by Calculated Risk on 6/06/2013 09:46:00 AM

Thursday, June 06, 2013

Trulia: Asking House Prices increased in May

Press Release: Trulia Reports Asking Prices up 16.3 Percent Year-over-year in the Least Affordable Housing Markets

In May, asking prices continued to increase steadily across the country, rising in 98 of the largest 100 metros. Nationally, prices are up 9.5 percent year-over-year (Y-o-Y). Seasonally adjusted, prices increased 4.0 percent quarter-over-quarter and 1.1 percent month-over-month.On rents, this is similar to the quarterly Reis report on apartments. It appears that rent increases are slowing.

Eight out of the 10 least affordable markets, with seven in California, are all showing double digit asking price increases making home affordability even tougher for would-be buyers. Orange County, Oakland, and San Jose all had price increases of more than 20 percent, making these already expensive markets even less affordable. Prices are up 16.3 percent, on average, in these 10 least affordable housing markets.

Nationally, rents are up 2.3 percent Y-o-Y, rising slower than asking prices in 23 of the 25 largest rental markets. Out of the 10 least affordable rental markets, five show increases below the national average, with California markets moving especially slow – San Francisco rents up 0.2 percent, Los Angeles 1.8 percent and Oakland 1.3 percent. Among these least affordable rental markets, Miami and Boston had the largest rent increases.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

Weekly Initial Unemployment Claims decline to 346,000

by Calculated Risk on 6/06/2013 08:37:00 AM

The DOL reports:

In the week ending June 1, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 11,000 from the previous week's revised figure of 357,000. The 4-week moving average was 352,500, an increase of 4,500 from the previous week's revised average of 348,000.The previous week was revised up from 354,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 352,500.

Claims close to the 345,000 consensus forecast.

Wednesday, June 05, 2013

Thursday: Weekly Unemployment Claims, Flow of Funds Report

by Calculated Risk on 6/05/2013 07:18:00 PM

A few interesting articles ...

From Joseph Cotterill at Alphaville on the IMF report about the mishandling of the situation in Greece: Ignored Many Flaws — the report

Click for the IMF’s “ex post evaluation” of its role in the Greek bailout. Its mea culpa.So they needed to write down debt sooner, and severe austerity made the situation much worse. Hoocoodanode?

And if you thought we were being harsh here, parts of the real thing are excoriating.

And from Tim Duy: Falling Inflation Expectations

...Yes, I know the Fed said they could move up or down. But I think the idea of "up" would only come after a "down." And clearly, if inflation expectations are any guide, market participants are getting the message that "down" is what is coming. And they are not getting that from just the hawkish policymakers. The doves too have been getting in on the action.And a funny (but still serious) piece from Noah Smith: What is "derp"? The answer is technical. It is always frustrating that so many pundits and policymakers don't change their views when confronted with contradictory data - Noah's post helps explain why.

Moreover, I have to imagine that the recent market action in Tokyo has made some policymakers a little bit nervous about the limits to quantitative easing. The Nikkei's rise and fall seems to indicate that at some point asset purchases do in fact become destabilizing.

My view is that asset purchases would be most effective if coupled with fiscal stimulus. Working only through financial markets may be simply too restrictive to yield broad-based economic improvement. It is almost as if the Fed is trying to force a fire hose of policy through a garden hose. Keep turning up the volume, and eventually that hose bursts. And that might be what we are seeing in Japan.

Bottom Line: Inflation[sp] expectations are falling, and that by itself should complicate the Fed's expectation that they can start scaling back asset purchases at the end of the summer. But falling inflation expectations may complicate monetary policy more broadly by revealing the limits to quantitative easing. And Japan isn't helping.

Thursday economic releases:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 345 thousand from 354 thousand last week.

• At 10:00 AM, the Trulia Price Rent Monitors for May will be released. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 12:00 PM, the Federal Reserve will release the Q1 Flow of Funds Accounts of the United States.

Report: Personal Bankruptcy Filings decline 11% year-over-year in May

by Calculated Risk on 6/05/2013 04:35:00 PM

From the American Bankruptcy Institute: May Bankruptcy Filings Decrease 12 Percent from Previous Year, Business Filings Decrease 25 Percent

Total bankruptcy filings in the United States decreased 12 percent in May over last year, according to data provided by Epiq Systems, Inc. Bankruptcy filings totaled 96,430 in May 2013, down from the May 2012 total of 109,538. Consumer filings declined 11 percent to 92,413 from the May 2012 consumer filing total of 104,197. Total commercial filings in May 2013 decreased to 4,017, representing a 25 percent decline from the 5,341 business filings recorded in May 2012.Personal bankruptcy filings peaked in 2010 at 1.54 million (highest since the bankruptcy law change in 2005). Filings declined to 1.22 million last year, and will probably be just over 1 million this year - the lowest level since 2008. Note: Even in good economic years, there are around 800 thousand personal bankruptcy filings.

...

"Sustained low interest rates, tighter lending standards and decreased consumer spending are assisting consumers and companies to shore up their balance sheets,” said ABI Executive Director Samuel J. Gerdano. “As households and businesses remain committed to deleveraging, the number of filings will continue to decrease.”

This is another indicator of a little less financial stress.

Fed's Beige Book: Economic activity "increased at a modest to moderate pace"

by Calculated Risk on 6/05/2013 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Minneapolis and based on information collected on or before May 24, 2013."

Overall economic activity increased at a modest to moderate pace since the previous report across all Federal Reserve Districts except the Dallas District, which reported strong economic growth. The manufacturing sector expanded in most Districts since the previous Beige Book. Most Districts noted slight to moderate gains in consumer spending and a moderate increase in vehicle sales. Tourism showed signs of strength in several Districts. A wide variety of business services expanded, and transportation traffic increased for producer, consumer, and trade goods. Residential real estate and construction activity increased at a moderate to strong pace in all Districts. Commercial real estate and construction activity grew at a modest to moderate pace in most Districts. Overall bank lending increased since the previous report.And on real estate:

Residential real estate and construction activity increased at a moderate to strong pace in all Districts. Several Districts reported that higher demand and low inventory of homes available for sale are resulting in multiple offers on properties. Almost all Districts reported higher home sale prices. The Kansas City District reported concerns that appraisals were not keeping pace with price increases. Foreclosed properties available for sale have declined significantly in the San Francisco District. The rental market remains tight with noticeable increases in rental rates in the New York District. Residential construction increased across all of the reporting Districts. ...Residential real estate continues to be a strong sector for the economy. Overall this was a slight downgrade from the previous beige book (downgrade from "moderate" growth to "modest to moderate").

Commercial real estate and construction activity expanded at a modest to moderate pace in most Districts. The New York District reported that the Manhattan market is particularly robust. The Chicago District noted that an increase in demand for leasing was pushing up commercial rents, with strong demand from the health care sector. However, a market in the Boston District indicated no change in commercial rents or vacancy rates since the previous report.

ISM Non-Manufacturing Index indicates slightly faster expansion in May

by Calculated Risk on 6/05/2013 10:00:00 AM

The May ISM Non-manufacturing index was at 53.7%, up from 53.1% in April. The employment index decreased in May to 50.1%, down from 52.0% in April. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in May for the 41st consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.7 percent in May, 0.6 percentage point higher than the 53.1 percent registered in April. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 56.5 percent, which is 1.5 percentage points higher than the 55 percent reported in April, reflecting growth for the 46th consecutive month. The New Orders Index increased by 1.5 percentage points to 56 percent, and the Employment Index decreased 1.9 percentage points to 50.1 percent, indicating growth in employment for the 10th consecutive month. The Prices Index decreased 0.1 percentage point to 51.1 percent, indicating prices increased at a slower rate in May when compared to April. According to the NMI™, 13 non-manufacturing industries reported growth in May. The majority of respondents' comments are optimistic about business conditions. However, there is a degree of uncertainty about the long-term outlook."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was at the consensus forecast of 53.8% and indicates slightly faster expansion in May than in April.

ADP: Private Employment increased 135,000 in May

by Calculated Risk on 6/05/2013 08:15:00 AM

Private sector employment increased by 135,000 jobs from April to May, according to the May ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. April’s job gains were revised downward to 113,000 from 119,000.This was below the consensus forecast for 171,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 167,000 payroll jobs in May, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market continues to expand, but growth has slowed since the beginning of the year. The slowdown is evident across all industries and all but the largest companies. Manufacturers are reducing payrolls. The softer job market this spring is largely due to significant fiscal drag from tax increases and government spending cuts."

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Refinance Applications decline sharply as Mortgage Rates Increase above 4%

by Calculated Risk on 6/05/2013 07:43:00 AM

From the MBA: Mortgage Applications Decrease as Rates Jump in Latest MBA Weekly Survey

The Refinance Index decreased 15 percent from the previous week and is at its lowest level since the end of November 2011. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.07 percent, the highest rate since April 2012, from 3.90 percent, with points decreasing to 0.35 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This was the largest single-week increase in this rate since the week ending July 1, 2011.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates moving above 4%, refinance activity has fallen sharply.

This index is down almost 40% over the last four weeks, and this is the lowest level since November 2011.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.

Tuesday, June 04, 2013

Wednesday: ADP Employment, ISM Service Index, Fed's Beige Book

by Calculated Risk on 6/04/2013 07:25:00 PM

The earliest report tomorrow - the weekly mortgage survey from the Mortgage Bankers Association - is expected to show 30 year mortgage rates at or above 4%. Neil Irwin at the WaPo asks: Will higher mortgage rates kill the housing market? Maybe not!

[R]ising mortgage rates, if they’re rising for good reasons, could actually be net positives for the housing market if they result from more people having jobs and being confident in their prospects.I'm not a fan of "affordability" indexes, but I don't think an increase in mortgage rates will hurt the recovery for residential investment (mostly new home sales). However an increase in rates will sharply reduce refinance activity - something we are already seeing.

This gets at one of the realities of the housing market and interest rates: It doesn’t just matter whether mortgage rates are rising, but why they’re rising.

Stronger economic growth makes homebuying more attractive, as people are more confident in their jobs and incomes (Goldman estimates that a 1 percentage point in real GDP growth translates to 1.8 percentage points in annual home price appreciation). Higher inflation can make homebuying more desirable, as you are buying a large asset whose value should rise with inflation while taking on a debt that has a fixed interest rate (Goldman estimates that a 1 percentage point increase in inflation translates to an 0.9 percent rise in home prices).

That being the case, as long as home prices remain below the level where affordability is out of reach, and so long as mortgage rates are rising because the economy is on the mend, the housing market should be able to withstand the blow.

Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. Expect 30 year mortgage rates at or above 4%, and another sharp decline in refinance activity.

• At 8:15 AM, the ADP Employment Report for May will be released. This report is for private payrolls only (no government). The consensus is for 171,000 payroll jobs added in May.

• At 10:00 AM, the ISM non-Manufacturing Index for May. The consensus is for a reading of 53.8, up from 53.1 in April. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 1.4% increase in orders.

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. In the previous Beige Book, in early April, the report noted "economic activity expanded at a moderate pace".

Lawler: Single Family Homes Built/Sold in 2012: “Back to Bigger,” But on Very Low Volumes

by Calculated Risk on 6/04/2013 02:48:00 PM

Census released its estimates for the characteristics of single-family homes completed and sold in 2012.

CR Note: from the release:

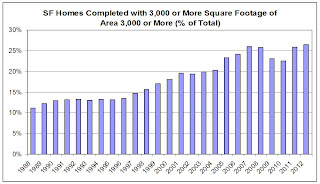

Of the 483,000 single-family homes completed in 2012:From Lawler: Here is a chart showing the % of SF homes completed with square feet of floor area of 3,000 or more.

• 432,000 had air-conditioning.

• 63,000 had two or fewer bedrooms and 198,000 had four bedrooms or more.

• 34,000 had one and one-half bathrooms or less, whereas 145,000 homes had three or more bathrooms.

• 142,000 had a full or partial basement, while 78,000 had a crawl space, and 263,000 had a slab or other type of foundation.

• 266,000 had two or more stories.

• 278,000 had a warm-air furnace and 183,000 had a heat pump as the primary heating system.

• 285,000 heating systems were powered by gas and 189,000 were powered by electricity.

The average single-family house completed was 2,505 square feet.

Click on graph for larger image.

There has been a long-term upward trend in the average and median square footage of SF homes built in the US, though “size” has had a bit of a cyclical component as well – generally rising more rapidly during strong markets, and more slowly during “soft” markets. The “dip” in 2009-10 may also have reflected a temporary increase in building targeted at first-time home buyers related to the home buyer tax credits, while the recent rebound reflects the post-tax-credit weakness in first-time home buyer demand.

Of course, the recent increase in the share of “large” SF homes built has been on very low overall volumes.

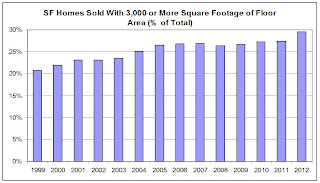

Census also released estimates of the characteristics of new SF homes sold (total SF completions include not just homes built for sale, but also owner- and contractor-built homes, as well as a small number of SF homes built for rent. These characteristics reflect SF homes sold based on contract signing/earnest money exchange, and not completions, and the square footage data only go back to 1999.

Here is a chart showing the % of new SF homes sold that had four or more bedrooms, with data going back to 1978.

And here is a chart showing the number of new SF homes sold with four or more bedrooms.