by Calculated Risk on 7/21/2013 09:19:00 PM

Sunday, July 21, 2013

Monday: Existing Home Sales

From Nick Timiraos at the WSJ on housing: Price Gains May Moderate, but It Remains a Seller's Market for Now

The surge in rates could test buyers' appetites to pay above asking prices, potentially slowing the run-up in home prices witnessed in the first half of the year. The biggest pinch will be felt by potential homeowners in high-cost housing markets that had been stretching to qualify for the largest loan possible.Monday:

"The frenzy has concluded," said Jim Klinge, a real-estate agent in Carlsbad, Calif. "The pool of crazy buyers—those willing to pay higher prices because they're tired of losing bidding wars—has diminished considerably."

• At 8:30 AM ET, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 5.27 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 5.18 million SAAR. Economist Tom Lawler is estimating the NAR will report a June sales rate of 4.99 million.

Weekend:

• Schedule for Week of July 21st

• Existing Home Sales: Expect Below Consensus Sales

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 7 and DOW futures are up 57 (fair value).

Oil prices have increased recently with WTI futures at $108.40 per barrel and Brent at $108.42 per barrel.

DataQuick on California Home Sales: Total Sales Down, Conventional Sales up Sharply, Foreclosures lowest since August 2007

by Calculated Risk on 7/21/2013 01:16:00 PM

From DataQuick: California June Home Sales

An estimated 41,027 new and resale houses and condos sold statewide last month. That was down 6.9 percent from a revised 44,087 in May, and down 3.5 percent from 42,513 sales in June 2012, according to San Diego-based DataQuick.Sales are down year-over-year, but the key is the percentage of distressed sales is down significantly - and the number of conventional sales are up about 40% year-over-year!

California June sales have varied from a low of 35,202 in 2008 to a high of 76,669 in 2004. Last month's sales were 16.8 percent below the average of 49,301 sales for all the months of June since 1988, when DataQuick's statistics begin.

...

Of the existing homes sold last month, 10.0 percent were properties that had been foreclosed on during the past year – the lowest level since foreclosure resales were 9.4 percent of the resale market in August 2007. Last month’s figure was down from a revised 11.3 percent in May and 24.9 percent a year earlier. Foreclosure resales peaked at 58.8 percent in February 2009.

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 16.0 percent of the homes that resold last month. That was down from an estimated 16.8 percent the month before and 24.3 percent a year earlier.

...

Indicators of market distress continue to decline. Foreclosure activity remains well below year-ago and peak levels reached several years ago. Financing with multiple mortgages is low, while down payment sizes are stable, DataQuick reported.

emphasis added

This is kind of a preview for the NAR June report that will be released tomorrow. The headline June sales number will probably be below the consensus forecast, but the keys will be inventory and the increase in conventional sales (unfortunately the NAR doesn't do a good job of tracking distressed sales).

Unofficial Problem Bank list declines to 734 Institutions

by Calculated Risk on 7/21/2013 08:01:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 19, 2013.

Changes and comments from surferdude808:

With the OCC releasing its actions through mid-June 2013 on Friday, there were many changes to the Unofficial Problem Bank List this week. For the week, there were 11 removals and three additions leaving the list at 734 institutions with assets of $267.2 billion. A year ago, the list held 905 institutions with assets of $349.7 billion.

This week the OCC and Federal Reserve terminated actions against 10 institutions. One has to go back to the week of April 27, 2012 when there were 11 terminations to find a week this busy. Actions were terminated against The Suffolk County National Bank of Riverhead, Riverhead, NY ($1.6 billion Ticker: SUBK); Sterling Bank and Trust, FSB, Southfield, MI ($893 million); Citizens National Bank of Texas, Waxahachie, TX ($605 million); Britton & Koontz Bank, N.A., Natchez, MS ($312 million Ticker: BKBK); Citizens Bank, National Association, Fort Scott, KS ($264 million); Rocky Mountain Bank, Jackson, WY; The First National Bank of Wamego, Wamego, KS ($153 million); Calusa National Bank, Punta Gorda, FL ($150 million); The First National Bank of Wellston, Wellston, OH ($95 million Ticker: MDWE); and The First National Bank of Sedan, Sedan, KS ($51 million). The other removal was Roebling Bank, Roebling, NJ ($156 million) through an unassisted acquisition.

The three additions this week were The Somerville National Bank, Somerville, OH ($178 million); RepublicBankAZ, N.A., Phoenix, AZ ($83 million); and Ruby Valley National Bank, Twin Bridges, MT ($81 million).

There is some news on Capitol Bancorp, Ltd. to pass along, a U.S. Bankruptcy judge will allow the company to sell its remaining seven banks at an auction. No other details on the auction have been made public.

Next Friday, we anticipate for the FDIC to release its actions through June 2013.

Saturday, July 20, 2013

Existing Home Sales: Expect Below Consensus Sales

by Calculated Risk on 7/20/2013 04:06:00 PM

The NAR is scheduled to report June existing home sales on Monday. The consensus is for sales of 5.27 million on seasonally adjusted annual rate (SAAR) basis. However economist Tom Lawler is estimating the NAR will report a June sales rate of 4.99 million.

I'm reminded of the Damon Runyon line paraphrasing Ecclesiastes:

"The race is not always to the swift, nor the battle to the strong, but that's how the smart money bets."Tom Lawler isn't always closer than the consensus, but that is the way to bet - and I expect existing home sales were less than the consensus in June.

Unfortunately a below consensus report also means more hand wringing about the "housing recovery". That will be nonsense.

The problem is many people don't understand what "housing recovery" means. There are really two recoveries: House prices and residential investment. Most people - homeowners and potential buyers - focus on prices, and for prices we should use the repeat sales indexes, and not the NAR median price (repeat sales indexes include Case-Shiller, CoreLogic, etc). What matters in the NAR report for prices is inventory and months-of-supply.

For GDP and jobs, the key is what the Bureau of Economic Analysis (BEA) calls "residential investment" (RI) . For existing homes, only the broker's commission is part of GDP, but for new homes the entire sales price is part of GDP. There are some spillover effects from home sales (furniture, etc), but those aren't included in RI.

If existing home sales decline there is only a minor impact on RI and GDP. When we talk about the "housing recovery" for jobs and GDP, existing home sales are mostly irrelevant - the focus should be on new home sales, housing starts and home improvement.

This is a reminder that the key number in the existing home sales report is not sales, but inventory. It is mostly visible inventory that impacts prices. When we look at sales for existing homes, the focus should be on the composition between conventional and distressed, not total sales.

Bottom line: I expect sales to be below the consensus, but for conventional sales to be increasing. I also expect further evidence that inventory bottomed early this year. And, oh, expect some more uninformed hand wringing!

Note: Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 3 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Usually when there has been a fairly large spread (like the current month) between Lawler's estimate and the "consensus", Lawler has been closer. As an example, last month the consensus was 5.00 million SAAR, Lawler's forecast was 5.18 million, and the NAR reported 5.20 million.

Note: The consensus average miss was 170 thousand with a standard deviation of 190 thousand. Lawler's average miss was 70 thousand with a standard deviation of 50 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | |

| 1NAR initially reported before revisions. | |||

Schedule for Week of July 21st

by Calculated Risk on 7/20/2013 11:30:00 AM

The key reports this week are the June existing home sales on Monday, and the June new home sales report on Wednesday.

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for July will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 5.27 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 5.18 million SAAR. Economist Tom Lawler is estimating the NAR will report a June sales rate of 4.99 million.

A key will be inventory and months-of-supply.

9:00 AM: FHFA House Price Index for May 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 8 for this survey, unchanged from June (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: The Markit US PMI Manufacturing Index Flash for July. The consensus is for an increase to 52.8 from 52.2 in June.

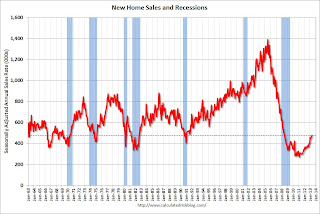

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for an increase in sales to 481 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 476 thousand in May.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 341 thousand from 334 thousand last week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 0 for this survey, up from minus 5 in June (Above zero is expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 84.0.

Krugman: How Much Should We Worry About A China Shock?

by Calculated Risk on 7/20/2013 09:33:00 AM

Quite a few people have asked me about China. My view is the impact of a Chinese slowdown - or even recession - will be minimal on the US.

Note: As always, I recommend reading Michael Pettis' China Financial Markets website. He has been way ahead of the curve on China. (Pettis' site feed sometimes gets hacked - that is the joke at the bottom of Krugman's post today).

Paul Krugman discusses three possible impacts: How Much Should We Worry About A China Shock?

Suppose that those of us now worried that China’s Ponzi bicycle is hitting a brick wall (or, as some readers have suggested, a BRIC wall) are right. How much should the rest of the world worry, and why?There is more in Krugman's post. The mechanical trade impact is the one everyone worries about, and it really isn't a huge concern. On the second point, the US does sell some commodities to China (Lumber prices started falling when Chinese buying slowed). However, overall for the US, lower commodity prices is mostly a positive.

I’d group this under three headings:

1. “Mechanical” linkages via exports, which are surprisingly small.

2. Commodity prices, which could be a bigger deal.

3. Politics and international stability, which involves some serious risks.

So, on the first: this is what many people immediately think of. China’s economy stumbles; China therefore buys less from the rest of the world; and the result is a global slump. Or, maybe not so much.

Some quick, rough, but I think useful math: In 2011, the combined GDP of all the world’s economies not including China was slightly over $60 trillion. Meanwhile, Chinese imports of goods and services were about $2 trillion, or around 3 percent of the rest of the world’s GDP.

Now suppose that China has a slowdown of 5 percent relative to trend. Imports would fall more than this; typical estimates of the “income elasticity” of imports (the percentage change from a 1 percent change in GDP, other things equal) are around 2. So we could be looking at a 10 percent fall in Chinese imports — an adverse shock to the rest of the world of one-tenth of 3 percent,or 0.3 percent of GDP. Not nothing, but not [catastrophic].

The last one - political unrest - is the scary one and is complete unknown.

Friday, July 19, 2013

Two more Q2 GDP Downgrades

by Calculated Risk on 7/19/2013 07:42:00 PM

From Reuters: Morgan Stanley cuts second quarter U.S. GDP forecast to 0.3 percent

Morgan Stanley economist Ted Wieseman, but the softness in June nonetheless prompted him to cut Morgan Stanley’s Q2 GDP estimate to 0.3 percent from 0.4 percent.From Merrill Lynch:

This week we are marking to market both our growth and inflation forecasts. On the growth side, the story is simple. With most of the data in, our tracking model pegs 2Q GDP growth at just 0.9%. ... Clearly, the fiscal shock and weak global growth are undercutting the recovery. The main reasons for the downward revision in 2Q are weaker inventory accumulation and a wider trade deficit.And Mark Zandi of Moody's Analytics last week:

This weakness is not a fluke: it reflects weakness in many key growth indicators. ...

That said, the good news is that we don’t think the weakness will be persistent. The consumer looks healthier heading into 2H, and manufacturing is starting to improve thanks to autos. Low inventories in 2Q give capacity to rebuild in 3Q. Thus, we are revising up 3Q GDP growth to 2.0% from 1.5%, and continue to expect 2.5% in 4Q. We are not out of the woods yet, but conditions are improving.

The thing that changed is the GDP number.... That is really coming in much weaker than anyone had expected. Certainly than I had expected earlier in the year. It's tracking slightly positive and it's possible that it could be a negative print in Q2.This slowdown is probably related to the significant drag from fiscal policy. I expect the fiscal policy drag to diminish and growth to improve going forward.

DOT: Vehicle Miles Driven increased 0.9% in May

by Calculated Risk on 7/19/2013 03:44:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +0.9% (2.3 billion vehicle miles) for May 2013 as compared with May 2012. Travel for the month is estimated to be 262.1 billion vehicle miles.

The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 66 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in May compared to May 2012. In May 2013, gasoline averaged of $3.67 per gallon according to the EIA. In 2012, prices in May averaged $3.79 per gallon. However gasoline prices were up year-over-year in June and especially in July of this year, so I expect miles driven to be down year-over-year in July.

Gasoline prices were down in May compared to May 2012. In May 2013, gasoline averaged of $3.67 per gallon according to the EIA. In 2012, prices in May averaged $3.79 per gallon. However gasoline prices were up year-over-year in June and especially in July of this year, so I expect miles driven to be down year-over-year in July.Gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

Brent and WTI Oil Futures: "The Spread is Dead"

by Calculated Risk on 7/19/2013 01:25:00 PM

From MarketWatch: WTI crude prices trade at premium to Brent

Prices for West Texas Intermediate crude oil on the New York Mercantile Exchange traded at a premium versus Brent crude prices on ICE futures Friday.

That was the first time WTI cost more than Brent crude since October 2010 ...

“Assuming our petroleum product consumption and exports remain at recent levels or more, then the spread is dead.” [said Richard Hastings, a macro strategist at Global Hunter Securities]

Click on graph for larger image.

Click on graph for larger image.For the last few years there have been some capacity issues at Cushing (see Jim Hamilton's post Prices of gasoline and crude oil for a discussion of the issues).

As Hamilton noted:

[A]n increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.The spread has been closing as more infrastructure has been put in place, US demand has increased, and global demand (Brent) has slowed. At one point Brent was selling for about 25% more than WTI (even though they are comparable quality). Right now the "spread is dead".

BLS: State unemployment rates were "little changed" in June

by Calculated Risk on 7/19/2013 10:00:00 AM

Note: This data was released yesterday. From the BLS: Regional and state unemployment rates were little changed in June

Twenty-eight states had unemployment rate increases, 11 states had decreases, and 11 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in June, 9.6 percent. The next highest rates were in Illinois and Mississippi, 9.2 percent and 9.0 percent, respectively. North Dakota again had the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only three states: Nevada, Illinois, and Mississippi. This is the fewest states with 9% unemployment since 2008.

For some of the sand states (largest real estate bubble states), the improvement has been significant. The unemployment rate in California has declined from 10.6% in June 2012 to 8.5% in June 2013. The unemployment rate in Florida has declined from 8.8% in June 2012 to 7.1% in June 2013.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently only three states have an unemployment rate above 9% (purple), sixteen states above 8% (light blue), and 27 states above 7% (blue).