by Calculated Risk on 5/28/2013 11:49:00 AM

Tuesday, May 28, 2013

Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

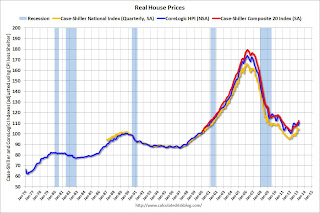

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation. This is why economists also look at real house prices (inflation adjusted).

Note: If were I "wishcasting" as opposed to "forecasting", I'd like to see real house prices mostly move sideways for a few years. But given the low level of inventory, pent up demand, significant investor buying, and some bounce off the bottom in certain areas - real prices have been increasing fairly rapidly over the last year. I expect more inventory to come on the market and for price increases to slow.

Earlier: Case-Shiller: Comp 20 House Prices increased 10.9% year-over-year in March

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q3 2003 levels (and also back up to Q4 2008), and the Case-Shiller Composite 20 Index (SA) is back to December 2003 levels, and the CoreLogic index (NSA) is back to February 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q2 2000 levels, the Composite 20 index is back to March 2001, and the CoreLogic index back to March 2001.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q2 2000 levels, the Composite 20 index is back to February 2001 levels, and the CoreLogic index is back to March 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 32% above January 2000. Some cities - like Denver and Dallas - are close to the peak level. Detroit prices are still below the January 2000 level.

Dallas and Richmond Fed: Regional Manufacturing Activity mixed in May

by Calculated Risk on 5/28/2013 10:30:00 AM

These are the last two regional manufacturing surveys for May. From the Richmond Fed: Manufacturing Activity Declined At A Slightly Slower Rate In May; Expectations Improved

Manufacturing activity in the central Atlantic region contracted at a less pronounced rate in May after pulling back in April, according to the Richmond Fed’s latest survey. ...And from the Dallas Fed: Texas Manufacturing Activity Expands

In May, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained four points settling at −2 from April's reading of −6. Among the index's components, shipments recouped seventeen points to 8, the gauge for new orders slipped two points to finish at −10, and the jobs index subtracted six points to end at −3.

Texas factory activity increased sharply in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from -0.5 to 11.2, indicating a notable pickup in output.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Stronger manufacturing activity was reflected in other survey measures as well. The new orders index rebounded to 6.2 after falling to -4.9 in April. Similarly, the shipments index bounced back to 3.1 after dipping to -0.4. The capacity utilization index came in at 6.4, up from 2.7 last month.

Perceptions of broader business conditions continued to worsen in May. The general business activity index remained negative but moved up five points to -10.5. The company outlook index declined from -2.2 to -6.8, reaching its lowest level since July 2010.

Labor market indicators reflected weaker labor demand. The employment index fell to -6.3 in May, registering its first negative reading this year and reaching its lowest level since November 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The ISM index for May will be released Monday, June 3rd, and these surveys suggest another weak reading, possibly even at or below 50 (contraction).

Case-Shiller: Comp 20 House Prices increased 10.9% year-over-year in March

by Calculated Risk on 5/28/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the Q1 national index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices See Strong Gains in the First Quarter of 2013 According to the S&P/Case-Shiller Home Price Indices

Data through March 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that all three composites posted double-digit annual increases. The 10-City and 20-City Composites increased by 10.3% and 10.9% in the year to March with the national composite rising by 10.2% in the last four quarters. All 20 cities posted positive year-over-year growth.

In the first quarter of 2013, the national composite rose by 1.2%. On a monthly basis, the 10- and 20-City Composites both posted increases of 1.4%. Charlotte, Los Angeles, Portland, Seattle and Tampa were the five MSAs to record their largest month-over-month gains in over seven years.

“Home prices continued to climb,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Home prices in all 20 cities posted annual gains for the third month in a row. Twelve of the 20 saw prices rise at double-digit annual growth. The National Index and the 10- and 20-City Composites posted their highest annual returns since 2006.

“Phoenix again had the largest annual increase at 22.5% followed by San Francisco with 22.2% and Las Vegas with 20.6%. Miami and Tampa, the eastern end of the Sunbelt, were softer with annual gains of 10.7% and 11.8%. The weakest annual price gains were seen in New York (+2.6%), Cleveland (+4.8%) and Boston (+6.7%); even these numbers are quite substantial.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 27.3 % from the peak, and up 1.5% in March (SA). The Composite 10 is up 10.3% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 26.6% from the peak, and up 1.3% (SA) in March. The Composite 20 is up 10.9% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 10.2% compared to March 2012.

The Composite 20 SA is up 10.9% compared to March 2012. This was the tenth consecutive month with a year-over-year gain and this was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 53.6% from the peak, and prices in Denver only off 0.1% from the peak.

This was above the consensus forecast for a 10.2% YoY increase. I'll have more on prices later.

LPS: House Price Index increased 1.4% in March, Up 7.6% year-over-year

by Calculated Risk on 5/28/2013 07:31:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses March closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 1.4 Percent for the Month; Up 7.6 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on March 2013 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 19.5% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 49.0% from the peak in Las Vegas, 37.3% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and at a new peak in Austin, Dallas and Denver! (Also a new peak for the state of Texas).

Note: Case-Shiller for March will be released this morning.

Monday, May 27, 2013

Tuesday: Case-Shiller House Prices

by Calculated Risk on 5/27/2013 09:18:00 PM

From the WSJ: Lower Commodities Prices Provide Tailwind

Lower prices for commodities from cotton to copper are helping U.S. businesses by reducing their raw-material costs and buoying consumers by keeping a lid on prices paid.Not mentioned in the article, lumber prices are off about 20% from the recent high and oil prices are down over 10% from the February levels.

Copper, used in many goods including electronics, is off nearly 10% this year. Silver, which has various industrial uses, has tumbled more than 25%, and wheat is down more than 10%.

Tuesday economic releases:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March. The consensus is for a 10.2% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 9.8% year-over-year, and for prices to increase 0.9% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for May. The consensus is for a a reading of minus 3 for this survey, up from minus 6 in April (Below zero is contraction).

• Also at 10:00 AM, the Conference Board's consumer confidence index for May. The consensus is for the index to increase to 71.5 from 68.1.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for May. This is the last of regional surveys for May. The consensus is a reading of minus 8, up from minus 15 in April (below zero is contraction).

Weekend:

• Schedule for Week of May 26th

• Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

• States: Mo Money Mo Problems

The Asian markets are mixed tonight with the Nikkei down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 9 and Dow futures are up 87 (fair value).

Oil prices are down slightly with WTI futures at $93.84 per barrel and Brent at $102.61 per barrel.

May Vehicle Sales forecast to be at or above 15 million SAAR

by Calculated Risk on 5/27/2013 06:23:00 PM

Note: The automakers will report May vehicle sales on Monday, June 3rd (next Monday). Here are a few forecasts:

From J.D. Power: J.D. Power and LMC Automotive Report: May New-Vehicle Retail Selling Rate Expected to be 1 Million Units Stronger than a Year Ago

Total light-vehicle sales in May 2013 are expected to increase to 1,439,400, up 8 percent from May 2012 [forecast is 15.2 million Seasonally Adjusted Annual Rate, SAAR]. Fleet sales have generally been weaker than expected in 2013, but continue to average nearly 21 percent of total sales. Fleet sales in May 2013 are projected to reach 281,000 units, representing less than 20 percent of total sales.From TrueCar: May 2013 New Car Sales Expected to Be Up Almost Nine Percent According to TrueCar; May 2013 SAAR at 15.2M, Highest May SAAR

...

Strong demand for full-size pickups is also helping to keep industry average transaction prices at record levels. The average transaction price for all new vehicles thus far in May is $28,921, the highest ever for the month of May and 3 percent higher than May 2012.

For May 2013, new light vehicle sales in the U.S. (including fleet) is expected to be 1,435,495 units, up 8.5 percent from May 2012 and up 12.1 percent from April 2013 (on an unadjusted basis).From Kelley Blue Book: New-car Sales To Improve 6 Percent In May With Help From Memorial Day Weekend Sale Events

The May 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.2 million new car sales, up from 14.9 April 2013 and up from 13.9 million in May 2012.

New-car sales will hit 15.0 million seasonally adjusted annual rate (SAAR) in May, which is an expected 6 percent year-over-year improvement, according to Kelley Blue Book ...Note: There were 1.33 million light vehicle sales in May 2012 or a 13.9 million SAAR. This year sales will probably be around 1.44 million with the same number of selling days - up about 8% from May 2012.

"Growth in the truck segment has been driven by a jump in new-home construction, relatively affordable gas prices and high inventory levels," said [Alec Gutierrez, senior market analyst of automotive insights for Kelley Blue Book.]

Two key points: 1) sales growth will slow in 2013, and 2) it appears auto sales were solid in May (no signs of a consumer slowdown).

Based on the first four months of 2013, it appears auto sales will increase again this year, but not double digit growth like the last few years. This suggests auto sales will contribute less to GDP growth this year than in the previous three years.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.2 | 5.3% |

| 1Sales rate for first four months of 2013. | ||

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 5/27/2013 11:41:00 AM

Last month I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush).

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a better comparison might be to look at the percentage change, but this gives an overall view of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama has just started his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The employment recovery during Mr. G.W. Bush's first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush, with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton and 14,688,000 under President Reagan.

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. A few months into Mr. Obama's second term, there are now 2,582,000 more private sector jobs than when he took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

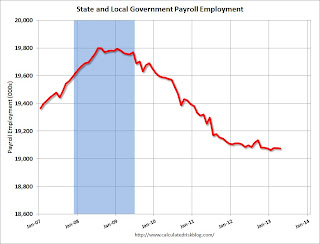

However the public sector has declined significantly since Mr. Obama took office (down 739,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level.

Sunday, May 26, 2013

Gasoline Prices: Down slightly from last year on Memorial Day

by Calculated Risk on 5/26/2013 03:59:00 PM

According to Gasbuddy.com (see graph at bottom), gasoline prices are down slightly over the last few days to a national average of $3.66 per gallon. One year ago for the week of Memorial Day, prices were at $3.67 per gallon, and for the same week two years ago prices were $3.85 per gallon.

| Memorial Day | Weekly Average Gasoline Price |

|---|---|

| 28-May-07 | $3.25 |

| 26-May-08 | $3.99 |

| 25-May-09 | $2.57 |

| 31-May-10 | $2.78 |

| 30-May-11 | $3.85 |

| 28-May-12 | $3.67 |

| 27-May-13 | $3.66 |

According to Bloomberg, WTI oil is at $94.15 per barrel, and Brent is at $102.64 per barrel. Last year on Memorial Day, Brent was at $107.86 per barrel, and two years ago Brent was at $114.85.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.40 per gallon. That is about 26 cents below the current level according to Gasbuddy.com, however I think there is a seasonal factor that isn't included in the calculator.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

States: Mo Money Mo Problems

by Calculated Risk on 5/26/2013 10:15:00 AM

From the NY Times: California Faces a New Quandary, Too Much Money

After years of grueling battles over state budget deficits and spending cuts, California has a new challenge on its hand: too much money. An unexpected surplus is fueling an argument over how the state should respond to its turn of good fortune.A few comments:

The amount is a matter of debate, but by any measure significant: between $1.2 billion, projected by Gov. Jerry Brown, and $4.4 billion, the estimate of the Legislature’s independent financial analyst.

...

At least seven other states — among them Connecticut, Utah and Wisconsin — have reported budget surpluses in recent weeks, setting the stage for legislative battles that, if not as wrenching as the ones over cuts, promise to be no less pitched. Lawmakers are debating whether the new money should be used to restore programs cut during the recession, finance tax cuts or put into a rainy-day fund for future needs.

1) At the least, this means that the fiscal drag at the state and local levels is mostly over. This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

However the drag from state and local governments has continued. The drag from state and local governments has been a relentless drag on the economy. Just ending this drag will be a positive for the economy. Note: In real terms, state and local government spending is back to early 2001 levels.

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) State and local employment is unchanged so far in 2013.

Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

2) The article notes three possibilities for the small surpluses: "restore programs cut during the recession, finance tax cuts or put into a rainy-day fund". With the surpluses just starting, I think tax cuts should be off the table (they are too hard to reverse if revenue falters). My suggestion would be to pay down debt (rainy-day fund) and cautiously restore some cuts.

3) Last November, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”Nice to see it is happening in other states too.

Saturday, May 25, 2013

How to Calculate Q2 Personal Consumption Expenditure (PCE) Growth

by Calculated Risk on 5/25/2013 05:05:00 PM

In the schedule for the coming week, I mentioned that the consensus is for personal consumption expenditures (PCE) to be unchanged in April compared to March. Does this mean PCE might not grow in Q2?

First, we don't know the actual number for April yet - and we don't know about May and June - but even if PCE were flat for all three months compared to March, quarterly PCE would grow 1.3% in Q2. This is because quarterly PCE is calculated as an average of the current quarter divided by the average for the previous quarter (seasonally adjusted and annualized).

The following table shows how this works. For Q4 2012, PCE averaged $9,663.8 SAAR (Seasonally Adjusted Annual Rate, billions, 2005 dollars). For Q1 2013, PCE averaged $9,740.0.

If we divided $9,740.0 by $9,663.8 we get 1.007885. Then annualize (take to the fourth power) and subtract 1, and the growth rate is 3.2% (just what the BEA reported for PCE growth in Q1).

If we do the same calculation for Q2, even if PCE is flat for all three months in Q2 (April, May and June), PCE will grow by 1.3% in Q2.

| Q2 Personal Consumption Expenditure (PCE) Growth | ||||

|---|---|---|---|---|

| Quarter | Month | Real PCE, SAAR 2005 dollars (Billions) | Qtr Average | Qtr Growth Rate |

| Oct-12 | $9,629.5 | |||

| Q4 | Nov-12 | $9,673.0 | $9,663.8 | |

| Dec-12 | $9,689.0 | |||

| Jan-13 | $9,708.7 | |||

| Q1 | Feb-13 | $9,740.3 | $9,740.0 | 3.2% |

| Mar-13 | $9,771.1 | |||

| Apr-13 | $9,771.11 | |||

| Q2 | May-13 | $9,771.1 | 1.3% | |

| Jun-13 | ||||

| 1Consensus forecast for April 2013 | ||||

If instead we just compare April to January, PCE would be growing at a 2.6% annual rate in Q2. This is one of the reasons several analysts have recently upgraded their forecasts for Q2 GDP. It appears likely that PCE growth will be above 2% in Q2. Of course government spending - especially Federal government spending - will probably remain a drag on GDP in Q2 (there has been record shrinkage of the public sector over the last several years).

The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Since PCE grew at just under a 4% annualized rate in February and March (and quarterly PCE is an average for the quarter), if PCE is flat in April, May and June, PCE already has some growth built in for Q2 compared to Q1.