by Calculated Risk on 5/25/2013 11:26:00 AM

Saturday, May 25, 2013

Schedule for Week of May 26th

The key reports this week are the second estimate of Q1 GDP on Thursday, the April Personal Income and Outlays report on Friday, and the Case-Shiller house prices for March on Tuesday.

The FDIC will probably release the Q1 Quarterly Banking Profile this week (no scheduled date).

All US markets will be closed in observance of Memorial Day.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March.

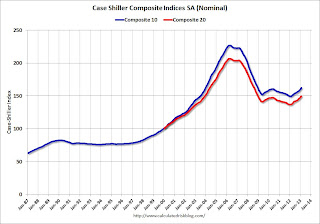

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through February 2012 (the Composite 20 was started in January 2000).

The consensus is for a 10.2% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 9.8% year-over-year, and for prices to increase 0.9% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for May. The consensus is for the index to increase to 71.5 from 68.1.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May. The consensus is for a a reading of minus 3 for this survey, up from minus 6 in April (Below zero is contraction).

10:30 AM: Dallas Fed Manufacturing Survey for May. This is the last of regional surveys for May. The consensus is a reading of minus 8, up from minus 15 in April (below zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims at 340 thousand, unchanged from last week.

8:30 AM: Q1 GDP (second estimate). This is the second estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1, unrevised from the advance report.

10:00 AM ET: Pending Home Sales Index for April. The consensus is for a 1.4% increase in the index.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.1% increase in personal income in April, and for no change in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for an increase to 50.0, up from 49.0 in April.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 83.7.

Unofficial Problem Bank list declines to 767 Institutions

by Calculated Risk on 5/25/2013 10:01:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 24, 2013.

Changes and comments from surferdude808:

This week the Unofficial Problem Bank List declined to 767 institutions with assets of $283.7 billion after four removals and one addition. A year ago, the list held 931 institutions with assets of $358.0 billion. The removals were all from unassisted mergers including Centennial Bank, Fountain Valley, CA ($546 million); The Washington Savings Bank, FSB, Bowie, MD ($357 million); First National Bank of Baldwin County, Foley, AL ($187 million); and Kinderhook State Bank, Kinderhook, IL ($18 million). The addition was The Talbot Bank of Easton, Easton, MD ($713 million Ticker: SHBI).On the unofficial list:

The legal hearing in Nevada on Capitol Bancorp's restraining order to prevent the closing of 1st Commerce Bank, North Las Vegas ($24 million) was sealed by the presiding judge. So there is nothing new to report on that matter. Next week, we anticipate the FDIC will release its enforcement action activity through April 2013 and, perhaps, industry results for the first quarter of 2013, which will include updated figures for the Official Problem Bank List. The institution count difference between the official and the unofficial list was 157 at the last quarterly release and the difference will likely reduce to around 150.

Because the FDIC does not publish the official list, a proxy or unofficial list can be developed by reviewing press releases and published formal enforcement actions issued by the three federal banking regulators, reviewing SEC filings, or through media reports and company announcements describing that the bank is under a formal enforcement action. For the most part, the official problem bank list is comprised of banks with a safety & soundness CAMELS composite rating of 4 or 5 (the banking regulators use the FFIEC rating system known as CAMELS, which stands for the components that receive a rating including Capital adequacy, Asset quality, Management quality, Earnings strength, Liquidity strength, and Sensitivity to market risk. A composite rating is assigned from the components, but it does not result from a simple average of the components. The composite and component rating scale is from 1 to 5, with 1 being the strongest). Customarily, a banking regulator will only issue a safety & soundness formal enforcement when a bank has a composite CAMELS rating of 4 or 5, which reflects an unsafe & unsound financial condition that if not corrected could result in failure. There is high positive correlation between banks with a safety & soundness composite rating of 4 or worse and those listed on the official list. For example, many safety & soundness enforcement actions state in their preamble that an unsafe & sound condition exists, which is the reason for action issuance.

Since 1991, the banking regulators have statutorily been required to publish formal enforcement actions. For many reasons, the banking regulators have a general discomfort publishing any information on open banks especially formal enforcement actions, so not much energy is expended on their part ensuring the completeness of information in the public domain or making its retrieval simple. Given the difficulty for easy retrieval of all banks operating under a safety & soundness formal enforcement action, the unofficial list fills this void as a matter of public interest.

All of the banks on the unofficial list have received a safety & soundness formal enforcement action by a federal banking regulator or there is other information in the public domain such as an SEC filing, media release, or company statement that describe the bank being issued such an action. No confidential or non-public information supports any bank listed and a hypertext link to the public information is provided in the spreadsheet listing. The publishers make every effort to ensure the accuracy of the unofficial list and welcome all feedback and any credible information to support removal of any bank listed erroneously.

Friday, May 24, 2013

Labor Force Participation Rate Sensitivity

by Calculated Risk on 5/24/2013 09:25:00 PM

This morning I posted some comments from Michelle Meyer at Merrill Lynch on the likely path of the labor force participation rate. She wrote:

[W]e forecast the LFPR will slip slightly this year, but with a stronger recovery under way next year, the LFPR should start to level off some and potentially increase beginning in 2015.The following table is an estimate of the unemployment rate in December 2013 and December 2014 assuming the LFPR stays close to the current level of 63.3% (I looked at 63.0%, 63.3% and 63.6%). The current unemployment rate is 7.5%.

I also looked at three rates of payroll job growth, 167 thousand per month, 185 thousand per month and 200 thousand per month. I think it is possible that employment growth will pick up later this year, and if that happens, the unemployment rate will fall further in 2014.

Caveat: The payroll estimate is for the establishment survey, and the unemployment rate and participation rate are from the household survey - and this is just a rough estimate.

Looking at the table, the participation rate is very important for estimating the unemployment rate. If the participation rate stays steady, the unemployment rate will probably be close to 7.1% in December at the current rate of payroll growth, and around 6.6% in December 2014. If the participation rate dips further, the unemployment rate could fall below 7% this year and low 6%s at the end of 2014.

| December 2013 Unemployment Rate | |||

|---|---|---|---|

| Jobs added per month (000s) | |||

| Participation Rate | 167 | 183 | 200 |

| 63.0% | 6.8% | 6.7% | 6.6% |

| 63.3% | 7.2% | 7.1% | 7.1% |

| 63.6% | 7.6% | 7.5% | 7.4% |

| December 2014 Unemployment Rate | |||

| Jobs added per month (000s) | |||

| Participation Rate | 167 | 183 | 200 |

| 63.0% | 6.4% | 6.2% | 6.0% |

| 63.3% | 6.8% | 6.6% | 6.4% |

| 63.6% | 7.2% | 7.0% | 6.7% |

Lawler: Vegas Housing Market: “Sizzlin’ Hot,” and Yet So Cold

by Calculated Risk on 5/24/2013 03:06:00 PM

From housing economist Tom Lawler:

Dataquick released its April report on Las Vegas home sales based on property records in Clark County, Nevada, and the report portrayed “mixed” news on the health of the Vegas housing market. Here are some summary stats on home sales and median prices, as well as various shares of sales in the report.

| Selected Share of New And Resale Home Sales, Las Vegas | ||

|---|---|---|

| Apr-12 | Apr-13 | |

| Absentee Buyer Share of Total Sales | 50.5% | 53.1% |

| All-Cash Share of Total Sales | 53.6% | 56.6% |

| Foreclosure Share of Resales | 43.7% | 12.2% |

| Estimated Short-Sales Share of Resales | 29.4% | 30.3% |

| Las Vegas-Paradise, Nevada Home Sales | ||||

|---|---|---|---|---|

| Number of sales | Apr-12 | Mar-13 | Apr-13 | YOY % Change |

| Resale houses | 3,233 | 2,998 | 3,309 | 2.4% |

| Resale condos | 807 | 803 | 848 | 5.1% |

| New homes | 510 | 684 | 712 | 39.6% |

| All homes | 4,550 | 4,485 | 4,869 | 7.0% |

| Median sale price | Apr-12 | Mar-13 | Apr-13 | YOY % Change |

| Resale houses | $122,000 | $155,199 | $160,000 | 31.1% |

| Resale condos | $60,000 | $79,995 | $84,948 | 41.6% |

| New homes | $197,320 | $220,000 | $234,981 | 19.1% |

| All homes | $119,000 | $155,000 | $160,000 | 34.5% |

The report also included some stats on buyers of multiple homes, as well as median home prices for absentee-buyer and all-cash home sales.

Based on the share and other data in the report, here are some “derived” stats for home sales by various “cuts.” Also included are partial data for April 2011 based on last year’s report. (Note: The short-sales share for April 2011 is not available, because Dataquick revised its methodology for estimating short sales in the latter part of last year but has not released historical revisions to the public.)

From several perspectives the data suggest that the Vegas market has been “sizzlin’ hot,” mainly reflecting increased buying from investors despite huge declines in the number of “distressed” properties for sale. To others, however, the lack of any growth in homes purchased by folks who plan to live in the purchased home suggests that the Vegas market is disturbingly “cold.”

| April Home Sales, Las Vegas Region | April 2013 vs | ||||

|---|---|---|---|---|---|

| Apr-11 | Apr-12 | Apr-13 | Apr-11 | Apr-12 | |

| Total | 4,490 | 4,550 | 4,869 | 8.4% | 7.0% |

| New | 399 | 510 | 712 | 78.4% | 39.6% |

| Existing | 4,091 | 4,040 | 4,157 | 1.6% | 2.9% |

| Absentee Buyer | 2,128 | 2,298 | 2,585 | 21.5% | 12.5% |

| Primary Residence | 2,362 | 2,252 | 2,284 | -3.3% | 1.4% |

| All-Cash | 2,425 | 2,439 | 2,756 | 13.6% | 13.0% |

| Mortgage Financed | 2,065 | 2,111 | 2,113 | 2.3% | 0.1% |

| Foreclosure Resales | 2,279 | 1,765 | 507 | -77.8% | -71.3% |

| Short-Sales Resales | N/A | 1,188 | 1,260 | N/A | 6.1% |

| Distressed Resales | N/A | 2,953 | 1,767 | N/A | -40.2% |

| Ex-Foreclosure Resales | 1,812 | 2,275 | 3,650 | 101.4% | 60.4% |

| Ex-Distressed Resales | N/A | 1,087 | 2,390 | N/A | 119.9% |

| Ex-Foreclosure Total | 2,211 | 2,785 | 4,362 | 97.3% | 56.6% |

| Ex-Distressed Total | N/A | 1,597 | 3,102 | N/A | 94.2% |

| Multi-Home Buyers | N/A | 454 | 813 | N/A | 79.1% |

| 10+ Buyers | N/A | 81 | 360 | N/A | 344.4% |

| Median Sales Price | April 2013 vs | ||||

| Apr-11 | Apr-12 | Apr-13 | Apr-11 | Apr-12 | |

| Resale Home | $125,000 | $122,000 | $160,000 | 28.0% | 31.1% |

| Resale Condo | $61,000 | $60,000 | $84,948 | 39.3% | 41.6% |

| New Home | $190,000 | $197,320 | $234,981 | 23.7% | 19.1% |

| All Homes | $117,000 | $119,000 | $160,000 | 36.8% | 34.5% |

| Absentee | $99,000 | $96,000 | $136,000 | 37.4% | 41.7% |

| All-Cash | $90,000 | $89,900 | $135,000 | 50.0% | 50.2% |

The numbers that have gotten the most attention, of course, are the median sales prices, which are way up from their lows. This partly reflects the huge decline in foreclosure resales, but also reflects continued increases in “absentee” buyer (mostly investor) purchases of homes in Vegas, despite the plunge in the number of foreclosure (as well as overall “distressed”) home sales.

From the standpoint of overall home sales, the recent sales increase despite the sizable drop in “distressed” home sales -- “ex-distressed” home sales this April were up 94.2% from last April – seems rather remarkable. In addition, the sizable jump in new home sales both this year and last year – albeit from extremely low levels – is “encouraging.” What is equally remarkable but less encouraging (at least to some) is that purchases by buyers for their primary residence last month were virtually unchanged from last year, and down from two years ago. Homes purchased by absentee buyers (identified by buyers who indicated that the property tax bill would go to a different address than the property purchased) continued to increase, with the biggest increases coming from buyers who purchased one or more homes, with homes purchased by “entities” that purchased 10 or more homes jumping sharply. (Dataquick notes that some “individuals and partnerships” purchase homes under multiple names, so the “multi-home” buyer numbers may be understated).

CR Note: This was from Tom Lawler.

Update: The Two Bottoms for Housing

by Calculated Risk on 5/24/2013 01:13:00 PM

By request, I've updated the graphs in this post with the most recent data. Last year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it is, and here is another update to that graph.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the recent housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. These measure are very important and are probably the best leading indicators for the economy. But this says nothing about house prices.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through February.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through February.

Although the CoreLogic data only goes back to 1976, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 (real prices were mostly flat for several years). Something similar happened in the early 1980s - first activity bottomed, and then real prices - although the two bottoms were closer in the '80s.

Now it appears activity bottomed in 2009 through 2011 (depending on the measure) and real house prices bottomed in early 2012.

Merrill Lynch on Labor Force Participation Rate

by Calculated Risk on 5/24/2013 10:29:00 AM

Last week I summarized some recent research on the labor force participation rate. The following piece from Michelle Meyer at Merrill Lynch argues the LFPR will likely move sideways over the next few years. Changes in the participation rate have important implications for the number of jobs needed to lower the unemployment rate.

An excerpt from Michelle Meyer's piece:

The future trajectory of the labor force participation rate (LFPR) is very important in gauging the trend in the unemployment rate and risks to wage inflation. In order to forecast the labor force participation rate, we must understand the drivers behind its recent sharp movements – to what extent is a long-term trend related to demographics (aging population) versus secular or cyclical dynamics?

We can isolate the effect of demographics on the LFPR by looking at the participation rates by age cohort. The aggregate LFPR is equal to the summation of each individual age cohort's LFPR weighted by its share of the population. ... This suggests that half of the 2.7pp decline in the LFPR since the onset of the recession can be explained simply from the aging population. In other words, holding all else equal – meaning no business cycle dynamics – the LFPR would be at 64.6% today compared to the actual rate of 63.3%. The remaining 1.4pp drop is due to some combination of secular and short-term cyclical factors.

The two primary secular trends are the decline in the LFPR among the youth population and the rise among 55+. The LFPR for 16 to 19 year olds plunged to 34.3% last year from 52% in 2000. While this may have been accelerated by the past two recessions, we believe this is a permanent trend. On the other end, the LFPR of the older population has increased, likely reflecting higher life expectancy, less confidence in social benefit programs and loss of wealth from the Great Recession.

... we still believe that there are some cyclical components. One way to gauge the cyclicality of the LFPR is to observe state-level variation in the relationship between the LFPR and the health of the economy. Based on work from a recent San Francisco Fed paper, we compare the percentage decline in state payrolls to the decline in the LFPR during the recession, both weighted by the relative size of its labor force. We find a positive relationship where larger declines in employment are associated with bigger drops in the LFPR. The paper does the same exercise for prior recessions and finds a positive relationship existed in each, with the exception of the 2000 cycle.

If the relationship holds on the downside, do we also observe it during the recovery? There is little evidence of such correlation in this recovery, but it does exist for prior cycles. In prior cycles, the positive correlation did not become apparent until the economy had exceeded the previous employment peak by a significant amount. This suggests that the cyclical pressure in the LFPR may not be observed until 2015, at the earliest.

We can simulate a future path for the LFPR based on our assessment of the drivers of the downturn in the LFPR. The first step is to account for the continued aging of the population using the Census Bureau's projections by age cohort. If we keep the LFPR by age group constant at 2007 levels and only allow for demographic adjustments, we find that the LFPR will fall by another 3.3pp by 2025 and then slip to 59.2% in 2050. ...

We also assume that the secular trends exhibited during the last decade persist, but at a slower pace, implying a modest downturn in the LFPR among the youth and an upward trajectory for the 55+ age group. ... Based on these rough assumptions, we forecast the LFPR will slip slightly this year, but with a stronger recovery under way next year, the LFPR should start to level off some and potentially increase beginning in 2015 (Chart 4).

The cyclical dynamics, in our view, are not strong enough to generate a pop higher in the LFPR given the downward pull from demographics. But at a minimum, we expect these dynamics can counter the downside pressure and allow the LFPR to move sideways once the recovery builds momentum.

Durable Goods Orders increased 3.3% in April

by Calculated Risk on 5/24/2013 09:06:00 AM

From the Department of Commerce: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders April 2013

New orders for manufactured durable goods in April increased $7.2 billion or 3.3 percent to $222.6 billion, the U.S. Census Bureau announced today. This increase, up two of the last three months, followed a 5.9 percent March decrease. Excluding transportation, new orders increased 1.3 percent. Excluding defense, new orders increased 2.1 percent.This was above expectations of a 1.1% increase. This report is difficult to predict and very noisy month-to-month.

Thursday, May 23, 2013

Friday: Durable Goods (and a comment on housing driving the recovery)

by Calculated Risk on 5/23/2013 08:32:00 PM

Several people have asked me about this article at CNBC by Jeff Cox: Why Housing Won't Drive the Recovery

Despite data points that in some cases are at multiyear highs, Robert Shiller, Karl Case and David Blitzer believe there are multiple headwinds that will keep a lid on housing gains.First, housing (technically residential investment) will be a key driver for the economy. Period.

Among the obstacles are a low level of new housing starts, an unexpectedly slow migration of so-called shadow inventory onto the market, and continued difficulty for buyers to secure financing.

"You've got a lot of breathless commentary in the media," said Shiller, a Yale University economist. "All this talk that we're in this great recovery—we probably are in the short run, the longer run doesn't look so terrific to me."

It is important to understand that "residential investment" is mostly new homes and home improvement. For existing home sales, only the broker's commission is included in residential investment (nothing is added to the housing stock). Those looking at the level of existing home sales are looking at the wrong number, as are those focused only on house prices.

Look at "headwinds" that are mentioned in the article:

1) "a low level of new housing starts". That is a headwind? To me, the low level of starts means there is more upside based on demographics. The homeownership rate peaks for those in the 55 to 75 age group, so the boomers will not negatively impact homeownership for a decade or more.

2) "an unexpectedly slow migration of so-called shadow inventory onto the market". Do they expect the pace of foreclosures to increase? I don't. The process is very long in most judicial states, and I don't expect another wave of foreclosures hitting the market - but I do think we will see distressed sales for years.

3) "continued difficulty for buyers to secure financing". OK, but this has been a headwind for the last couple of years. Looking forward, I expect some loosening in lending standards. So this is really a potential tailwind.

Nothing in this article changes my view.

Friday economic release:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

Note: The bond market will close early Friday at 2PM ET. The stock market will close at the normal time. All markets are closed on Monday in observance of Memorial Day.

The Calculated Risk blog is always open!

Freddie Mac: "Mortgage Rates Continue Upward Trend"

by Calculated Risk on 5/23/2013 03:33:00 PM

From Freddie Mac today: Mortgage Rates Continue Upward Trend

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey(R) (PMMS®), showing fixed mortgage rates trending higher for the third consecutive week and putting pressure on refinance momentum. ...

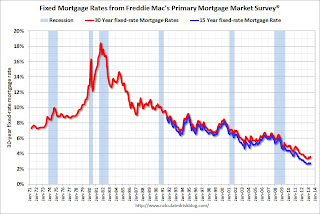

30-year fixed-rate mortgage (FRM) averaged 3.59 percent with an average 0.7 point for the week ending May 23, 2013, up from last week when it averaged 3.51 percent. Last year at this time, the 30-year FRM averaged 3.78 percent.

15-year FRM this week averaged 2.77 percent with an average 0.7 point, up from last week when it averaged 2.69 percent. A year ago at this time, the 15-year FRM averaged 3.04 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®. Not much of an increase recently ... but it will slow refinance activity.

The Freddie Mac survey started in 1971 and 30 year mortgage rates are still near the record low set last November.

A few comments on New Home Sales

by Calculated Risk on 5/23/2013 12:47:00 PM

Obviously the new home sales report this morning was solid with sales above expectations and significant upward revisions to prior months. I try not to react too much to the month to month ups and downs; the key points right now are that sales are increasing and will probably continue to increase for some time.

Now that we have four months of data for 2013, one way to look at the growth rate is to use the "not seasonally adjusted" (NSA) year-to-date data.

According to the Census Bureau, there were 153 thousand new homes sold in 2013 through April, up about 26.4% from the 121 thousand sold during the same period in 2012. That is a very solid increase in sales, and this was the highest sales for these months since 2008.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or an increase of around 22% to 25% on an annual basis from the 369 thousand in 2012.

Although there has been a large increase in the sales rate, sales are just above the lows for previous recessions. This suggests significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current sales rate.

And an important point worth repeating: Housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to continue to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.