by Calculated Risk on 8/07/2013 07:03:00 AM

Wednesday, August 07, 2013

MBA: Mortgage Applications mostly unchanged in Latest Weekly Survey

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 2, 2013. ...

The Refinance Index was unchanged from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.61 percent from 4.58 percent, with points increasing to 0.42 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

...

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.66 percent from 3.67 percent, with points increasing to 0.43 from 0.40 (including the origination fee) for 80 percent LTV loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates up over the last 3 months, refinance activity has fallen sharply, decreasing in 11 of the last 13 weeks.

This index is down 57% over the last 13 weeks.

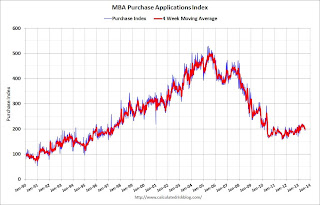

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last month), and the 4-week average of the purchase index is up about 7% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last month), and the 4-week average of the purchase index is up about 7% from a year ago.

Tuesday, August 06, 2013

Wednesday: Mortgage Applications Index, Consumer Credit

by Calculated Risk on 8/06/2013 06:59:00 PM

From Tim Duy: Crazy Fedspeak

There are two interviews of note hitting the wires today. One is with Atlanta Federal Reserve President Dennis Lockhart, in which he leaves open the possibility of a September beginning to the tapering process. ... then we see the comments of Chicago Federal Reserve President and noted dove Charles Evans ... via the Wall Street Journal:Wednesday:

During a breakfast briefing with reporters Mr. Evans said, “I clearly would not rule that out,” when asked if the Fed might begin throttling back on its asset purchases at the Federal Reserve‘s Sept. 17-18 policy meeting....... If Evans thinks it is possible, then it must be very possible, despite only another month's data between now and then.

...The Fed is “quite likely to reduce the flow purchase rate starting later this year,” Mr. Evans said. “I couldn’t tell you exactly which month that will be.”

...

Bottom Line: I think the Fed very much wants to taper in September, and hence why I am wary to believe we need to see some significant acceleration in the data to push them in that direction.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 1:00 PM, President Barack Obama will answer questions about housing in an event hosted by Zillow CEO Spencer Rascoff. Submit questions here. The virtual event will be streamed on zillow.com/whitehouse and Whitehouse.gov.

• At 3:00 PM, Consumer Credit for June from the Federal Reserve. The consensus is for credit to increase $15.0 billion in June.

Tract Houses: "From the low $1 Millions"

by Calculated Risk on 8/06/2013 04:18:00 PM

Just a screen grab from a Jim the Realtor video. Jim says "That doesn't seem right."

No kidding ...

Click on picture for larger image.

Trulia: "Asking Home Price Slowdown Amid Rising Mortgage Rates, Expanding Inventory, and Declining Investor Interest"

by Calculated Risk on 8/06/2013 01:36:00 PM

This was released earlier today: Trulia Reports Asking Home Price Slowdown Amid Rising Mortgage Rates, Expanding Inventory, and Declining Investor Interest

Asking home prices are now starting to lose steam as mortgage rates rise, inventory expands, and investor demand declines. Nationally, asking prices dropped 0.3 percent in July – the first month-over-month (M-o-M) decline since November 2012. Seasonally adjusted, prices rose 3.3 percent quarter-over quarter (Q-o-Q), down from a peak of 4.2 percent in April. Year-over-year (Y-o-Y), prices are up 11 percent nationally; however, this change is an average over the past 12 months and is therefore slower to show changes than monthly and quarterly numbers.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests slower house price increases over the next few months on a seasonally adjusted basis.

In 64 out of 100 U.S. metros, the quarterly asking home price gain was lower than in the previous quarter. This slowdown was most apparent in the West Coast where prices have rebounded strongly already. Among housing markets where asking prices rose sharply Y-o-Y, price gains dipped the most Q-o-Q in Las Vegas, Oakland, and San Francisco. ...

Rents rose 3.9 percent year-over-year nationally, which was a big increase compared with inflation or income growth, but small compared with asking home price gains. Even as asking home prices slow down, July was the first time that prices outpaced rents in the 25 largest rental markets since Trulia started tracking rent trends in March 2011. ...

If you were worried about a housing bubble, July’s asking-price slowdown will probably be the best news you’ve heard this year,” said Jed Kolko, Trulia’s Chief Economist. “The asking home price slowdown in July could be the start of the return to normal price gains. The blazing fast price increases we’ve seen in recent months could not last, especially with rising mortgage rates, expanding inventory, and declining investor interest.”

emphasis added

More from Kolko: Bubblephobes, Rejoice: Asking Home Prices Declined in July

BLS: Job Openings little changed in June

by Calculated Risk on 8/06/2013 11:16:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.9 million job openings on the last business day of June, little changed from May, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.1 percent) and separations rate (3.0 percent) also were little changed in June. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in June for total nonfarm, total private, government, all industries, and all four regions.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in June to 3.936 million, up from 3.907 million in May. The number of job openings (yellow) is the highest since 2008, but openings are only up 4% year-over-year compared to June 2012.

Quits were down in June, and quits are up about 1% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

CoreLogic: House Prices up 11.9% Year-over-year in June

by Calculated Risk on 8/06/2013 10:02:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

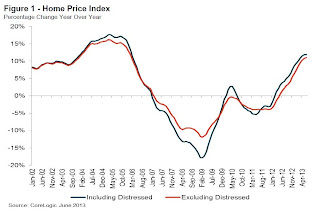

From CoreLogic: CoreLogic Reports June Home Prices Rise by 11.9 Percent Year Over Year

Home prices nationwide, including distressed sales, increased 11.9 percent on a year-over-year basis in June 2013 compared to June 2012. This change represents the 16th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 1.9 percent in June 2013 compared to May 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 11 percent in June 2013 compared to June 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1.8 percent in June 2013 compared to May 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that July 2013 home prices, including distressed sales, are expected to rise by 12.5 percent on a year-over-year basis from July 2012 and rise by 1.8 percent on a month-over-month basis from June 2013.

...

“In the first six months of 2013, the U.S. housing market appreciated a remarkable 10 percent,” said Dr. Mark Fleming, chief economist for CoreLogic. “This trend in home price gains is moving at the fastest pace since 1977.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.9% in June, and is up 11.9% over the last year. This index is not seasonally adjusted, and this is usually the strongest time of the year for price increases.

The index is off 19% from the peak - and is up 20.7% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for sixteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for sixteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This matches the largest year-over-year increase since 2006.

This was another very strong month-to-month increase.

Trade Deficit decreased in June to $34.2 Billion

by Calculated Risk on 8/06/2013 08:56:00 AM

The Department of Commerce reported this morning:

[T]otal June exports of $191.2 billion and imports of $225.4 billion resulted in a goods and services deficit of $34.2 billion, down from $44.1 billion in May, revised. June exports were $4.1 billion more than May exports of $187.1 billion. June imports were $5.8 billion less than May imports of $231.2 billion.The trade deficit was lower than the consensus forecast of $43.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through June 2013.

Click on graph for larger image.

Click on graph for larger image.Imports decreased in June, and exports increased.

Exports are 15% above the pre-recession peak and up 3% compared to June 2012; imports are 3% below the pre-recession peak, and down 1% compared to June 2012 (mostly moving sideways).

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $96.93 in June, up slightly from $96.84 in May, and down from $100.13 in June 2012.

The trade deficit with the euro area was $6.1 billion in June, down from $6.9 billion in June 2012.

The trade deficit with China decreased to $26.6 billion in June, down from $27.5 billion in June 2012. Most of the trade deficit is related to oil and China. And most of the recent improvement in the trade deficit is related to a decline in the volume of imported petroleum.

Monday, August 05, 2013

Tuesday: Trade Deficit, Job Openings

by Calculated Risk on 8/05/2013 09:16:00 PM

From Nick Timiraos at the WSJ: Obama to Seek Limited U.S. Mortgage Role

In a speech Tuesday, Mr. Obama will begin making the case that a limited government guarantee is needed to preserve access to the long-term, fixed-rate loans that have become a staple of the U.S. housing market. But he also will call for ending the business model of Fannie and Freddie ...On Wednesday, President Obama will answer questions on housing. From Yahoo:

Mr. Obama is expected to outline other steps that can begin shrinking the federal government's outsized role in the mortgage market, including allowing loan limits in high-cost housing markets to gradually decline. Advisers said the president would also reiterate calls for long-stalled legislation that would help homeowners refinance even if they owe more than their homes are worth.

Zillow CEO Spencer Rascoff will moderate the event, using questions submitted through a range of social media with the hashtag #AskObamaHousing. Zillow will be looking for especially frequent questions, as well as queries that housing experts think are timely. The White House will not get the questions in advance.Tuesday:

There are three ways to submit a question for Obama:

1. Video: Create a short video submission on YouTube, Instagram or Vine. Share the video on Twitter or Facebook using #AskObamaHousing.

2. Facebook: Visit Zillow’s Facebook page (facebook.com/Zillow) to submit a question.

3. Twitter: Tweet a question to @Zillow using #AskObamaHousing.

• At 8:30 AM ET, the Trade Balance report for June from the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $43.0 billion in June from $45.0 billion in May.

• At 10:00 AM, Job Openings and Labor Turnover Survey for June from the BLS. Jobs openings increased in May to 3.828 million, up from 3.800 million in April. The number of job openings has generally been trending up, but openings are only up 1% year-over-year compared to May 2012.

• Also at 10:00 AM, the Trulia Price Rent Monitors for July. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Lawler: Builder Buying of Land/Lots Over Last Year to Boost SF Production “Soon”

by Calculated Risk on 8/05/2013 06:12:00 PM

CR Note: Tom Lawler mentioned in a previous note that the Census Bureau will probably revise down New Home sales for the first half. The table below is on starts and completions. Early this year I mentioned: "I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline)." That has shown up in the results (fewer communities), but will probably be resolved soon as Lawler notes below.

From housing economist Tom Lawler: First Half Housing: MF Starts a Bit Above, SF Starts Below Consensus; Builder Buying of Land/Lots Over Last Year to Boost SF Production “Soon”

| US Housing Starts (000's) | |||

|---|---|---|---|

| Total | SF | MF | |

| 2010 | 586.9 | 471.2 | 115.7 |

| 2011 | 608.8 | 430.6 | 178.2 |

| 2012 | 780.6 | 535.3 | 245.3 |

| 2013 H1 SAAR | 914.7 | 611.5 | 303.2 |

| US Housing Completions (000's) | |||

| 2010 | 651.7 | 496.3 | 155.4 |

| 2011 | 584.9 | 446.6 | 138.3 |

| 2012 | 649.2 | 483.0 | 166.2 |

| 2013 H1 SAAR | 736.7 | 559.7 | 177.0 |

While overall housing starts in the first half weren’t that different from consensus, the mix was different, with SF starts somewhat below but MF starts somewhat above consensus. SF starts were in all likelihood lower than what home builders would have liked, reflecting labor shortages, some materials’ shortages, and developed lot “shortages.” (Recall that the NAHB Housing Market Index dipped from January to April of this year, in part because of labor/other shortages as well as spikes in lumber costs).

Home builders as a group have, however, increased their acquisitions of land/lots significantly, and as a group are planning a significant increase in active communities and homes for sale. E.g., for the nine publicly-traded builders I track who report on a “MJSD” basis (DHI, PHM, RYL, NVR, SPF, MDC, MTH, MHO, and BZH), their combined number of lots controlled at the end of this June was up 23.6% from a year ago, with only Pulte (with its “balanced approach” strategy) not showing an increase.

Click on graph for larger image.

Click on graph for larger image.Here is some history of lots owned or optioned by D.R. Horton, the nation’s largest home builder (Horton’s FY ends in September).

The second graph are some historical stats for lots owned or optioned at Toll Brothers, the self-proclaimed “leading builder of luxury homes.” The latest data available are for April 30, 2013 – Toll reports on a JAJO basis, and its FY ends on Halloween.

Note that both the largest builder of “affordable” homes and the leading builder of luxury homes went on a speculative land/lot “buying spree” in 2004 and 2005, exacerbating the real estate bubble.

Note that both the largest builder of “affordable” homes and the leading builder of luxury homes went on a speculative land/lot “buying spree” in 2004 and 2005, exacerbating the real estate bubble.

Weekly Update: Existing Home Inventory is up 17.2% year-to-date on Aug 5th

by Calculated Risk on 8/05/2013 04:51:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for June). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 17.2%, and I expect some further increases over the next month or two.

It now seems likely that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 9.9% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.