is for June and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.7% annualized, and core CPI increased 1.9% annualized. Also core PCE for June increased 2.6% annualized.

Inflation is still mostly below the Fed's target.

NAHB: Builder Confidence increases in August to 59, Highest in almost 8 Years

by Calculated Risk on 8/15/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 3 points in August to 59. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Three Points in August

Builder confidence in the market for newly built, single-family homes rose three points to 59 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for August, released today. This fourth consecutive monthly gain brings the index to its highest level in nearly eight years.

“Builder confidence continues to strengthen along with rising demand for a limited supply of new and existing homes in most local markets,” noted NAHB Chief Economist David Crowe. “However, this positive momentum is being slowed by the ongoing headwinds of tight credit and low supplies of finished lots and labor.”

...

Two of the HMI’s three components posted gains in August. The component gauging current sales conditions rose three points to 62, while the component gauging sales expectations in the next six months gained a single point to 68 and the component gauging traffic of prospective buyers held unchanged at 45.

All but one region saw a gain in its three-month moving average HMI score in August. The Midwest and West each posted six-point increases, to 60 and 57, respectively, while the South posted a four-point gain to 54 and the Northeast held unchanged at 39.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the August release for the HMI and the June data for starts (July housing starts will be released tomorrow). This was above the consensus estimate of a reading of 57.

Fed: Industrial Production unchanged in July

by Calculated Risk on 8/15/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

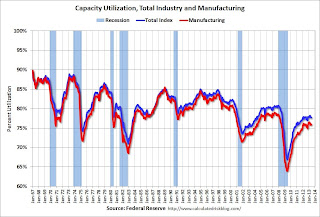

Industrial production was unchanged in July after having gained 0.2 percent in June. In July, manufacturing production declined 0.1 percent. The output of mines advanced 2.1 percent, its fourth consecutive monthly increase, and the production of utilities fell 2.1 percent, its fourth consecutive monthly decrease. At 98.9 percent of its 2007 average, total industrial production in July was 1.4 percent above its year-earlier level. Capacity utilization for total industry edged down 0.1 percentage point to 77.6 percent in July, a rate 0.3 percentage point below its level of a year earlier and 2.6 percentage points below its long-run (1972-2012) average

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in July at 98.9. This is 18.1% above the recession low, but still 1.9% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.3% increase in Industrial Production in July, and for Capacity Utilization to increase to 77.9%.

Weekly Initial Unemployment Claims at 320,000, Four Week Average Lowest since 2007

by Calculated Risk on 8/15/2013 08:30:00 AM

The DOL reports:

In the week ending August 10, the advance figure for seasonally adjusted initial claims was 320,000, a decrease of 15,000 from the previous week's revised figure of 335,000. The 4-week moving average was 332,000, a decrease of 4,000 from the previous week's revised average of 336,000.

The previous week was revised up from 333,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 332,000.

The 4-week average is at the lowest level since November 2007 (before the recession started). Claims were below the 330,000 consensus forecast.

Wednesday, August 14, 2013

Thursday: Unemployment Claims, CPI, Philly & NY Fed Mfg Surveys, Industrial Production, Builder Confidence

by Calculated Risk on 8/14/2013 07:52:00 PM

First, here is a price index for commercial real estate that I follow. From CoStar: Commercial Real Estate Prices See Midyear Surge

COMMERCIAL REAL ESTATE PRICES SURGE IN SECOND QUARTER 2013: On the strength of improving market fundamentals, the two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — continued their upward trend in June. The value-weighted index, which is influenced by larger transactions and generally tracks with high quality core real estate properties, gained 5.9% in the second quarter, its best quarterly showing since 2011. Meanwhile, the equal-weighted index, which is comprised of smaller, more numerous transactions representative of the lower end of the market, jumped by an impressive 9.1% in the second quarter, its strongest quarterly gain on record.Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

...

RETAIL TURNS IN STRONGEST PERFORMANCE OF MAJOR PROPERTY TYPES: Stronger consumer spending and a near dearth in new construction helped to bolster pricing gains for retail properties as reflected in the 16% gain in the CCRSI Retail Index over the past 12-month period ending in the second quarter, the strongest performance of the four major property types. Meanwhile, pricing in the Office Index advanced by 11.4%, while the Multifamily Index gained a more modest 11.1% year over year.

...

DISTRESS SALES CONTINUE TO ABATE: The percentage of commercial property selling at distressed prices dropped to just 13.6% in June 2013, down from nearly 24% one year earlier, the lowest level of distress recorded since the end of 2008. The long-term average for distress trading is less than 1% of total volume, so the recovery still has a ways to go, but the recent declines have helped to boost liquidity and pricing by giving lenders more confidence to do deals.

emphasis added

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 333 thousand last week.

• Also at 8:30 AM, the Consumer Price Index for July. The consensus is for a 0.2% increase in CPI in July and for core CPI to increase 0.2%.

• Also at 8:30 AM: the NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 10.0, up from 9.5 in July (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

• At 10:00 AM, the August NAHB homebuilder survey. The consensus is for a reading of 57, the same as in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of 15.8, down from 19.8 last month (above zero indicates expansion).

DataQuick: SoCal Home Sales "Jump" in July, Fewest Foreclosures since 2007

by Calculated Risk on 8/14/2013 04:24:00 PM

CR Note: So far the regional data suggests a strong increase for existing home sales in July. If so, my guess is there was a rush to close while buyers had mortgage rates locked in - and sales will decline in August.

From DataQuick: Southland Home Sales Jump in July

Southern California home sales surged in July, rising to an eight-year high for that month as buyers found more homes for sale. ... A total of 25,419 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 17.6 percent from 21,608 sales in June, and up 23.5 percent from 20,588 sales in July 2012, according to San Diego-based DataQuick.This is moving in the right direction (fewer distressed sales, fewer absentee buyers). However I expect existing home sales to decline in August after the jump in July.

Last month’s sales approached a historically normal level. They were 0.5 percent below the average number of sales – 25,541 – in the month of July since 1988, when DataQuick’s statistics begin. Southland sales haven’t been above average for any particular month in more than seven years.

In a sign of continued market confidence, Southern California home buyers continue to put near-record amounts of their own money into residential real estate. In July they paid a total of $5.39 billion out of their own pockets in the form of down payments or cash purchases. That was up from $5.25 billion in June and up from $3.61 billion a year ago.

“July home sales came in very strong, and we think a lot of the increase in activity can be chalked up to a rising inventory of homes for sale. The jump in mortgage rates a couple of months back might have spurred more buying, too. The market continues its rebalancing act, with more and more people who’ve been ‘underwater’ now able to sell their homes at a profit, or at least break even. As the mismatch between supply and demand eases, it will be more difficult for home prices to rise as steeply as we’ve seen over the past year,” said John Walsh, DataQuick president.

In July foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 7.8 percent of the Southland resale market. That was down from a revised 9.0 percent the month before and down from 20.7 percent a year earlier. Last month’s foreclosure resale rate was the lowest since it was 7.3 percent in June 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 14.5 percent of Southland resales last month. That was the lowest level since it was 14.1 percent in May 2009. Last month’s short sale figure was down from an estimated 16.1 percent the month before and down from 26.2 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 27.4 percent of the Southland homes sold last month, which is the lowest share for any month this year. Last month’s level was down from 28.6 percent in June and down slightly from 27.5 percent a year earlier.

emphasis added

By Request: U.S. Population by Age (earlier was by distribution), 1900 through 2060

by Calculated Risk on 8/14/2013 01:21:00 PM

By request here is an animation of the U.S population by age (as opposed to by distribution), from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Also - by request - I've slowed the animation down to 2 seconds per slide (and included a slower distribution animation below).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

Animation updates every two seconds.

Notes: Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

The second graph is by distribution (updates every 2 seconds).

NY Fed: Household Debt declined in Q2 as Deleveraging Continues

by Calculated Risk on 8/14/2013 11:00:00 AM

From the NY Fed: Auto Loan Balances Increase for Ninth Straight Quarter, New York Fed Report Shows

In its latest Household Debt and Credit Report, the Federal Reserve Bank of New York announced that outstanding household debt declined by $78 billion from the previous quarter, due in large part to a decline in housing-related debt. Total auto loan balances increased $20 billion from the previous quarter, the ninth consecutive quarterly increase and the largest quarter over quarter increase since 2006. ...Here is the Q2 report: Household Debt and Credit Report

In Q2 2013 total household indebtedness fell to $11.15 trillion; 0.7 percent lower than the previous quarter and 12 percent below the peak of $12.68 trillion in Q3 2008. Mortgages, the largest component of household debt, fell $91 billion from the first quarter.

“Although overall debt declined in the second quarter, households did increase non-housing debt, led by rising auto loan balances,” said Andrew Haughwout, vice president and research economist at the New York Fed. “Furthermore, households improved their overall delinquency rates for the seventh straight quarter, an encouraging sign going forward.”

emphasis added

Mortgages, the largest component of household debt, fell in the second quarter of 2013, although the fall was in part due to reporting gaps associated with the servicing transfer of a higher-than-usual number of loans. Mortgage balances shown on consumer credit reports stand at $7.84 trillion, down $91 billion from the level in the first quarter of 2013. Balances on home equity lines of credit (HELOC) dropped by $12 billion (2.2%) and now stand at $540 billion. Household non-housing debt balances increased by 0.9%, bolstered by gains of $20 billion in auto loan balances, $8 billion in student loan balances, and $8 billion in credit card balances.Here are two graphs from the report:

...

About 380,000 consumers had a bankruptcy notation added to their credit reports in 2013Q2, a 4.8% drop from the same quarter last year, the tenth consecutive quarter with a drop in bankruptcies on a year-over-year basis.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased in Q2.

Although overall debt is decreasing, Student debt (red) is still increasing. From the NY Fed:

Outstanding student loan balances increased to $994 billion as of June 30, 2013, a $8 billion uptick from the first quarter

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Delinquency rates improved considerably in 2013Q2. As of June 30, 7.6% of outstanding debt was in some stage of delinquency, compared with 8.1% in 2013Q1. About $845 billion of debt is delinquent, with $635 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

MBA: Mortgage Applications decrease in Latest Weekly Survey

by Calculated Risk on 8/14/2013 08:31:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 9, 2013. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.56 percent from 4.61 percent, with points decreasing to 0.39 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

...

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.60 percent from 3.66 percent, with points decreasing to 0.35 from 0.43 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates up over the last 3 months, refinance activity has fallen sharply, decreasing in 12 of the last 14 weeks.

This index is down 59% over the last 3 months. The last time the index declined this far was in late 2010 and early 2011 when mortgage increased sharply with the Ten Year Treasury rising from 2.5% to 3.5%. We've seen a similar increase over the last few months with the Ten Year Treasury yield up from 1.6% to over 2.7% today.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 7% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 7% from a year ago.