by Calculated Risk on 7/24/2013 01:38:00 PM

Wednesday, July 24, 2013

AIA: "Architecture Billings Index Stays in Growth Mode" in June

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Stays in Growth Mode

The Architecture Billings Index (ABI) remained positive again in June after the first decline in ten months in April. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 51.6, down from a mark of 52.9 in May. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.6, up sharply from the reading of 59.1 the previous month.

“With steady demand for design work in all major nonresidential building categories, the construction sector seems to be stabilizing,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Threats to a sustained recovery include construction costs and labor availability, inability to access financing for real estate projects, and possible adverse effects in the coming months from sequestration and the looming federal debt ceiling debate.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in June, down from 52.9 in May. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 10 of the last 11 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The increases in this index over the past 11 months suggest some increase in CRE investment in the second half of 2013.

A Few Comments on New Home Sales

by Calculated Risk on 7/24/2013 11:28:00 AM

As I noted over the weekend, the key number in the existing home sales report is not sales, but inventory. It is mostly visible inventory that impacts prices. When we look at sales for existing homes, the focus should be on the composition between conventional and distressed, not total sales. So, for those who follow housing closely, the existing home sales report on Monday was solid even though sales were down.

However, for the new home sales report, the key number IS sales! An increase in sales adds to both GDP and employment (completed inventory is at record lows, so any increase in sales will translate to more single family starts). So sales in June at 497 thousand SAAR were very solid (the highest sales rate since May 2008). The housing recovery is ongoing.

Earlier: New Home Sales at 497,000 Annual Rate in June

Looking at the first half of 2013, there has been a significant increase in sales this year. The Census Bureau reported that there were 244 new homes sold in the first half of 2013, up 28.4% from the 190 thousand sold during the same period in 2012. This was the highest sales for the first half of the year since 2008.

And even though there has been a large increase in the sales rate, sales are just above the lows for previous recessions. This suggests significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current sales rate.

And an important point worth repeating every month: Housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades.

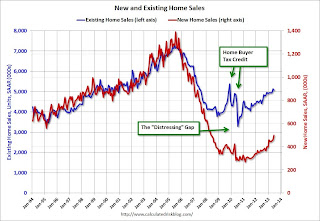

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through June 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to continue to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down - and is currently at the lowest level since November 2008. I expect this ratio to continue to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 497,000 Annual Rate in June

by Calculated Risk on 7/24/2013 10:00:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 497 thousand. This was up from 459 thousand SAAR in May (May sales were revised down from 476 thousand).

March sales were revised down from 451 thousand to 443 thousand, and April sales were revised down from 466 thousand to 453 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in June 2013 were at a seasonally adjusted annual rate of 497,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.3 percent above the revised May rate of 459,000 and is 38.1 percent above the June 2012 estimate of 360,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in June to 3.9 months from 4.2 months in May.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of June was 161,000. This represents a supply of 3.9 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is at a record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In June 2013 (red column), 48 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in June. The high for June was 115 thousand in 2005, and the low for June was 28 thousand in 2010 and 2011.

This was above expectations of 481,000 sales in June, and a solid report even with the downward revisions to previous months. I'll have more later today.

MBA: Mortgage Applications decrease slightly in Latest Weekly Survey

by Calculated Risk on 7/24/2013 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 1 percent from the previous week driven by a 12 percent drop in the Government Refinance index while the Conventional Refinance index rose by 2 percent. The Refinance Index is at the lowest level since July 2011. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

The refinance share of mortgage activity remained unchanged at 63 percent of total applications.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.58 percent from 4.68 percent, with points decreasing to 0.40 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

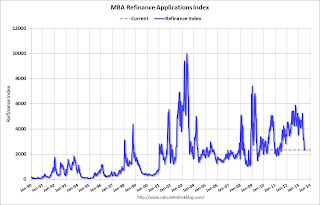

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4.5%, refinance activity has fallen sharply, decreasing in 10 of the last 11 weeks.

This index is down 55% over the last eleven weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 6% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 6% from a year ago.

Tuesday, July 23, 2013

Wednesday: New Home Sales

by Calculated Risk on 7/23/2013 09:17:00 PM

From the WSJ: Easing of Mortgage Curb Weighed

Concerned that tougher mortgage rules could hamper the housing recovery, regulators are preparing to relax a key plank of the rules proposed after the financial crisis.We need to see the final rules, but it is important that the interests of the mortgage lenders align - at least a little - with the interest of those who invest in mortgage backed securities.

The watchdogs, which include the Federal Reserve and Federal Deposit Insurance Corp., want to loosen a proposed requirement that banks retain a portion of the mortgage securities they sell to investors, according to people familiar with the situation.

The plan, which hasn't been finalized and could still change, would be a major U-turn for the regulators charged with fleshing out the Dodd-Frank financial-overhaul law passed three years ago.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash for July. The consensus is for an increase to 52.8 from 52.2 in June.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for an increase in sales to 481 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 476 thousand in May.

• During the day: the AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

DataQuick: Q2 California Foreclosure Starts up from Q1, Down 52.9% from Q2 2012

by Calculated Risk on 7/23/2013 05:24:00 PM

From DataQuick: California Foreclosure Starts Up From First Quarter

While up from the first quarter, the number of California homeowners entering the foreclosure process was at its second-lowest level in seven years last quarter, largely the result of a steep rise in home values, a real estate information service reported.

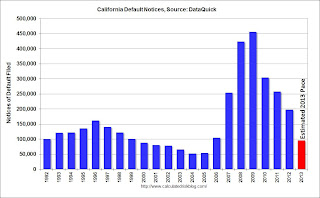

Lenders filed 25,747 Notices of Default (NoDs) during the April-to-June period. That was up 38.7 percent from 18,568 for the previous quarter, and down 52.9 percent from 54,615 for second-quarter 2012, according to San Diego-based DataQuick.

The 18,568 NoDs filed in the first quarter of this year marked the lowest quarterly total since fourth-quarter 2005, when 15,337 NoDs were recorded. In addition to less distress in the housing market pipeline, this year's remarkably low first-quarter number mainly reflected policy and regulatory changes.

NoD filings plummeted early this year as a package of new state foreclosure laws - the "Homeowner Bill of Rights" - took effect on January 1. In California and other states in recent years foreclosure activity has sometimes plunged temporarily after a new law kicks in and the industry takes time to adjust.

Setting aside this year's first quarter, last quarter's NoD tally was the lowest since second-quarter 2006, when 20,909 NoDs were recorded. California NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

"At this point in the cycle, it's fairly straightforward to see what's going on. Just do the math - it's not calculus, it's 4th grade arithmetic. A foreclosure only makes sense when the home is worth less than what is owed on it. As home values rise, fewer homeowners owe more on their homes than the homes are worth," said John Walsh, DataQuick president.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. For 2013 (red), the bar is an estimated annual rate (since the California "Homeowner Bill of Rights" slowed foreclosure activity in Q1, the estimate rate is Q1 + 3 times Q2).

It looks like this will be the lowest year for foreclosure starts since 2005, and also below the levels in 1997 through 1999 when prices were rising following the much smaller housing bubble / bust in California.

ATA Trucking Index increases slightly in June

by Calculated Risk on 7/23/2013 02:51:00 PM

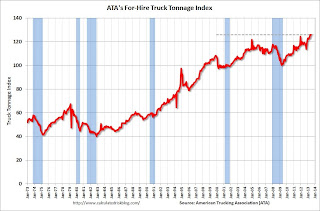

Here is a minor indicator that I follow that is at a new record high, from ATA: ATA Truck Tonnage Index Rose 0.1% in June

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index edged 0.1% higher in June after surging 2.1% in May. ... In June, the SA index equaled 125.9 (2000=100) versus 125.8 in May. June 2013 is the highest level on record. Compared with June 2012, the SA index surged 5.9%, which is robust, although below May’s 6.5% year-over-year gain. Year-to-date, compared with the same period in 2012, the tonnage index is up 4.7%.

“The fact that tonnage didn’t fall back after the 2.1% surge in May is quite remarkable,” ATA Chief Economist Bob Costello said. “While housing starts were down in June, tonnage was buoyed by other areas like auto production which was very strong in June and durable-goods output, which increased 0.5% during the month according to the Federal Reserve.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is fairly noisy, but the index is at a record high and is up solidly year-over-year.

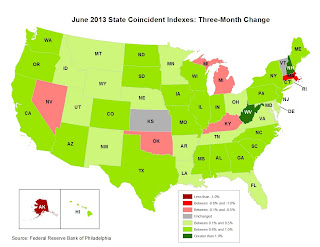

Philly Fed: State Coincident Indexes increased in 29 States in June

by Calculated Risk on 7/23/2013 12:06:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2013. In the past month, the indexes increased in 29 states, decreased in seven states, and remained stable in 14, for a one-month diffusion index of 44. Over the past three months, the indexes increased in 42 states, decreased in six, and remained stable in two, for a three-month diffusion index of 72.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In June, 36 states had increasing activity, down from 40 in May (including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.The map is mostly green, but several states are red again.

Richmond Fed: Regional Manufacturing Activity Weakens

by Calculated Risk on 7/23/2013 10:00:00 AM

From the Richmond Fed: Manufacturing Activity Weakens - Outlook Remains Optimistic

Manufacturing activity in the central Atlantic region declined in July, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments, new orders, backlogs, and capacity utilization fell this month. Vendor lead-time remained virtually unchanged, while finished goods inventories rose more quickly. On the employment front, hiring and the average workweek flattened. Average wages rose more slowly than in June. ...This was well below the consensus forecast of a reading of 8 for the composite index.

The seasonally adjusted composite index of manufacturing activity—our broadest measure of manufacturing—fell eighteen points in July to a reading of −11. Among the components of that index, shipments dropped twenty-six points to −15 in July. The new orders index also fell to −15; the previous reading was 9; and the gauge for the number of employees remained at 0 for a second month in July.

The index for the number of employees settled at 0, matching last month, and the gauge for the average manufacturing workweek slowed to 2 from June's reading of 11. Average wages also grew somewhat more slowly, with the index shedding two points to end at 8 in July.

Surveyed manufacturers were optimistic about prospects for the next six months. The indexes for expected shipments and new orders both rose to 24, three points above the June readings, while the backlogs gauge flattened to 0 from a June reading of 6.

emphasis added

House Price Indexes: FHFA up 7.3% YoY, Zillow up 5.8% YoY

by Calculated Risk on 7/23/2013 09:21:00 AM

Two more house price indexes ... the FHFA is for May, Zillow is for June.

From the FHFA: FHFA House Price Index Up 0.7 Percent in May

U.S. house price appreciation continued in May 2013, rising 0.7 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The May HPI change marks the sixteenth consecutive monthly price increase in the purchase-only, seasonally adjusted index. The previously reported 0.7 percent increase in April was revised downward to a 0.5 percent increase.From Zillow: 2013 Spring Selling Season Was Hottest Since 2004, As Recovery Accelerates & Widens

The HPI is calculated using home sales price information from mortgages either sold to or guaranteed by Fannie Mae and Freddie Mac. Compared to May 2012, house prices were up 7.3 percent in May. The U.S. index is 11.2 percent below its April 2007 peak and is roughly the same as the January 2005 index level.

emphasis added

On an annual basis, the Zillow Home Value Index (ZHVI) rose 5.8% from June 2012 levels. Monthly appreciation remains strong with national home values growing by 0.9% from May. Not only did the pace of home value appreciation quicken in the second quarter, but the recovery also fully took hold nationwide. Markets in some areas of the Northeast, Midwest and Southeastern U.S., such as Atlanta, Chicago and St. Louis, that had previously been slow to turn the corner began to appreciate, which helped boost the overall national market. All of the top 30 largest metro areas covered by Zillow experienced annual appreciation in home values as of the end of the second quarter, and all have hit their bottom.

According to the Zillow Home Value Forecast (ZHVF), we expect national home values to increase 5% over the next year (June 2013 to June 2014). ... Overall, national home values are back to August 2004 levels, down 17.2% since their peak in May 2007.