by Calculated Risk on 6/13/2013 12:28:00 PM

Thursday, June 13, 2013

Freddie Mac: "Mortgage Rates on Six Week Streak Higher"

From Freddie Mac today: Mortgage Rates on Six Week Streak Higher

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates climbing higher amid a solid employment report for May. Since beginning their climb last month, the 30-year fixed-rate mortgage has increased over half a percentage point. ...This graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

30-year fixed-rate mortgage (FRM) averaged 3.98 percent with an average 0.7 point for the week ending June 13, 2013, up from last week when it averaged 3.91 percent. Last year at this time, the 30-year FRM averaged 3.71 percent.

15-year FRM this week averaged 3.10 percent with an average 0.7 point, up from last week when it averaged 3.03 percent. A year ago at this time, the 15-year FRM averaged 2.98 percent.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.18% and 30 year mortgage rates are at 3.98% (according to Freddie Mac). Based on the relationship from the graph, if the ten year yield stays in this range, 30 year mortgage rates might move up to 4.1% or so in the Freddie Mac survey.

Note: The yellow markers are for the last three years with the ten year yield below 3%. A trend line through the yellow markers only is a little lower, but still close to 4% at the current 10 year Treasury yield.

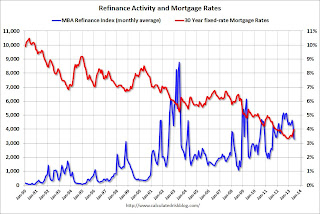

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 36% over the last 5 weeks) and will probably decline significantly if rates stay at this level.

Weekly Initial Unemployment Claims decline to 334,000

by Calculated Risk on 6/13/2013 09:15:00 AM

Catching up ... the DOL reports:

In the week ending June 8, the advance figure for seasonally adjusted initial claims was 334,000, a decrease of 12,000 from the previous week's unrevised figure of 346,000. The 4-week moving average was 345,250, a decrease of 7,250 from the previous week's unrevised average of 352,500.The previous week was unrevised at 346,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 345,250.

Claims was below the 350,000 consensus forecast.

Retail Sales increased 0.6% in May

by Calculated Risk on 6/13/2013 08:30:00 AM

On a monthly basis, retail sales increased 0.6% from April to May (seasonally adjusted), and sales were up 4.3% from May 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $421.1 billion, an increase of 0.6 percent from the previous month, and 4.3 percent above May 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 27.1% from the bottom, and now 11.4% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 0.3%. Retail sales ex-gasoline increased 0.6%.

Excluding gasoline, retail sales are up 24.3% from the bottom, and now 11.9% above the pre-recession peak (not inflation adjusted).

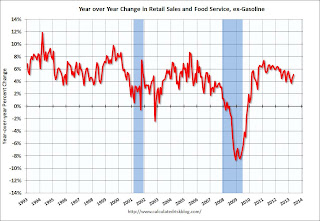

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.1% on a YoY basis (4.3% for all retail sales).

This was slightly above the consensus forecast of 0.5% increase in retail sales mostly due to strong auto sales.

Wednesday, June 12, 2013

Thursday: Retail Sales, Weekly Unemployment Claims

by Calculated Risk on 6/12/2013 07:26:00 PM

First, here is a price index for commercial real estate that I follow. From CoStar: Commercial Real Estate Prices Shake Off Effects of First Quarter Seasonal Slowdown with Strong Showing in April

COMMERCIAL REAL ESTATE PRICE RECOVERY REGAINED MOMENTUM IN APRIL: As the effects of the first quarter seasonal slowdown in investment activity subsided, commercial real estate prices advanced across the board in April 2013. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the equal-weighted U.S. Composite Index and the value-weighted U.S. Composite Index—each posted solid monthly gains in April of 1.9% and 1.1%, respectively, which reflects improvement in market fundamentals across the major CRE property types. The two components of the equal-weighted U.S. Composite Index (the Investment Grade and General Commercial indices) also made substantial gains in April 2013, signifying an extension of the recovery in commercial property pricing to more secondary property types and markets.

...

DISTRESS SALES FALL TO LOWEST LEVEL SINCE 2008: The percentage of commercial property selling at distressed prices tumbled to 13.2% in April 2013, 64% lower than the peak level observed in March 2011. This reduction in distressed deal volume has supported higher, more consistent pricing and enhanced market liquidity by giving buyers greater confidence to do deals.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 40.9% from the bottom (showing the demand for higher end properties) and up 10.8% year-over-year. However the Equal-Weighted index is only up 8.0% from the bottom, and up 6.3% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Thursday economic releases:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for an increase to 350 thousand from 346 thousand last week.

• Also at 8:30 AM, Retail sales for May will be released. The consensus is for retail sales to increase 0.5% in May, and to increase 0.4% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.3% increase in inventories.

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in May

by Calculated Risk on 6/12/2013 04:44:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in May.

Look at the two columns in the table for Total "Distressed" Share. In almost every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales in all of these cities. Also there has been a shift from foreclosures to short sales. In all of these areas - except Minneapolis- short sales now out number foreclosures.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| May-13 | May-12 | May-13 | May-12 | May-13 | May-12 | Apr-13 | Apr-12 | |

| Las Vegas | 31.8% | 32.6% | 10.3% | 34.7% | 42.1% | 67.3% | 57.9% | 54.4% |

| Reno | 27.0% | 39.0% | 7.0% | 22.0% | 34.0% | 61.0% | ||

| Phoenix | 12.3% | 26.6% | 9.7% | 16.9% | 22.0% | 43.4% | 38.9% | 46.3% |

| Sacramento | 22.5% | 30.1% | 7.5% | 28.1% | 30.0% | 58.2% | 33.6% | 31.5% |

| Minneapolis | 6.8% | 10.6% | 20.1% | 28.8% | 26.9% | 39.4% | 18.7% | 20.1% |

| Mid-Atlantic (MRIS) | 8.2% | 11.8% | 7.2% | 10.2% | 15.5% | 22.1% | 16.7% | 17.2% |

| So. California* | 17.7% | 24.3% | 10.8% | 26.9% | 28.5% | 51.2% | 31.9% | 32.1% |

| Hampton Roads | 26.3% | 26.3% | ||||||

| Memphis* | 21.5% | 30.5% | ||||||

| Birmingham AL | 21.0% | 27.3% | ||||||

| *share of existing home sales, based on property records | ||||||||

Sacramento: Conventional Sales in May highest in Years, Inventory increases year-over-year

by Calculated Risk on 6/12/2013 02:06:00 PM

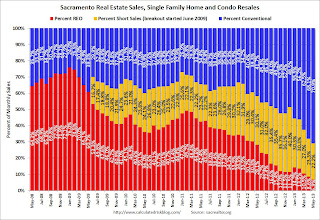

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For some time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In May 2013, 29.1% of all resales (single family homes) were distressed sales. This was down from 31.9% last month, and down from 58.3% in May 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs decreased to 6.9%, and the percentage of short sales decreased to 22.2%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently, and there were more than three times as many short sales as REO sales in May.

Active Listing Inventory for single family homes increased 5.3% year-over-year in May. This is the first year-over-year increase in inventory in two years and suggests inventory might have bottomed in Sacramento.

Cash buyers accounted for 33.6% of all sales, down from 37.2% last month (frequently investors).

Total sales were down 14% from May 2012, but conventional sales were up 45% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increase.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales.

Possibly the most important number in the release this month was the year-over-year increase in active inventory. This suggests price increases will slow in Sacramento, and I expect to see a similar pattern in other areas.

CoreLogic: Negative Equity Decreases in Q1 2013, 9.7 Million Properties still with Negative Equity

by Calculated Risk on 6/12/2013 10:20:00 AM

From CoreLogic: 9.7 Million Residential Properties with a Mortgage Still in Negative Equity

CoreLogic ... today released new analysis showing approximately 850,000 more residential properties returned to a state of positive equity during the first quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 39 million. The analysis shows that 9.7 million, or 19.8 percent of all residential properties with a mortgage, were still in negative equity at the end of the first quarter of 2013 with a total value of $580 billion. This figure is down from 10.5 million*, or 21.7 percent of all residential properties with a mortgage, at the end of the fourth quarter of 2012.

... At the end of the first quarter of 2013, 2.1 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“The impressive home price gains of 2012 and the beginning of 2013 have had a big impact on the distribution of residential home equity,” said Dr. Mark Fleming, chief economist for CoreLogic. “During the past year, 1.7 million borrowers have regained positive equity. We expect the pent-up supply that falling negative equity releases will moderate price gains in many of the fast-appreciating markets this spring.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 45.4 percent, followed by Florida (38.1 percent), Michigan (32 percent), Arizona (31.3 percent) and Georgia (30.5 percent). These top five states combined account for 32.8 percent of negative equity in the U.S."

The second graph shows the distribution of home equity. Just over 8% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity.

The second graph shows the distribution of home equity. Just over 8% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But other borrowers are close.

MBA: Mortgage Applications Increase, Mortgage Rates highest since March 2012

by Calculated Risk on 6/12/2013 08:11:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 5 percent from the previous week. Despite the increase in the refinance index last week, the level is still 11 percent lower than two weeks prior and 36 percent lower than the recent peak at the beginning of May. The seasonally adjusted Purchase Index increased 5 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.15 percent, the highest rate since March 2012, from 4.07 percent, with points increasing to 0.48 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

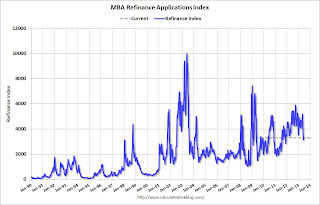

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4%, refinance activity has fallen sharply over the last 5 weeks even with the slight increase last week.

This index is down 36% over the last five weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

Tuesday, June 11, 2013

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 6/11/2013 09:31:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

Below is another update to the long term graph of the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 32% from the peak, and is still declining. The number of salesperson's licenses has fallen to June 2004 levels.

However brokers' licenses are only off 8% and have only fallen to late 2006 levels - and appear to have stopped falling

Click on graph for larger image.

Click on graph for larger image.

If we look at examinations (and new licensees issued), there are more people obtaining licenses than a year ago. However - since the number of salesperson's licenses are still declining - there are still more people letting their licensees expire.

So far there is no sign of a new bubble in real estate agents!

Comment: Senator Elizabeth Warren and Short Sale Fraud

by Calculated Risk on 6/11/2013 06:53:00 PM

I like Elizabeth Warren, but I was shocked to see this commentary from her: Commentary: FHFA’s Senseless Arm’s-Length Policy on Short Sales (ht jb). Warren argued for having the FHA allow short sales to family members and friends so the owner can stay in the home.

Apparently Ms. Warren isn't familiar with short sale fraud. I've covered this extensively, from Tanta in 2007: Let the Short Sale Scams Begin, from the FBI in 2009: FBI: U.S. Mortgage Fraud "Rampant" and "Escalating" (see short sale fraud), from John Gittelsohn at Bloomberg in 2010: Banks Face Short-Sale Fraud as Home `Flopping' Spreads, from Jim the Realtor in 2010: Jim the Realtor on Short Sales: "Rampant Fraud and Deceit" and Short Sales: Arm’s Length Transactions and many more ...

Lenders have always been afraid of short sales because of fraud. Short sales increased after lenders put many fraud protections in place - such as having all parties sign that there is no undisclosed consideration, that the transaction are arms-length (not to related party) and more. This hasn't stopped all short sale fraud, but it has helped.

Warren writes:

Short sales can make good sense, and private lenders have gone along with them in many cases. But the FHFA – the regulator overseeing the bailed-out housing giants Fannie Mae and Freddie Mac and the financing of about half the country’s outstanding mortgages – has blocked the way.Uh, one of the reasons private lenders have "gone along with" short sales is because they require that the sales be "arms-length". The FHFA has the same requirement - for good reason.

In some of those short sales, friends, families, or nonprofit organizations are willing to buy the home at fair market value, then work out a rental or re-sale to the family living in it. The mortgage company gets the same amount as in a sale to strangers, but the homeowner has a last-chance to save the family home.

Warren seems to think that the lender will get the same amount either way ... not likely. She writes:

The FHFA claims that its policy prevents sweetheart insider deals that benefit the homeowners at the expense of Fannie and Freddie. But that makes no sense when the house is sold at market value or when people affiliated with the homeowner put in the highest bid to save the home. In those cases, the identity of the bidder makes no meaningful difference because Fannie and Freddie’s bottom line stays the same.Warren doesn't understand that short sales don't go to the highest bidder. The first chance to negotiate with the bank goes to someone the homeowner (or agent) picks. Since the homeowner has no financial interest in the property, this creates an agency problem, and opens the door to fraud (I've suggested having the lender hire the agent). The "arms-length" protection is an important tool to prevent fraud.

If friends and family want to help, they could contact the bank about modification and offer to pay down some of the debt, but eliminating the "arms-length" rule would just mean more fraud.