by Calculated Risk on 6/18/2013 05:26:00 PM

Tuesday, June 18, 2013

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in May

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in May.

Look at the two columns in the table for Total "Distressed" Share. In almost every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales in all of these cities. Also there has been a shift from foreclosures to short sales. In all of these areas - except Minneapolis, and the California Bay Area - short sales now out number foreclosures.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| May-13 | May-12 | May-13 | May-12 | May-13 | May-12 | Apr-13 | Apr-12 | |

| Las Vegas | 31.8% | 32.6% | 10.3% | 34.7% | 42.1% | 67.3% | 57.9% | 54.4% |

| Reno | 27.0% | 39.0% | 7.0% | 22.0% | 34.0% | 61.0% | ||

| Phoenix | 12.3% | 26.6% | 9.7% | 16.9% | 22.0% | 43.4% | 38.9% | 46.3% |

| Sacramento | 22.5% | 30.1% | 7.5% | 28.1% | 30.0% | 58.2% | 33.6% | 31.5% |

| Minneapolis | 6.8% | 10.6% | 20.1% | 28.8% | 26.9% | 39.4% | 18.7% | 20.1% |

| Mid-Atlantic (MRIS) | 8.2% | 11.8% | 7.2% | 10.2% | 15.5% | 22.1% | 16.7% | 17.2% |

| Orlando | 21.7% | 27.6% | 18.9% | 25.0% | 40.6% | 52.6% | 53.5% | 51.6% |

| California (DQ)* | 17.7% | 23.7% | 11.4% | 28.5% | 29.1% | 52.2% | ||

| Bay Area CA (DQ)* | 7.3% | 21.4% | 13.9% | 21.2% | 21.2% | 42.6% | 27.6% | 28.3% |

| So. California (DQ)* | 17.7% | 24.3% | 10.8% | 26.9% | 28.5% | 51.2% | 31.9% | 32.1% |

| Hampton Roads | 26.3% | 26.3% | ||||||

| Northeast Florida | 36.6% | 42.9% | ||||||

| Chicago | 33.0% | 36.0% | ||||||

| Houston | 9.4% | 17.8% | ||||||

| Memphis* | 21.5% | 30.5% | ||||||

| Birmingham AL | 21.0% | 27.3% | ||||||

| *share of existing home sales, based on property records | ||||||||

Housing Starts: A few comments

by Calculated Risk on 6/18/2013 02:11:00 PM

A few comments:

• Overall the housing starts report was a little disappointing with total starts at a 914 thousand rate on a seasonally adjusted annual rate basis (SAAR) in May. This was below the consensus forecast of 950 thousand SAAR.

• However starts are up significantly from the same period last year. Over the first five months of 2013, multi-family starts are up close to 40% from the same period in 2012, and single family starts are up 24%. Those are significant increases in activity. Based on permits and the June homebuilder confidence survey, I expect starts will increase further in June.

• Even with this significant year-over-year increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. This suggests significantly more growth in housing starts over the next few years.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind. It is interesting that completions have lagged so far behind starts, and this suggests completions will increase significantly later this year (completions lag starts by about 12 months).

There will be a significant increase in multi-family deliveries this year. However the level of multi-family starts over the last 12 months - almost to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Key Measures show low and falling inflation in May

by Calculated Risk on 6/18/2013 11:53:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for May here. Fuel oil declined at a 28% annualized rate in May.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.8% annualized rate) in May. The CPI less food and energy increased 0.2% (2.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.7%. Core PCE is for April and increased just over 1.0% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.6% annualized, and core CPI increased 2.0% annualized. Also core PCE for April increased 0.1% annualized.

This below target level of inflation will be a key topic at the FOMC meeting today and tomorrow.

Fed: Household Debt Service Ratio near lowest level in 30+ years

by Calculated Risk on 6/18/2013 10:31:00 AM

The Federal Reserve released the Q1 2013 Household Debt Service and Financial Obligations Ratios yesterday. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

...

The homeowner mortgage FOR includes payments on mortgage debt, homeowners' insurance, and property taxes, while the homeowner consumer FOR includes payments on consumer debt and automobile leases

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased slightly in Q1, and is just above the record low set last quarter thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt also increased slightly in Q1, and is back to levels last seen in early 1995.

Even the homeowner's financial obligation ratio for mortgages (blue) is down to 1990s levels. This ratio increased rapidly during the housing bubble, and continued to increase until 2008. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined to 1998 (and 1981) levels.

Housing Starts increase in May to 914,000 SAAR

by Calculated Risk on 6/18/2013 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 914,000. This is 6.8 percent above the revised April estimate of 856,000 and is 28.6 percent above the May 2012 rate of 711,000.

Single-family housing starts in May were at a rate of 599,000; this is 0.3 percent above the revised April figure of 597,000. The May rate for units in buildings with five units or more was 306,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 974,000. This is 3.1 percent below the revised April rate of 1,005,000, but is 20.8 percent above the May 2012 estimate of 806,000.

Single-family authorizations in May were at a rate of 622,000; this is 1.3 percent above the revised April figure of 614,000. Authorizations of units in buildings with five units or more were at a rate of 374,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in May following the sharp decrease in April (Multi-family is volatile month-to-month).

Single-family starts (blue) increased slightly to 599,000 SAAR in May (Note: April was revised down from 610 thousand to 597 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was below expectations of 950 thousand starts in May. Total starts in May were up 28.6% from May 2012; however single family starts were only up 16.3% year-over-year. I'll have more later ...

Monday, June 17, 2013

Tuesday: Housing Starts, CPI

by Calculated Risk on 6/17/2013 09:22:00 PM

Earlier today, Robin Harding at the Financial Times released a market moving story of the Fed: Fed likely to signal tapering move is close

Ben Bernanke is likely to signal that the US Federal Reserve is close to tapering down its $85bn-a-month in asset purchases when he holds a press conference on Wednesday, but balance that by saying subsequent moves depend on what happens to the economy.This depends on the definition of "close". I think it is very unlikely the Fed will start to taper before September, and based on my expectations of only a slow improvement in the unemployment rate and continued low inflation, I think they will wait even longer.

excerpt with permission

Tuesday economic releases:

• At 8:30 AM, Housing Starts for May. The consensus is for total housing starts to increase to 950 thousand (SAAR) in May.

• Also at 8:30 AM, the Consumer Price Index for May will be released. The consensus is for a 0.2% decrease in CPI in May and for core CPI to increase 0.2%.

FNC: House prices increased 4.6% year-over-year in April

by Calculated Risk on 6/17/2013 05:56:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Rise in Home Prices Picks up in April

The latest FNC Residential Price Index™ (RPI) shows that U.S. home prices continue to rise in April, up 0.7% from the previous month. April’s gain marks the largest price acceleration since June 2012, caused in part by rising seasonal demand entering spring and summer.Note: This increase is partially seasonal. This year prices were up 0.7% in April (from March). Last year, in April 2012, prices were up 1.0% in April - so this is slower seasonal price appreciation.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that April home prices rose much faster than in the previous months. The two narrower indices (30-MSA and 10-MSA composites) similarly recoded a nearly 1.0% increase. On a year-over-year basis, home prices were up 4.6% from a year ago. The indices have been revised downward for the prior months, resulting in more moderate annual price accelerations.

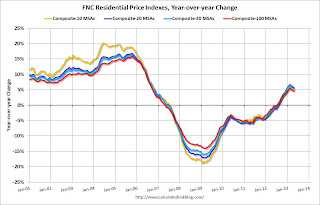

The year-over-year change slowed in April, with the 100-MSA composite up 4.6% compared to April 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 28.6% from the peak.

Existing Home Inventory is up 14.9% year-to-date on June 17th

by Calculated Risk on 6/17/2013 02:10:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 14.9%, however inventory is down over the last few weeks. I expect further increases over the next few months.

Inventory is well above the peak percentage increases for 2011 and 2012 and this suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.8% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Redfin: "Here Comes the Inventory"

by Calculated Risk on 6/17/2013 12:47:00 PM

The bottom for inventory is a key topic for 2013 ...

From Tim Ellis at Redfin: Here Comes the Inventory

Increasing home prices are giving more sellers sufficient equity to sell, and sellers who already had equity are being lured into the market after seeing their neighbor’s homes sell in record time and in fierce bidding wars.

More inventory begets more inventory, too. “I have several clients who are ready to take the plunge and list their homes—they’ve even decluttered and we have the listing ready to hit the MLS,” explained Redfin listing specialist Paul Stone. “The sellers are just waiting to get under contract on a home to buy, at which point we’ll pull the trigger and list their current home.”

Here’s what the inventory recovery looks like so far, along with a forecast for the rest of the year, should the trend hold:

Total active listings are still down 22% from a year ago as of May, but even that is an improvement compared to the 32% year-over-year drop we experienced in January.

New listings have turned around completely in just four months, from a 10% year-over-year decline in January to a 15% year-over-year increase in May.CR Notes: I've been tracking inventory very closely this year. Ellis thinks (first graph) that inventory in the areas Redfin tracks will continue to build until September or October, and only decline slightly at the end of the year. He thinks inventory will be up year-over-year towards the end of this year. (that is pretty close to my current outlook for inventory).

...

As supply and demand are brought back into balance bidding wars will ease and price gains will moderate.

As more inventory comes on the market, buyer urgency will wane and price increases will slow and even decline seasonally in many areas this winter. IMO this will be another step towards a more normal housing market.

NAHB: Builder Confidence increases in June, Over 50 for first time since April 2006

by Calculated Risk on 6/17/2013 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 8 points in June to 52. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Hits Major Milestone in June

Builder confidence in the market for newly-built single-family homes hit a significant milestone in June, surging eight points to a reading of 52 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Any reading over 50 indicates that more builders view sales conditions as good than poor.

“This is the first time the HMI has been above 50 since April 2006, and surpassing this important benchmark reflects the fact that builders are seeing better market conditions as demand for new homes increases,” said NAHB Chairman Rick Judson, a home builder and developer from Charlotte, N.C. “With the low inventory of existing homes, an increasing number of buyers are gravitating toward new homes.”

...

All three HMI components posted gains in June. The index gauging current sales conditions increased eight points to 56, while the index measuring expectations for future sales rose nine points to 61 – its highest level since March 2006. The index gauging traffic of prospective buyers rose seven points to 40.

The HMI three-month moving average was up in three of the four regions, with the Northeast and Midwest posting a one-point and three-point gain to 37 and 47, respectively. The South registered a four point gain to 46 while the West fell one point to 48.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the June release for the HMI and the April data for starts (May housing starts will be released tomorrow). This was well above the consensus estimate of a reading of 45.