by Calculated Risk on 7/05/2013 01:58:00 PM

Friday, July 05, 2013

Update: Four Charts to Track Timing for QE3 Tapering

We now have data to update all four charts that I'm using to track when the Fed will start tapering the QE3 purchases.

At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

Click on graph for larger image.

Click on graph for larger image.The first graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first quarter was below the FOMC projections (red), and it appears the second quarter will also be below the FOMC forecast - if so, then GDP will have to pickup in the 2nd half of 2013 for the Fed to start tapering QE3 purchases in December.

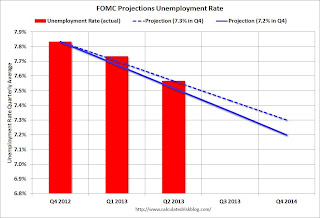

The second graph is for the unemployment rate.

The second graph is for the unemployment rate.The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We now have data through Q2, and so far the unemployment rate is tracking at the high end of the forecast.

If the participation rate ends the year at 63.6% (level for the year), then job growth will have to pickup up a little in the 2nd half to meet the FOMC projections. See the Atlanta Fed's Jobs Calculator tool to estimate how many jobs per month will be needed to reach a certain unemployment level.

The third graph is for PCE prices.

The third graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through May, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The fourth graph is for core PCE prices.

The fourth graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through May, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It has only been just over two weeks since the FOMC press conference, and all of the data has been worse than the FOMC forecasts (GDP revised down, unemployment rate at high end, prices below forecast). It would be a stretch to say the incoming data has been "broadly inconsistent" with the June FOMC projections, but clearly the economy will have to pickup before the FOMC would meet their "broadly consistent" goal and start to taper QE3 purchases in December. (September tapering seems less likely now since the key data has been worse than forecast, but still not impossible).

Employment Report: More Hiring, Wages Up, Still Weak Labor Market

by Calculated Risk on 7/05/2013 11:04:00 AM

The good news: This was the best first half for private employment gains since 1999. Also hourly and weekly wages increased 0.4% in June, and hourly wages are now up 2.2% over the last year (weekly wages are up 2.5% year-over-year).

Some bad news: the employment-population ratio for the 25 to 54 year old group (prime working age) declined, the number of part time workers (for economic reasons) increased and U-6 (an alternative measure of labor underutilization) increased to 14.3%.

Some numbers: Total nonfarm employment is up 2.293 million over the last 12 months, and up 1.211 million so far in 2013 (a 2.42 million annual pace).

Private employment is up 2.357 million over the last year, and up 1.234 million so far in 2013 (a 2.47 million annual pace). The following table shows the first and second half and full year changes in private employment since 1998.

| Change in Private Payrolls (000s) | |||

|---|---|---|---|

| Year | First Half | Second Half | Full Year |

| 1998 | 1,389 | 1,312 | 2,701 |

| 1999 | 1,296 | 1,413 | 2,709 |

| 2000 | 953 | 727 | 1,680 |

| 2001 | -773 | -1,535 | -2,308 |

| 2002 | -531 | -234 | -765 |

| 2003 | -366 | 470 | 104 |

| 2004 | 1,111 | 761 | 1,872 |

| 2005 | 1,211 | 1,087 | 2,298 |

| 2006 | 1,109 | 753 | 1,862 |

| 2007 | 688 | 139 | 827 |

| 2008 | -861 | -2,936 | -3,797 |

| 2009 | -3,876 | -1,100 | -4,976 |

| 2010 | 434 | 801 | 1,235 |

| 2011 | 1,209 | 1,211 | 2,420 |

| 2012 | 1,146 | 1,123 | 2,269 |

| 2013 | 1,234 | ||

Of course public payrolls are continuing to shrink (four plus years of declining public payrolls now). Public employment was down 7 thousand in June (mostly at the Federal level), and public employment is down 64 thousand over the last year, and down 23 thousand so far in 2013 (a 46 thousand annual pace).

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The ratio decreased to 75.9% in June from 76.0% in May. This ratio should probably move close to 80% as the economy recovers.

The participation rate for this group also decreased in June to 81.1%. The decline in the participation rate for this age group is probably mostly due to economic weakness (as opposed to demographics) and this suggests the labor market is still very weak.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

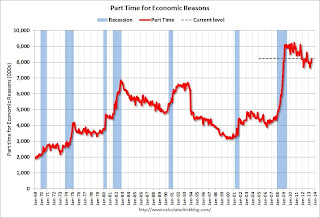

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by 322,000 to 8.2 million in June. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in June to 8.226 million.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 14.3% in June from 13.8% in May.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.328 million workers who have been unemployed for more than 26 weeks and still want a job. This was down slightly from 4.357 million in May. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In June 2013, state and local governments lost 2,000 jobs, and state and local employment is up 23 thousand so far in 2013.

I think most of the state and local government layoffs are over. Of course total public employment declined again as the Federal government layoffs are ongoing - and with many more layoffs expected.

Overall this was a solid report - especially with the upward revisions to April and May employment and the pickup in wage gains. But the labor market is still weak and millions of people are unemployed or underemployed.

June Employment Report: 195,000 Jobs, 7.6% Unemployment Rate

by Calculated Risk on 7/05/2013 08:52:00 AM

From the BLS:

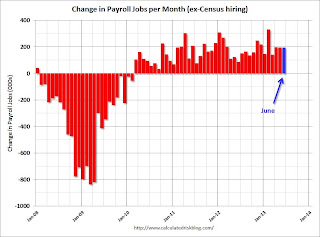

Total nonfarm payroll employment increased by 195,000 in June, and the unemployment rate was unchanged at 7.6 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was above expectations of 161,000 payroll jobs added. Employment for April and May were also revised higher.

...

The change in total nonfarm payroll employment for April was revised from +149,000 to +199,000, and the change for May was revised from +175,000 to +195,000. With these revisions, employment gains in April and May combined were 70,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

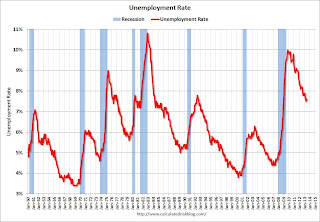

The second graph shows the unemployment rate.

The unemployment rate was unchanged in June at 7.6%.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased to 63.5% in June (blue line) from 63.4% in May. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio increased in June to 58.7% (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was above expectations and was a solid report including the upward revisions to April and May. I'll have much more later ...

Thursday, July 04, 2013

Friday: Jobs

by Calculated Risk on 7/04/2013 08:36:00 PM

First, the employment situation release tomorrow for June is the initial estimate. Since January 2011, there have been 29 monthly employment releases through May 2013, and 21 have been revised up so far. Since it looks like the annual revision (based on state level data) will be up again this year, I expect almost all of the revisions for the last year to be up with the final counting. So one key tomorrow will be to look at the revisions for April and May (reported as 149 and 175 thousand respectively in the last release).

Another key will be the unemployment rate. The current Fed forecast is for the unemployment rate to decline to the 7.2% to 7.3% range in Q4 2013 from just over a 7.8% average in Q4 of 2012. Of course the participation rate is important too (at 63.4% in May). Although the participation rate is expected to continue to decline over the next decade due to demographics, some bounce back (or at least stability) would be expected this year if the labor market is improving. We'd like to see the unemployment rate decline in June without a decline in the participation rate.

Also a reminder from the BLS on seasonal adjustments in the June report:

[I]n the household survey, the large number of youth entering the labor force each June is likely to obscure any other changes that have taken place relative to May, making it difficult to determine if the level of economic activity has risen or declined. Similarly, in the establishment survey, payroll employment in education declines by about 20 percent at the end of the spring term and later rises with the start of the fall term, obscuring the underlying employment trends in the industry. Because seasonal employment changes at the end and beginning of the school year can be estimated, the statistics can be adjusted to make underlying employment patterns more discernable.Last year the BLS reported 1.33 million teens (16 to 19 years old) joined the labor force Not Seasonally Adjusted (NSA), but that was expected - and seasonally adjusted to just an increase of 93 thousand. This year a fairly large number of teens (409 thousand) joined the labor force in May (more than expected), so the June number will probably be a little lower. This is important because teens have a high unemployment rate - and the early entry this year (like happened in 2008) could have pushed up the overall unemployment rate in May.

Friday:

• At 8:30 AM ET, the Employment Report for June will be released. The consensus is for an increase of 161,000 non-farm payroll jobs in June following the 175,000 non-farm payroll jobs in May. The consensus is for the unemployment rate to decrease to 7.5% in June from 7.6% in May.

Some Employment Statistics

by Calculated Risk on 7/04/2013 03:46:00 PM

The key report for this week will be the June employment situation report to be released on Friday.

The following table summarizes some of the labor statistics and compares the current situation (May 2013) with the employment situation when the recession started (December 2007) - and also the worst numbers during the recession.

Even though the noninstitutional population has increased by over 12 million, the labor force has only increased by 1.7 million since December 2007. This decline in the participation rate has been a key topic, and some of the decline in participation was due to demographics - and some due to economic weakness.

Nonfarm payrolls are up 6.3 million from the trough, but still 2.35 million below the December 2007 levels. Private payrolls are up 6.9 million from the depth of the recession, but still 1.8 million below the pre-recession level.

And the unemployment rate has fallen about halfway back to the pre-recession level.

However the numbers of unemployed, part-time for economic reasons, marginally attached, and long term unemployed have not improved as much. Whereas the headline unemployment rate is about halfway back to the pre-recession level, the U-6 unemployment rate is less than 40% of the way back to the pre-recession level.

This is a reminder we need to look at more than just payroll jobs and the unemployment rate. There are still millions of workers unemployed or underemployed - and this says nothing about weak wage growth. There is still a long way to go.

| Employment Statistics (Thousands or Percent)1 | |||

|---|---|---|---|

| May-13 | Dec-07 | Worst | |

| Civilian noninstitutional population (16 and over) | 245,363 | 233,156 | --- |

| Civilian labor force | 155,658 | 153,936 | --- |

| Total nonfarm Payroll | 135,637 | 137,983 | 129,320 |

| Private Payroll | 113,789 | 115,606 | 106,850 |

| Unemployment Rate | 7.6% | 5.0% | 10.0% |

| Unemployed | 11,760 | 7,664 | 15,382 |

| Part-Time for Economic Reasons | 7,904 | 4,638 | 9,103 |

| Marginally Attached to Labor Force2 | 2,164 | 1,395 | 2,809 |

| Discouraged Workers2 | 780 | 363 | 1,318 |

| U-6 Unemployment rate3 | 13.8% | 8.8% | 17.1% |

| Unemployed for 27 Weeks & over | 4,357 | 1,327 | 6,704 |

1 The payroll numbers are from the Current Employment Statistics (establishment survey), and the remaining numbers are from the Current Population Survey (household survey).

2 BLS: "Discouraged workers are a subset of persons marginally attached to the labor force. The marginally attached are those persons not in the labor force who want and are available for work, and who have looked for a job sometime in the prior 12 months, but were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. Among the marginally attached, discouraged workers were not currently looking for work specifically because they believed no jobs were available for them or there were none for which they would qualify."

3 BLS: "Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers"

ECB's Draghi: "ECB interest rates to remain at present or lower levels for an extended period of time"

by Calculated Risk on 7/04/2013 10:34:00 AM

From David Keohane at FT Alphaville: Forward guidance is contagious and the ECB has caught it

From a very dovish Mario Draghi’s press conference following the European Central Bank’s decision to keep its key rates on hold ...And from the WSJ: ECB Chief Gives Rate Forecast

Looking ahead, our monetary policy stance will remain accommodative for as long as necessary. The Governing Council expects the key ECB interest rates ... to remain at present or lower levels for an extended period of time. This expectation is based on the overall subdued outlook for inflation extending into the medium term, given the broad-based weakness in the real economy and subdued monetary dynamics. In the period ahead, we will monitor all incoming information on economic and monetary developments and assess any impact on the outlook for price stability ...This feels really rather significant.

It is a radical departure from the policy the ECB has followed ever since it started operations in 1999, under which it never pre-committed to any level of rates in advance.

...

Earlier in the day, the Bank of England had also broken with its usual practice, issuing a forward-looking statement that, likewise, appeared aimed at damping expectations of future interest rate increases. Mr. Draghi said it was a "coincidence" that the two things had happened on the same day.

Mr. Draghi drew attention to the fact that the council had been unanimous on giving its new guidance, implying that even hawkish members such as Germany's Jens Weidmann had consented to what was a powerfully dovish signal.

Wednesday, July 03, 2013

Trulia: Asking Home Prices increased in June

by Calculated Risk on 7/03/2013 09:19:00 PM

This was released earlier today: Trulia Reports Asking Home Prices Up 10.7 Percent Year-over-year Nationally as Mortgage Rates Rise

Nationally, asking home prices rose 10.7 percent year-over-year (Y-o-Y) in June. Even excluding foreclosures, prices jumped 11.4 percent Y-o-Y, signaling that the current rise in prices is not primarily driven by the shift away from foreclosure to non-distressed homes for sale. However, asking prices will eventually slow down as mortgage rates rise, inventory expands, and investor demand falls.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

Nationally, asking home prices bottomed in February 2012 – but the turnaround has been uneven. Prices first rebounded two years ago in San Jose, Phoenix, Denver, Miami, and a few other housing markets where job growth or bargain buying started boosting prices earlier. Meanwhile, prices continued to fall in several East Coast and Midwest markets until three to six months ago. Now with the housing recovery in full swing, asking prices rose in 99 of the 100 largest metros.

Marking its biggest Y-o-Y increase since January, rents rose 2.8 percent Y-o-Y nationally in June. Rents climbed most in Houston, Miami, and Tampa-St. Petersburg, but fell where asking prices are up more than 30 percent: Las Vegas, Oakland, and Sacramento. In fact, home prices outpaced rents in 22 of the 25 largest rental markets. Only in Houston, New York, and Philadelphia did rents rise faster than home prices.

“Rising home prices have swept the country,” said Jed Kolko, Trulia’s Chief Economist. “Local markets that suffered most during the housing crisis are seeing the biggest price rebounds today. Now even markets that escaped the worst of the bust, like Chicago and Baltimore, are seeing prices climb. However, these runaway price gains won’t last: both rising mortgage rates and slowly growing inventories should start tapping the brakes on home prices, preventing them from rising back into bubble territory.”

emphasis added

More from Kolko: Asking Home Prices Not Cooling Off – Yet

Employment Situation Preview

by Calculated Risk on 7/03/2013 04:22:00 PM

On Friday, at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for an increase of 161,000 non-farm payroll jobs in June, and for the unemployment rate to decline to 7.5% from 7.6% in May.

Here is a summary of recent data:

• The ADP employment report showed an increase of 188,000 private sector payroll jobs in June. This was above expectations of 165,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index decreased in June to 48.7% from 50.1% in April. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased by close to 25,000 in June. The ADP report indicated a 1,000 increase for manufacturing jobs in June.

The ISM non-manufacturing (service) employment index increased in June to 54.7% from 50.1% in May. A historical correlation between the ISM service employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 185,000 in June.

Taken together, these surveys suggest only around 160,000 jobs added in June - in line with the consensus forecast.

• Initial weekly unemployment claims averaged about 345,000 in June. This was down slightly from 348,000 in May, and near the low for the year.

For the BLS reference week (includes the 12th of the month), initial claims were at 355,000; up from 344,000 in May.

• The final June Reuters / University of Michigan consumer sentiment index decreased to 84.1 from the May reading of 84.5. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors.

• The small business index from Intuit showed 25,000 payroll jobs added in June, Down from 35,000 in May.

• And on the unemployment rate from Gallup: Unadjusted Unemployment Rate Static in June

Gallup's unadjusted unemployment rate for the U.S. workforce was 7.8% in June, statistically similar to the 7.9% in May, and the 8.0% in June 2012.Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for June, however, was 7.6%, down from 8.2% in May.

• Conclusion: The employment related data was slightly better in June than in May. The ADP and ISM manufacturing reports suggest an increase in hiring. However weekly claims for the reference week were slightly higher in June than in May, and consumer sentiment decreased slightly.

There is always some randomness to the employment report, but my guess is the BLS will report close to the consensus of 161,000 jobs added in June. A key will the unemployment rate to see if that is tracking the Fed's forecast for QE3 tapering.

Reis: Regional Mall Vacancy Rates unchanged in Q2

by Calculated Risk on 7/03/2013 01:38:00 PM

Reis reported that the vacancy rate for regional malls was unchanged in Q2 at 8.3%, the same is in Q1. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined slightly to 10.5% in Q2, down from 10.6% in Q1. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] During the second quarter vacancy declined by yet another 10 bps. This is the sixth time in the last seven quarters that vacancy fell by 10 bps. The market is proving to be consistent if not spectacular in its recovery. On a year‐over‐year basis, the vacancy rate declined by 30 bps. The amount of space absorbed continues to slightly exceed the amount of space completed. Since only 914,000 square feet were delivered, the modest improvement in vacancy remains a function of slack demand for space.

...

[New construction] With demand for space so meager, there exists no real catalyst for new construction in the market. Consequently, new construction continues to hover near record‐low levels. 914,000 square feet were delivered during the second quarter, versus 1.124 million square feet during the first quarter. This is a slight slowdown compared to the 1.171 million square feet of retail space that were delivered during the second quarter of 2012. In fact, 914,000 square feet is the fourth‐lowest figure on record since Reis began tracking quarterly data in 1999. Although construction this quarter came primarily from new centers and not expansion of existing centers, roughly 60% of the new space that came online during the quarter was in only three projects.

...

[Regional] The improvement in the malls subsector took a bit of a breather during the second quarter. The national vacancy rate was unchanged during the quarter, this first time this segment of the market did not register a decline in vacancy since the third quarter of 2011 when mall vacancies reached their all time high of 9.4%. Asking rent growth was also unchanged versus last quarter, growing by another 0.4%. This was the ninth consecutive quarter of asking rent increases and on a year‐over‐year basis, rent growth slightly accelerated.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP through Q1 2013. This has increased from the bottom because this includes renovations and improvements. New mall investment has essentially stopped.

The good news is, as Severino noted, new square footage is near a record low, and with very little new supply, the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.

Trade Deficit increased in May to $45.0 Billion

by Calculated Risk on 7/03/2013 11:13:00 AM

Catching up ... the Department of Commerce reported this morning:

[T]otal May exports of $187.1 billion and imports of $232.1 billion resulted in a goods and services deficit of $45.0 billion, up from $40.1 billion in April, revised. May exports were $0.5 billion less than April exports of $187.6 billion. May imports were $4.4 billion more than April imports of $227.7 billion.The trade deficit was higher than the consensus forecast of $40.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through May 2013.

Click on graph for larger image.

Click on graph for larger image.Imports increased in May, and exports decreased slightly.

Exports are 13% above the pre-recession peak and up 2% compared to May 2012; imports are at the pre-recession peak, and up 1% compared to May 2012 (mostly moving sideways).

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.Oil averaged $96.84 in May, down slightly from $97.82 in April, and down from $108.06 in May 2012.

The trade deficit with the euro area was $8.9 billion in May, up from $8.7 billion in May 2012.

The trade deficit with China increased to $27.9 billion in May, up from $26.0 billion in May 2012. Most of the trade deficit is related to oil and China.