by Calculated Risk on 8/04/2013 05:02:00 PM

Sunday, August 04, 2013

Update: Recovery Measures

Following the release of the comprehensive revision for GDP, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

Two of the indicators are back (or close) to pre-recession levels (GDP and Personal Income less Transfer Payments), and two indicators are still below the pre-recession peaks (employment and industrial production).

Click on graph for larger image.

Click on graph for larger image.

The first graph is for real GDP through Q2 2013.

Real GDP returned to the pre-recession peak in Q2 2011, and has hit new post-recession highs for nine consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 4.3% from the 2007 peak (before the revision, GDP was reported off 4.7% at the worst point).

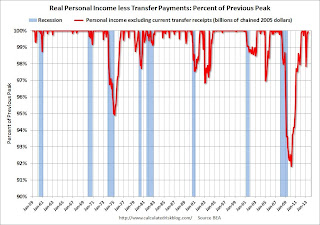

This graph shows real personal income less transfer payments as a percent of the previous peak through the June report.

This graph shows real personal income less transfer payments as a percent of the previous peak through the June report.

Before the revisions, this measure was off 11.2% at the trough in October 2009. With the revisions, this indicator was "only" off 8.2% at the worst point (the recession wasn't as bad as originally reported).

Real personal income less transfer payments surged in December due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013 (I've left December out going forward). Real personal income less transfer payments declined sharply in January (as expected), and are now close to the pre-recession peak.

The third graph is for industrial production through June 2013.

The third graph is for industrial production through June 2013.

Industrial production was off 16.9% at the trough in June 2009, and was initially one of the stronger performing sectors during the recovery.

However industrial production is still 1.7% below the pre-recession peak. This indicator might return to the pre-recession peak in in 2014.

The final graph is for employment and is through July 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment and is through July 2013. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 1.5% below the pre-recession peak and will probably be back to pre-recession levels in 2014.