by Calculated Risk on 8/05/2013 02:00:00 PM

Monday, August 05, 2013

Fed Survey: Banks eased lending standards, "experienced stronger demand in most loan categories"

From the Federal Reserve: The July 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months. The survey also contained special questions about changes in banks' lending standards on, and demand for, the three main types of commercial real estate (CRE) loans over the past year, and on the current levels of banks' lending standards for many types of business and household loans relative to longer-term norms. In the July survey, domestic banks, on balance, reported having eased their lending standards and having experienced stronger demand in most loan categories over the past three months. This summary is based on the responses from 73 domestic banks and 22 U.S. branches and agencies of foreign banks.

Regarding loans to businesses, the July survey generally indicated that banks eased their lending policies for commercial and industrial (C&I) and CRE loans and experienced stronger demand for such loans over the past three months ...

The survey results also indicated that banks eased standards and terms on, and saw increases in demand for, some categories of lending to households. Modest net fractions of respondents reported having eased standards on prime residential or nontraditional mortgage loans, and a large net fraction indicated that they had seen increased demand for prime mortgage loans. A moderate net fraction of respondents reported that they had eased standards on auto loans over the past three months, and small net fractions indicated that they had eased standards on credit card loans and other consumer loans. Demand for all three types of consumer loans asked about in the survey had reportedly strengthened, on balance, over the second quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

These two graphs shows the change in lending standards and demand for CRE (commercial real estate) loans.

Increasing demand and easing in standards suggests some increase in CRE activity going forward.

In general this survey indicates lending standards are easing and demand is increasing.

ISM Non-Manufacturing Index at 56.0 indicates faster expansion in July

by Calculated Risk on 8/05/2013 10:00:00 AM

The July ISM Non-manufacturing index was at 56.0%, up from 52.2% in June. The employment index decreased in July to 53.2%, down from 54.7% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 43rd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56 percent in July, 3.8 percentage points higher than the 52.2 percent registered in June. This indicates continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased substantially to 60.4 percent, which is 8.7 percentage points higher than the 51.7 percent reported in June, reflecting growth for the 48th consecutive month. The New Orders Index increased significantly by 6.9 percentage points to 57.7 percent, and the Employment Index decreased 1.5 percentage points to 53.2 percent, indicating growth in employment for the 12th consecutive month. The Prices Index increased 7.6 percentage points to 60.1 percent, indicating prices increased at a significantly faster rate in July when compared to June. According to the NMI™, 16 non-manufacturing industries reported growth in July. Respondents' comments are mostly positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in July than in June.

LPS: Seasonal Increase in Mortgage Delinquencies in June

by Calculated Risk on 8/05/2013 08:57:00 AM

LPS released their Mortgage Monitor report for June today. According to LPS, 6.68% of mortgages were delinquent in June, up from 6.08% in May. The increase was in short term delinquencies, and most of this increase was seasonal (delinquencies usually increase in June).

LPS reports that 2.93% of mortgages were in the foreclosure process, down from 4.09% in June 2012.

This gives a total of 9.61% delinquent or in foreclosure. It breaks down as:

• 1,983,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,345,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,458,000 loans in foreclosure process.

For a total of 4,785,000 loans delinquent or in foreclosure in June. This is down from 5,663,000 in June 2012.

The first graph from LPS shows percent of loans delinquent and in the foreclosure process over time.

From LPS:

“June’s increase in delinquencies is representative of a documented seasonal phenomenon,” [LPS Applied Analytics Senior Vice President Herb Blecher] said. “Over the last 18 years, similar changes occurred in June for all but four of those years. And this month’s increase was felt across all 50 states -- from a roughly 14 percent month-over-month rise in 30-day delinquencies in Nevada to a nearly 32 percent upswing in Colorado. ...

“Of course, focusing solely on month-to-month shifts in mortgage performance can be like tracking the stock market on a daily basis,” Blecher continued. “You may see periodic spikes and dips, but without a longer-term perspective, you lack a clear picture of how the market is actually performing. Though June’s 9.9 percent spike was indeed significant -- and a reversal of five consecutive months of declines -- on a quarterly basis, the rise was much more moderate than the historical average. Since 1995, delinquency rates have risen from Q1 to Q2 in all but two years, with an average 7 percent increase. By comparison, the 2013 Q1 to Q2 increase was just 1.34 percent.”

The second graph compares the percent of loans in the foreclosure process in judicial and non-judicial foreclosure states.

The second graph compares the percent of loans in the foreclosure process in judicial and non-judicial foreclosure states.From LPS:

Foreclosure inventories in judicial states are 26% off their peak vs. 50% in non-judicial ... Distressed inventory in the northeast remains close to peakForeclosure inventories peaked much earlier in non-judicial states, and have fallen quicker.

There is much more in the mortgage monitor.

Sunday, August 04, 2013

Monday: ISM Service Index, Senior Loan Officer Survey

by Calculated Risk on 8/04/2013 08:55:00 PM

Monday:

• Early: The LPS June Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for a reading of 53.0, up from 52.2 in June. Note: Above 50 indicates expansion, below 50 contraction.

• At 2:00 PM, the July 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. This might show some slight loosening in lending standards.

Weekend:

• Schedule for Week of August 4th

The Nikkei is down about 1.0%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3 and DOW futures are down 20 (fair value).

Oil prices have increased this week with WTI futures at $106.19 per barrel and Brent at $108.42 per barrel. The spread between WTI and Brent is back (but still small).

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are starting to decline again. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Recovery Measures

by Calculated Risk on 8/04/2013 05:02:00 PM

Following the release of the comprehensive revision for GDP, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

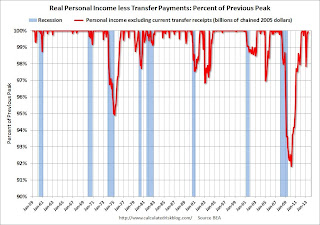

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

Two of the indicators are back (or close) to pre-recession levels (GDP and Personal Income less Transfer Payments), and two indicators are still below the pre-recession peaks (employment and industrial production).

Click on graph for larger image.

Click on graph for larger image.

The first graph is for real GDP through Q2 2013.

Real GDP returned to the pre-recession peak in Q2 2011, and has hit new post-recession highs for nine consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 4.3% from the 2007 peak (before the revision, GDP was reported off 4.7% at the worst point).

This graph shows real personal income less transfer payments as a percent of the previous peak through the June report.

This graph shows real personal income less transfer payments as a percent of the previous peak through the June report.

Before the revisions, this measure was off 11.2% at the trough in October 2009. With the revisions, this indicator was "only" off 8.2% at the worst point (the recession wasn't as bad as originally reported).

Real personal income less transfer payments surged in December due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013 (I've left December out going forward). Real personal income less transfer payments declined sharply in January (as expected), and are now close to the pre-recession peak.

The third graph is for industrial production through June 2013.

The third graph is for industrial production through June 2013.

Industrial production was off 16.9% at the trough in June 2009, and was initially one of the stronger performing sectors during the recovery.

However industrial production is still 1.7% below the pre-recession peak. This indicator might return to the pre-recession peak in in 2014.

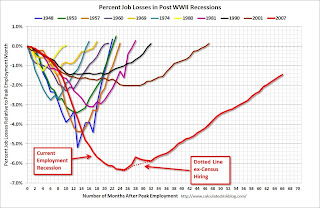

The final graph is for employment and is through July 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment and is through July 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 1.5% below the pre-recession peak and will probably be back to pre-recession levels in 2014.

Update: Four Charts to Track Timing for QE3 Tapering

by Calculated Risk on 8/04/2013 10:25:00 AM

We now have data to update all four charts that I'm using to track when the Fed will start tapering the QE3 purchases.

At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

Click on graph for larger image.

Click on graph for larger image.The first graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first and second quarters were below the FOMC projections (red), and GDP will have to pickup in the 2nd half of 2013 for the Fed to start tapering QE3 purchases in December.

GDP would have to increase at a 3.2% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.8% rate to reach the higher projection.

The second graph is for the unemployment rate.

The second graph is for the unemployment rate.The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We now have data through July, and so far the unemployment rate is tracking in the middle of the forecast.

If the participation rate ends the year at 63.6% (level for the year), then job growth will have to pickup up a little in the 2nd half to meet the FOMC projections. See the Atlanta Fed's Jobs Calculator tool to estimate how many jobs per month will be needed to reach a certain unemployment level.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

So far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

PCE prices would have to increase at a 1.8% annual rate in the 2nd half to reach the upper FOMC projection.

This graph is for core PCE prices.

This graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

So far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.

With the exception of the unemployment rate, it would be a stretch to say the incoming data has been "broadly consistent" with the June FOMC projections. Clearly the economy will have to pickup before the FOMC would start to taper QE3 purchases in December. (September tapering seems less likely now since the key data has been worse than forecast, but still not impossible).

Saturday, August 03, 2013

Percent Job Losses: Great Recession and Great Depression

by Calculated Risk on 8/03/2013 01:11:00 PM

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression.

In April 2012, Treasury released a slide deck titled Financial Crisis Response In Charts. One of the charts shows the percentage jobs lost in the current recession compared to the Great Depression.

Here is that graph (I've modified the graph slightly and added a few dots to update the current recession).

This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression, the 2007 recession, and the average for several recent recession following financial crisis.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

For reference, the second graph shows the job losses from the start of the employment recession through July, in percentage terms, compared to other post WWII recessions.

For reference, the second graph shows the job losses from the start of the employment recession through July, in percentage terms, compared to other post WWII recessions.

The Great Depression would be "off the chart".

Schedule for Week of August 4th

by Calculated Risk on 8/03/2013 09:00:00 AM

The key reports this week are the ISM service index on Monday and the Trade deficit report on Tuesday.

The Fed's July Senior Loan Officer Survey will be released on Monday.

Yesterday on the employment report:

• July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

• Employment Report: Steady, but Slow Improvement

• Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Early: The LPS June Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

10:00 AM: ISM non-Manufacturing Index for July. The consensus is for a reading of 53.0, up from 52.2 in June. Note: Above 50 indicates expansion, below 50 contraction.

2:00 PM ET: The July 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. This might show some slight loosening in lending standards.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. Imports increased in May, and exports decreased slightly.

The consensus is for the U.S. trade deficit to decrease to $43.0 billion in June from $45.0 billion in May.

10:00 AM: Trulia Price Rent Monitors for July. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in May to 3.828 million, up from 3.800 million in April. The number of job openings (yellow) has generally been trending up, but openings are only up 1% year-over-year compared to May 2012.

Quits were up in May, and quits are up about 2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer Credit for June from the Federal Reserve. The consensus is for credit to increase $15.0 billion in June.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 336 thousand from 326 thousand last week.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for June. The consensus is for a 0.4% increase in inventories.

Friday, August 02, 2013

Unofficial Problem Bank list declines to 726 Institutions

by Calculated Risk on 8/02/2013 08:53:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 2, 2013.

Changes and comments from surferdude808:

After a 56 day hiatus, the FDIC got back to closing a bank. The closing and some action terminations and an addition led to several changes this week to the Unofficial Problem Bank List. In all, there were four removals and one addition that leave the list with 726 institutions with assets of $259.1 billion. Last year, the list held 899 institutions with assets of $349.4 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

The FDIC closed First Community Bank of Southwest Florida, Fort Myers, FL ($265 million) this Friday. This is the 62nd bank to fail in Florida since 2008, which only trails the 87 banks that have failed in Georgia. Combined, the failures in the two states have cost an estimated $24.4 billion to resolve. Failure costs within the seven states of the FDIC's Atlanta Region have risen to a staggering $31.8 billion.

Actions were terminated against EVB, Tappahannock, VA ($1.1 billion Ticker: EVBS); The Coastal Bank, Savannah, GA ($443 million); and Pacific Commerce Bank, Los Angeles, CA ($160 million Ticker: PFCI).

The Federal Reserve issued a Written Agreement against Port Byron State Bank, Port Byron, IL ($88 million). This is the first safety & soundness enforcement actions issued by the Federal Reserve since April 25, 2013.

There is nothing new to report on the remaining banks controlled by Capitol Bancorp, Ltd. Next week will likely be a light week in terms of changes.

Earlier on the employment report:

• July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

• Employment Report: Steady, but Slow Improvement

• Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Bank Failure #17 in 2013: First Community Bank of Southwest Florida

by Calculated Risk on 8/02/2013 05:52:00 PM

From the FDIC: C1 Bank, Saint Petersburg, Florida, Assumes All of the Deposits of First Community Bank of Southwest Florida, Fort Myers, Florida

As of March 31, 2013, First Community Bank of Southwest Florida had approximately $265.7 million in total assets and $254.2 million in total deposits. ... The FDIC estimates that cost to the Deposit Insurance Fund will be $27.1 million. ... First Community Bank of Southwest Florida is the 17th FDIC-insured institution to fail in the nation this year, and the third in Florida.The FDIC gets back to work. At the current pace, the number of bank failures this year will be the lowest since 2008 when 25 banks failed.

Earlier on the employment report:

• July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

• Employment Report: Steady, but Slow Improvement

• Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes