by Calculated Risk on 7/18/2013 10:00:00 AM

Thursday, July 18, 2013

Philly Fed Manufacturing Survey indicates Solid Expansion in July

From the Philly Fed: July Manufacturing Survey

Manufacturing firms responding to the July Business Outlook Survey indicated that regional manufacturing conditions improved this month. All of the survey’s broadest current indicators were positive, and most showed improvement from last month. The surveyʹs indicators of future activity also showed a notable rise, suggesting that firms expect a pickup in business over the next six months.This was above the consensus forecast of a reading of 9.0 for July. Earlier in the week, the Empire State manufacturing survey also indicated faster expansion in July.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 12.5 in June to 19.8, its highest reading since March 2011.

Labor market conditions showed a notable improvement this month. The current employment index, at 7.7, registered its first positive reading in four months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys turned positive in June, and increased further in July. This suggests a further rebound in the ISM report for July.

Weekly Initial Unemployment Claims decline to 334,000

by Calculated Risk on 7/18/2013 08:30:00 AM

The DOL reports:

In the week ending July 13, the advance figure for seasonally adjusted initial claims was 334,000, a decrease of 24,000 from the previous week's revised figure of 358,000. The 4-week moving average was 346,000, a decrease of 5,250 from the previous week's revised average of 351,250.The previous week was revised down from 360,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 346,000.

The 4-week average has mostly moved sideways over the last few months. Claims were below the 344,000 consensus forecast.

Wednesday, July 17, 2013

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey, Bernanke

by Calculated Risk on 7/17/2013 09:10:00 PM

First, here is a price index for commercial real estate that I follow. From CoStar: Commercial Real Estate Recovery Accelerates in May

COMMERCIAL REAL ESTATE PRICES ADVANCE ACROSS THE BOARD IN MAY: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 0.7% and 2.0%, respectively, in the month of May 2013, reflecting continued improvement in market fundamentals and increased investment activity. The value-weighted index, which is heavily influenced by larger transactions and typically tracks with high quality core real estate prices, has now increased by 41% from its most recent trough in 2010. For comparison, the equal-weighted index, which is influenced by smaller, more numerous opportunistic transactions, has improved by 10% from its bottom in 2011.Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

...

DISTRESS SALES DECLINE WITH IMPROVING FUNDAMENTALS: The percentage of commercial property selling at distressed prices declined to an average of 14.1% in April and May, the lowest two-month average on record since 2008. The decline in the number of distressed trades continues to support higher, more consistent pricing and has enhanced market liquidity by giving buyers and sellers greater confidence to do deals.

emphasis added

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for an decrease to 344 thousand from 360 thousand last week.

• At 10:00 AM, Testimony by Fed Chairman Ben Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate. The prepared testimony will be the same as delivered Wednesday, but the Q&A might be interesting.

• Also at 10:00 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 9.0, down from 12.5 last month (above zero indicates expansion).

• Also at 10:00 AM, the Conference Board Leading Indicators for June. The consensus is for a 0.3% increase in this index.

Lawler: Update on June existing Home Sales and Table of Distressed Sales and Cash buyers for Selected Cities

by Calculated Risk on 7/17/2013 05:38:00 PM

From housing economist Tom Lawler:

Local realtor reports released since last Friday have been consistent with my early assessment that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.99 million in June, down 3.7% from May’s pace. Limited data suggest that a mild slowdown in all-cash (and investor) buying may be a reason for the dip in June’s sales pace.CR Note: The NAR is scheduled to report June existing home sales on Monday, July 22nd. Based on Tom's earlier estimate, the NAR will report inventory at around 2.2 million for June, and months-of-supply around 5.3 (up from 5.1 months in May). This would still be a very low level of inventory - probably the lowest for June since 2002 or so - but a 6.3% year-over-year decline in inventory would be the smallest year-over-year decline since early 2011 (when inventory started to decline sharply). Note: In May, inventory was down 10.1% compared to May 2012. These smaller year-over-year declines suggest inventory bottomed earlier this year.

Tom Lawler also sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in June.

CR Note: Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales in all of these cities except Springfield, Ill. Even short sales are now starting to decline year-over-year.

Also, as Tom noted, the percent of cash buyers seems to be down a little in most areas.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jun-13 | Jun-12 | Jun-13 | Jun-12 | Jun-13 | Jun-12 | Jun-13 | Jun-12 | |

| Las Vegas | 31.0% | 34.2% | 9.0% | 27.8% | 40.0% | 62.0% | 55.3% | 54.0% |

| Reno | 24.0% | 37.0% | 6.0% | 21.0% | 30.0% | 58.0% | ||

| Phoenix | 12.7% | 32.8% | 8.7% | 14.1% | 21.5% | 46.8% | 37.5% | 46.9% |

| Sacramento | 23.2% | 31.0% | 7.5% | 19.7% | 30.7% | 50.7% | 29.9% | 33.4% |

| Minneapolis | 6.0% | 9.6% | 15.7% | 25.1% | 21.7% | 34.6% | ||

| Mid-Atlantic | 7.6% | 10.2% | 6.3% | 8.7% | 13.9% | 18.9% | 15.9% | 16.5% |

| Orlando | 18.7% | 28.5% | 18.1% | 25.2% | 36.8% | 53.7% | 49.8% | 51.7% |

| So. California* | 16.2% | 24.4% | 9.1% | 24.4% | 25.3% | 48.8% | 30.2% | 32.3% |

| Hampton Roads | 22.8% | 28.8% | ||||||

| Northeast Florida | 35.6% | 39.9% | ||||||

| Chicago | 28.0% | 33.0% | ||||||

| Toledo | 28.1% | 33.0% | ||||||

| Tucson | 32.8% | 32.9% | ||||||

| Omaha | 14.9% | 14.4% | ||||||

| Pensacola | 29.8% | 34.3% | ||||||

| Des Moines | 17.5% | 18.9% | ||||||

| Houston | 8.4% | 16.8% | ||||||

| Memphis* | 18.2% | 29.6% | ||||||

| Birmingham AL | 19.4% | 26.4% | ||||||

| Springfield IL | 12.0% | 9.2% | ||||||

| *share of existing home sales, based on property records | ||||||||

Fed's Beige Book: Economic activity increased "at a modest to moderate pace"

by Calculated Risk on 7/17/2013 02:05:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of St. Louis and based on information collected on or before July 8, 2013."

Reports from the twelve Federal Reserve Districts indicate that overall economic activity continued to increase at a modest to moderate pace since the previous survey. Manufacturing expanded in most Districts since the previous report, with many Districts reporting increases in new orders, shipments, or production. Most Districts noted that overall consumer spending and auto sales increased during the reporting period. Activity in a wide variety of nonfinancial services was stable or increased in most reporting Districts. Transportation was stable or increased in several Districts. Tourism remained strong in some reporting Districts, although several Districts noted softness from bad weather. Residential real estate and construction activity increased at a moderate to strong pace in all reporting Districts. Commercial real estate market conditions and construction continued to improve across the Districts. Banking conditions generally improved across the Districts. Credit quality improved, while credit standards remained largely unchanged. Agricultural conditions were mixed, as weather patterns varied, while extraction was generally stable or increased.And on real estate:

Residential real estate activity increased at a moderate to strong pace in most Districts. Most Districts reported increases in home sales. Cleveland noted that June sales of single-family homes were down compared with earlier in the spring but up from last year. Boston, New York, Minneapolis, Kansas City, Dallas, and San Francisco noted strong residential real estate markets. Home prices increased throughout the majority of the reporting Districts. Boston, New York, Richmond, Atlanta, Minneapolis, Kansas City, and Dallas noted low or declining home inventories and upward pressures on home prices in some areas. Residential construction activity also improved moderately across the Districts, and contacts in New York, Philadelphia, Chicago, Minneapolis, Dallas, and San Francisco reported faster growth in multi-family construction, in particular.Residential real estate continues to be a strong sector for the economy. Overall this was similar to the previous beige book with economic activity increasing at a "modest to moderate" pace.

Commercial real estate market conditions continued to improve across most Districts. New York, Philadelphia, Cleveland, Atlanta, Chicago, St. Louis, Minneapolis, and San Francisco reported modest to moderate improvements in nonresidential real estate activity. Dallas reported strong growth in leasing activity for office and industrial space. Boston and Richmond reported that commercial real estate conditions were holding steady or improving, depending on location. Nonresidential construction activity was stable or increased throughout the nation.

emphasis added

Housing Starts: A few comments

by Calculated Risk on 7/17/2013 12:25:00 PM

A few comments:

• Overall the housing starts report was disappointing with total starts at a 836 thousand rate on a seasonally adjusted annual rate basis (SAAR) in June. This was well below the consensus forecast of 951 thousand SAAR. Most of the decline was related to the volatile multi-family sector.

• Single family permits were at the highest level since May 2008, and it appears single family starts will increase over the next few months.

• Also housing starts are up significantly from the same period last year. Over the first half of 2013, multi-family starts are up close to 34% from the same period in 2012, and single family starts are up 20%. Those are significant increases in activity.

• Even with this significant year-over-year increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. This suggests significantly more growth in housing starts over the next few years.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind. It is interesting that completions have lagged so far behind starts, and this suggests completions will increase significantly later this year and into 2014 (completions lag starts by about 12 months).

However the level of multi-family starts over the last 12 months - almost to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Bernanke: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 7/17/2013 09:29:00 AM

Federal Reserve Chairman Ben Bernanke testimony "Semiannual Monetary Policy Report to the Congress" Before the Committee on Financial Services, U.S. House of Representatives (starts at 10 AM ET):

I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course. On the one hand, if economic conditions were to improve faster than expected, and inflation appeared to be rising decisively back toward our objective, the pace of asset purchases could be reduced somewhat more quickly. On the other hand, if the outlook for employment were to become relatively less favorable, if inflation did not appear to be moving back toward 2 percent, or if financial conditions--which have tightened recently--were judged to be insufficiently accommodative to allow us to attain our mandated objectives, the current pace of purchases could be maintained for longer. Indeed, if needed, the Committee would be prepared to employ all of its tools, including an increase the pace of purchases for a time, to promote a return to maximum employment in a context of price stability.Here is the C-Span Link

emphasis added

Here is the Bloomberg TV link.

Housing Starts declined in June to 836,000 SAAR

by Calculated Risk on 7/17/2013 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 836,000. This is 9.9 percent below the revised May estimate of 928,000, but is 10.4 percent above the June 2012 rate of 757,000.

Single-family housing starts in June were at a rate of 591,000; this is 0.8 percent below the revised May figure of 596,000. The June rate for units in buildings with five units or more was 236,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 911,000. This is 7.5 percent below the revised May rate of 985,000, but is 16.1 percent above the June 2012 estimate of 785,000.

Single-family authorizations in June were at a rate of 624,000; this is 0.6 percent above the revised May figure of 620,000. Authorizations of units in buildings with five units or more were at a rate of 261,000 in June.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in June (Multi-family is volatile month-to-month).

Single-family starts (blue) decreased slightly to 591,000 SAAR in June (Note: May was revised down from 599 thousand to 596 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was well below expectations of 951 thousand starts in June and the lowest level for starts since August 2012. Total starts in June were up 10.4% from June 2012; single family starts were only up 11.5% year-over-year. I'll have more later ...

MBA: Mortgage Purchase Applications increase slightly, Refinance Applications Decline in Latest Weekly Survey

by Calculated Risk on 7/17/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

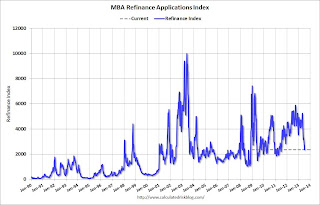

The Refinance Index decreased 4 percent from the previous week and is at its lowest level since July 2011. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The refinance share of mortgage activity decreased to 63 percent of total applications from 64 percent the previous week and is at its lowest level since April 2011.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) was unchanged at 4.68 percent, with points decreasing to 0.42 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4.5%, refinance activity has fallen sharply, decreasing in 9 of the last 10 weeks.

This index is down 55% over the last ten weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

Tuesday, July 16, 2013

Wednesday: Housing Starts, Bernanke

by Calculated Risk on 7/16/2013 08:45:00 PM

Oops ... from Mort Zuckerman writing in the WSJ:

That brings us to a stunning fact about the jobless recovery: The measure of those adults who can work and have jobs, known as the civilian workforce-participation rate, is currently 63.5%—a drop of 2.2% since the recession ended. Such a decline amid a supposedly expanding economy has never happened after previous recessions. Another statistic that underscores why this is such a dysfunctional labor market is that the number of people leaving the workforce during this economic recovery has actually outpaced the number of people finding a new job by a factor of nearly three.I guess Mr. Zuckerman hasn't been following the discussion of current demographic trends. A significant portion of the recent decline in the participation rate is due to baby boomers retiring and other demographic trends (like more younger Americans staying in school).

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for their weekly mortgage applications survey. Expect a further decline in refinance activity.

• At 8:30 AM, the Census Bureau will release Housing Starts for June. The consensus is for total housing starts to increase to 951 thousand (SAAR) in June from 914 thousand in May.

• At 10:00 AM, Testimony by Fed Chairman Ben Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts.