by Calculated Risk on 6/04/2013 12:21:00 PM

Tuesday, June 04, 2013

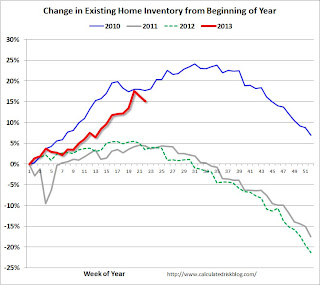

Existing Home Inventory is up 15.2% year-to-date on June 4th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 15.2%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.3% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

CoreLogic: House Prices up 12.1% Year-over-year in April

by Calculated Risk on 6/04/2013 09:46:00 AM

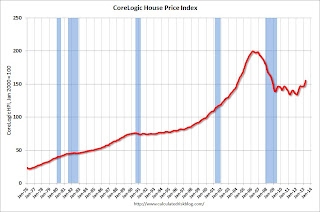

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Report Shows Home Prices Rise by 12.1 Percent Year Over Year in April

Home prices nationwide, including distressed sales, increased 12.1 percent on a year-over-year basis in April 2013 compared to April 2012. This change represents the biggest year-over-year increase since February 2006 and the 14th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 3.2 percent in April 2013 compared to March 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 11.9 percent in April 2013 compared to April 2012. On a month-over-month basis, excluding distressed sales, home prices increased 3 percent in April 2013 compared to March 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that May 2013 home prices, including distressed sales, are expected to rise by 12.5 percent on a year-over-year basis from May 2012 and rise by 2.7 percent on a month-over-month basis from April 2013. Excluding distressed sales, May 2013 home prices are poised to rise 13.2 percent year over year from May 2012 and by 3.1 percent month over month from April 2013.

...

“House price growth continues to surprise to the upside with an impressive 12.1 percent gain year over year in April,” said Dr. Mark Fleming, chief economist for CoreLogic. “Increasing demand for new and existing homes, coupled with low inventory, has created a virtuous cycle for price gains, most clearly seen in the Western states with year-over-year gains of 20 percent or more.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 3.2% in April, and is up 12.1% over the last year. This index is not seasonally adjusted, and this is usually the strongest time of the year for price increases.

The index is off 22% from the peak - and is up 15.9% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for fourteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for fourteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

This was another very strong month-to-month increase. At some point more inventory will come on the market and slow the price increases. Note: CoreLogic notes that prices are up year-over-year in all 50 states excluding distressed sales.

Trade Deficit increased in April to $40.3 Billion

by Calculated Risk on 6/04/2013 08:46:00 AM

The Department of Commerce reported:

[T]otal April exports of $187.4 billion and imports of $227.7 billion resulted in a goods and services deficit of $40.3 billion, up from $37.1 billion in March, revised. April exports were $2.2 billion more than March exports of $185.2 billion. April imports were $5.4 billion more than March imports of $222.3 billion..The trade deficit was lower than the consensus forecast of $41.2 billion.

The first graph shows the monthly U.S. exports and imports in dollars through April 2013.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in April. Imports rebounded from the decline in March that was partially due to the timing of the Chinese New Year.

Exports are 13% above the pre-recession peak and up 2% compared to April 2012; imports are 2% below the pre-recession peak, and down 1% compared to April 2012 (mostly moving sideways).

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.Oil averaged $97.82 in April, up from $96.95 per barrel in March, but down from $109.69 in April 2012. Oil import prices should decline in May.

The trade deficit with the euro area was $10.0 billion in April, up from $7.8 billion in April 2012.

The trade deficit with China decreased to $24.1 billion in April, down from $24.5 billion in April 2012. Most of the trade deficit is related to China.

Monday, June 03, 2013

Tuesday: Trade Deficit

by Calculated Risk on 6/03/2013 10:06:00 PM

An interesting article on investor buying from Nathaniel Popper at the NY Times Dealbook: Behind the Rise in House Prices, Wall Street Buyers

Large investment firms have spent billions of dollars over the last year buying homes in some of the nation’s most depressed markets. The influx has been so great, and the resulting price gains so big, that ordinary buyers are feeling squeezed out. Some are already wondering if prices will slump anew if the big money stops flowing.Investor buying has played a key role, but I don't expect investors to start selling in bulk (although the buying will probably slow down). Most of these large investors are planning on holding the properties for some time, but you never know ...

...

Blackstone ... has bought some 26,000 homes in nine states. Colony Capital, a Los Angeles-based investment firm, is spending $250 million each month and already owns 10,000 properties. ... Most of the firms are renting out the homes, with the possibility of unloading them at a profit when prices rise far enough.

While these investors have not touched many healthy real estate markets, they are among the biggest buyers in struggling areas of the country where housing prices have been increasing the fastest. Those gains, in turn, have been at the leading edge of rising home prices nationwide.

Tuesday economic releases:

• At 8:30 AM ET, Trade Balance report for April from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $41.2 billion in April from $38.8 billion in March.

Fannie Mae, Freddie Mac: Mortgage Serious Delinquency rates declined in April, Lowest since early 2009

by Calculated Risk on 6/03/2013 06:11:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in April to 2.93% from 3.02% in March. The serious delinquency rate is down from 3.63% in April 2012, and this is the lowest level since January 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in April to 2.91% from 3.03% in March. Freddie's rate is down from 3.51% in April 2012, and this is the lowest level since June 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until late 2016 or 2017.

U.S. Light Vehicle Sales increased to 15.3 million annual rate in May

by Calculated Risk on 6/03/2013 03:10:00 PM

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.31 million SAAR in May. That is up 10% from May 2012, and up 3% from the sales rate last month.

This was slightly above the consensus forecast of 15.2 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 15.31 million SAAR from AutoData).

Click on graph for larger image.

Click on graph for larger image.

This was the near the post-recession high for auto sales.

After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry even if sales move mostly sideways for the rest of 2013.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and had been a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 5% from 2012.

Construction Spending increased in April

by Calculated Risk on 6/03/2013 11:35:00 AM

The Census Bureau reported that overall construction spending increased in April:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during April 2013 was estimated at a seasonally adjusted annual rate of $860.8 billion, 0.4 percent above the revised March estimate of $857.7 billion. The April figure is 4.3 percent above the April 2012 estimate of $825.1 billion.Private construction spending increased, and public construction spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $602.0 billion, 1.0 percent above the revised March estimate of $595.9 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $258.8 billion, 1.2 percent below the revised March estimate of $261.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 55% below the peak in early 2006, and up 36% from the post-bubble low. Note: Residential spending was revised up for February and March.

Non-residential spending is 28% below the peak in January 2008, and up about 33% from the recent low.

Public construction spending is now 20% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is flat year-over-year. Public spending is down 5.1% year-over-year.

A few key themes:

1) Private residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Private residential is now slightly higher than private non-residential, and residential will probably be the largest category of construction spending in 2013. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels.

3) Public construction spending has declined to 2006 levels (not adjusted for inflation). This has been a drag on the economy for 4 years. In real terms, this is the lowest level of public construction spending since February 2001.

ISM Manufacturing index declines in May to 49.0, Lowest since June 2009

by Calculated Risk on 6/03/2013 10:00:00 AM

The ISM manufacturing index indicated contraction in May. The PMI was at 49.0% in May, down from 50.7% in April. The employment index was at 50.1%, down from 50.2%, and the new orders index was at 48.8%, down from 52.3% in April.

From the Institute for Supply Management: May 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector contracted in May for the first time since November 2012, and the overall economy grew for the 48th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 49 percent, a decrease of 1.7 percentage points from April's reading of 50.7 percent, indicating contraction in manufacturing for the first time since November 2012 and only the second time since July 2009. This month's PMI™ reading is at its lowest level since June 2009, when it registered 45.8 percent. The New Orders Index decreased in May by 3.5 percentage points to 48.8 percent, and the Production Index decreased by 4.9 percentage points to 48.6 percent. The Employment Index registered 50.1 percent, a slight decrease of 0.1 percentage point compared to April's reading of 50.2 percent. The Prices Index registered 49.5 percent, decreasing 0.5 percentage point from April, indicating that overall raw materials prices decreased from last month. Several comments from the panel indicate a flattening or softening in demand due to a sluggish economy, both domestically and globally."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 51.0% and suggests manufacturing contracted in May for the first time since November 2012.

MarkIt PMI shows "only a modest rate of growth" in May

by Calculated Risk on 6/03/2013 09:07:00 AM

From MarkIt: Markit U.S. Manufacturing PMI™ – final data

The final Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 signalled a further improvement in manufacturing business conditions in May. However, at 52.3, up slightly from a six-month low of 52.1 in April and higher than the earlier flash estimate of 51.9, the PMI was consistent with only a modest rate of growth.The ISM PMI will be released at 10 AM today.

...

Firms linked the increase in production to higher new order requirements. Incoming new work rose modestly in May, with the rate of increase stronger than the six-month low recorded in April and faster than signalled by the earlier flash estimate.

...

Manufacturing employment in the U.S. rose further in May. Nonetheless, the rate of job creation was only modest and the weakest since last November.

“The May survey paints a downbeat picture of U.S. manufacturing business conditions. Output, order books and employment are all growing modestly, suggesting the sector is at risk of stalling. The main weakness is from export markets, where new orders fell marginally due to weakening global demand. [said Chris Williamson, Chief Economist at Markit]

“There is a possibility that growth may pick up again. The deteriorating export performance is being offset by rising demand in the domestic market, and large firms are reporting the strongest growth of new orders for just over a year.”

“However, the short-term outlook is one of subdued growth at best, suggesting the recent slowdown in the manufacturing economy will add to the likelihood of GDP growth weakening in the second quarter.”

Sunday, June 02, 2013

Monday: ISM Manufacturing Index, Auto Sales, Construction Spending

by Calculated Risk on 6/02/2013 08:00:00 PM

Note: Several sites list May auto sales on Tuesday - that appears incorrect. GM, Ford and others have already announced they will release results on Monday.

For some amusement, Jon Hilsenrath at the WSJ lists several of Fed Chairman Ben Bernanke's jokes today: Funnyman Ben Bernanke? You’ve Got to Be Kidding

A dozen years ago I was minding my own business teaching Economics 101 in Alexander Hall and trying to think of good excuses for avoiding faculty meetings. Then I got a phone call ...From CNBC: Pre-Market Data and Bloomberg futures: the early S&P futures are up slightly and DOW futures are up 35 (fair value).

Oil prices have moved down recently with WTI futures at $91.42 per barrel and Brent at $99.94 per barrel.

• Schedule for Week of June 2nd

Monday economic releases:

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for May. The consensus is for the index to be unchanged at 52.1.

• At 10:00 AM, ISM Manufacturing Index for May will be released. The consensus is for an increase to 51.0 from 50.7 in April. Based on the regional surveys, a reading at or below 50 is possible.

• Also at 10:00 AM, the Census Bureau will release Construction Spending for April. The consensus is for a 1.0% increase in construction spending.

• All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 15.2 million SAAR in May (Seasonally Adjusted Annual Rate) from 14.9 million SAAR in April.