by Calculated Risk on 7/23/2013 02:51:00 PM

Tuesday, July 23, 2013

ATA Trucking Index increases slightly in June

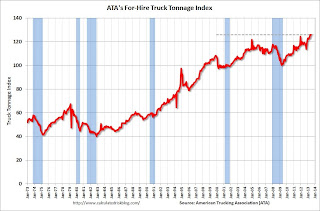

Here is a minor indicator that I follow that is at a new record high, from ATA: ATA Truck Tonnage Index Rose 0.1% in June

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index edged 0.1% higher in June after surging 2.1% in May. ... In June, the SA index equaled 125.9 (2000=100) versus 125.8 in May. June 2013 is the highest level on record. Compared with June 2012, the SA index surged 5.9%, which is robust, although below May’s 6.5% year-over-year gain. Year-to-date, compared with the same period in 2012, the tonnage index is up 4.7%.

“The fact that tonnage didn’t fall back after the 2.1% surge in May is quite remarkable,” ATA Chief Economist Bob Costello said. “While housing starts were down in June, tonnage was buoyed by other areas like auto production which was very strong in June and durable-goods output, which increased 0.5% during the month according to the Federal Reserve.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is fairly noisy, but the index is at a record high and is up solidly year-over-year.

Philly Fed: State Coincident Indexes increased in 29 States in June

by Calculated Risk on 7/23/2013 12:06:00 PM

From the Philly Fed:

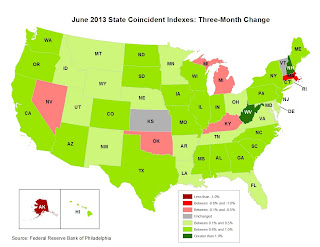

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2013. In the past month, the indexes increased in 29 states, decreased in seven states, and remained stable in 14, for a one-month diffusion index of 44. Over the past three months, the indexes increased in 42 states, decreased in six, and remained stable in two, for a three-month diffusion index of 72.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In June, 36 states had increasing activity, down from 40 in May (including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.The map is mostly green, but several states are red again.

Richmond Fed: Regional Manufacturing Activity Weakens

by Calculated Risk on 7/23/2013 10:00:00 AM

From the Richmond Fed: Manufacturing Activity Weakens - Outlook Remains Optimistic

Manufacturing activity in the central Atlantic region declined in July, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments, new orders, backlogs, and capacity utilization fell this month. Vendor lead-time remained virtually unchanged, while finished goods inventories rose more quickly. On the employment front, hiring and the average workweek flattened. Average wages rose more slowly than in June. ...This was well below the consensus forecast of a reading of 8 for the composite index.

The seasonally adjusted composite index of manufacturing activity—our broadest measure of manufacturing—fell eighteen points in July to a reading of −11. Among the components of that index, shipments dropped twenty-six points to −15 in July. The new orders index also fell to −15; the previous reading was 9; and the gauge for the number of employees remained at 0 for a second month in July.

The index for the number of employees settled at 0, matching last month, and the gauge for the average manufacturing workweek slowed to 2 from June's reading of 11. Average wages also grew somewhat more slowly, with the index shedding two points to end at 8 in July.

Surveyed manufacturers were optimistic about prospects for the next six months. The indexes for expected shipments and new orders both rose to 24, three points above the June readings, while the backlogs gauge flattened to 0 from a June reading of 6.

emphasis added

House Price Indexes: FHFA up 7.3% YoY, Zillow up 5.8% YoY

by Calculated Risk on 7/23/2013 09:21:00 AM

Two more house price indexes ... the FHFA is for May, Zillow is for June.

From the FHFA: FHFA House Price Index Up 0.7 Percent in May

U.S. house price appreciation continued in May 2013, rising 0.7 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The May HPI change marks the sixteenth consecutive monthly price increase in the purchase-only, seasonally adjusted index. The previously reported 0.7 percent increase in April was revised downward to a 0.5 percent increase.From Zillow: 2013 Spring Selling Season Was Hottest Since 2004, As Recovery Accelerates & Widens

The HPI is calculated using home sales price information from mortgages either sold to or guaranteed by Fannie Mae and Freddie Mac. Compared to May 2012, house prices were up 7.3 percent in May. The U.S. index is 11.2 percent below its April 2007 peak and is roughly the same as the January 2005 index level.

emphasis added

On an annual basis, the Zillow Home Value Index (ZHVI) rose 5.8% from June 2012 levels. Monthly appreciation remains strong with national home values growing by 0.9% from May. Not only did the pace of home value appreciation quicken in the second quarter, but the recovery also fully took hold nationwide. Markets in some areas of the Northeast, Midwest and Southeastern U.S., such as Atlanta, Chicago and St. Louis, that had previously been slow to turn the corner began to appreciate, which helped boost the overall national market. All of the top 30 largest metro areas covered by Zillow experienced annual appreciation in home values as of the end of the second quarter, and all have hit their bottom.

According to the Zillow Home Value Forecast (ZHVF), we expect national home values to increase 5% over the next year (June 2013 to June 2014). ... Overall, national home values are back to August 2004 levels, down 17.2% since their peak in May 2007.

Monday, July 22, 2013

Tuesday: FHFA House Price Index, Richmod Fed Mfg Survey

by Calculated Risk on 7/22/2013 09:41:00 PM

It looks like many people are still "doubling up" or living in their parent's basement. From Josh Mitchell at the WSJ: Economic Casualties: 'Missing Households'

The number of so-called missing households—representing adults who would be owning or renting their own home if household formation had stayed at normal rates since the recession—has increased 4% over the past year, according to an analysis for The Wall Street Journal.Tuesday:

There are now some 2.4 million such people, many of them living with their parents, but also seniors living with their adult offspring and people renting rooms in a home headed by an unrelated person.

...

The analysis on missing households, performed using census data by Jed Kolko, chief economist of real-estate website Trulia Inc., suggests that four years into the U.S. recovery, slow household formation remains an obstacle to a more robust economy. It is damping demand in the housing market, where home sales have been rising but remain below historical levels.

Young adults "have not regained confidence in the economy enough to start moving out of their parents' homes," Mr. Kolko said. "Even people with jobs are choosing the security ... of living under their parents' roof rather than forming their own households."

• Early, the Zillow Value Index for June.

• At 9:00 AM ET, FHFA House Price Index for May 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 8 for this survey, unchanged from June (Above zero is expansion).

Weekly Update: Existing Home Inventory is up 18.4% year-to-date on July 22nd

by Calculated Risk on 7/22/2013 06:42:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the data this morning was for June). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 18.4%, and I expect some further increases over the next month or two.

It now seems likely that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 10.7% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Earlier on existing home sales:

• Existing Home Sales in June: 5.08 million SAAR, 5.2 months of supply

• Comments on Existing Home Sales: Solid Report, Inventory near Bottom

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in June

by Calculated Risk on 7/22/2013 04:59:00 PM

From housing economist Tom Lawler:

Based on a survey of a relatively small sample of realtors that does not necessarily represent the overall market, the NAR alleged that foreclosure sales were 8% of last month’s sales, down from 13% last June; that short sales were 7% of last month’s sales compared to 12% last June; that first-time home buyers comprised 29% of last month’s transactions, down from 32% last June; that all-cash buyers comprised 31% of last month’s sales, up from 29% last June; and that “individual investors” comprised 17% of last month’s sales, down from 19% last June.

CR Note: This is an updated table for a number of cities where distress sales are reported. Lawler has included the NAR's Confidence Index Report. Most of the reporting areas experienced a high percentage of distressed sales (Las Vegas, Phoenix, California, Florida, etc), and it appears that distressed sales are declining just about everywhere.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun-13 | Jun-12 | Jun-13 | Jun-12 | Jun-13 | Jun-12 | Jun-13 | Jun-12 | |

| Las Vegas | 31.0% | 34.2% | 9.0% | 27.8% | 40.0% | 62.0% | 55.3% | 54.0% |

| Reno | 24.0% | 37.0% | 6.0% | 21.0% | 30.0% | 58.0% | ||

| Phoenix | 12.7% | 32.8% | 8.7% | 14.1% | 21.5% | 46.8% | 37.5% | 46.9% |

| Sacramento | 23.2% | 31.0% | 7.5% | 19.7% | 30.7% | 50.7% | 29.9% | 33.4% |

| Minneapolis | 6.0% | 9.6% | 15.7% | 25.1% | 21.7% | 34.6% | ||

| Mid-Atlantic (MRIS) | 7.6% | 10.2% | 6.3% | 8.7% | 13.9% | 18.9% | 15.9% | 16.5% |

| Orlando | 18.7% | 28.5% | 18.1% | 25.2% | 36.8% | 53.7% | 49.8% | 51.7% |

| California (DQ)* | 16.0% | 24.3% | 10.0% | 24.9% | 26.0% | 49.2% | ||

| Bay Area CA (DQ)* | 12.1% | 22.7% | 6.0% | 17.8% | 18.1% | 40.5% | 25.6% | 27.3% |

| So. California (DQ)* | 16.2% | 24.4% | 9.1% | 24.4% | 25.3% | 48.8% | 30.2% | 32.3% |

| Miami MSA SF | 16.8% | 21.3% | 9.6% | 16.3% | 26.4% | 37.6% | 43.3% | 44.9% |

| Miami MSA C/TH | 13.8% | 19.5% | 14.3% | 18.3% | 28.1% | 37.8% | 76.3% | 79.1% |

| Northeast Florida | 35.6% | 39.9% | ||||||

| Chicago | 28.0% | 33.0% | ||||||

| Houston | 8.4% | 16.8% | ||||||

| Memphis* | 18.2% | 29.6% | ||||||

| Birmingham AL | 19.4% | 26.4% | ||||||

| Springfield IL | 12.0% | 9.2% | ||||||

| Tucson | 32.8% | 35.9% | ||||||

| Toledo | 28.1% | 33.0% | ||||||

| Des Moines | 17.5% | 18.9% | ||||||

| Omaha | 14.9% | 14.4% | ||||||

| Pensacola | 29.8% | 34.3% | ||||||

| NAR RCI** | 7.0% | 12.0% | 8.0% | 13.0% | 15.0% | 25.0% | 31.0% | 29.0% |

| *share of existing home sales, based on property records | ||||||||

| **NAR Survey of Realtors, Realtor Confidence Index Report | ||||||||

Comments on Existing Home Sales: Solid Report, Inventory near Bottom

by Calculated Risk on 7/22/2013 11:49:00 AM

First, the headline sales number was no surprise and not bad news (see Existing Home Sales: Expect Below Consensus Sales).

Second, I usually ignore the median price. The median price is distorted by the mix, and with more conventional sales - and more mid-to-high end sales - the median is increasing faster than actual prices (as reported by the repeat sales indexes).

The key number in the existing home sales report is inventory (not sales), and the NAR reported that inventory increased 1.9% in June from May, and is only down 7.6% from June 2012. This fits with the weekly data I've been posting.

This is the lowest level of inventory for the month of June since 2001, but this is also the smallest year-over-year decline since June 2011. The key points are: 1) inventory is very low, but 2) the year-over-year inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

When will the NAR report a year-over-year increase in inventory? Soon. Right now I'm guessing inventory will be up year-over-year in September or October.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 15.2% from June 2012, but conventional sales are probably up close to 30% from June 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – were 15 percent of June sales, down from 18 percent in May, and are the lowest share since monthly tracking began in October 2008; they were 26 percent in June 2012.Although this survey isn't perfect, if total sales were up 15.2% from June 2012, and distressed sales declined to 15% of total sales (15% of 5.08 million) from 26% (26% of 4.41 million in June 2012), this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying; the NAR is reporting:

All-cash sales made up 31 percent of transactions in June, down from 33 percent in May; they were 29 percent in June 2012. Individual investors, who account for many cash sales, purchased 17 percent of homes in June, down from 18 percent in May and 19 percent in June 2012.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in June (red column) are above the sales for 2008 through 2012, however sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report. Conventional sales have increased sharply, although some of this is investor buying. And inventory is low, but the year-over-year decline in inventory is decreasing.

Earlier:

• Existing Home Sales in June: 5.08 million SAAR, 5.2 months of supply

Existing Home Sales in June: 5.08 million SAAR, 5.2 months of supply

by Calculated Risk on 7/22/2013 10:00:00 AM

The NAR reports: June Existing-Home Sales Slip but Prices Continue to Roll at Double-Digit Rates

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, dipped 1.2 percent to a seasonally adjusted annual rate of 5.08 million in June from a downwardly revised 5.14 million in May, but are 15.2 percent higher than the 4.41 million-unit level in June 2012.

Total housing inventory at the end of June rose 1.9 percent to 2.19 million existing homes available for sale, which represents a 5.2-month supply at the current sales pace, up from 5.0 months in May. Listed inventory remains 7.6 percent below a year ago, when there was a 6.4-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2013 (5.08 million SAAR) were 1.2% lower than last month, and were 15.2% above the June 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.19 million in June up from 2.15 million in May. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.19 million in June up from 2.15 million in May. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 7.6% year-over-year in June compared to June 2012. This is the 28th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since 2011 (I expect the YoY to turn positive soon).

Inventory decreased 7.6% year-over-year in June compared to June 2012. This is the 28th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since 2011 (I expect the YoY to turn positive soon).Months of supply increased to 5.2 months in June.

This was below expectations of sales of 5.27 million (just above economist Tom Lawler's forecast). For existing home sales, the key number is inventory - and inventory is still down year-over-year, although the declines are slowing. This was another solid report. I'll have more later ...

Chicago Fed: "Economic Activity Slightly Improved in June"

by Calculated Risk on 7/22/2013 08:37:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slightly Improved in June

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to –0.13 in June from –0.29 in May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to –0.26 in June from –0.37 in May, marking its fourth consecutive reading below zero. June’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in June (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.