by Calculated Risk on 8/01/2013 03:03:00 PM

Thursday, August 01, 2013

U.S. Light Vehicle Sales decline to 15.6 million annual rate in July, Best July since 2006

Based on an estimate from WardsAuto, light vehicle sales were at a 15.61 million SAAR in July. That is up 11% from July 2012, and down 2% from the sales rate last month.

This was below the consensus forecast of 15.8 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 15.61 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

This is highest level for July auto sales since 2006.

After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another solid year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and had been a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 8% from 2012.

Construction Spending declined in June, Public Construction Spending at Lowest Level since 2006

by Calculated Risk on 8/01/2013 11:54:00 AM

The Census Bureau reported that overall construction spending declined in June:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2013 was estimated at a seasonally adjusted annual rate of $883.9 billion, 0.6 percent below the revised May estimate of $889.4 billion. The June figure is 3.3 percent above the June 2012 estimate of $855.8 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $622.8 billion, 0.4 percent below the revised May estimate of $625.4 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $261.1 billion, 1.1 percent below the revised May estimate of $264.0 billion.

Click on graph for larger image.

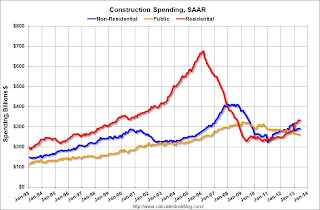

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 51% below the peak in early 2006, and up 45% from the post-bubble low.

Non-residential spending is 30% below the peak in January 2008, and up about 29% from the recent low.

Public construction spending is now 20% below the peak in March 2009 and at the lowest level since 2006.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 23%. Non-residential spending is up slightly year-over-year. Public spending is down 9.3% year-over-year.

A few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. I expect private non-residential to start to increase later this year.

3) Public construction spending decreased in June. Public spending has declined to 2006 levels (not adjusted for inflation) and has been a drag on the economy for 4 years. In real terms, public construction spending has declined to 2001 levels.

The good news going forward is 1) private residential construction spending is still very low and will probably continue to increase over the next few years, 2) Private non-residential spending appears about to increase (see forecast from American Institute of Architects, and 3) public construction spending is probably close to a bottom.

ISM Manufacturing index increases in July to 55.4

by Calculated Risk on 8/01/2013 10:00:00 AM

The ISM manufacturing index indicated faster expansion in July. The PMI was at 55.4% in July, up from 50.9% in June. The employment index was at 54.4%, up from 48.7%, and the new orders index was at 58.3%, up from 51.9% in June.

From the Institute for Supply Management: July 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in July for the second consecutive month, and the overall economy grew for the 50th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 55.4 percent, an increase of 4.5 percentage points from June's reading of 50.9 percent. June's PMI™ reading, the highest of the year, indicates expansion in the manufacturing sector for the second consecutive month. The New Orders Index increased in July by 6.4 percentage points to 58.3 percent, and the Production Index increased by 11.6 percentage points to 65 percent. The Employment Index registered 54.4 percent, an increase of 5.7 percentage points compared to June's reading of 48.7 percent. The Prices Index registered 49 percent, decreasing 3.5 percentage points from June, indicating that overall raw materials prices decreased from last month. Comments from the panel generally indicate stable demand and slowly improving business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 53.1% and suggests manufacturing expanded at a faster pace in July.

Weekly Initial Unemployment Claims decline to 326,000

by Calculated Risk on 8/01/2013 08:30:00 AM

The DOL reports:

In the week ending July 27, the advance figure for seasonally adjusted initial claims was 326,000, a decrease of 19,000 from the previous week's revised figure of 345,000. The 4-week moving average was 341,250, a decrease of 4,500 from the previous week's revised average of 345,750.

The previous week was revised up from 343,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 341,250.

The 4-week average has mostly moved sideways over the last few months, and is near the low for the year. Claims were below to the 345,000 consensus forecast.

Wednesday, July 31, 2013

Thursday: Vehicle Sales, Unemployment Claims, ISM Mfg Index, Construction Spending

by Calculated Risk on 7/31/2013 08:29:00 PM

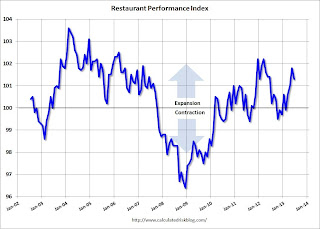

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

From the National Restaurant Association: Despite June Decline, Restaurant Performance Index Remains Steadily Positive

As a result of positive sales and traffic and an optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) remained in expansion territory in June. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.3 in June, down 0.5 percent from May’s level of 101.8. Despite the decline, June represented the fourth consecutive month that the RPI exceeded the 100 level, which signifies expansion in the index of key industry indicators.

“Although the overall RPI dipped somewhat in June, it remained in positive territory as restaurant operators continued to report gains in both sales and customer traffic,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, restaurant operators remain generally optimistic about the business environment in the months ahead, with the Expectations Index holding steady at a 12-month high.”

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.3 in June from 101.8 in May. (above 100 indicates expansion).

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for an increase to 345 thousand from 343 thousand last week.

• All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 15.8 million SAAR in July (Seasonally Adjusted Annual Rate) from 15.9 million SAAR in June.

• At 9:00 AM, The Markit US PMI Manufacturing Index for July. The consensus is for the index to increase to 53.1 from 51.9 in June.

• At 10:00 AM, the ISM Manufacturing Index for July. The consensus is for an increase to 53.1 from 50.9 in June. Based on the regional surveys, an increase in July seems likely. The ISM manufacturing index indicated expansion in June at 50.9%. The employment index was at 48.7%, and the new orders index was at 51.9%.

• Also at 10:00 AM, Construction Spending for June. The consensus is for a 0.4% increase in construction spending.

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since December 2008

by Calculated Risk on 7/31/2013 04:11:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in June to 2.77% from 2.83% in May. The serious delinquency rate is down from 3.53% in June 2012, and this is the lowest level since December 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier Freddie Mac reported that the Single-Family serious delinquency rate declined in June to 2.79% from 2.85% in May. Freddie's rate is down from 3.45% in June 2012, and is at the lowest level since May 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2016 or so.

FOMC Statement: Downgrade from "moderate" to "modest"

by Calculated Risk on 7/31/2013 02:00:00 PM

Economic activity downgraded and more concern about inflation too low (update: added "too low).

FOMC Statement:

Information received since the Federal Open Market Committee met in June suggests that economic activity expanded at a modest pace during the first half of the year. Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has been strengthening, but mortgage rates have risen somewhat and fiscal policy is restraining economic growth. Partly reflecting transitory influences, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will pick up from its recent pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished since the fall. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes. In determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Charles L. Evans; Jerome H. Powell; Sarah Bloom Raskin; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.

emphasis added

Q2 GDP: More Weakness, Data below FOMC June Projections

by Calculated Risk on 7/31/2013 11:36:00 AM

Overall this was another weak GDP report although slightly above expectations.

It appears that the drag from state and local governments might be ending, although the drag from Federal government spending is ongoing.

Residential investment (RI) remains a bright spot (increasing at a 13.4% annualized rate), and RI as a percent of GDP is still very low - and I expect RI to continue to increase over the next few years.

For the FOMC meeting today, the data showed all indicators are still below the June projections (see bottom three graphs).

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 11 quarters (through Q2 2013).

And the drag from state and local governments may be ending.

At the least the drag has diminished, and based on recent news reports, I expect state and local governments to make small positive contributions to GDP going forward.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

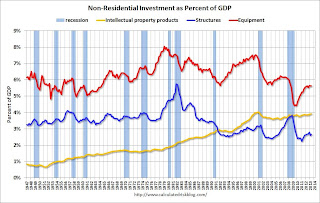

The third graph shows non-residential investment in structures, equipment and the new category "intellectual property products".

The third graph shows non-residential investment in structures, equipment and the new category "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014 (with the usual caveats about Europe and policy errors in the US).

The following charts are relevant for the FOMC meeting today. At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

This graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first and second quarters were below the FOMC projections (red), and GDP will have to pickup in the 2nd half of 2013 for the Fed to start tapering QE3 purchases in December.

GDP would have to increase at a 3.2% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.8% rate to reach the higher projection.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

So far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

PCE prices would have to increase at a 1.8% annual rate in the 2nd half to reach the upper FOMC projection.

This graph is for core PCE prices.

This graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

So far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.

Real GDP increased 1.7% Annualized in Q2

by Calculated Risk on 7/31/2013 08:30:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.7 percent in the second quarter of 2013 (that is, from the first quarter to the second quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 1.1 percent (revised).Personal consumption expenditures (PCE) increased at a 1.8% annualized rate, and residential investment increased 13.4%. Equipment increased 4.1%, Intellectual property products 3.8%, and non-residential investment 4.6%.

The increase in real GDP in the second quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, private inventory investment, and residential investment that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP in the second quarter primarily reflected upturns in nonresidential fixed investment and in exports, a smaller decrease in federal government spending, and an upturn in state and local government spending that were partly offset by an acceleration in imports and decelerations in private inventory investment and in PCE.

"Change in private inventories" added 0.41 percentage points to GDP in Q2, and the Federal government subtracted 0.12 percentage points (mostly a decrease in non-defense spending). State and local governments turned slightly positive.

This was above expectations of a 1.1% growth rate. I'll have much more on GDP later including all the revisions ...

ADP: Private Employment increased 200,000 in July

by Calculated Risk on 7/31/2013 08:19:00 AM

Private-sector employment increased by 200,000 jobs from June to July, according to the June ADP National Employment Report®. ... June’s job gain was revised upward from 188,000 to 198,000.This was above the consensus forecast for 179,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 175,000 payroll jobs in July, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "Job growth remains remarkably stable. Businesses are adding to payrolls in most industries and across all company sizes. The job market has admirably weathered the fiscal headwinds, tax increases and government spending cuts. This bodes well for the next year when those headwinds are set to fade.”

Note: ADP hasn't been very useful in predicting the BLS report.