by Calculated Risk on 6/07/2013 12:47:00 PM

Friday, June 07, 2013

WSJ: Fed could slow QE later this year

Depending on how the economy performs over the summer, the Fed could slow QE bond purchases later this year. The most likely time to announce a change in purchases would be either at the September or December FOMC meeting (those meetings will be followed by a Bernanke press conference). My guess right now is the Fed will wait until the end of the year or early next year, mostly because I think fiscal policy will be a significant drag on economic activity over the next couple of quarters - and also because inflation is still below the Fed's target.

From Jon Hilsenrath at the WSJ: Fed on Track to Ease Up on Bond Buying Later This Year

Federal Reserve officials are likely to signal at their June policy meeting that they're on track to begin pulling back their $85-billion-a-month bond-buying program later this year, as long as the economy doesn't disappoint.Two keys: "later this year" if "the economy doesn't disappoint".

The central bank faces a number of challenges. One is managing the signal that they send to the market with their next series of moves.It is clear they will not raise rates for a long time.

Officials in their public statements have been trying to make clear that they are going to proceed cautiously with the bond program and are still probably years away from raising short-term interest rates, which have been near zero since late 2008.

Officials will be updating their forecasts at the next policy meeting. One risk: Economic headwinds from tightening fiscal policy could continue longer than they expect.

Employment Report Comments and more Graphs

by Calculated Risk on 6/07/2013 10:30:00 AM

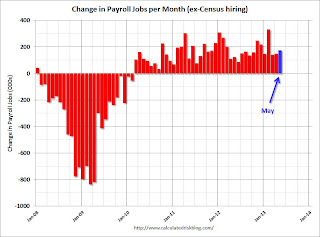

Total nonfarm employment is up 2.115 million over the 12 months, and up 946 thousand so far in 2013 (a 2.27 million annual pace).

Private employment is up 2.173 million over the last year, and up 972 thousand so far in 2013 (a 2.33 million annual pace).

Of course public payrolls are continuing to shrink (four years of declining public payrolls now). Public employment is down 58 thousand over the last year, and down 26 thousand so far in 2013 (a 62 thousand annual pace).

And on construction employment: Construction employment is up 189 thousand over the last year, and up 93 thousand so far in 2013 (a 223 thousand annual pace).

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio increased to 76.0% in May, the highest since April 2009. The participation rate for this group also increased in May to 81.3%. The decline in the participation rate for this age group is probably mostly due to economic weakness, whereas most of the decline in the overall participation rate is probably due to demographics.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

In May, the number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was unchanged at 7.9 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decreased slightly in May to 7.904 million.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased slightly to 13.8% in May. This matches the lowest level for U-6 since December 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.357 million workers who have been unemployed for more than 26 weeks and still want a job. This was slightly from from 4.353 million in April. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In May 2013, state and local governments added 11,000 jobs, and state and local employment is up 25 thousand so far in 2013.

I think most of the state and local government layoffs are over. Of course total public employment declined again as the Federal government layoffs are ongoing - and with many more layoffs expected due to the sequestration spending cuts.

In 2013, construction is a bright spot for employment, the drag from state and local cutbacks is mostly over - and Federal fiscal cutbacks are an ongoing drag. Pretty much as expected.

May Employment Report: 175,000 Jobs, 7.6% Unemployment Rate

by Calculated Risk on 6/07/2013 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 175,000 in May, and the unemployment rate was essentially unchanged at 7.6 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was slightly above expectations of 167,000 payroll jobs added. Employment for March and April combined was revised slightly lower.

...

The change in total nonfarm payroll employment for March was revised from +138,000 to +142,000, and the change for April was revised from +165,000 to +149,000. With these revisions, employment gains in March and April combined were 12,000 less than previously reported.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate increased to 7.6% in May from 7.5% in April.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased to 63.4% in May (blue line) from 63.3% in April. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was unchanged at 58.6% in May (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was at expectations - of course expectations are fairly low. I'll have much more later ...

Thursday, June 06, 2013

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 6/06/2013 09:40:00 PM

First, LPS released their Mortgage Monitor report for April today. According to LPS, 6.21% of mortgages were delinquent in April, down from 6.59% in March

LPS reports that 3.17% of mortgages were in the foreclosure process, down from 4.20% in April 2012.

This gives a total of 9.38% delinquent or in foreclosure. It breaks down as:

• 1,717,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,394,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,588,000 loans in foreclosure process.

For a total of 4,699,000 loans delinquent or in foreclosure in April. This is down from 5,617,000 in April 2012.

The first graph from LPS shows percent of mortgage delinquent and in-foreclosure by month.

The percent of delinquent loans is still high (normal is in the 4% to 5% range), but the percent of delinquent loans is falling quickly.

The second graph shows the percent of loans in foreclosure in judicial and non-judicial foreclosure states.

[T]he disparity in foreclosure timelines between judicial and non-judicial states -- continues to grow. Still, as LPS Applied Analytics Senior Vice President Herb Blecher explained, the steady return to a relative degree of normality in the foreclosure sale rate has helped to bring down foreclosure inventories at the national level.There is much more in the mortgage monitor.

“The foreclosure sale rate in judicial states rose nearly 17 percent from March to April,” Blecher said. “This is the highest that rate has been since the moratoria and process reviews in the fall of 2010 led to a near-complete halt in the process in both judicial and non-judicial states. Non-judicial rates were relatively quick to bounce back, but judicial states experienced a much slower, though steady, increase. This has helped drive an overall decline in foreclosure inventory at the national level, which is now at 3.2 percent -- its lowest point in four years.

“The situation is far from resolved,” Blecher stressed. “Foreclosure inventories in judicial states are still more than three times the size of those in non-judicial states, and national inventories are still more than seven times pre-crisis levels. Additionally, recently announced moratoria will need to be monitored to determine the impact on timelines, as well as the rate of the improvement trend.”

Friday economic releases:

• At 8:30 AM, the BLS will release the Employment Report for May. The consensus is for an increase of 167,000 non-farm payroll jobs in May; the economy added 165,000 non-farm payroll jobs in April. The consensus is for the unemployment rate to be unchanged at 7.5% in May.

• At 3:00 PM, Consumer Credit for April from the Federal Reserve. The consensus is for credit to increase $14.0 billion in April.

Bank Failure #15 in 2013: 1st Commerce Bank, North Las Vegas, Nevada

by Calculated Risk on 6/06/2013 07:20:00 PM

From the FDIC: Plaza Bank, Irvine, California, Assumes All of the Deposits of 1st Commerce Bank, North Las Vegas, Nevada

As of March 31, 2013, 1st Commerce Bank had approximately $20.2 million in total assets and $19.6 million in total deposits. ... The FDIC estimates that cost to the Deposit Insurance Fund will be $9.4 million. ... 1st Commerce Bank is the 15th FDIC-insured institution to fail in the nation this year, and the first in Nevada.Surferdude has been discussing this bank in his weekly unofficial problem bank posts. Three weeks ago he wrote:

[I]n Nevada, the Nevada Department of Business and Industry's Financial Institutions Division was prevented from closing 1st Commerce Bank, North Las Vegas ($24 million) through another legal action by Capitol Bancorp.And last week he noted:

There is nothing new to report on the status of Capitol Bancorp's banking subsidiaries, particularly 1st Commerce Bank, North Las Vegas ($24 million), which is subject to a sealed hearing on the ability of the Nevada Department of Business and Industry's Financial Institutions Division to terminate its banking charter.This is the second mid-week Capitol Bancorp related closing in the last month - both closings were delayed by legal filings.

Europe: Been down so long ...

by Calculated Risk on 6/06/2013 05:54:00 PM

From Jack Ewing at the NY Times: Down So Long It Looks Like Up to the Euro Zone

This is what passes for good economic news in Europe: Spain just added 265 jobs. ... Never mind that nearly five million people in Spain are out of work. The latest unemployment report from the government, issued on Tuesday, was held up by Mr. Rajoy as a sign that maybe, just maybe, the economy is getting better.Eventually the euro zone will start growing again. The will not be a sign of "success" of current policies - these are already a clear failure given the severe pain and suffering in the interim.

Nearly six years after the financial crisis in the United States spread across the Atlantic, plunging Europe into recession and, in some places, desperate depression, “good” is relative. ...

During a visit to Athens last week, the Dutch finance minister said he detected “the first signal of a turn in the economy.” Then, on Wednesday, news arrived from Brussels that the Greek economy was indeed getting better. It shrank by only — only — 5.3 percent in the first three months of the year. That was in fact an improvement: it had contracted 5.7 percent the previous quarter.

Employment Situation Preview: Expect Disappointment

by Calculated Risk on 6/06/2013 02:24:00 PM

On Friday, at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for an increase of 167,000 non-farm payroll jobs in May, and for the unemployment rate to be unchanged at 7.5%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 135,000 private sector payroll jobs in May. This was below expectations of 171,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in May to 50.1% from 50.2% in April. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased by close to 20,000 in May. The ADP report indicated a 6,000 decrease in manufacturing jobs.

The ISM non-manufacturing (service) employment index decreased in May to 50.1% from 52.0% in April. A historical correlation between the ISM service employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 65,000 in May.

Taken together, these surveys suggest only around 45,000 jobs added in May - significantly below the consensus forecast.

• Initial weekly unemployment claims averaged about 348,000 in May. This was up from 343,000 in March, but still near the low for the year.

For the BLS reference week (includes the 12th of the month), initial claims were at 344,000; down from 355,000 in April.

• The final May Reuters / University of Michigan consumer sentiment index increased to 84.5 from the April reading of 76.4. This was the highest level since July 2007. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors.

• The small business index from Intuit showed 35,000 payroll jobs added, the same as for April. This index is improving a little.

• And on the unemployment rate from Gallup: U.S. Payroll to Population and Unemployment Worsen in May

Gallup's unadjusted unemployment rate for the U.S. workforce was 7.9% for the month of May, a half-point increase over April, and statistically unchanged from May 2012 (8.0%).Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for May was 8.2%, up from 7.8% in April. Gallup calculates its seasonally adjusted employment rate by applying the adjustment factor the U.S. government used for the same month in the previous year.

• Conclusion: The employment related data was mostly disappointing again in May. The ADP and ISM manufacturing reports suggest a decrease in hiring. However weekly claims for the reference week were slightly lower in May than in April (although claims for the month were higher), and consumer sentiment increased sharply.

There is always some randomness to the employment report, but my guess is the BLS will report below the consensus of 171,000 jobs added in May. Based on the ISM reports (and more), we might see a very weak report on Friday.

Fed's Q1 Flow of Funds: Household Mortgage Debt down $1.3 Trillion from Peak, Record Household Net Worth

by Calculated Risk on 6/06/2013 12:26:00 PM

The Federal Reserve released the Q1 2013 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q1 compared to Q4 2012, and is at a new record. Net worth peaked at $67.4 trillion in Q3 2007, and then net worth fell to $51.4 trillion in Q1 2009 (a loss of $16 trillion). Household net worth was at $70.3 trillion in Q1 3013 (up $18.3 trillion from the trough).

The Fed estimated that the value of household real estate increased to $18.5 trillion in Q1 2013. The value of household real estate is still $4.2 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP. Although household net worth is at a record high, this is still below the peaks in 2000 (stock bubble) and 2006 (housing bubble).

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable (or increasing gradually) for almost 50 years, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q1 with both stock and real estate prices increasing.

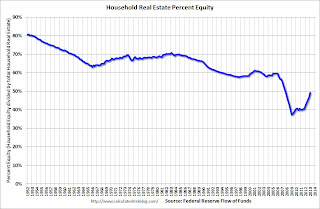

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2013, household percent equity (of household real estate) was at 49.2% - up from Q4, and the highest since Q4 2007. This was because of both an increase in house prices in Q1 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 49.2% equity - and millions have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $53.2 billion in Q1. Mortgage debt has now declined by $1.27 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q1 (as house prices increased), but not far above the lows of the last 30 years. However household mortgage debt, as a percent of GDP, is still historically high, suggesting still more deleveraging ahead for certain households.

Trulia: Asking House Prices increased in May

by Calculated Risk on 6/06/2013 09:46:00 AM

Press Release: Trulia Reports Asking Prices up 16.3 Percent Year-over-year in the Least Affordable Housing Markets

In May, asking prices continued to increase steadily across the country, rising in 98 of the largest 100 metros. Nationally, prices are up 9.5 percent year-over-year (Y-o-Y). Seasonally adjusted, prices increased 4.0 percent quarter-over-quarter and 1.1 percent month-over-month.On rents, this is similar to the quarterly Reis report on apartments. It appears that rent increases are slowing.

Eight out of the 10 least affordable markets, with seven in California, are all showing double digit asking price increases making home affordability even tougher for would-be buyers. Orange County, Oakland, and San Jose all had price increases of more than 20 percent, making these already expensive markets even less affordable. Prices are up 16.3 percent, on average, in these 10 least affordable housing markets.

Nationally, rents are up 2.3 percent Y-o-Y, rising slower than asking prices in 23 of the 25 largest rental markets. Out of the 10 least affordable rental markets, five show increases below the national average, with California markets moving especially slow – San Francisco rents up 0.2 percent, Los Angeles 1.8 percent and Oakland 1.3 percent. Among these least affordable rental markets, Miami and Boston had the largest rent increases.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

Weekly Initial Unemployment Claims decline to 346,000

by Calculated Risk on 6/06/2013 08:37:00 AM

The DOL reports:

In the week ending June 1, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 11,000 from the previous week's revised figure of 357,000. The 4-week moving average was 352,500, an increase of 4,500 from the previous week's revised average of 348,000.The previous week was revised up from 354,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 352,500.

Claims close to the 345,000 consensus forecast.