by Calculated Risk on 8/03/2013 01:11:00 PM

Saturday, August 03, 2013

Percent Job Losses: Great Recession and Great Depression

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression.

In April 2012, Treasury released a slide deck titled Financial Crisis Response In Charts. One of the charts shows the percentage jobs lost in the current recession compared to the Great Depression.

Here is that graph (I've modified the graph slightly and added a few dots to update the current recession).

This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression, the 2007 recession, and the average for several recent recession following financial crisis.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

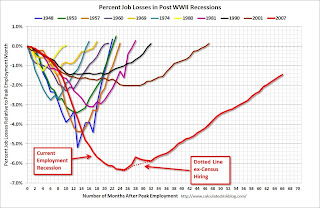

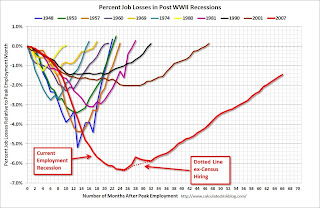

For reference, the second graph shows the job losses from the start of the employment recession through July, in percentage terms, compared to other post WWII recessions.

For reference, the second graph shows the job losses from the start of the employment recession through July, in percentage terms, compared to other post WWII recessions.

The Great Depression would be "off the chart".

Schedule for Week of August 4th

by Calculated Risk on 8/03/2013 09:00:00 AM

The key reports this week are the ISM service index on Monday and the Trade deficit report on Tuesday.

The Fed's July Senior Loan Officer Survey will be released on Monday.

Yesterday on the employment report:

• July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

• Employment Report: Steady, but Slow Improvement

• Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Early: The LPS June Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

10:00 AM: ISM non-Manufacturing Index for July. The consensus is for a reading of 53.0, up from 52.2 in June. Note: Above 50 indicates expansion, below 50 contraction.

2:00 PM ET: The July 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. This might show some slight loosening in lending standards.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. Imports increased in May, and exports decreased slightly.

The consensus is for the U.S. trade deficit to decrease to $43.0 billion in June from $45.0 billion in May.

10:00 AM: Trulia Price Rent Monitors for July. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in May to 3.828 million, up from 3.800 million in April. The number of job openings (yellow) has generally been trending up, but openings are only up 1% year-over-year compared to May 2012.

Quits were up in May, and quits are up about 2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer Credit for June from the Federal Reserve. The consensus is for credit to increase $15.0 billion in June.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 336 thousand from 326 thousand last week.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for June. The consensus is for a 0.4% increase in inventories.

Friday, August 02, 2013

Unofficial Problem Bank list declines to 726 Institutions

by Calculated Risk on 8/02/2013 08:53:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 2, 2013.

Changes and comments from surferdude808:

After a 56 day hiatus, the FDIC got back to closing a bank. The closing and some action terminations and an addition led to several changes this week to the Unofficial Problem Bank List. In all, there were four removals and one addition that leave the list with 726 institutions with assets of $259.1 billion. Last year, the list held 899 institutions with assets of $349.4 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

The FDIC closed First Community Bank of Southwest Florida, Fort Myers, FL ($265 million) this Friday. This is the 62nd bank to fail in Florida since 2008, which only trails the 87 banks that have failed in Georgia. Combined, the failures in the two states have cost an estimated $24.4 billion to resolve. Failure costs within the seven states of the FDIC's Atlanta Region have risen to a staggering $31.8 billion.

Actions were terminated against EVB, Tappahannock, VA ($1.1 billion Ticker: EVBS); The Coastal Bank, Savannah, GA ($443 million); and Pacific Commerce Bank, Los Angeles, CA ($160 million Ticker: PFCI).

The Federal Reserve issued a Written Agreement against Port Byron State Bank, Port Byron, IL ($88 million). This is the first safety & soundness enforcement actions issued by the Federal Reserve since April 25, 2013.

There is nothing new to report on the remaining banks controlled by Capitol Bancorp, Ltd. Next week will likely be a light week in terms of changes.

Earlier on the employment report:

• July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

• Employment Report: Steady, but Slow Improvement

• Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Bank Failure #17 in 2013: First Community Bank of Southwest Florida

by Calculated Risk on 8/02/2013 05:52:00 PM

From the FDIC: C1 Bank, Saint Petersburg, Florida, Assumes All of the Deposits of First Community Bank of Southwest Florida, Fort Myers, Florida

As of March 31, 2013, First Community Bank of Southwest Florida had approximately $265.7 million in total assets and $254.2 million in total deposits. ... The FDIC estimates that cost to the Deposit Insurance Fund will be $27.1 million. ... First Community Bank of Southwest Florida is the 17th FDIC-insured institution to fail in the nation this year, and the third in Florida.The FDIC gets back to work. At the current pace, the number of bank failures this year will be the lowest since 2008 when 25 banks failed.

Earlier on the employment report:

• July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

• Employment Report: Steady, but Slow Improvement

• Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 8/02/2013 04:16:00 PM

Earlier on the employment report:

• July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

• Employment Report: Steady, but Slow Improvement

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The long term unemployed is at 2.7% of the labor force - the lowest since May 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment - and the unemployment rate is moving sideways for those with a college degree!

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 358 thousand. According to the BLS, essentially no construction jobs have been over the last five months. Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in the 2nd half of 2013 (I also think construction employment will be revised up in the annual revision).

The BLS diffusion index for total private employment was at 54.5 in July, down from 57.3 in June.

The BLS diffusion index for total private employment was at 54.5 in July, down from 57.3 in June.For manufacturing, the diffusion index increased to 50.0, up from 45.7 in June.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for total private employment was not widespread in July.

Personal Income increased 0.3% in June, Spending increased 0.5%

by Calculated Risk on 8/02/2013 01:39:00 PM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $45.4 billion, or 0.3 percent ... in June, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $59.4 billion, or 0.5 percent.Core PCE increased at a 2.6% annual rate in June, but only a 1.2% annual rate in Q2.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in June, the same increase as in May. ... The price index for PCE increased 0.4 percent in June, compared with an increase of 0.1 percent in May. The PCE price index, excluding food and energy, increased 0.2 percent, compared with an increase of 0.1 percent.

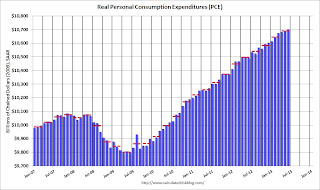

The following graph shows real Personal Consumption Expenditures (PCE) through June (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Real PCE increased at a 1.8% annual rate in Q2.

Note: This includes the comprehensive revisions and the change to 2009 dollars.

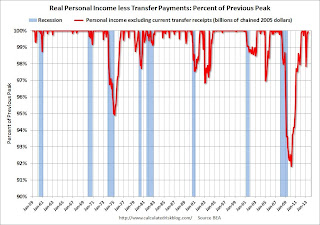

This is interesting! With the comprehensive revisions, personal income less transfer payments had returned to the pre-recession level. Note: The following graph constructed as a percent of the peak. This shows when the real personal income less transfer payments bottomed - and when the indicator returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

This graph shows real personal income less transfer payments as a percent of the previous peak through the June report.

This graph shows real personal income less transfer payments as a percent of the previous peak through the June report.Before the revisions, this measure was off 11.2% at the trough in October 2009. With the revisions, this indicator was "only" off 8.2% at the worst point (the recession wasn't as bad as originally reported).

Real personal income less transfer payments surged in December due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013 (I've left December out going forward). Real personal income less transfer payments declined sharply in January (as expected), and are now close to the pre-recession peak..

Employment Report: Steady, but Slow Improvement

by Calculated Risk on 8/02/2013 11:21:00 AM

If we look at the year-over-year change in employment - to minimize the monthly volatility - total nonfarm employment is up 2.276 million from July 2012, and private employment is up 2.315 million. That is essentially the same year-over-year gain as in June (2.267 million total, 2.331 million private year-over-year in June). Steady, but not strong, job growth.

Hourly wages declined slightly in July, but are up 1.9% year-over-year. Hourly wages were up 2.1% year-over-year in June.

In July, average hourly earnings for all employees on private nonfarm payrolls edged down by 2 cents to $23.98, following a 10-cent increase in June. Over the year, average hourly earnings have risen by 44 cents, or 1.9 percent.The decline in the unemployment rate to 7.4% from 7.6% in June was due to a larger increase in employment in the household survey (227,000 increase in jobs) combined with a decline in the participation rate (not good news). If the participation rate had held steady, the unemployment rate would have declined to 7.5% instead of 7.4%.

In general this report was more of the same - steady but slow improvement.

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The ratio was unchanged at 75.9% in July. This ratio should probably move close to 80% as the economy recovers.

The participation rate for this group was also unchanged at 81.1% in July. The decline in the participation rate for this age group is probably mostly due to economic weakness (as opposed to demographics) and this suggests the labor market is still very weak.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

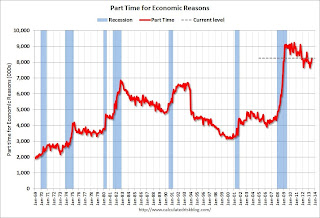

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 8.2 million in July. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in July to 8.245 million.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 14.0% in July from 14.3% in June.

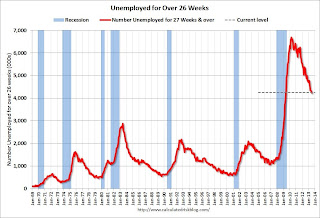

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.246 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.328 million in June and is at the lowest level since May 2009. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

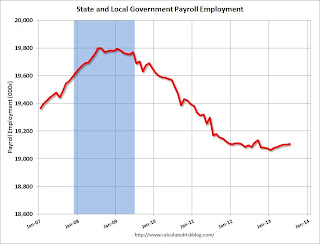

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In July 2013, state and local governments added 3,000 jobs, and state and local employment is up 31 thousand so far in 2013.

I think most of the state and local government layoffs are over. Of course Federal government layoffs are ongoing - and with many more layoffs expected.

Overall this was a tepid report - especially with the downward revisions to May and June employment and the slight decline in hourly wages. The labor market is still weak and millions of people are unemployed or underemployed.

July Employment Report: 162,000 Jobs, 7.4% Unemployment Rate

by Calculated Risk on 8/02/2013 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 162,000 in July, and the unemployment rate edged down to 7.4 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was below expectations of 175,000 payroll jobs added. Employment for May and June were also revised lower.

...

The change in total nonfarm payroll employment for May was revised from +195,000 to +176,000, and the change for June was revised from +195,000 to +188,000. With these revisions, employment gains in May and June combined were 26,000 less than previously reported.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate declined in July to 7.4% from 7.6% in June.

This is the lowest level for the unemployment rate since November 2008.

This is the lowest level for the unemployment rate since November 2008.The unemployment rate is from the household report and the household report showed a larger increase in employment than the establishment report, and that combined with a decline in the participation rate meant a lower unemployment rate.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 63.4% in July (blue line) from 63.5% in June. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was unchanged in July at 58.7% (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was below expectations. I'll have much more later ...

Thursday, August 01, 2013

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 8/01/2013 09:16:00 PM

From economist Sven Jari Stehn at Goldman Sachs on the employment report:

We expect a 200,000 gain in nonfarm payrolls in July (a bit above consensus), as well as a decline in the unemployment rate to 7.5% (in line with consensus). As far as payrolls are concerned, our forecast would be in line with the 3-, 6- and 12-month moving average.Thursday:

The reason for expecting another strong report is that a number of labor market indicators released for July so far have been encouraging, including manufacturing survey employment indices, consumers' assessment of job availability and the ADP report. Other indicators are sending no clear directional signal relative to June, including jobless claims, online advertising and the effects of the sequester on payrolls.

We expect another small effect of the sequester on employment. Our best guess is a sequester impact of around 5,000-10,000 in the federal government, which might bring the overall reduction in federal payrolls to 10,000-15,000.

• At 8:30 AM ET, the Employment Report for July. The consensus is for an increase of 175,000 non-farm payroll jobs in July; the economy added 195,000 non-farm payroll jobs in June. The consensus is for the unemployment rate to decrease to 7.5% in July from 7.6% in June.

• Also at 8:30 AM, Personal Income and Outlays for June. The consensus is for a 0.4% increase in personal income in June, and for a 0.4% increase in personal spending.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is for a 2.3% increase in orders.

Employment Situation Preview

by Calculated Risk on 8/01/2013 05:49:00 PM

Tomorrow at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for an increase of 175,000 non-farm payroll jobs in July, and for the unemployment rate to decline to 7.5% from 7.6% in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 200,000 private sector payroll jobs in July. This was above expectations of 179,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index increased in July to 54.4% from 48.7% in June. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing increased by close to 5,000 in July. However the ADP report indicated a loss of 5,000 manufacturing jobs in July.

The ISM non-manufacturing (service) employment index will be released next Monday.

• Initial weekly unemployment claims averaged about 341,000 in July. This was down slightly from 345,000 in June, and near the low for the year.

For the BLS reference week (includes the 12th of the month), initial claims were at 336,000; down from 355,000 in June.

• The final July Reuters / University of Michigan consumer sentiment index increased to 85.1, up from the June reading of 84.1. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors.

• And on the unemployment rate from Gallup: More Americans working part-time vs. a year ago, but no growth in full-time jobs

Gallup's unadjusted unemployment rate for the U.S. workforce is 7.8% in July, unchanged from June (7.8%), but down from 8.2% in July 2012.Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for July is 7.4%, a slight decline from 7.6% in June.

• Conclusion: The employment related data was slightly better in July than in June when the BLS reported 195,000 jobs added. Both the ADP employment and ISM manufacturing reports suggest an increase in hiring. Also weekly claims for the reference week were lower in July than in June, and consumer sentiment increased slightly.

There is always some randomness to the employment report, but my guess is the BLS will report above the consensus of 175,000 jobs added in July. A key will be the unemployment rate (and participation rate) to see if unemployment is tracking the Fed's forecast for QE3 tapering.