by Calculated Risk on 7/30/2013 09:00:00 AM

Tuesday, July 30, 2013

Case-Shiller: Comp 20 House Prices increased 12.2% year-over-year in May

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Continue to Increase in May 2013 According to the S&P/Case-Shiller Home Price Indices

Data through May 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed increases of 2.5% and 2.4% for the 10- and 20-City Composites in May versus April. Dallas and Denver reached record levels surpassing their pre-financial crisis peaks set in June 2007 and August 2006. ...

The 10- and 20-City Composites annual returns rose slightly from April to May as they posted the best year-over-year gains since March 2006. All 20 cities increased from May 2012 to May 2013 and from April 2013 to May 2013. ...

“Home prices continue to strengthen,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Two cities set new highs, surpassing their pre-crisis levels and five cities – Atlanta, Chicago, San Diego, San Francisco and Seattle – posted monthly gains of over three percent, also a first time event. ... “The overall report points to some shifts among various markets: Washington DC is no longer the standout leader and the eastern Sunbelt cities, Miami and Tampa, are lagging behind their western counterparts.”

All 20 cities showed positive monthly returns for May. Ten cities – Chicago, Denver, Detroit, Las Vegas, Miami, New York, Phoenix, Portland, Seattle and Tampa – showed acceleration. Chicago posted an impressive monthly rate of 3.7% in May; it was higher than in April by one percentage point. Miami and Seattle had their largest monthly gains since August 2005 and April 1990, respectively.

Click on graph for larger image.

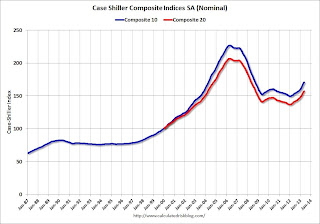

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 24.8% from the peak, and up 1.1% in May (SA). The Composite 10 is up 14.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 24.0% from the peak, and up 1.0% (SA) in May. The Composite 20 is up 14.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 11.8% compared to May 2012.

The Composite 20 SA is up 12.2% compared to May 2012. This was the twelfth consecutive month with a year-over-year gain and this was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in May seasonally adjusted. Prices in Las Vegas are off 51.4% from the peak, and prices in Denver and Dallas are at new highs.

This was close to the consensus forecast for a 12.3% YoY increase. I'll have more on prices later.

Monday, July 29, 2013

Tuesday: Case-Shiller House Price Index

by Calculated Risk on 7/29/2013 09:48:00 PM

Some horrible reporting on the next Fed Chair decision, first from he usually excellent Binyamin Appelbaum and Annie Lowrey at the NY Times who wrote:

Richard W. Fisher, president of the Federal Reserve Bank of Dallas, said this year that if the president chose Ms. Yellen, the decision would be “driven by gender.”What Fisher actually said (NY Times correction):

“It’s a presidential decision, and we’ll see if it is driven by gender or other considerations and so on. Janet is extremely capable. There are other capable people.”And from the WSJ:

Nancy Pelosi has bellowed her support [for Yellen]What Pelosi actually said:

I want to see whomever the President appoints. Let me say that I think it would be great to have a woman, first woman chairman of the Fed. No question about it. Yellen would be, is extremely talented, it is not just that she is a woman. Larry Summers has been a patriotic leader in our country, working hard. ... Either one would make an excellent Chairman I'm sure.Pretty poor reporting ...

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. The consensus is for a 12.3% year-over-year increase in the Composite 20 index (NSA) for May. The Zillow forecast is for the Composite 20 to increase 12.1% year-over-year, and for prices to increase 1.3% month-to-month seasonally adjusted.

• At 10:00 AM, the Conference Board's consumer confidence index for July. The consensus is for the index to decrease to 81.0 from 81.4.

• Also at 10:00 AM, the Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS) and this survey probably shouldn't be used to estimate the excess vacant housing supply.

Weekly Update: Existing Home Inventory is up 17.6% year-to-date on July 29th

by Calculated Risk on 7/29/2013 04:50:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

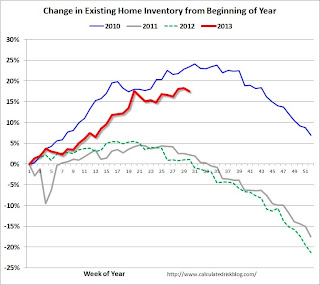

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for June). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 17.6%, and I expect some further increases over the next month or two.

It now seems likely that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 11% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

A comment on Fed Forecasting Records

by Calculated Risk on 7/29/2013 02:41:00 PM

Jon Hilsenrath and Kristina Peterson write about a "WSJ analysis of more than 700 economic predictions between 2009 and 2012 by Fed policymakers shows ... Janet Yellen ... the most prescient": Federal Reserve 'Doves' Beat 'Hawks' in Economic Prognosticating

As the U.S. emerged from recession in the summer of 2009, Janet Yellen, then president of the Federal Reserve Bank of San Francisco, took a grim view of the economy's prospects.A few comments:

"I expect the pace of the recovery will be frustratingly slow," she said in a San Francisco speech. A month later, addressing fears that money flooding into the economy from the Federal Reserve would stoke inflation, Ms. Yellen said not to worry in a speech to Idaho bankers: High unemployment and the weak economy would tamp wages and prices.

Others at the Fed spoke forcefully in the other direction. Unless the central bank reversed the easy money course, Philadelphia Fed President Charles Plosser warned in December 2009, "the inflation rate is likely to rise to levels that most would consider unacceptable."

Ms. Yellen was proved right.

1) The title of the article is about 'Doves' beating 'Hawks'. A good Fed Chair would be hawkish (raise rates) or dovish (lower rates) at the correct times. Over the period in question, 'dove' was synonymous with 'correct'. But no one should think Yellen is a perma-dove. As Professor Hamilton noted this weekend (He knows Yellen), she will certainly change her mind as circumstances change.

2) It is important to remember that Yellen was ahead of most other Fed presidents in the period between 2005 and 2008 (before this WSJ analysis). In 2005 Yellen was expressing concerns about housing, "analyses do indicate that house prices are abnormally high—that there is a "bubble" element, even accounting for factors that would support high house prices", and 'ghost towns' of the West in 2006. In 2007 she gave a speech correctly identifying some of the spillover effects from subprime.

3) This doesn't mean Yellen has a "crystal ball". She doesn't. Instead this means she has a strong understanding of macroeconomics and paid close attention to the data. A key for any successful manager is to be able to use a wide-angle lens (see the big picture) and also to be able to zoom in on the details (data driven) when necessary. Yellen's track record suggests to me that she excels at both.

Dallas Fed: "Texas Manufacturing Activity Increases but at a Slower Pace" in July

by Calculated Risk on 7/29/2013 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Increases but at a Slower Pace

Texas factory activity continued to expand in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 17.1 to 11.4, suggesting output growth continued but at a slower pace than in June. ...Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The new orders index was positive for the third month in a row, although it edged down from 13 to 10.8. ...Perceptions of broader business conditions improved again in July. The general business activity index posted a second consecutive positive reading, although it edged down from 6.5 to 4.4.

Labor market indicators reflected a pickup in labor demand. The employment index rose to 9.3, its highest reading in nearly a year. ...

Expectations regarding future business conditions remained optimistic in July. The indexes of future general business activity and future company outlook fell five points but remained in strongly positive territory. Indexes for future manufacturing activity also remained solidly positive.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

All of the regional surveys - except Richmond - showed expansion in July. The ISM index for July will be released Thursday August 1st, and the consensus is for an increase to 53.1 from 50.9 in June (above is expansion).

NAR: Pending Home Sales index declined 0.4% in June

by Calculated Risk on 7/29/2013 10:04:00 AM

From the NAR: Pending Home Sales Slip in June

The Pending Home Sales Index, a forward-looking indicator based on contract signings, edged down 0.4 percent to 110.9 in June from a downwardly revised 111.3 in May, but is 10.9 percent higher than June 2012 when it was 100.0; the data reflect contracts but not closings. Pending sales have been above year-ago levels for the past 26 months, and the pace in May was the highest since December 2006 when it reached 112.8.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

...

The PHSI in the Northeast was unchanged at 87.2 in June but is 12.2 percent higher than a year ago. In the Midwest the index slipped 1.0 percent to 114.3 in June but is 19.5 percent above June 2012. Pending home sales in the South fell 2.1 percent to an index of 118.3 in June but are 9.5 percent higher than a year ago. The index in the West rose 3.3 percent in June to 114.2, and is 4.4 percent above June 2012.

With limited inventory at the low end and fewer foreclosures, we might see flat existing home sales going forward.

LPS: House Price Index increased 1.3% in May, Up 7.9% year-over-year

by Calculated Risk on 7/29/2013 09:27:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses April closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: LPS Home Price Index Report: May Transactions Show U.S. Home Prices Up 1.3 Percent for the Month; Up 7.9 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on May 2013 residential real estate transactions. Beginning with this month's release, the LPS HPI has significantly expanded its property data tracking and now covers approximately 25 percent more U.S. counties - nearly 1,900 in total - and more than 18,500 ZIP codes. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of the ZIP codes covered. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 16.3% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 47.9% from the peak in Las Vegas, 39.0% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and at a new peak in Austin, Dallas, Denver and Houston!

Note: Case-Shiller for May will be released tomorrow.

Sunday, July 28, 2013

Sunday Night Futures

by Calculated Risk on 7/28/2013 09:13:00 PM

Monday:

• 10:00 AM ET, the NAR will release the Pending Home Sales Index for June. The consensus is for a 1.4% decrease in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for July. This is the last of the regional manufacturing surveys for July. The consensus is a reading of 6.4, mostly unchanged from the reading of 6.5 in June (above zero is expansion).

Weekend:

• Schedule for Week of July 28th

• FOMC Preview: Economic Slowdown

More support for Dr. Janet Yellen from Professor Hamilton at Econbrowser: The case for Janet Yellen as Federal Reserve chair

I have known Governor Yellen for many years, from the days when she was a professor at Berkeley to her distinguished service within the Federal Reserve. I have had an opportunity to interact with her in a variety of settings.The Nikkei is down about 1.8%.

Yellen is brilliant ... Yellen is one of the people I would trust most to be able to sort out what the key problems are and what needs to be done in any new situation. ...

If you examine her speeches and public statements, you will find that she has been one of the most accurate economic forecasters within the Federal Reserve, or for that matter compared with any private-sector economic analysts.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and DOW futures are up 3 (fair value).

Oil prices have declined slightly with WTI futures at $104.71 per barrel and Brent at $107.35 per barrel. The spread between WTI and Brent is back (but still small).

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are starting to decline again. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

They're Back! Congress threatens to Default Again

by Calculated Risk on 7/28/2013 05:12:00 PM

Treasury Secretary Jack Lew was on Meet the Press today (recorded Friday). Lew said:

"The fight over the debt limit in 2011 hurt the economy, even though, in the end, we saw an extension of the debt limit. We saw confidence fall, and it hurt the economy. Congress needs to do its job. It needs to finish its work on appropriation bills. It needs to pass a debt limit."

Click on graph for larger image.

Here is a graph of consumer sentiment. Notice the huge spike down in 2011 - that was due when Congress threatened to "not pay the bills".

As Jack Lew notes, there is no reason to do this again.

The following excerpts are from a post I wrote the last time Congress threatened to not pay the bills: Default Ceiling: Bluffing into the Nuts.

I wrote several posts about the "debt ceiling" debate in 2011. The debate clearly scared many Americans and impacted the economy. Hopefully this time the "debt ceiling" will be raised well in advance of the deadline.

I prefer "default ceiling" because "debt ceiling" sounds like some sort of virtuous limit, when, in reality, the vote is about whether or not to the pay the bills - and voting for default is reckless and irresponsible.

Note: Several financial articles recently have used poker terms - and the title of this post is my contribution to this sad trend. "The Nuts" is the best possible poker hand in a given situation. Bluffing into the nuts is a losing play - and that is what the Congress is trying to do with the "debt ceiling". The sooner they fold, the better for the economy and the Congress.

From the WaPo: GOP dissension over debt-ceiling strategy

House Speaker John A. Boehner (R-Ohio) likewise insisted that Republicans hold the line, telling his members they must demand that every dollar they raise the debt limit be paired with commensurate spending cuts.It is a bluff. As Republican Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

But other Republicans counseled caution, warning that pressure from the business community and the public to raise the $16.4 trillion federal borrowing limit renders untenable any threats not to do so and will weaken the GOP’s hand if their stance is perceived to be a bluff.

The bottom line is Congress is being silly (again), and they will raise the debt ceiling. It is just a matter of when. Note: There is a reason Congress never threatens to default right before an election, they hope everyone will forget!

FOMC Preview: Economic Slowdown

by Calculated Risk on 7/28/2013 10:19:00 AM

The Federal Open Market Committee (FOMC) is meeting on Tuesday and Wednesday, with the FOMC statement expected to be released at 2:00 PM ET on Wednesday.

Expectations are the FOMC will take no action at this meeting (the FOMC will probably not adjust the size of their purchases of agency mortgage-backed securities and Treasury securities).

Jon Hilsenrath at the WSJ wrote on Thursday: Up for Debate at Fed: A Sharper Easy-Money Message

The Federal Reserve is on track to keep its $85 billion-a-month bond-buying program in place at its policy meeting next week, but officials will debate changes to the way the central bank describes its plans for the program and for short-term interest rates.Any discussion on forward guidance will probably show up in the FOMC minutes, and not in the statement. It is possible that they could lower the unemployment rate threshold, although my guess is the guidance in the statement will remain as follows (Statement from June 19):

At their July 30-31 meeting, Fed officials are likely to discuss whether to refine or revise "forward guidance," the words they use to describe their intentions for the next few years.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.A key question for the meeting this week is how the FOMC will recognize the weaker incoming data. Q2 GDP will be released Wednesday morning before the FOMC statement is released, and expectations are for a weak reading (consensus is for 1.1% annualized growth rate in Q2). For growth, there will probably be some change to the first sentence in the June statement:

Information received since the Federal Open Market Committee met in May suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated.Perhaps something like the following, maybe without the "considerably" (from the August 2011 statement):

Information received since the Federal Open Market Committee met in June indicates that economic growth so far this year has been considerably slower than the Committee had expected.A key will be to watch the comments on inflation. At the last meeting, James Bullard dissented because he "believed that the Committee should signal more strongly its willingness to defend its inflation goal in light of recent low inflation readings". From the June meeting:

Partly reflecting transitory influences, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.Since then, it appears inflation has fallen even more. The recent decline in inflation is probably a growing concern for some FOMC participants.

As a reminder, here are the quarterly projections from the June meeting. If Q2 is close to consensus, GDP would have to be in the 3.3% to 3.9% range in the 2nd half to reach the FOMC projections (a sharp pickup in activity):

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 |

The unemployment rate was at 7.6% in June, and the outlook for Q4 unemployment probably hasn't changed much (the July unemployment rate will be released on Friday).

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 |

For inflation, PCE inflation was up 1.0% year-over-year in May, and only increased at a 0.4% annualized rate during the first five months of 2013. This is below the FOMC projected range.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 |

For core inflation, core PCE inflation was up 1.1% year-over-year in May, and only increased at a 1.1% annualized rate during the first five months of 2013. To reach the FOMC projections, inflation will have to pickup in the 2nd half of 2013.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 |

So a key for this statement is how the FOMC addresses the weaker incoming data.